Carsten Koall/Getty Images News

Sono Motors (NASDAQ:SEV) entered the bustling EV scene with its Sion solar car in November last year through an IPO that saw the Munich, Germany-based company take a position on the NASDAQ at a valuation of around $2.6 billion. This was the culmination of a journey from founding in 2016 to a series of highly successful crowdfunding campaigns. At the core of the company’s mission to help decarbonize transport is Sion, its solar-powered passenger vehicle. The concept is unique, and Sono hopes the car could eventually become the world’s first affordable solar electric vehicle for the mass market.

If the concept sounds niche, that’s because it is. It seems inherently obvious to use solar panels on EVs, essentially creating carbon-free energy at no incremental cost to owners. Indeed, this has been explored by other automakers including Tesla (TSLA) who wanted to develop a solar roof option for the Model 3. This idea was eventually walked back on by Elon Musk, who concluded that the maths for putting solar panels on vehicles does not work out as “the actual surface of the car is not that much.” Apart from Fisker’s (FSR) Ocean SUV, most other automakers have abandoned the feature for either expense or efficiency reasons.

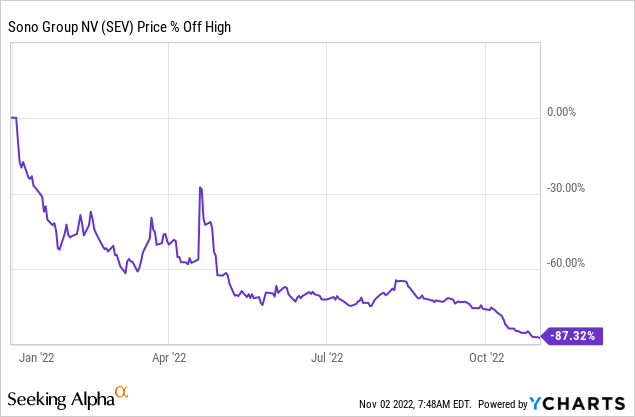

Hence, the Sion aims to create a subset of its own. The go-public transaction acted as a salvo for the company who was facing material financial difficulty and was hurtling close to bankruptcy, but shares are since down 87% year-to-date on the back of a market whose previous insatiable appetite for EV companies has turned into fear and relative derision. The more than year-long risk-off trade has seen a large selloff of broadly unprofitable firms in fast-growing sectors.

In this sense, whilst the go-public transaction allowed Sono to raise at least $150 million in new capital, the company did so during the worst period. Sentiment has turned sour, and the scale and extent of the pullback of its common shares reflect this material redaction of the previous hype and euphoria extended to EV companies. Indeed, at one point, pre-revenue peer Lucid Motors (LCID) had a larger valuation than Ford (F) and General Motors (GM).

Orders Are Growing As Production Is Set To Commence In Calendar 2023

Sono Motors had just over 20,000 reservations as of the start of September 2022. These are non-binding orders, but they have a small deposit fee attached to their €29,900 ($29,600) price tag. The company expects production and deliveries to commence in the second half of next year with a contract manufacturer based in Finland. Sono announced the signing of a term sheet with Valmet Automotive back in April after previous plans with Sweden-based NEVS fell through. Valmet is set to provide the company with a carbon-neutral production capacity for 43,000 vehicles per year.

Sono Motors

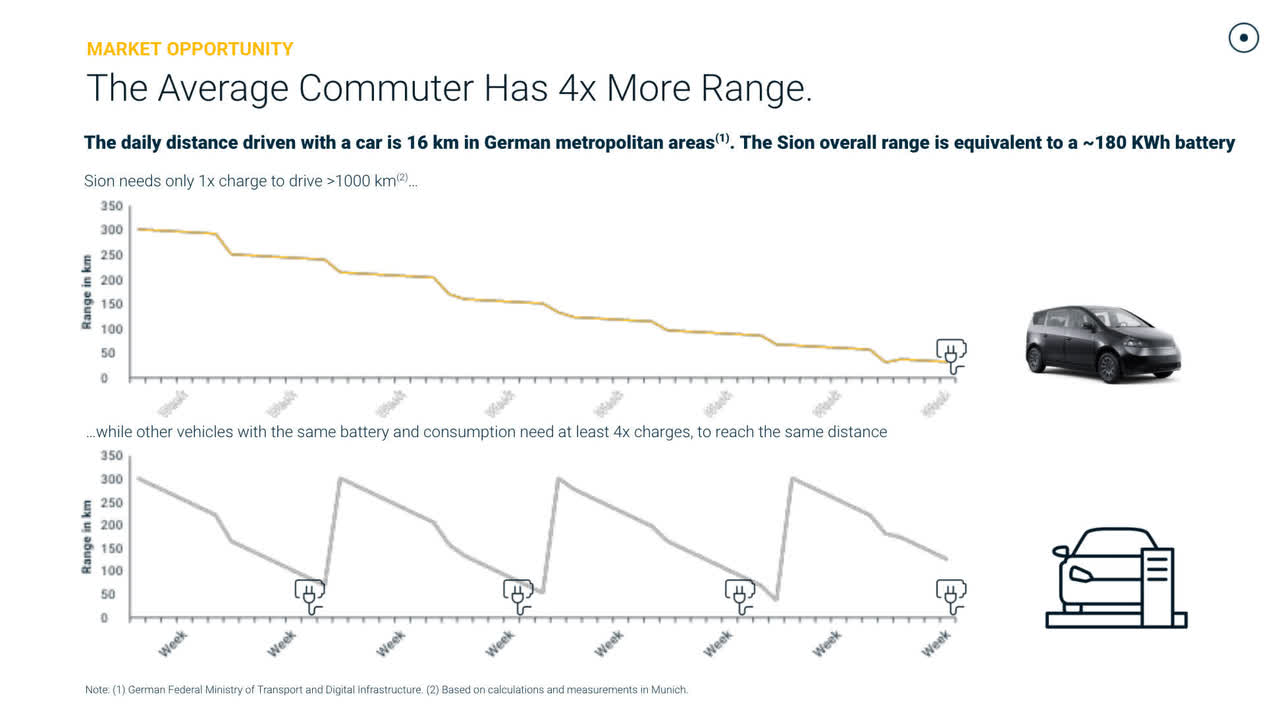

The company’s value proposition is that solar panels attached to cars can enable a greater range and broader cost-saving benefits for drivers. According to management, Sion can generate additional range from solar power of around 70 miles per week up to a maximum of 152 miles in sunshine-heavy weather or states like California. Hence, Sion can nearly self-sufficiently cover the average distance driven by an American on a weekly basis.

Solar Instead Of Paint

But there’s a problem. Whilst the company raised enough capital to avert the financial difficulties it faced pre-IPO, Sono still needs at least $200 million to get to the Start of Production. Manufacturing a car is not easy, even when being done by a third party. It’s an incredibly capital-intensive process, and Sono had up until IPO burnt through hundreds of millions of dollars in capital from its VCs and crowdfunding rounds. The company went public to be able to further tap the market for liquidity, but the collapse of its common shares and the broader pullback of previously buoyant animal spirits enjoyed by the sector now means EV manufacturers can and will fail. This most recently saw Electric Last Mile (ELMS) collapse just over a year after going public. The gushing money tap is over, and Sono will find it difficult to raise the amount it is targeting without risking an even more material collapse of its shares.

Sono plans to also sell and license its solar technology to other manufacturers as well as use it on Sion. Its polymer technology is set to be lighter, more flexible, and cheaper than competing glass-reliant hardware. Hence, the company might find that this eventually comes to dominate its revenues if there is a failure to raise more cash for Sion SoP.

The future for EVs is bright, with sales forecasted to grow to at least 26.8 million by 2030, up from 6.6 million in 2021. Sono’s approach to this growth is unique and with 20,000 orders it’s clearly building momentum. Shares are one to watch with a valuation that has collapsed to just $115 million.

Be the first to comment