Dilok Klaisataporn

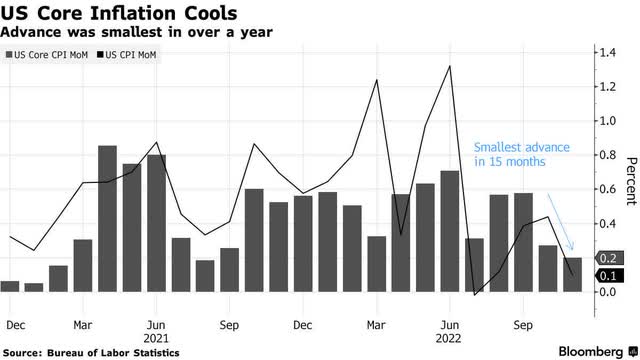

It isn’t often that we can be happy with stocks closing near their lows for the day, but when that translates into above average gains, as we saw yesterday, I will take it. Stocks surged higher at the open on news that the Consumer Price Index rose just 0.1% in November, which was well below the forecast for a 0.3% increase. Yet the major market averages faded as the day wore on over understandable concern about how the Fed would interpret the data after today’s final meeting of the year.

I have been steadfast in my call for a more rapid decline in the rate of inflation than the consensus expects, which should result in a lower terminal Fed funds rate than expected, alleviating the need for the Fed to strangle the economy and force a recession to rein in an elevated rate of inflation. I think we took another large step in that direction yesterday, which emboldens my outlook for a soft landing next year and increases the likelihood that the lows for this bear market are behind us. Today’s increase in interest rates by the Fed should be the last for this cycle, but I do not expect Chairman Powell or the Fed to acknowledge such, as they will want to continue managing expectations and see a third month of better-than-expected inflation data to confirm they are on target.

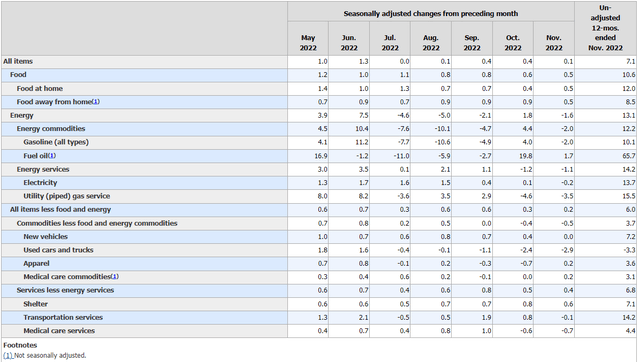

The November increase in prices was the smallest in 15 months. The headline number fell to 7.1% and was largely due to energy prices, but food price increases are waning. The monthly increase in food prices has consistently decelerated each of the past six months with the three-month percentage change falling to 7.8% from its peak of 13.9%. The Fed has little control over food prices, because this is a supply issue, while demand remains relatively constant. The soaring monthly increases in energy prices has flipped to declines in four of the past five months, and the still double-digit annual increases should drop sharply in coming months on much easier comparisons.

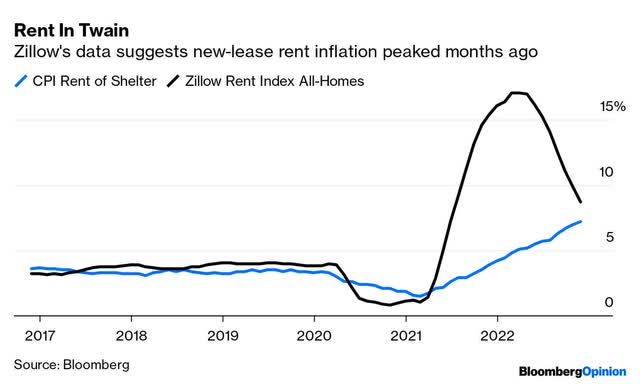

At the core, which excludes food and energy, we saw monthly declines for both medical care services and transportation services. Shelter was again the largest contributor to the overall number, but we have clear evidence the trajectory for this category is downward, as the rate of increase in new leases is plunging. It takes time for new lease rates to lower the average of all leases in force, but it is obvious this will happen next year, as it has for energy this year. I expect to see continued improvement in December’s number when reported in January.

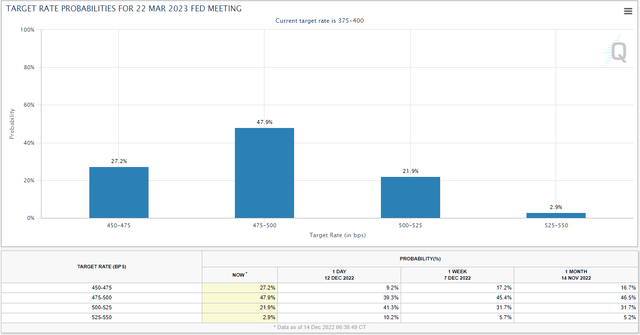

Interest rates across the curve fell yesterday, as investors reduced expectations for rate increases in the first half of next year. According to CME Fed funds futures, the consensus now expects another 25-basis-point rate increase in February, which is down from 50 basis points the day before. It also sees 25 basis points at the March meeting, down from 50 basis points the day before, resulting in a peak rate of 4.75-5%. This is why 2-year Treasury yields plunged yesterday to approximately 4.2% and stocks rose.

We have had two consecutive months of good news on inflation, and I think December will make it three, which should give the Fed confidence that its rate hikes through year end are sufficient to bring inflation back down to target during the second half of 2023. If so, a soft landing for the economy should look increasingly more likely, along with a double-digit return for the S&P 500 next year.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment