alexsl

ContextLogic (NASDAQ:NASDAQ:WISH) is an e-commerce company that is primarily known for its shopping app Wish. The business took off during the pandemic as people embraced digital shopping platforms. Wish’s bargain-driven approach to novelty and unique items struck a chord and Wish’s revenues soared.

However, everything went south shortly after the company’s IPO. In 2021, advertising costs went up significantly as the economy recovered and many temporarily closed businesses reopened and started taking up digital ad inventory. This priced Wish out of the market as the cost to acquire customers became too high. Throw in supply chain problems, rising logistics costs and problems with product quality, among other issues, and Wish had an absolutely dreadful year.

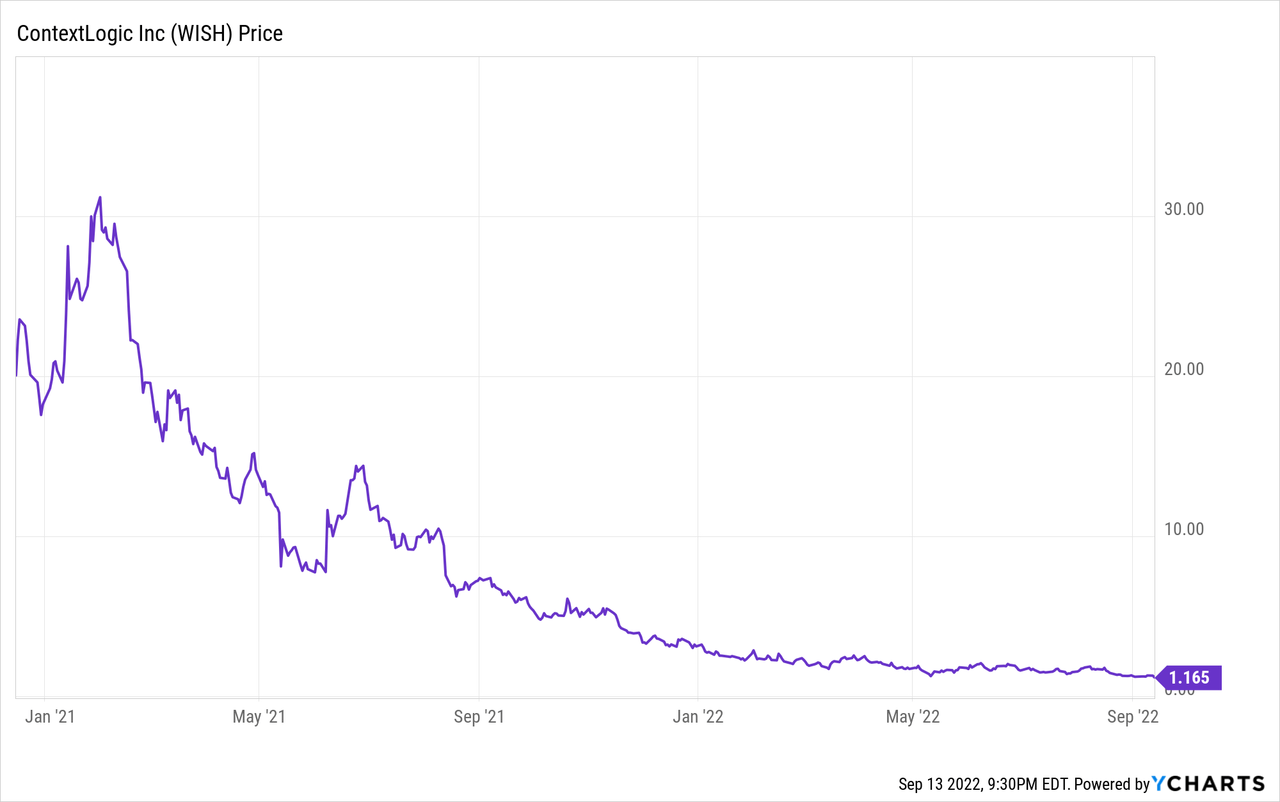

WISH stock reflected that, dropping from $30 in January 2021 to the low single digits by the end of last year:

2022 hasn’t been much better. Shares are down another 63% so far year-to-date. On Tuesday alone, the stock tumbled 9% amid the market rout that followed in the wake of the hot inflation reading.

Indeed, ContextLogic’s close at $1.16 per share marked a fresh all-time low for the company’s stock price. It also led to another interesting development; ContextLogic now has a meaningfully negative enterprise value. In fact, that’s why I decided to revisit WISH stock. In July, after all, I warned that shares were still overvalued when they traded for $1.71 each. Now, however, I’m changing my outlook to a hold. Here’s why I’m less pessimistic on the company going forward.

ContextLogic: Market Is Now Assigning No Value To The Operating Business

With the latest decline, ContextLogic now has a negative enterprise value. This means its net cash position exceeds its entire market capitalization. Historically, value investors such as Benjamin Graham have been drawn to stocks where their market capitalization is below their net current asset value. WISH stock now qualifies as such a company.

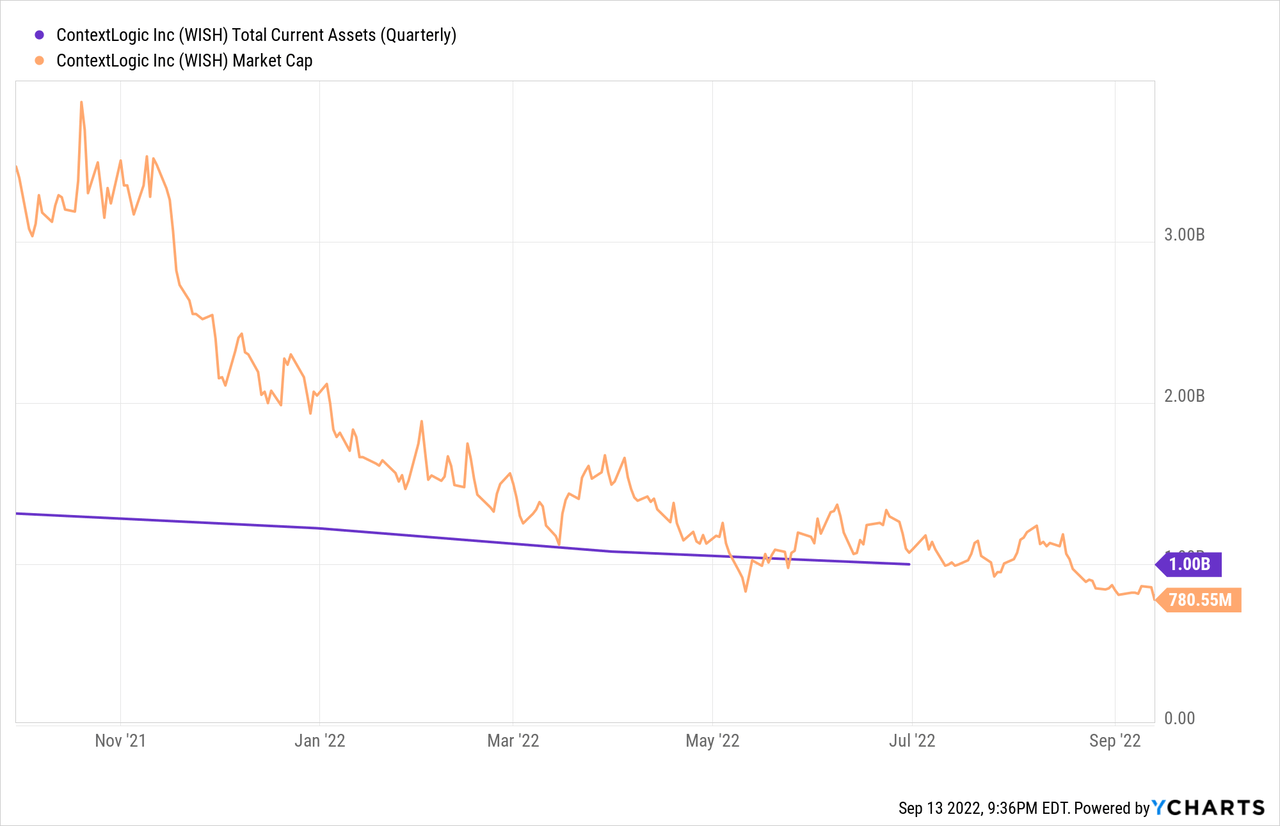

Below is a chart of ContextLogic’s total current assets compared to its market cap:

As you can see, as recently as last fall, people were paying more than $3 billion for the entirety of ContextLogic while getting around $1.3 billion of current assets, which are almost all cash and marketable securities.

Fast forward to the most recent quarter, and ContextLogic’s current assets have dropped to $1.0 billion, of which $947 million is cash. On the other hand, the market cap has slipped to less than $800 million following Tuesday’s slide. Given ContextLogic’s current burn rate, it should have at least $800 million of cash until early 2023, potentially making today’s price an interesting entry point from a balance sheet perspective.

If you prefer tangible book value, WISH stock had $1.02 per share of value on that metric as of last quarter. At Tuesday’s closing price of $1.16 per share, ContextLogic trades at just a tiny premium to the theoretical value one would get if the business were shut down tomorrow, all the assets sold off and liabilities paid off and the remaining cash was sent out to shareholders.

ContextLogic’s Strategic Direction Is Uncertain

In theory, there’s a decent margin of safety for WISH stock thanks to it holding the entirety of its market cap in cash and cash equivalents. And, given the relatively low burn rate, it’s not like this pile of cash will disappear overnight either.

On the other hand, there’s not much to reassure ContextLogic’s shareholders of what this cash will ultimately be used for.

The company’s founder, Piotr Szulczewski, stepped down from the CEO role in late 2021. Vijay Talwar replaced him as CEO, but Talwar just resigned from ContextLogic last week. Joe Yan, who is an operating partner at GGV Capital, will now take over as ContextLogic’s interim CEO while the company seeks a permanent replacement for the role.

Why is there so much turnover within management? Probably because the business’ operating results have full-on collapsed.

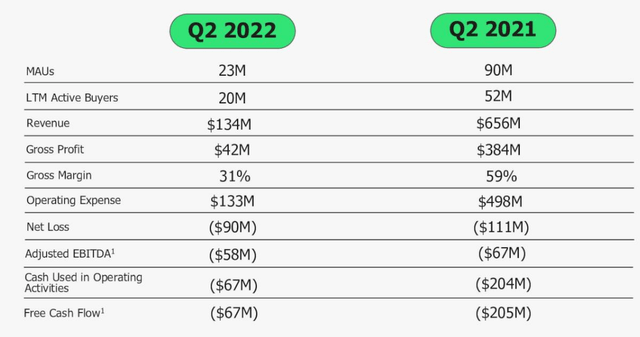

ContextLogic operating results (Corporate Presentation)

Seriously, these are some of the worst quarterly results I’ve ever seen from a publicly traded retailer. Revenues collapsed from $656 million in Q2 ’21 to just $134 million this past quarter. Gross profit imploded as the company’s margins somehow dove from 59% to 31%. You can’t blame a decline of that magnitude solely on inflation or supply chain issues.

Perhaps more worrisome, monthly active users dropped by more than two-thirds, from 90 million to just 23 million. This indicates that Wish had minimal customer retention. Despite having huge marketing expenses to acquire customers in 2020 and 2021, these customers failed to stick around as soon as ContextLogic lowered its promotional budget.

To the company’s credit, it has slashed operating expenses to try to stem the bleeding. However, the drop in revenues and profit margins was so great as to largely counter any benefit from the cost reductions; net loss was only reduced from $111 million to $90 million, and adjusted EBITDA barely improved at all.

The silver lining here is that free cash flow improved to -$67 million from greater than -$200 million in the same period of 2021. At this expense rate, figuring some seasonality in Q4, ContextLogic should be able to get its FCF burn to less than $250 million annually, which would give it almost four years of runway to keep operating based off its current cash and marketable securities balance.

WISH Stock Verdict

Four years is a lot of time in e-commerce. And the business still has a brand of some reputation along with considerable resources in areas such as logistics. Give all this plus nearly a billion dollars of cash to the right CEO, and you could see something good happen here.

Will ContextLogic be able to find the right CEO who can turn things around? And how possible is a turnaround in these trying economic times? It’s going to be a challenge for whoever the new CEO ends up being.

That said, I will say that the negative enterprise value gives some leeway to investors here. Even if ContextLogic is still operating poorly this time next year, there’s probably still going to be something like $700 million of cash left on the balance sheet at that time.

Meanwhile, the market cap is around $775 million today following Tuesday’s rout. Maybe the market cap drops to $700 million or even $600 million. But it probably won’t go all that far below cash, at least not until we see who the new CEO is and what plans they may come up with to try to turn things around.

I’d also point out that short interest is greater than 11% of the float right now. While there are plenty of reasons to be skeptical of a long position in ContextLogic, staying outright short seems a tad aggressive given that shares are already trading below cash. I wouldn’t be at all surprised to see the stock bounce back up toward $1.50 if there’s positive news in terms of the company’s strategic direction going forward, or sentiment picks up for beaten-down e-commerce stocks more generally.

WISH stock is highly speculative and not something I’d be excited about owning personally. That said, the risk/reward seems reasonably balanced in the medium-term and the cash balance gives the company far more room to maneuver than most other stocks that are down more than 90% off their highs.

As such, I’m no longer bearish on ContextLogic. But, I’d need to see positive operating momentum with the business to move past a hold rating on shares.

Be the first to comment