Lazy_Bear/iStock via Getty Images

In this article, I return to companies that feed into the built environment and construction businesses. We look at Resideo Technologies (NYSE:REZI), a company that supports residential environments with both security and comfort (think thermostats and HVAC) solutions. It was a spin-off from Honeywell (HON) and, as such, does not have a lengthy history. Resideo uses acquisitions but has a good team in place and appears to have attractive earnings and revenue growth opportunities. Does this make it a potential buy? Yes, there are large upside potentials here and a good margin of safety, but analysts’ estimates have been wrong in the past for this company.

Let us dive in and learn a little more about the opportunities and risks with the company. Most of Resideo’s revenue comes from the U.S. with some presence in Europe and other international markets. The two segments are:

- Products and Solutions: security/intrusion, thermostat, smart systems, HVAC, thermal and water control, and energy use.

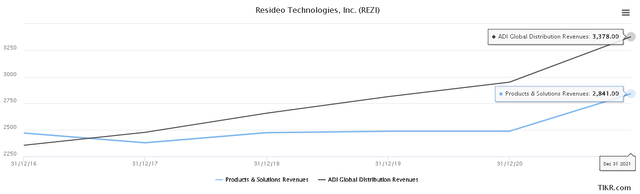

- ADI Global Distribution: distributes of security and low voltage fire protection products. This segment has seen strong growth (Figure 1).

Figure 1. Resideo’s segments and revenue growth (TIKR Terminal)

