DKosig

One Of The Best Ex-US Investments

Recent earnings reports highlight that one industry is set to continue extremely fast secular growth: supply chain logistics software. Exacerbated by the pandemic, and continuing to outperform the market while other technology firms fall back to earth, there are many strong investment candidates in the sector. However, I believe Australian firm WiseTech Global (OTCPK:WTCHF), and their CargoWise platform, are set to continue outperforming the sector. Also, thanks to favorable forex benefits at the moment, US-based investors can purchase this company at a discount, negating some of the effects of the inherently high valuation. Always remember, not all the best investments are listed in the US.

Qualitatively, WiseTech offers a strong position in the supply chain software industry, with the goal of becoming the leader in logistics software globally. At a $12 billion USD valuation, the company is certainly a major player in the industry, but will have fierce competition from legacy software providers and other high growth specialists. However, based on recent contracts, financial performance, and earnings of peers, WiseTech should be able to continue their upward trend with little headwinds. Due to all the beneficial qualities, I will be making WiseTech one of my largest holdings. This article will highlight all the key reasons why.

WiseTech

Efficiency Is Sticky, As Shown By Performance

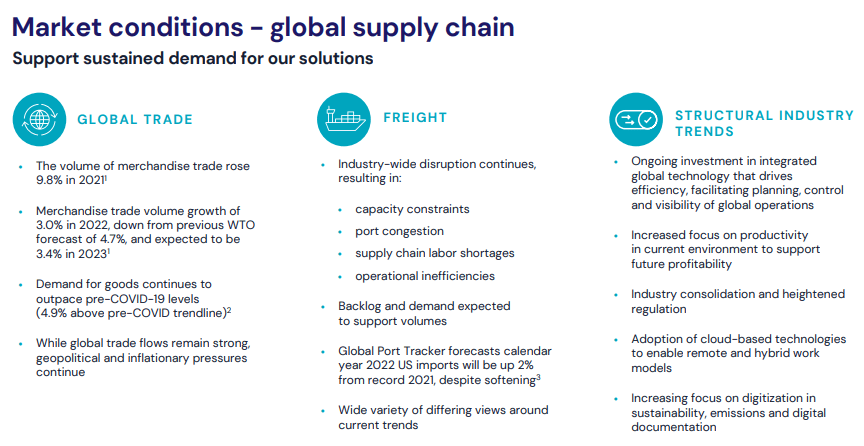

One major factor for long-term success is the diversity and scope of the CargoWise platform. With performance relying on global trade, it is without a doubt that the market will have secular growth through time. Short-term economic and political factors will do little to stop the ever-increasing world economy, thanks in part to industrialization, innovation, and population growth. At the same time, the industry is highly inefficient, as shown with the COVID supply chain disruptions, and the explosion of growth for the industry is not temporary.

The key is that increases to efficiency will outweigh a weak economy. Companies will continue to invest in logistics software even if global trade volume subsides over the next few years. The proof is evident thanks to the performance of the industry as a whole, but for WiseTech in particular. I believe this article will highlight the sheer beauty of the historical and current financial performance.

WiseTech

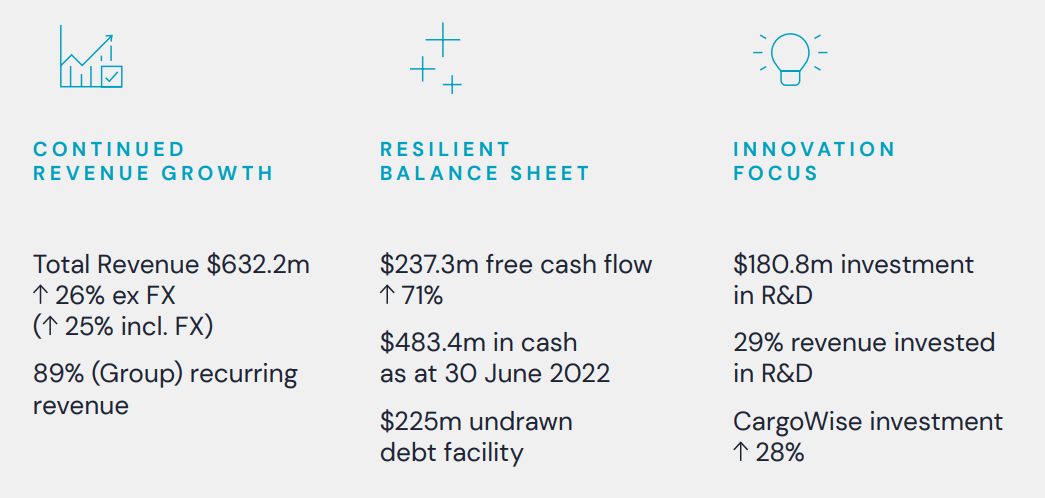

Strong Growth

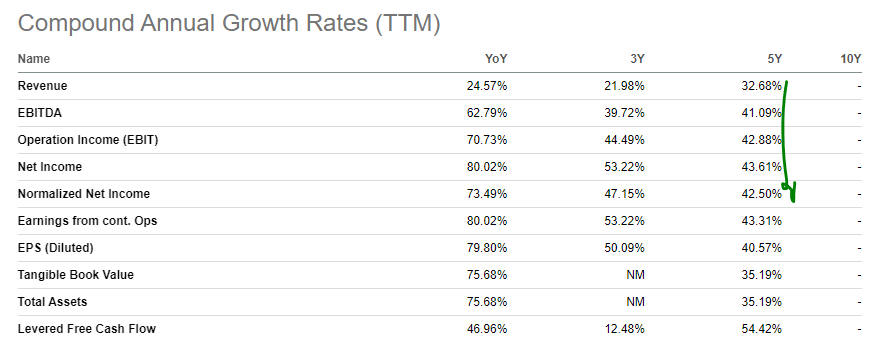

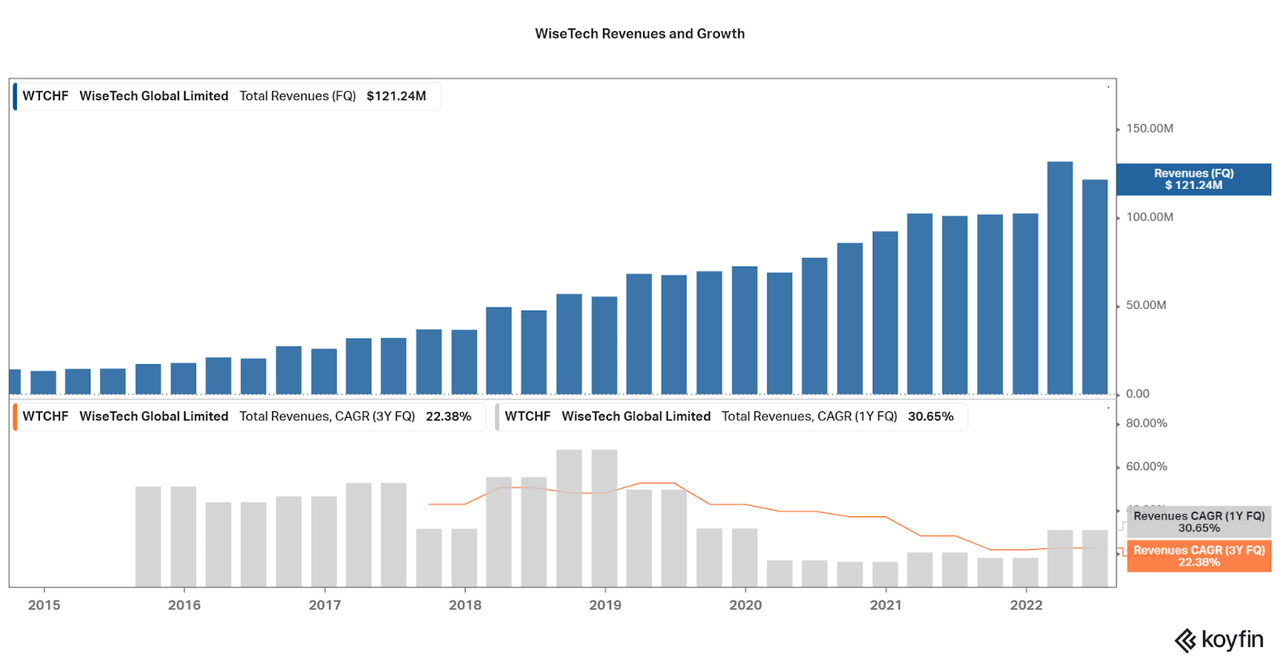

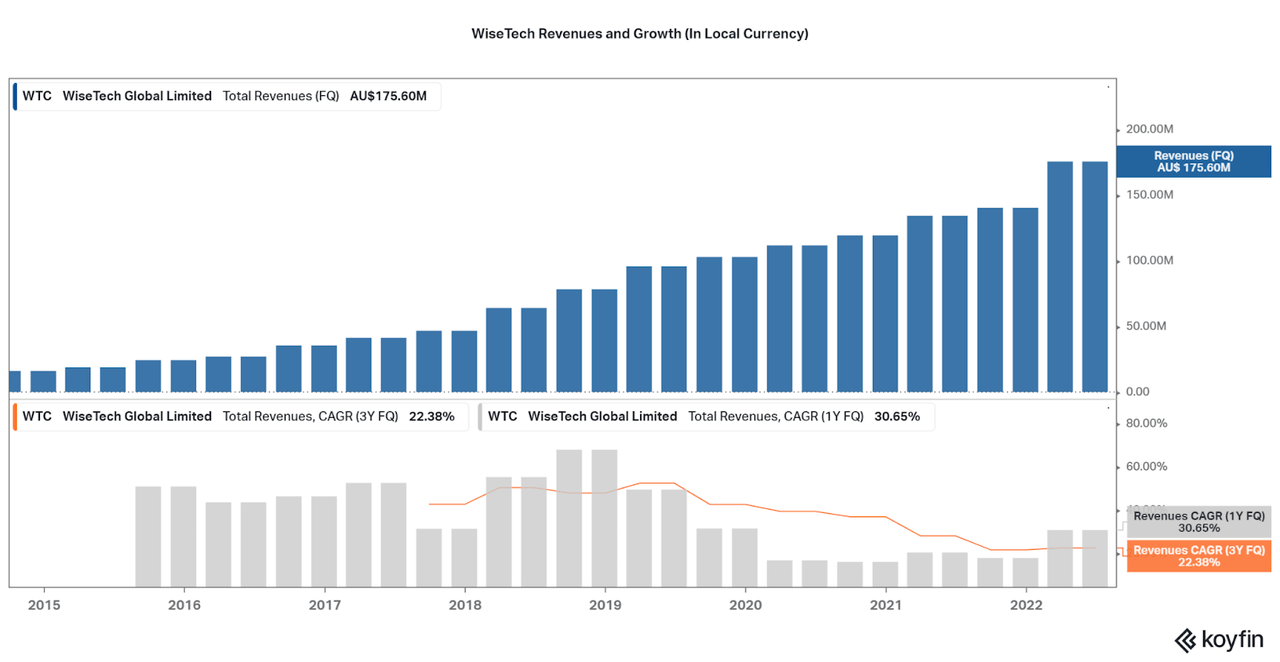

First and foremost, WiseTech is experiencing exponential upward momentum. Revenues have increased over the past five years at over a 30% annual rate, but growth has been strong since inception in the 90s as the platform has expanded. At the same time, profits have been growing at an even faster rate, with EBITDA, net income, and EPS, all growing over 40% annual over the past five years. However, it is important that growth is slowing down as the company reaches a large size. I will discuss the current state of revenues later in the article.

Seeking Alpha

Strong Profitability

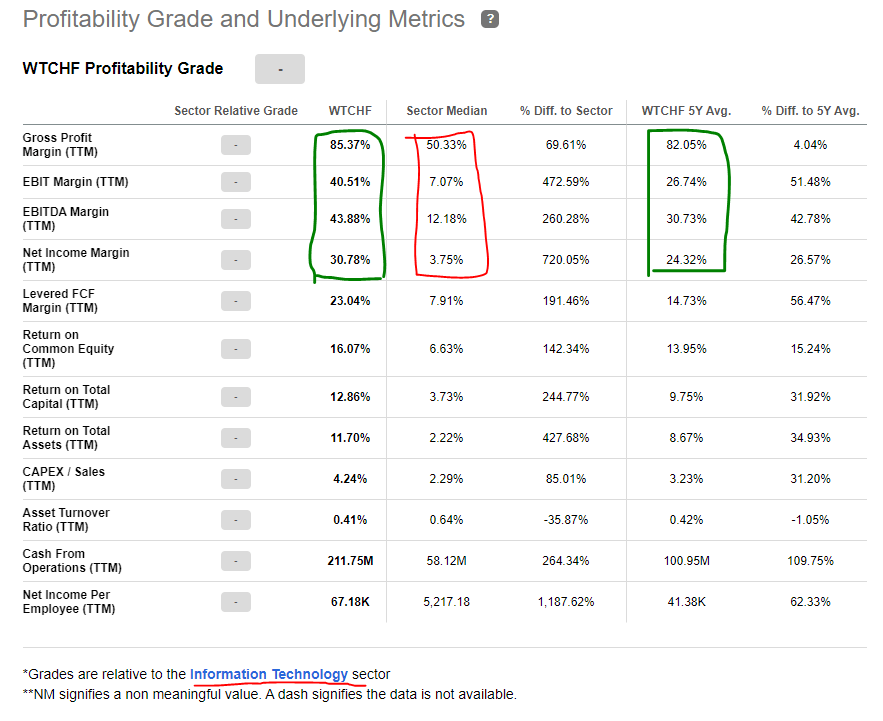

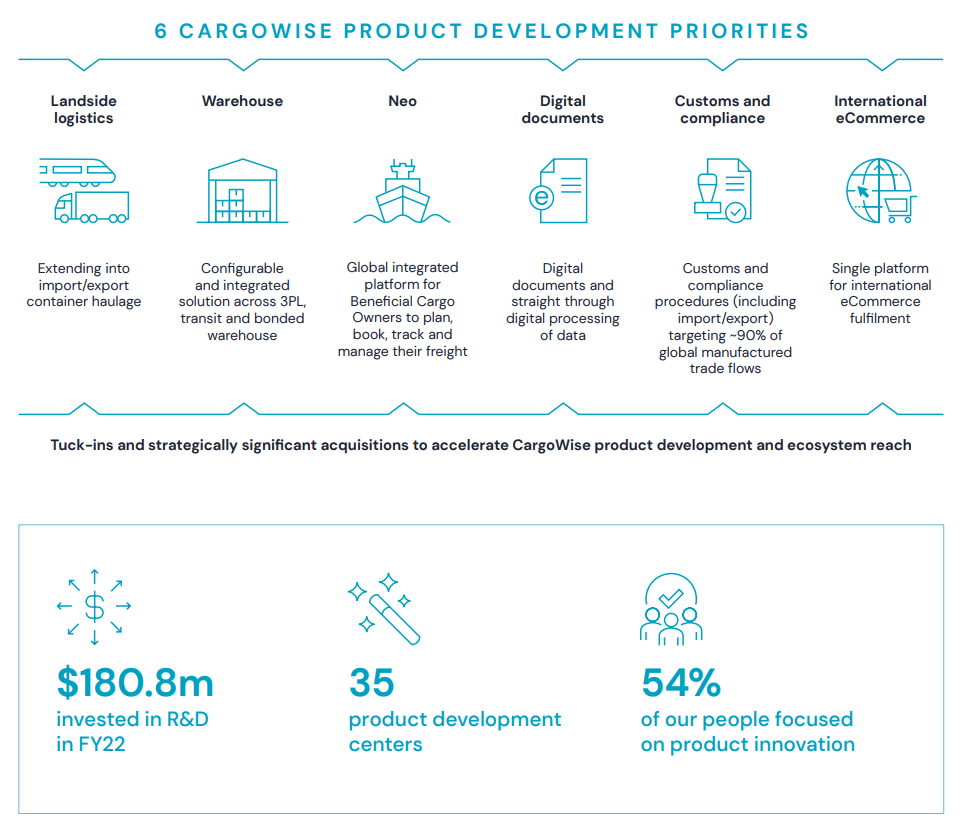

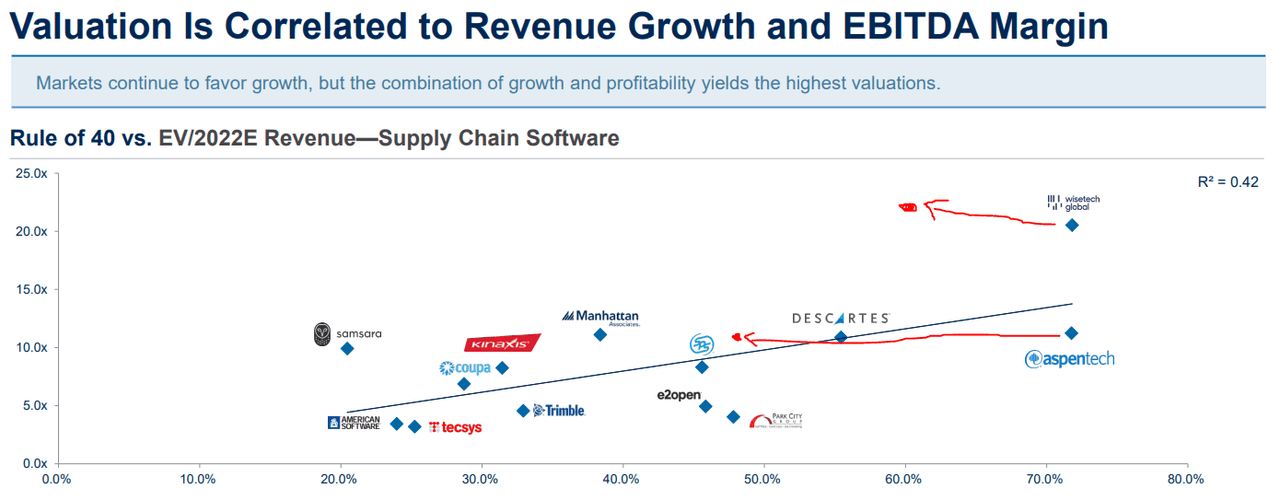

For now, I must highlight the extremely strong profitability metrics that cause WiseTech to stand out from other high growth peers. At 30% average EBITDA margins, and large premiums being earned on revenues over the past 12 months, we can see the platform is extremely valuable. With the current 40% EBITDA margins, WiseTech meets the strict Rule of 40 criteria, and growth is just an added benefit for current investors.

Long-term focused investors can expect that current profitability, especially the high amounts of net income, will be used to reinvest in the company to maintain growth, negating the effects of valuation the longer you hold. Just see the images below to see how much money is being spent on improvements.

Seeking Alpha

WiseTech

Success Through Mutualism

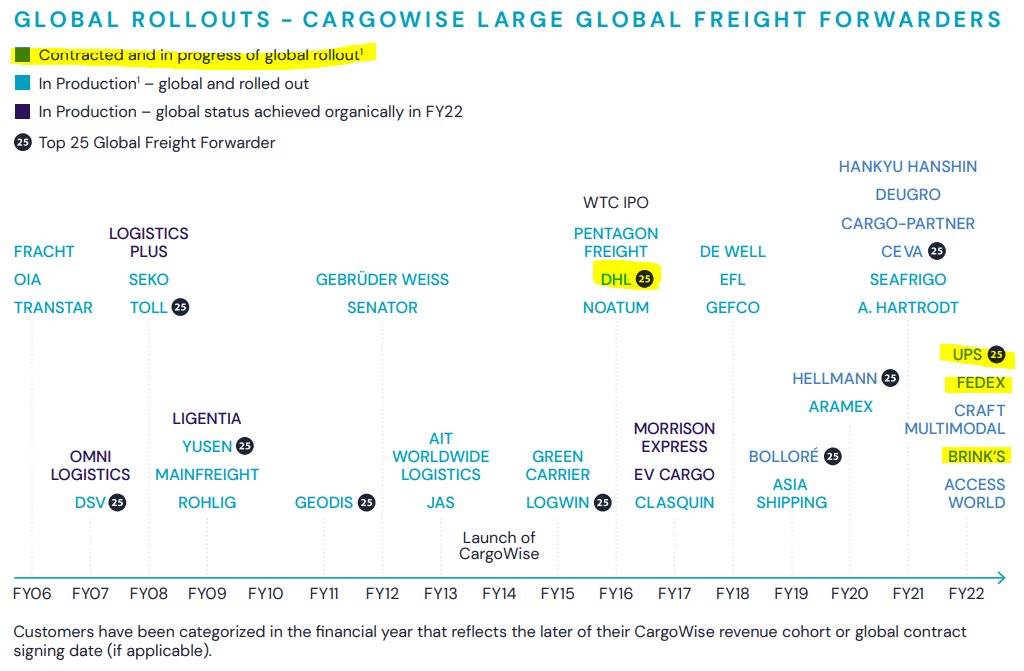

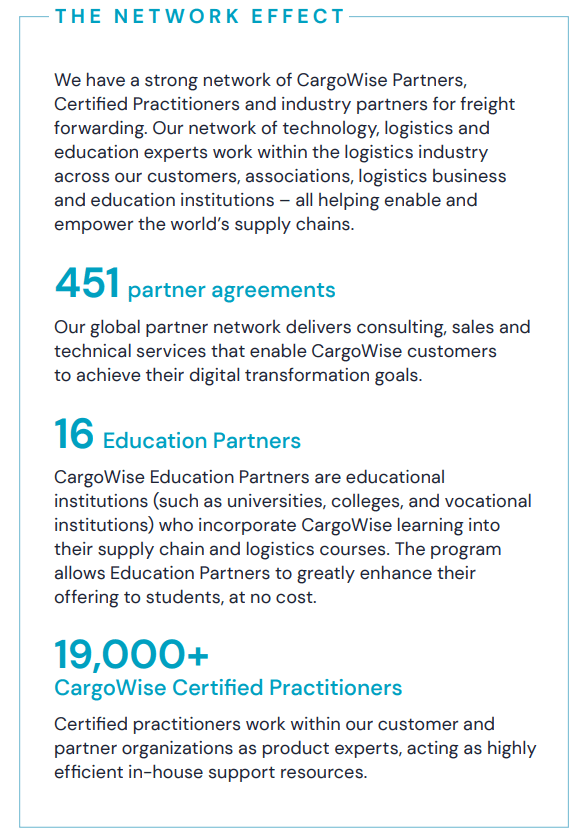

The key for a successful software company is stickiness and necessity. Arguably, the best way is to spread out the tendrils of the organization as far as they can reach so that there are little alternatives. WiseTech does this by leveraging their large network that is now used by 10 of the top 25 largest freight forwarders in the world, including United Parcel Service (UPS), FedEx (FDX), Deutsche Post (OTCPK:DPSTF), and Japan Post Holdings (OTCPK:JPPHY). The expanded rate of contracted clients is a great sign to see, and it will take large shifts for these partners to no longer use that integrated platform. When including the fact that the network also includes educational endeavors to train the next generation of users and a large network of distribution/consulting partners, the CargoWise platform will be one of the first supply chain platforms to be recommended.

WiseTech

WiseTech

Can Current Financial Success Continue?

While hindsight is 2020, and I am sure most readers wish they invested in WiseTech sooner, we must assess the company’s viability and outlook. While secular advantages in the dire need for supply chain optimization and global trade growth allow for optimism moving forward, there are a few other indicators we must look at. First, remember that CargoWise highlights stickiness and essentiality of their platform, and this will allow prices to be increased on a regular basis.

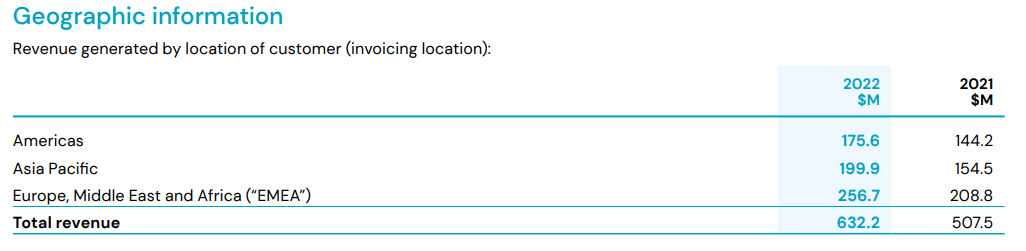

Then, as a global company, current economic instability may cause foreign exchange issues. If you look at the two charts below, the first with revenues reported in USD and the second in AUD, investors can see the significant changes in revenues that are the result of just exchange rates. However, recent earnings reports have discussed current foreign exchange impacts are currently a small reduction of 1% to revenues, mainly due to exposure to a wide range of both weak and strong currencies.

The company also has strong risk management and hedges in place to mitigate fluctuations in currencies, so I believe that worries about exchange rates are limited. The third image below highlights how revenues are currently quite diversified in terms of scope, with nearly equal sales in all regions of the world. But, with rising exposure to USD, the company may receive some tailwinds due to the sheer strength of the dollar over the past three months.

Want to learn more about the current opportunities surrounding a strong dollar? Consider reading my article “Strong Dollar Means Buy Abroad – Assessing Foreign Assets”.

One true worry point, however, is the slow decline in momentum over the past few years. Like most companies, it is hard to maintain profitable growth above 30% for a decade straight. Thankfully, the supply chain issues of 2021/22 seem strong enough to boost upward inertia, and the downward sloping trend line may flatten or even rise over the coming quarters. However, later in the article I will take into consideration declining growth in order to maintain realistic expectations of stalling growth.

