gorodenkoff

A Quick Take On Procore Technologies

Procore Technologies (NYSE:PCOR) reported its Q2 2022 financial results on August 3, 2022, beating expected revenue but missing EPS estimates.

The company provides construction management software to companies worldwide.

The firm’s worsening operating losses in a growing cost of capital environment make it difficult to see substantial potential upside in the near term.

Until management makes a significant turn toward operating breakeven, I’m on Hold for PCOR.

Procore Technologies Overview

Carpinteria, California-based Procore was founded to develop a comprehensive construction management SaaS platform for the complete lifecycle from pre-construction to ongoing management.

Management is headed by founder and CEO Craig Courtemanche, Jr., who was previously founder and CEO of software consulting firm Webcage.

The company’s primary offerings include:

-

Prequalification

-

Bid management

-

Project management

-

Quality & safety

-

Design coordination

-

BIM

-

Field productivity

-

Financial management and services

PCOR pursues medium and large customer accounts via direct sales efforts.

In addition, the firm is active in brand building efforts through participation in a large number of construction industry events.

Market & Competition

According to a 2019 market research report by Technavio, the market for construction management software is expected to grow by $725 million from 2020 to 2024.

A report commissioned by the company and prepared by Frost & Sullivan, indicated that the market for the firm’s existing products is $9.4 billion.

Deloitte estimates that 1.5% of the global construction expenditure will be spent on IT products and services, which would equate to about $15 billion.

The main drivers for this expected growth are the continuing urbanization trend in major countries worldwide and the ongoing need to upgrade or add new infrastructure.

Major competitive vendors include:

-

Oracle

-

Autodesk

-

Trimble

-

ComputerEase

-

Foundation

-

Jonas Software

Management says its combination of software tools plus its growing app marketplace promises to drive greater value for customers.

Procore’s Recent Financial Performance

-

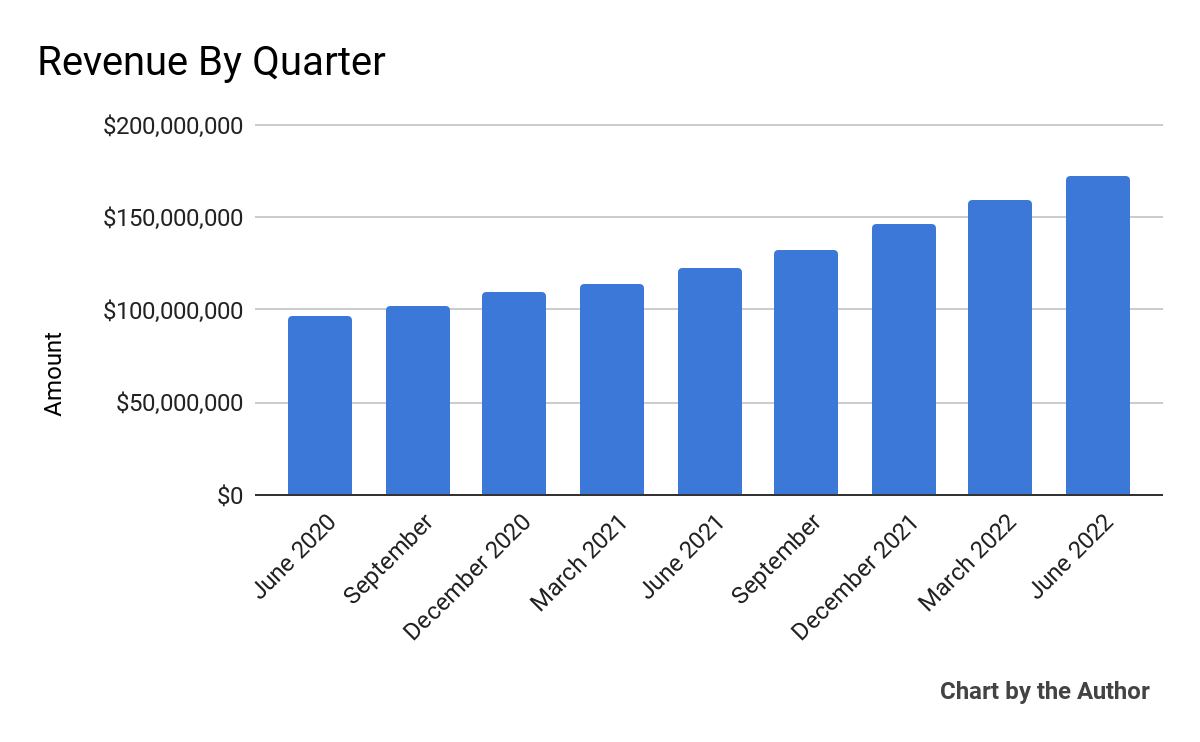

Total revenue by quarter has continued its recent upward trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

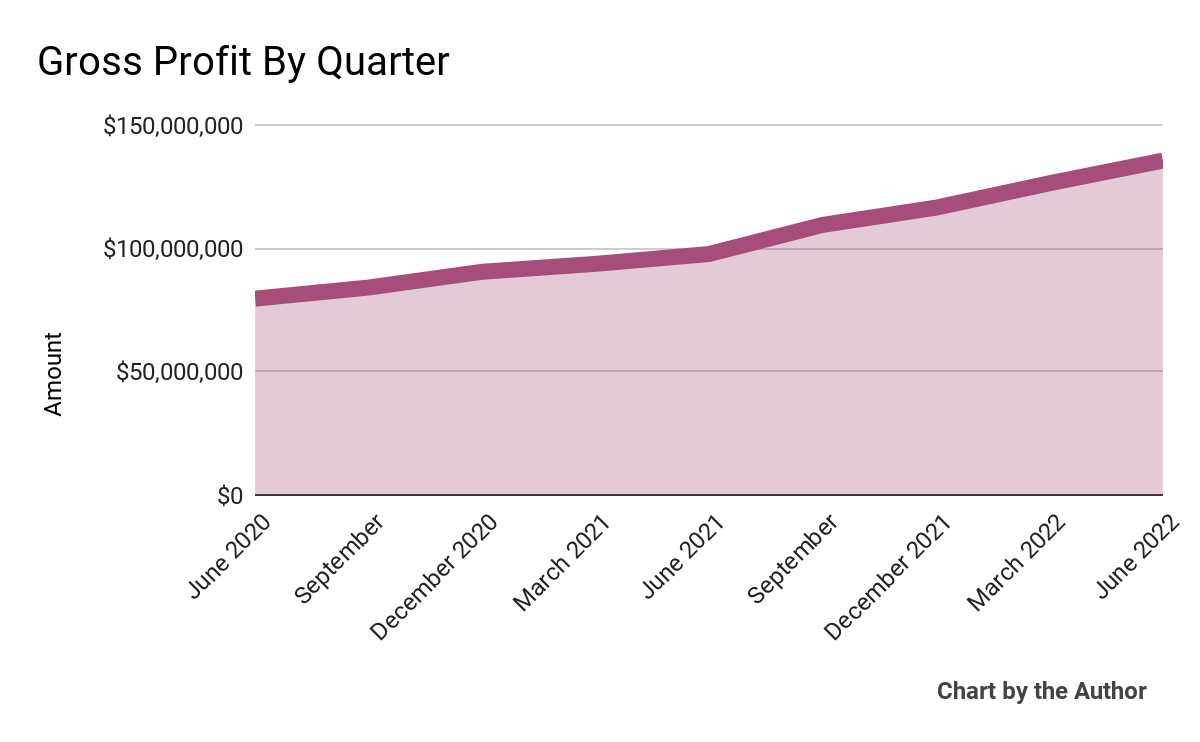

Gross profit by quarter has also grown impressively:

9 Quarter Gross Profit (Seeking Alpha)

-

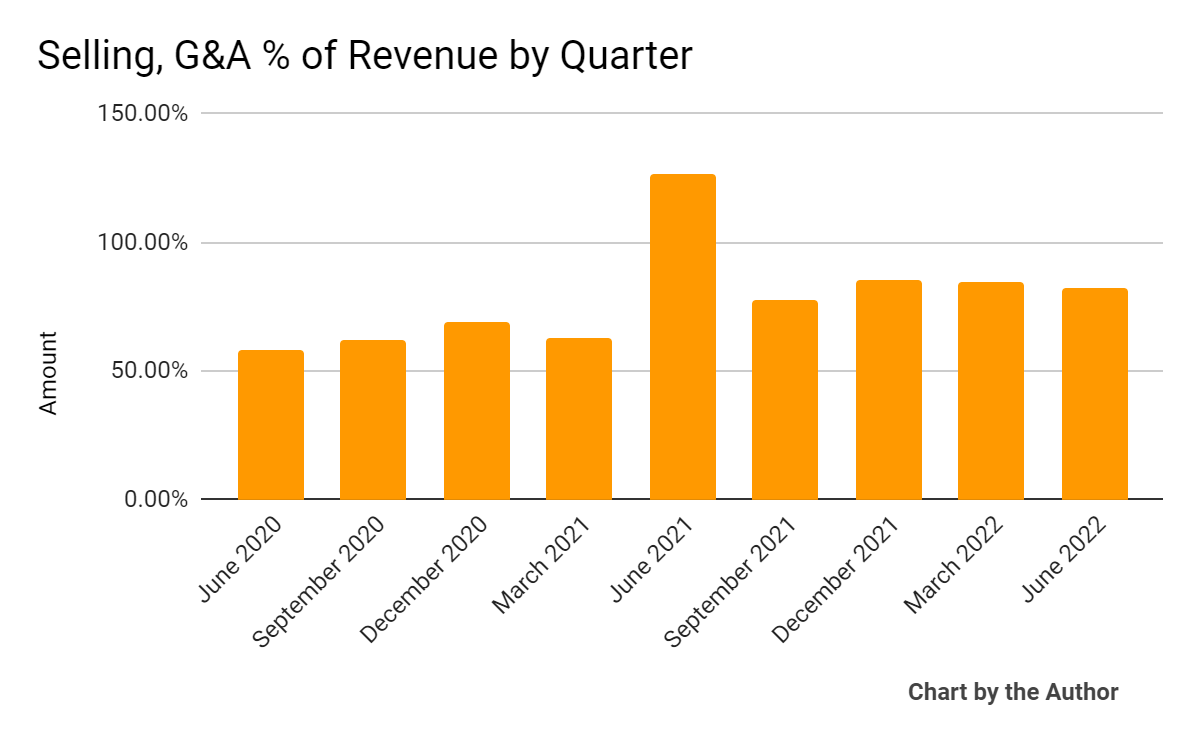

However, Selling, G&A expenses as a percentage of total revenue by quarter have also trended higher as revenues increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

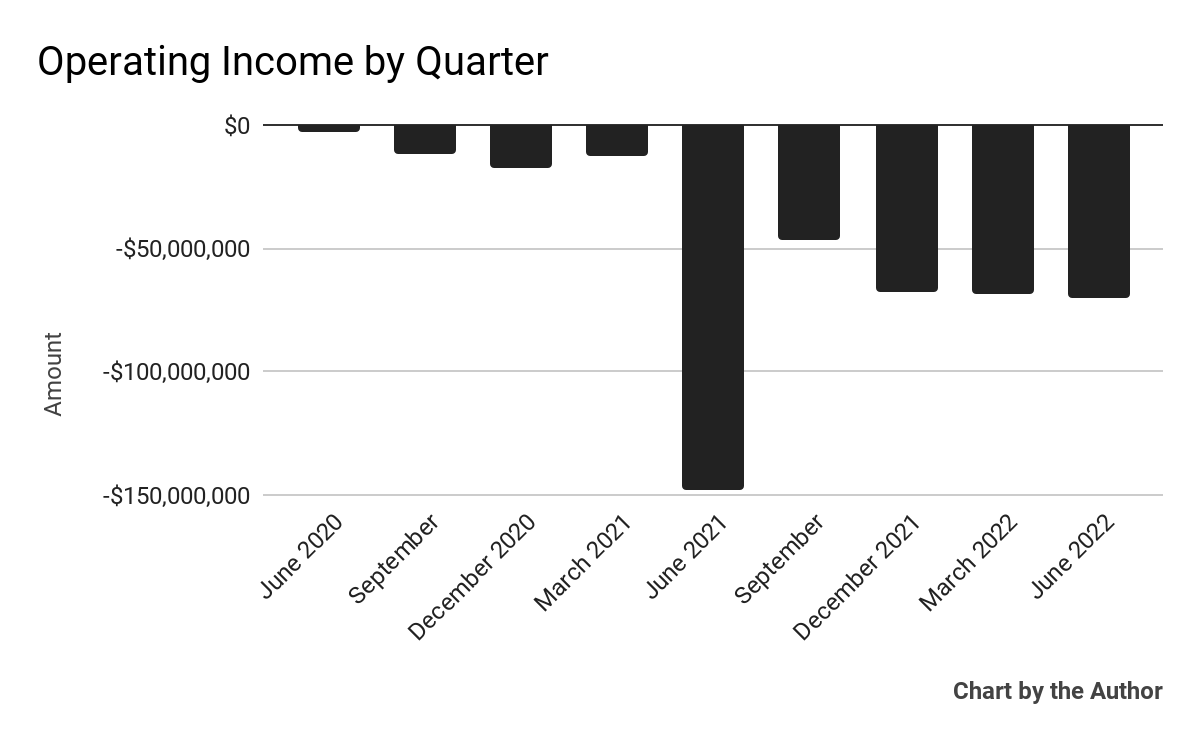

Operating losses by quarter have remained substantial in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

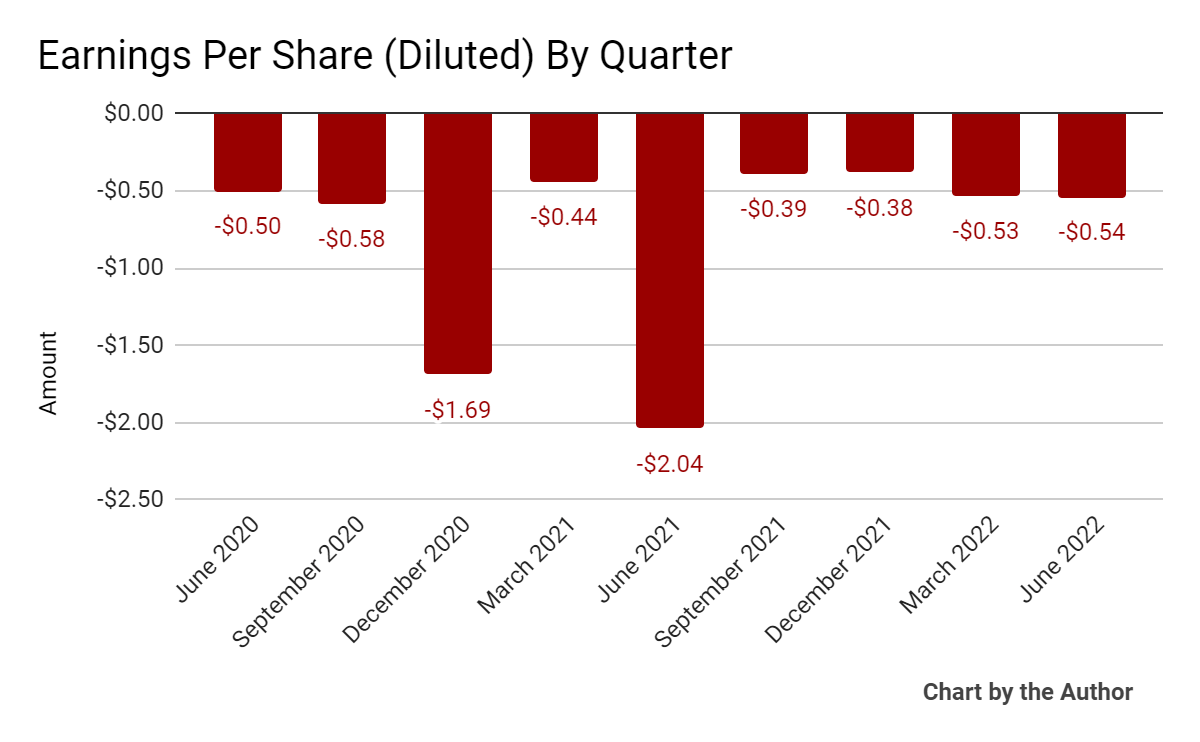

Earnings per share (Diluted) have also remained heavily negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

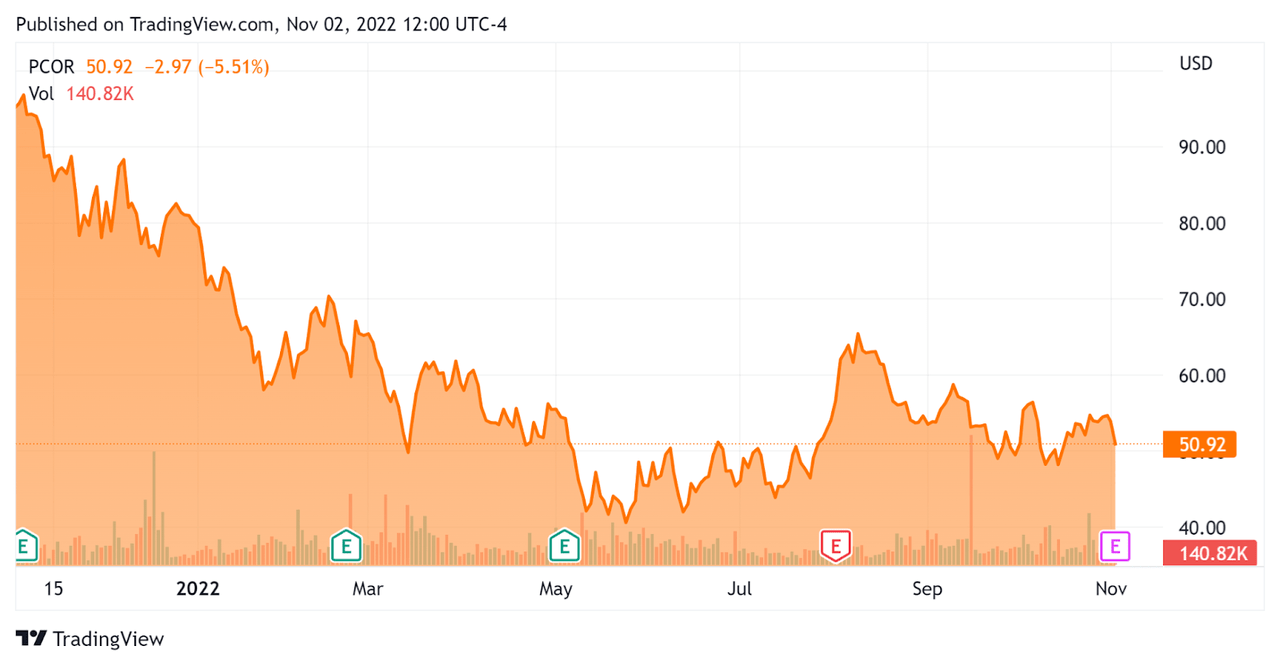

In the past 12 months, PCOR’s stock price has fallen 46.8% vs. the U.S. S&P 500 index’s drop of around 16.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Procore

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

11.49 |

|

Revenue Growth Rate |

36.1% |

|

Net Income Margin |

-40.4% |

|

GAAP EBITDA % |

-36.3% |

|

Market Capitalization |

$7,480,000,000 |

|

Enterprise Value |

$7,000,000,000 |

|

Operating Cash Flow |

-$5,110,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.84 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PCOR’s most recent GAAP Rule of 40 calculation was negative (0.2%) as of Q2 2022, so the firm is in need of significant improvement, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

36.1% |

|

GAAP EBITDA % |

-36.3% |

|

Total |

-0.2% |

(Source – Seeking Alpha)

Commentary On Procore

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the launch of more than 60 product enhancements and its Bid Management 2.0 update.

The company continues to see strong demand internally, although management noted that it is aware of external macroeconomic conditions.

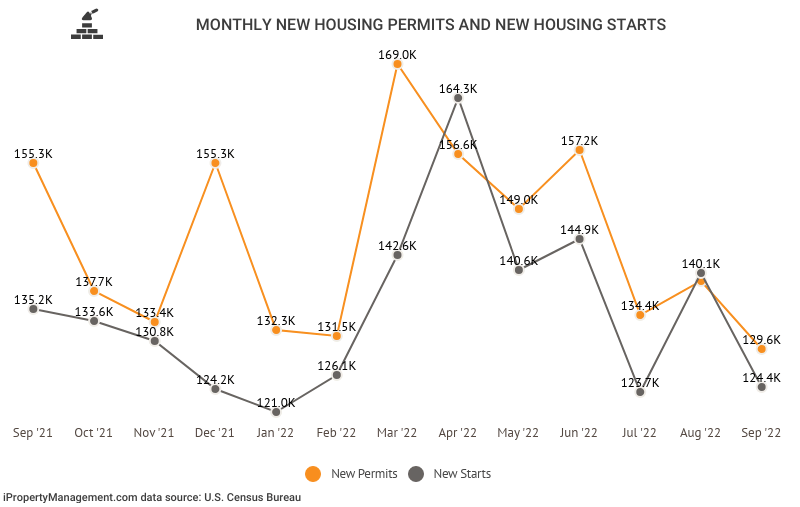

U.S. housing permits and starts have been dropping quickly in recent months, as the chart shows below:

New Housing Permits & Starts – U.S. (iPropertyManagement)

PCOR is also in the early days of sub contractor material financing solutions through its acquisition of Levelset.

As to its financial results, total revenue was up 40% year-over-year, 34% organically.

Management did not disclose the company’s net dollar retention rate, other than to say that it showed ‘improvement.’

PCOR’s Rule of 40 results have been poor, producing slightly negative results for this metric.

Operating losses worsened slightly sequentially, as did negative EPS results.

For the balance sheet, the firm finished the quarter with $563.2 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was $22.7 million, of which CapEx accounted for $17.6 million.

Looking ahead, for the full year of 2022, management expects total revenue growth of 34.5% at the midpoint of the range.

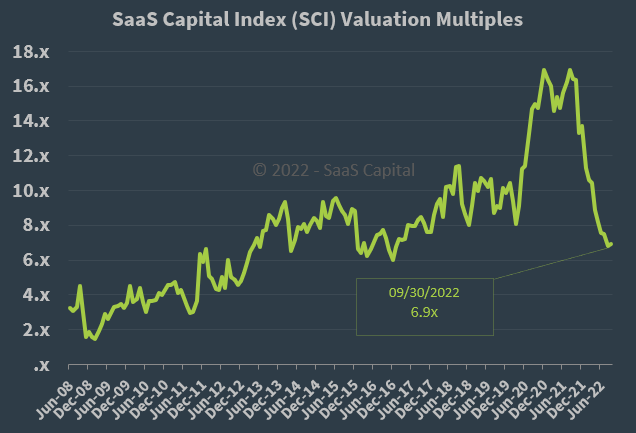

Regarding valuation, the market is valuing PCOR at an EV/Sales multiple of around 11.5x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x at September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, PCOR is currently valued by the market at a significant premium to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

An upside catalyst to the stock could be a tapering of U.S. interest rate increases, resulting in a higher valuation multiple expectation by the market.

Still, the firm’s worsening operating losses in a growing cost of capital environment make it difficult to see much potential upside in the near term.

Until management makes a significant turn toward operating breakeven, I’m on Hold for PCOR.

Be the first to comment