Resideo Technologies’ operational performance and profitability

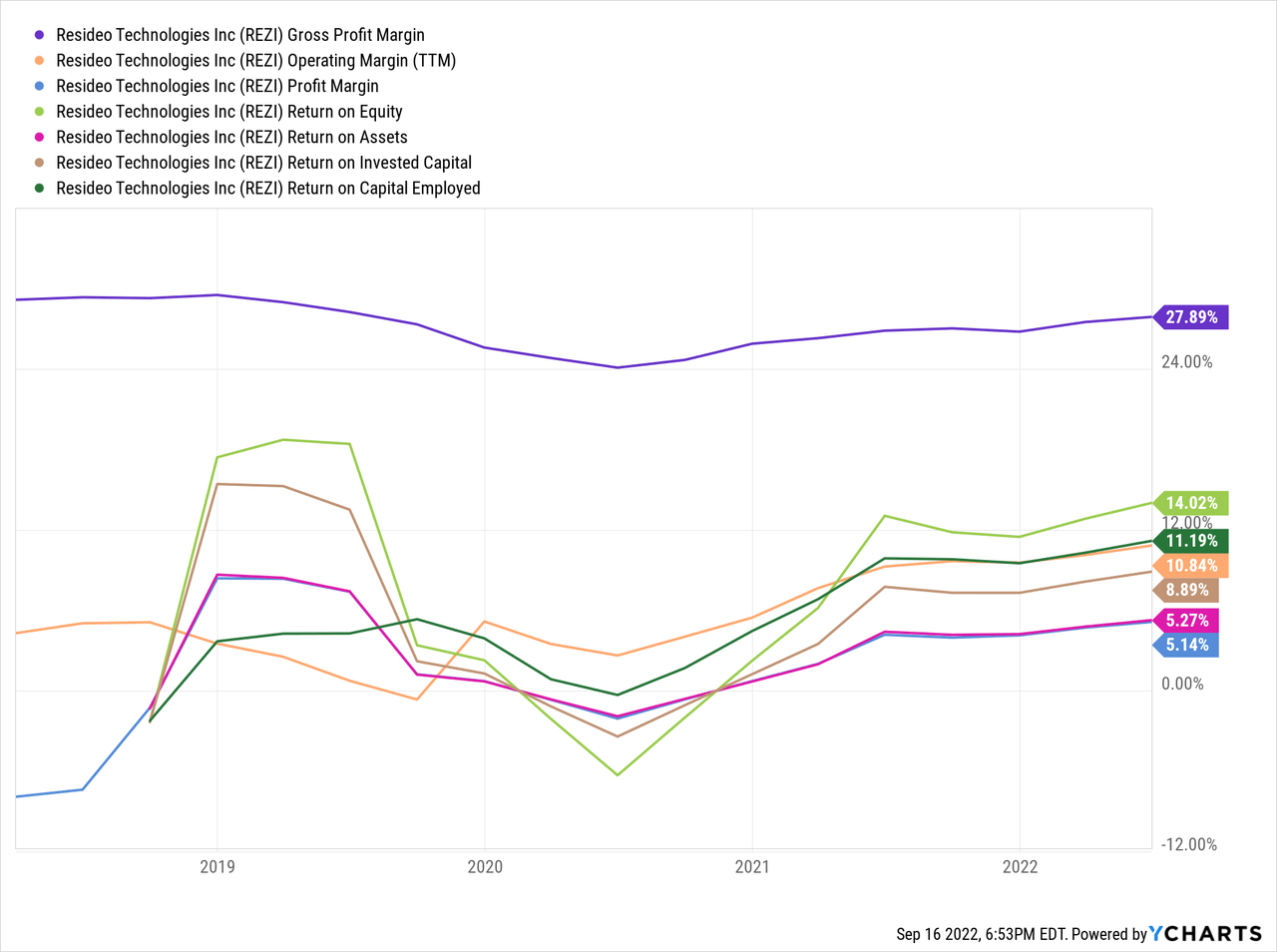

Resideo has worked to improve pricing and enhance efficiencies. The Q2 results show operating margins were up to 11% and a 14% YoY increase in revenues, reflecting the ongoing success of the company. The margins and profitability do not have a long history but appear to be holding stable with continued efforts to improve the margins, showing an impact over the last year (Figure 2).

Figure 2. Resideo’s profitability metrics

As with many other companies, they expected supply constraints to continue in 2022. The senior management team, however, take a very hands-on approach, as they explained in the Q2 earnings call:

we’ve been able to provide product to our retail customers. And that’s a big, big deal. As you all – as everybody knows on this call, the companies are able to manage better through the supply chain, get materials, build out product are going to benefit by that. […] It hasn’t just been our supply chain group or procurement group. It’s been senior leadership, including Phil, who runs P&S, it’s Rob, who runs ADI; myself personally, I’ve spent a lot of our personal time and calories on that with our lead supply partners. And that’s a differentiator out there. I mean I’m going to be – I got the next two weeks, I’m on the road, and I’m with thought on how many different supplies because one of your other natural questions for you or one of the other folks on the line is how do I see the future there in supply chain, everybody is asking for the same crystal ball.

[…] But again, it comes back to who’s got the relationships, who’s spending the time with them to help make that happen.[…] it’s all the additional time and effort face-to-face interaction with our pros. And you know the extensive nature that we have reach that we have in the pro base that’s out there and doing the things that are tied to the different training and what have you, it helps them make it stickier with our relationships and helps build business.

The extensive work that the team puts in appears to have supported them in avoiding the worst of the supply constraints and should support the expected revenue expansions in 2022 and 2023.

Resideo’s use of acquisitions

A large portion of revenue growth is being driven by acquisitions, with the importance underscored in the Q2 earnings call:

At the beginning of July, we announced the acquisition of electronic custom distributors, a leading regional distributor of residential audio, video, automation and telecommunication products. The acquisition adds significant capabilities to ADI’s growing audiovisual category. This is the fifth acquisition ADI has completed since 2020. In aggregate, these acquisitions are expected to contribute over $200 million of sales in 2022.

As noted in the Q2 earnings call, Resideo plans “to continue to invest organically in the business and look for attractive opportunities to deploy capital through acquisitions.”

Acquisitions can work but, ultimately, the right team needs to be driving them with the experience in making acquisitions work to select targets and realizing synergies. In this instance, Resideo’s team is enthusiastic about their experience as they note on the Q2 earnings call:

Everybody always asked, and I think we even made a talked about the last time around, last earnings call, the key is a success for M&A is companies that really have had a lot of experience in integration of acquisitions and the teams that we have in place and the people that we brought in are very versed in this, and that makes a big difference.