Koyfin

Koyfin

WiseTech

Miscellaneous Bullish Indicators

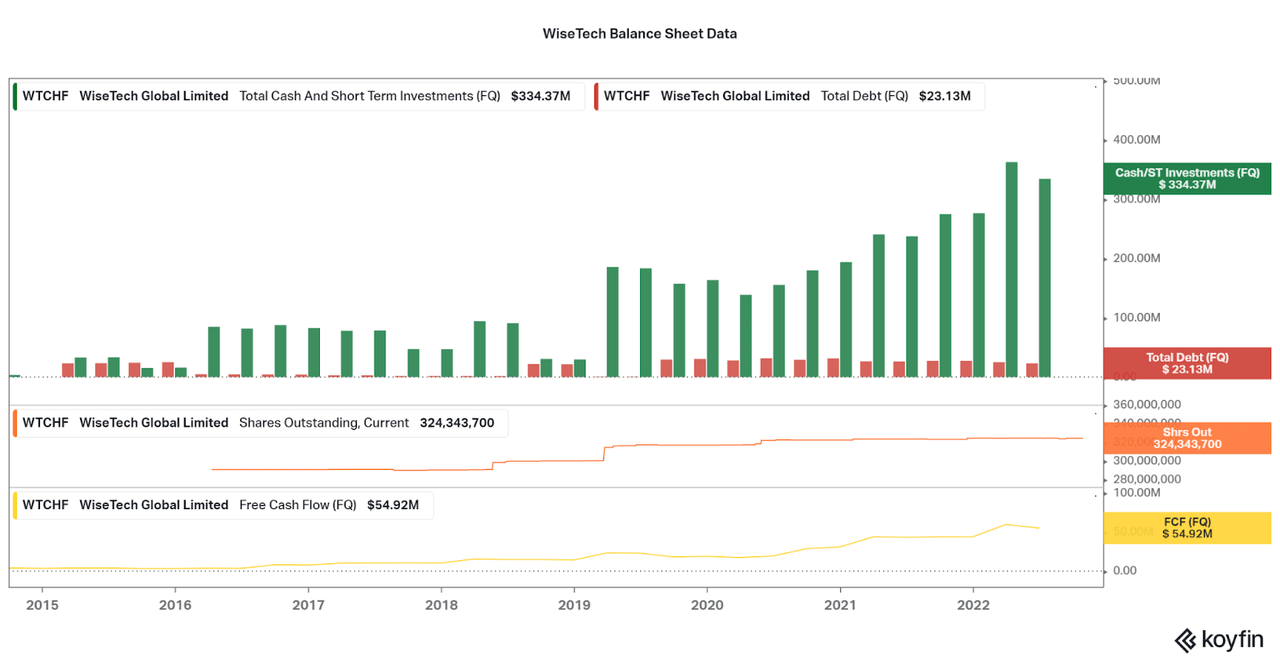

In order to continue the trend of positive investment indicators for the bullish case, I will begin to list a few other factors. Perhaps most importantly is the balance sheet that is healthy enough to drive shareholder returns regardless of the coming “recessions”. With strong profits and positive FCF every quarter, WiseTech has accumulated $330 million in cash and only $23 million in debt. We can also see that dilution has been almost non-existent as shares outstanding have only risen by ~15% over the past five years, far less than most growth peers.

