Nutthaseth Vanchaichana/iStock via Getty Images

Thesis

Warner Music Group Corp. (NASDAQ:WMG) presents a unique opportunity for dividend-focused investors. For a company that only recently IPO’ed, the company has been paying out reasonable dividends since the beginning and the company has raised dividends at an attractive pace. In the past couple of years, Warner Music Group has raised dividends at a 15% CAGR, and the company’s continued growth in its operations provides us confidence that the company can continue to maintain its payout and provide dividend income growth for long-term investors.

Company Overview

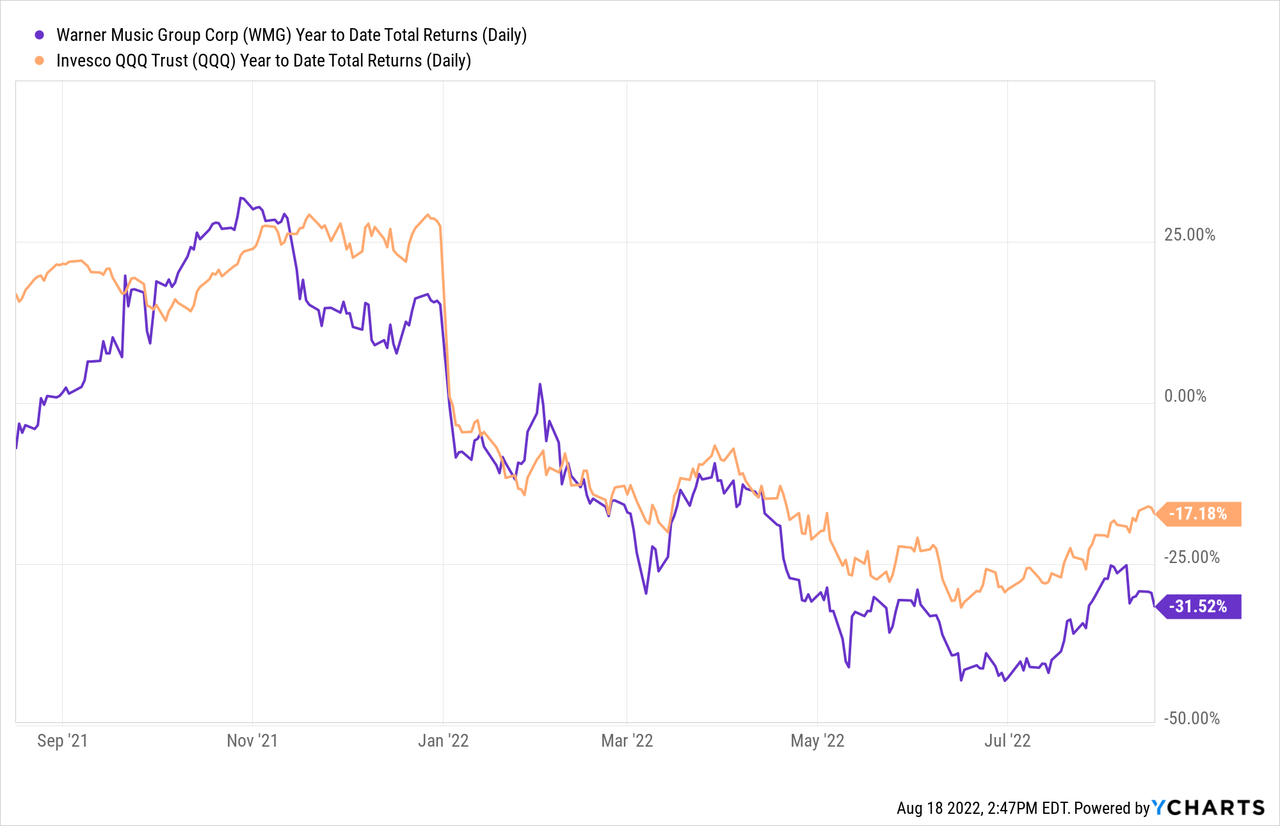

Warner Music Group engages in the creation and distribution of music and is one of the biggest music publishers in the industry. Warner Music Group operates in an industry dominated by a few publishers, and the company is one of the market incumbents with considerable market share. Warner Music Group partners with top artists like Lizzo and Ed Sheeran, and also have rights to the music content of top artists from the past, such as Red Hot Chili Peppers and Linkin Park. Warner Music Group generates revenue from various segments, including licensing revenue, publishing revenue, streaming revenue, and more. The company also owns and operates some of the largest and most successful labels in the world, including Elektra Records, Reprise Records, Warner Records, and Atlantic Records. The company’s stock performance has been poor year-to-date, as the stock declined more than ~30% compared to NASDAQ’s decline of ~17%.

Rising Dividend Star

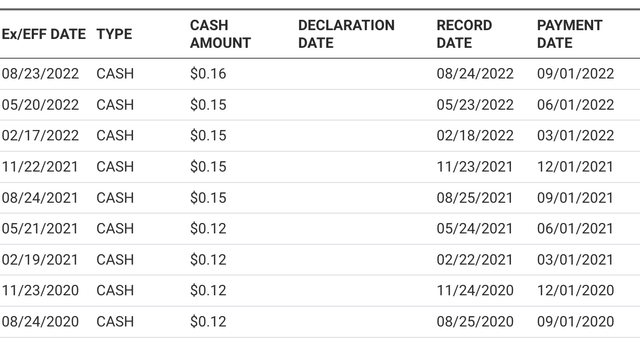

It has only been two years since the IPO, and the company is already starting to show signs of becoming a strong dividend stock. As seen below, in a span of just a couple of years, the company has raised its quarterly cash dividend from $0.12 to $0.16, which presents an annualized growth of around 15%. That outpaces the dividend growth of FY 2021 (~3%) and, as a matter of fact, 15% growth outpaces the average annual S&P 500 dividend growth since 2013. Assuming the dividend stays the same for the next 12 months, the company is trading at a forward dividend yield of 2.2% which is higher than the dividend yield of S&P 500 which is 1.61%.

Strong Financial Performance

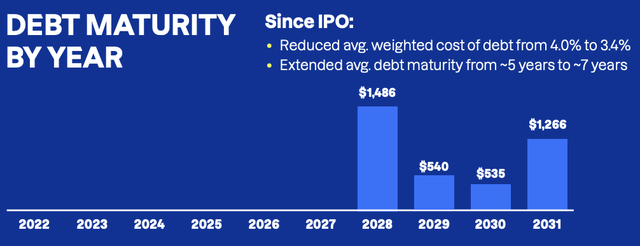

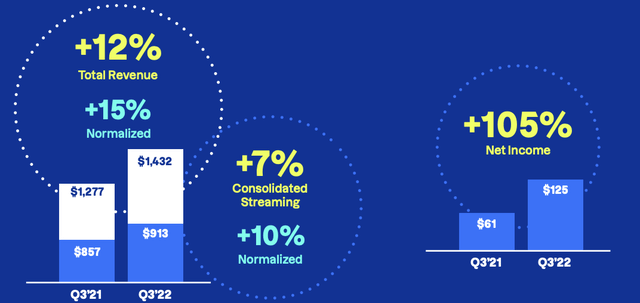

The prospects of a company’s dividend payouts are highly contingent upon the company’s ability to grow its cash flow. Thankfully, Warner Music Group has been able to produce great results that should ease any worries of dividend investors. In its most recent earnings announcement of Q3 2022, the company reported 12% (~15% normalized) YoY growth in revenue and a 105% growth in net income. Furthermore, management has been financially astute, with no debt maturities until 2028 and a continued effort to lower the cost of debt. These moves should allow the company to maintain and grow its dividend while having more financial flexibility to invest into the business and grow its bottom line. Furthermore, with only a forward payout ratio of ~60%, the company has the financial cap space to continue to grow (and at the very least maintain) its dividend payout, as the company continues to increase its revenue and expand its bottom line.

Warner Music Group Earnings Presentation Warner Music Group Earnings Presentation

Valuation

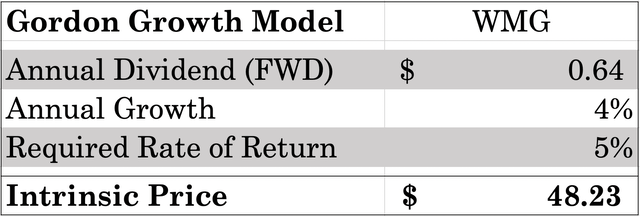

With a clear dividend growth trajectory, we feel comfortable in evaluating the stock based on the Gordon Growth Model. We assume a 4% long-term dividend growth rate, which is far less than the current annualized dividend growth and slightly more than the expected inflation outlook of ~3% based on 10Y treasury yields. We then borrow the cost of capital for the entertainment industry: 5.38%. Based on these assumptions, we see that the intrinsic value of the stock is $48.23, which presents a 66.2% upside from the current levels. We believe this model is rather conservative, as we see 4% dividend growth rate to be highly achievable given the growing top line and profit numbers, and the company’s market position.

Sweet Minute Capital Valuation Model

The Bottom Line

Though Warner Music Group is not considered by many income-focused investors as a dividend stock, we believe that based on the financial performance and its history of dividend growth in just the past couple of years, we see this stock to be a dividend grower for the foreseeable future. The current yield exceeds benchmark index yields, and the growth rate has outpaced that of dividend-paying companies. Even based on our conservative assumptions of dividend growth that slightly outperforms inflation rates, the stock presents a fantastic opportunity for investors to buy a dividend grower considerably below its intrinsic value.

Be the first to comment