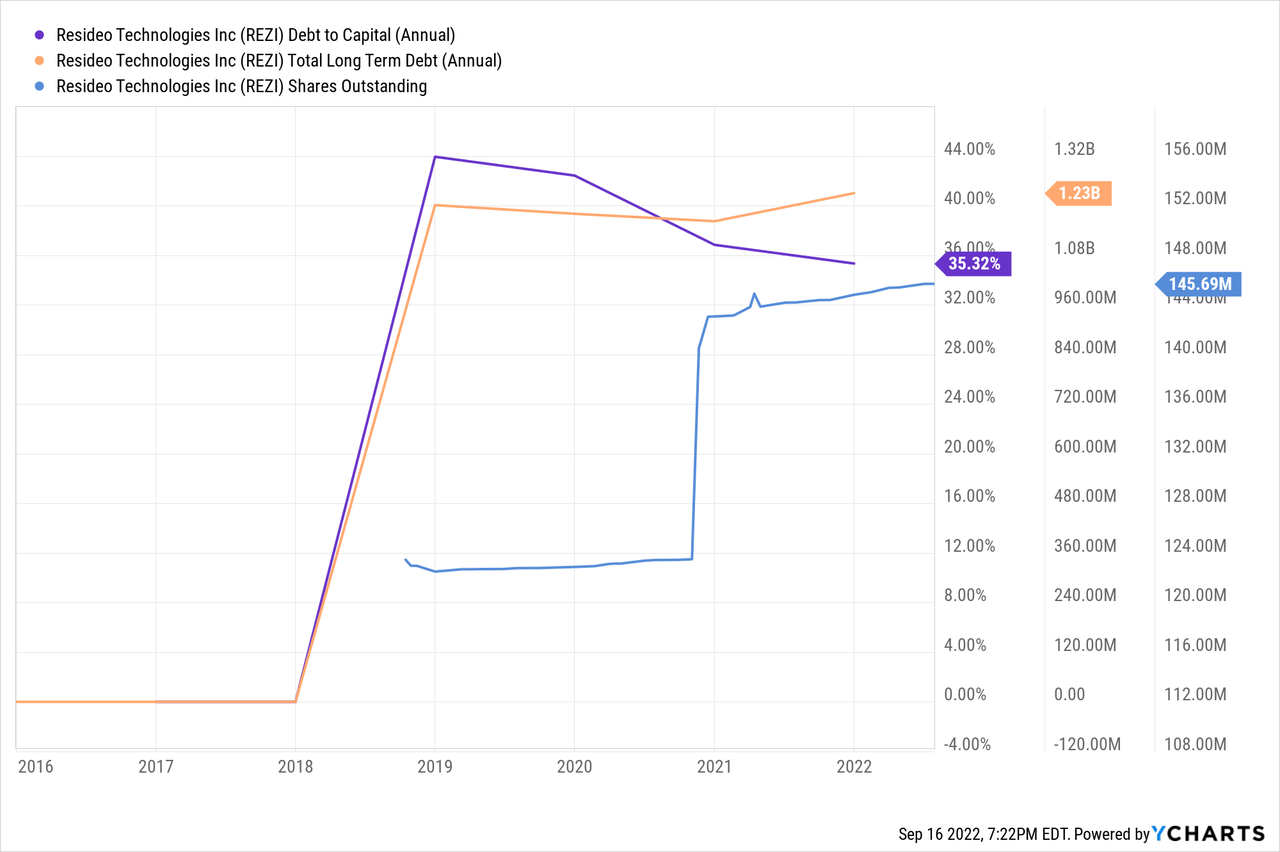

Using debt, and the credit agencies has noted the impact of acquisitions, but it is not entirely bad news; in 2021 S&P Global revised upwards to a BB with a stable outlook, following Moody’s early 2021 revision to Ba3, from B1.

I note Resideo has 42% goodwill on the balance sheet – this is something I am always cautious about and not keen to see because of the possibility of future impairments.

Figure 3. Resideo’s debt and shares outstanding

Potential risks and what to monitor when considering an investment in Resideo

Acquisitions always carry an element of risk. While the team in place has the experience to pull this off, there are debt implications and if they do not get the synergies, an acquisition could soon become a drag on the company. Monitor margins and the debt loads following notable acquisitions to assess whether these risks become prominent.

The diversity of products provides some buffer to risks of the wider economic climate. A slowdown in residential housing and construction would likely reduce the demand for some of their products, but, again, the diversity within the segment and the two separate segments provide some buffer against a slowdown in house construction.

How Resideo looks compared to peers

In selecting the peers for this analysis, I have opted to focus on the safety and security side of Resideo’s business, as this is the fastest-growing segment. I have selected:

- ADT (ADT)

- Allegion (ALLE)

- The Brink’s Company (BCO)

- Brady Corporation (BRC)

- MSA Safety Incorporated (MSA)

- Napco Security Technologies (NSSC)

- Vivint Smart Home (VVNT)

Overall, Resideo appears to be relatively affordable in terms of the peers in security and safety. In Table 1, I’ve put the lowest two companies on each metric in bold text. We can see that in each case, Resideo is the lowest compared to its peers and substantially lower than the average values in the final row. Further, Resideo has a reasonable Piotroski F-Score of 5, which is a reasonable score against the peers, and the ROIC is about average, which seems reasonable.

Table 1. REZI against peers in valuation metrics, ROIC, and Piotroski F-Score

| Company | EV / Sales | EV / EBITDA | Price / Sales | ROIC | Piotroski F Score |

| ADT | 3 | 8.1 | 1.3 | 2.30% | 5 |

| ALLE | 3.1 | 14 | 2.7 | 18.50% | 4 |

| BCO | 1.2 | 8.4 | 0.6 | 8.00% | 7 |

| BRC | 1.7 | 9.5 | 1.7 | 14.40% | 6 |

| MSA | 3.5 | 41.8 | 3.2 | 3.90% | 5 |

| NSSC | 7.5 | 45 | 7.8 | 17.90% | 5 |

| REZI | 0.7 | 7.1 | 0.5 | 9.50% | 5 |

| VVNT | 2.5 | 51 | 0.9 | -1.50% | 5 |

| Summary | 2.9 | 23.1 | 1.1 | 9.10% | 5 |

Source: Author, with data from Stock Rover

Valuation and investment opportunities in Resideo Technologies

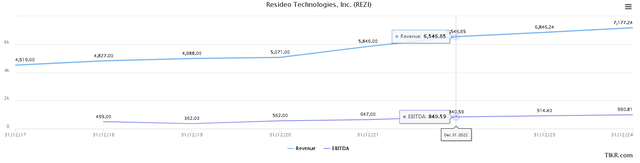

While Resideo may look undervalued compared to close peers, it is still valuable to look at the future prospects of the company using analysts’ estimates in the first instance. We can see that the analysts’ expectations are for positive growth in the next several years for both revenues and EBITDA (Figure 4).

Figure 4. Analysts’ estimates for revenue and EBITDA (TIRK Terminal)

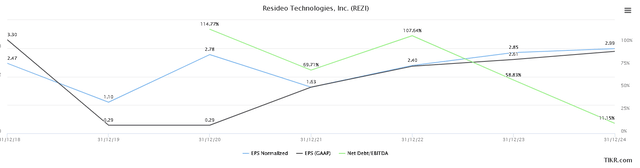

With the context of improved revenues and EBITDA, we can also see that analysts expect this improvement to translate to EPS gains in the coming years (Figure 5).

Figure 5. Analysts’ estimates of EPS and debt (TIKR Terminal)

From Figure 5 and the analysts’ expectations of better reduction in the debt load, we might expect Resideo to be a better investment in a few years.

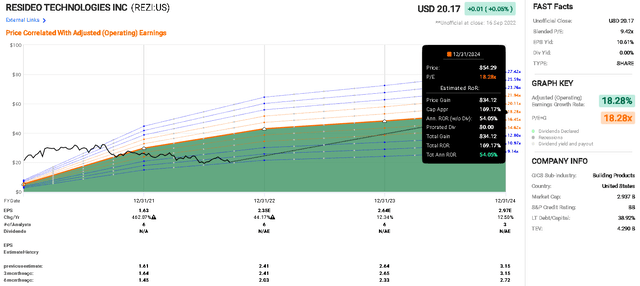

Is there an upside to an investment in Resideo? It does not pay a dividend, which I often look for as a cushion while I wait for an upside move. The analysts’ expectations are for relatively strong growth in 2022 of 44% earnings growth followed by just over 12% each in 2023 and 2024 (Figure 6).

From these estimates, we can then assume that if the P/E multiple stays at about the PE=G ratio of 18.28x, we can calculate a likely price at the end of 2024 and use this to calculate the rate of return. Turning to the FAST Graph calculator, we see that if Resideo’s price rises to this multiple with these estimated earnings, the total rate of return would be 169%, or an annualized RoR of 54%.

Figure 6. Analysts’ estimates and P/E multiples used to assess likely rates of return for Resideo Technologies’ (FAST Graphs)

Is this sufficient upside? The analysts estimates are very bullish and from the lower panel in Figure 6, we can see that over the last six months the analysts’ estimates have been relatively stable, with a slight trend towards positive. revisions.

Note, however, that the FAST Graphs Analysts Scorecard lists three of three misses for the analysts for one-year estimates, at the 10% margin of error. This outcome suggests challenges in relying on the estimates.

A quick overview of my thoughts on Resideo Technologies

Below, I summarize my thoughts.

- Business – acquisitions continue while REZI manages debt ratios to better levels. Watch for improvements in credit ratings.

- Valuation – appears to be a large margin of safety; low P/E that is below peers and below the expected P/E=G of 18x. Appears to be good upside potential.

- Financial safety – BB rated with issues around debt levels.

- Dividend – None paid.

- Catalysts – continued acquisitions.

- Recent moves – acquisitions.

Thesis

Resideo Technologies makes use of acquisitions and investors should be comfortable with this. They do not have a long history and have struggled to meet analysts’ earnings estimates. There appear to be expectations of strong revenue growth (Figure 4) and earnings growth (Figure 6). Coupled with the opportunity for P/E multiple expansions from the low level that Resideo exhibits (compared to peers, Table 1), there appears to be good upside potential.

As such, I rate this as a Buy but note the more speculative nature of the investment with large upside potential, particularly given the difficulties analysts have had with their estimates. Further, the lack of dividends make this less attractive for me as there is no income while I wait for the upside potential to be filled. I will continue to monitor the company and its actions in the future.

Thank you for taking the time to read this analysis. Let me know if you have questions or if there are any other companies you think I should examine.

Be the first to comment