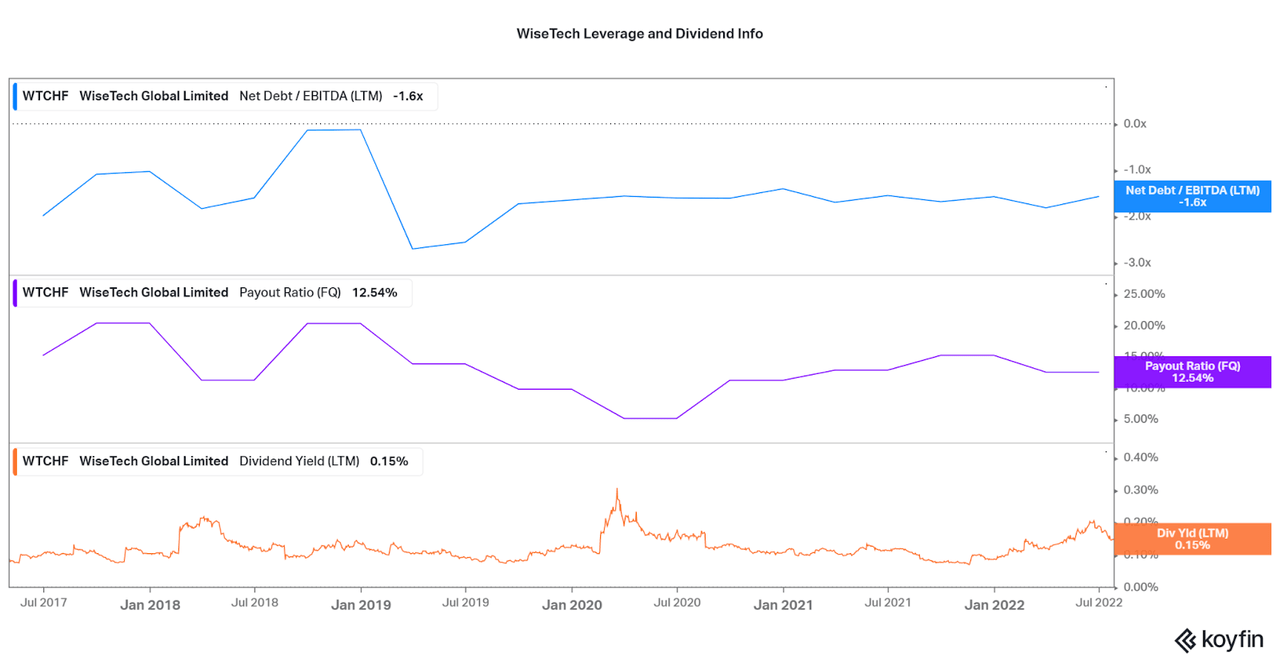

I expect shares outstanding to remain at this level for the quarters ahead only due to the fact that the company does not need cash, but shares also remain at a premium to dissuade repurchasing. But, down the road WiseTech will have plenty of earnings per quarter to buy back shares, but the timeline is unclear at the moment. Thankfully, investors can also expect minor income from WiseTech’s dividend yield, albeit a minor 0.2% average yield. As long as leverage and the payout ratio are extremely low, investors can expect nothing but safely increasing amounts of high-quality returns moving forward.

Koyfin

Koyfin

The Problem Always Seems To Come From Valuation

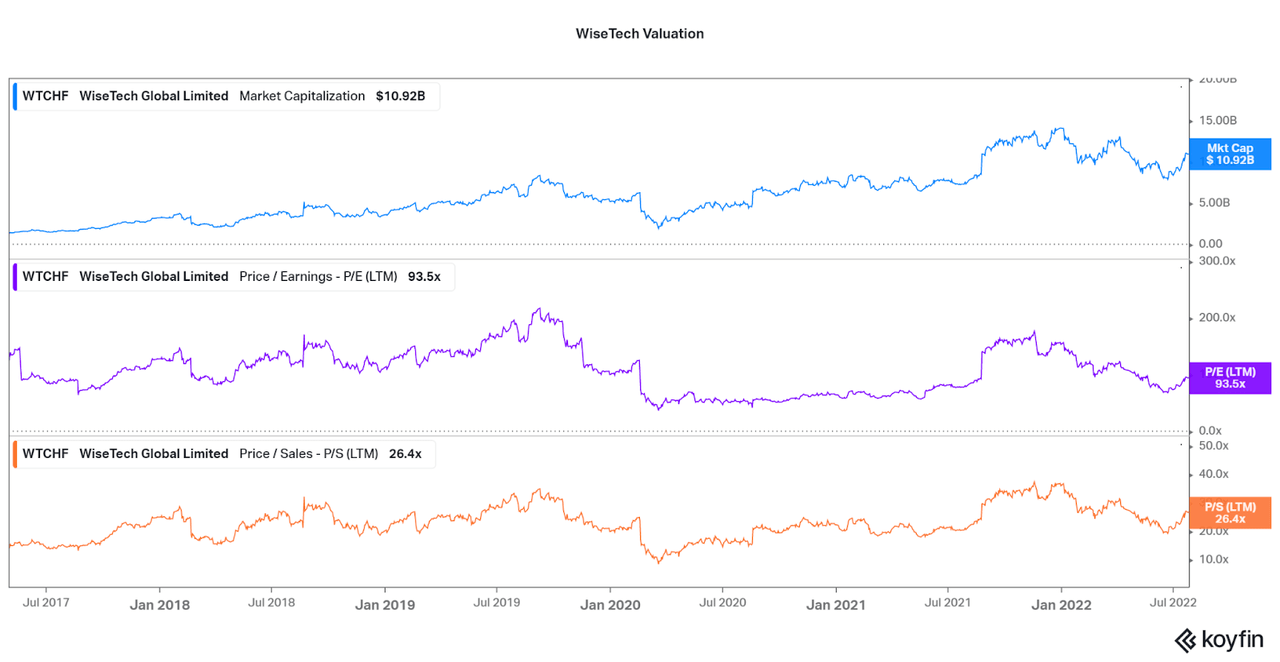

Due to the inherent value in the company profile, it is unlikely to come as a surprise that WiseTech offers a steep barrier to entry in terms of valuation. At a $11 billion market cap and less than $500 million in annual revenues, current investors are optimistic of continued forward momentum. However, WiseTech has also historically traded between a 20-30x P/S ratio, preventing any reason to expect a significant decline, outside of the initial stages of the pandemic.

The problem is that, as discussed above, the revenues that were once on the decline through 2021 now seem to be on the rebound as global supply chains remain disrupted. Across the sector, valuations are elevated and most peers are shrugging off the current bear market. But, I find there is no need to worry.

Koyfin

According to the industry data collected by Houlihan Lokey below (as of August 11th, 2022), WiseTech offered a premium valuation when compared to major competitor Aspen Technology (AZPN). I updated the data to account for current FWD revenue growth estimates and TTM EBITDA margins to calculate the Rule of 40, along with current valuations. As you can see, WiseTech remains at a premium, but continues to outperform significantly.

To understand why WiseTech trades at a premium, just look at the table I compiled comparing the three major players, WiseTech, Aspen, and Descartes (DSGX), but on a five-year average basis. As shown, CargoWise has far better momentum at competitive profit margins, leading to the understandable premium.

Houlihan Lokey

|

Stock |

5 Yr Average Revenue Growth (YoY) |

5 Yr Average Diluted EPS Growth |

5 Yr Average EBITDA Margin |

5 Yr Average Net Income Margin |

5 Yr Average EV/EBITDA (TTM) |

|

Aspen Technology |

17.7 |

23.3 |

44.1 |

41.2 |

45.5 |

|

Descartes Systems |

15.8 |

28.2 |

36.4 |

14.0 |

33.2 |

|

WiseTech |

34.3 |

69.9 |

30.8 |

24.3 |

77.0 |

Source: Seeking Alpha. Compiled by Author.

While performance data suggests that the current premium valuation is in-line with historical averages and in comparison with peers, it is important to consider the future prospects of the company. Primarily, we must consider whether the dire consequences of global inflation and potential recession are enough to disrupt growth and cause the company’s valuation to plummet.

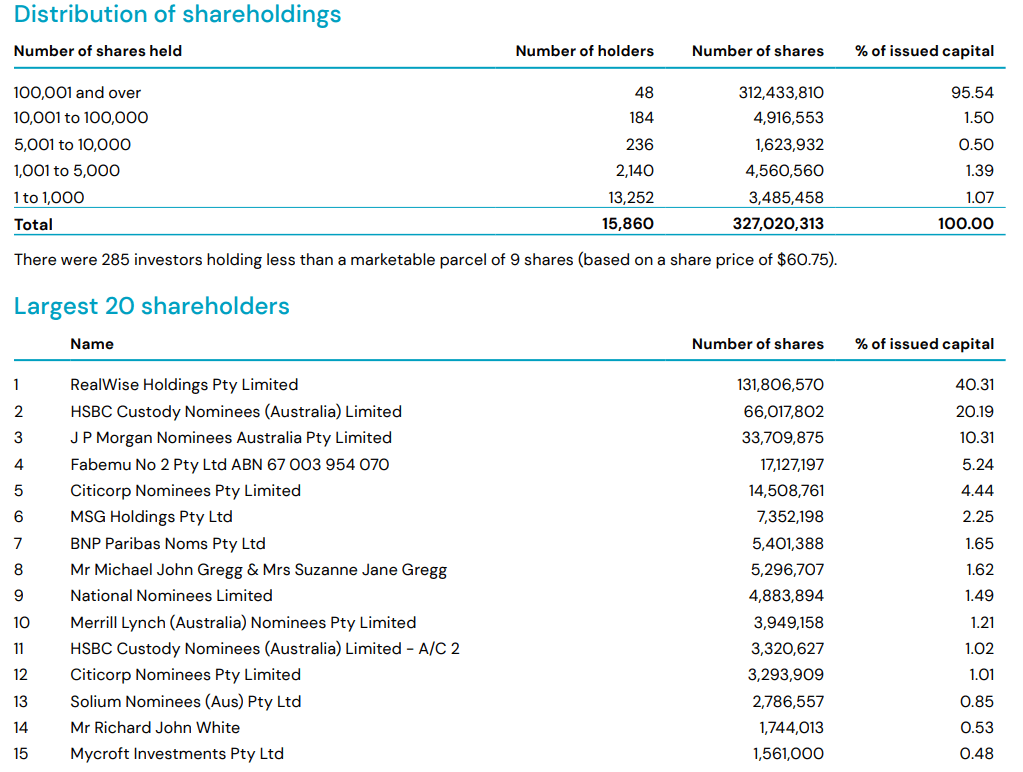

I would recommend keeping a long-term investing horizon and suggest that recurring investments regardless of valuation is critical, there is also one key factor to suggest that WiseTech is insulated to swings in investor sentiment: insider ownership.

According to the company website and Yahoo Finance, insiders own 52% of all shares, with the co-founder and CEO accounting for 40% of the total issued capital. Also, only 45% of the current float is owned by institutions and there are many large percentage individual investors within the top holders, limiting downside as long as insiders/individuals continue to hold. While much of this can be attributed to being listed OTC in the US with low volume, there is still around $30 million in value traded per day on the ASX.

However, US shareholders are recommended to buy on the ASX in order to find enough liquidity for their buys and sells. As the company grows, investors should look forward to increases in liquidity through either a US-listing or increased non-insider ownership.

WiseTech Website

Conclusion

When looking abroad for diversification, it is important to consider that there are more risks involved. However, through this analysis, I believe that implications with WiseTech’s falling growth and premium valuation are outweighed by the current financial performance, and potential down the road. While it will be important to assess the risks of liquidity and the listing on the ASX, some modern brokerages can allow for global investing cheaply and with far less risk than in years prior.

Want to learn more about the industry? I discuss another strong US-based candidate, SPS Commerce (SPSC), in another recent article.

For now, I will remain long WiseTech, and will continue to add to my holdings steadily for many years to come. This does not mean that the share price will only go up, but due to uncertainty, I will base my bullish thesis on at least a 5-10 year horizon. Volatility may be an issue in perpetuity, but swings in valuation will always be additional buy points to take advantage of. I hope I present clear data points in order to bolster your own due diligence. I also hope I made it clear why I believe that WiseTech is one of the best ex-US investments out there.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment