alexsl/iStock via Getty Images

This article was coproduced with Wolf Report

Wise PLC (OTCPK:WPLCF) is an interesting payment company based in the UK. It is, among other things, the company Wolf Report uses for non-European payments, and it works flawlessly. He’s been using a number of companies for this over the years, the latest being PayPal (PYPL).

However, fees aside, Wise offers more convenience and ease of use as you will see in this article, and how this translates into being an attractive investment.

Now, full disclosure straight away – Wolf does not own Wise shares, but he may just buy a starter position in the company in 72 hours.

What is Wise?

Wise, with the former name of TransferWise, is a London-based fintech company offering payment solutions. It was founded almost 11 years ago after the financial crisis by two Estonian businessmen, who remain chairman and CEO of the company to this day.

One of the founders was actually the first employee of Skype. The entire idea for Wise came because they faced difficulties transferring money back to Estonia.

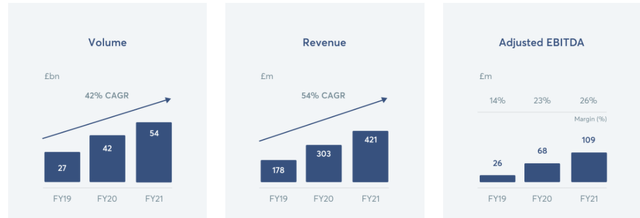

This company has revenues of £300M, £21M in profits, and a market capitalization of around £5B. Despite being a relatively small company, this business is followed by many investors around the world.

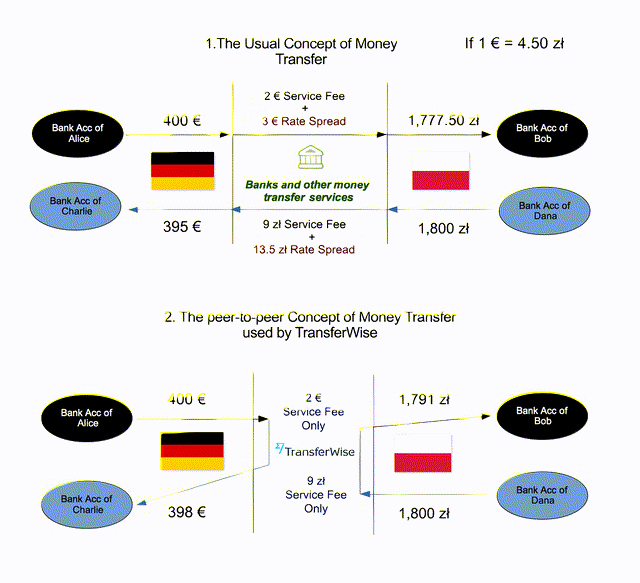

Wise is often compared to a so-called hawala-money transfer system in how it works. To show you what Wise does, I’m showing you a comparison graphic that I believe speaks louder than several paragraphs worth of words.

Wikipedia

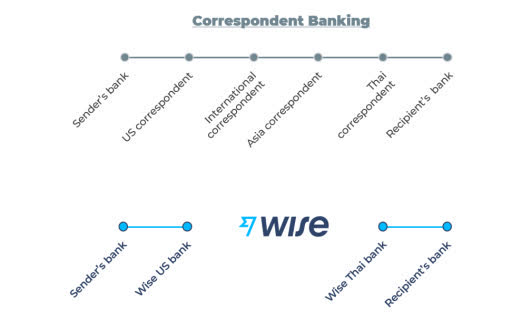

Wise as a company is all about so-called transaction gateways. When Wise does its thing, money actually never crosses borders. Instead, Wise owns bank accounts in both geographies and acts as the gateway procedure party which looks into KYC, AML/etc., and sends transfer requests locally once the deposit/transfer in the other account is approved.

Wise Gateways

As you can see, Wise customers save a significant amount of money in the long run in terms of rate spreads. On average, and compared to PayPal, Wolf’s savings on a monthly basis by using Wise instead of PayPal based on FX as well as lower service fees is nearly 93%.

This payment product is very quickly gaining market share from the incumbent – and inefficient – banks, many of which Wolf wrote about on a frequent basis.

While we still would characterize Wise as a bit of a “niche” product – it took Wolf Report months to become comfortable using the service – the company is in an excellent position to gain market share from old, inefficient infrastructure.

As an example, Wolf can receive a payment to his US-based Wise account, complete with an ACH-compliant account number, and transfer it to a Swedish bank account with a turnover less than 36 hours from the time of transfer initiation to my Wise account. This is a marked improvement on the typical 3-5 business days it usually takes with standard banking methods.

So, Wise is both cheaper and faster as well as more convenient than traditional banks.

Wise IR

But Wise is not a bank. The company doesn’t even hold a banking license, and management has repeatedly said it won’t become a bank. The company works with banks, and collects deposits, but does not perform lending, has no overdraft, and does not invest its deposits (at least not to any major degree).

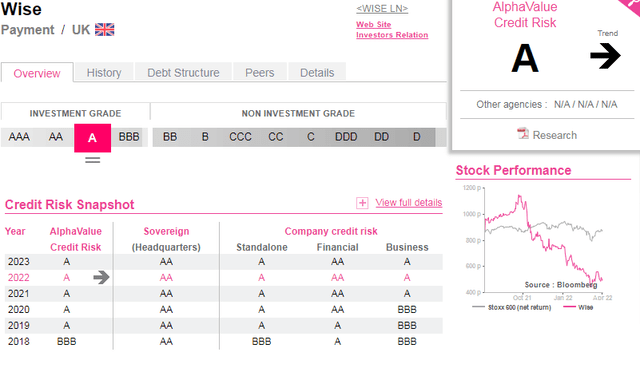

Wise has no dividend yield – it’s a pure growth company. It doesn’t have an agency-rated credit rating, but AlphaValue rates the company at an A in terms of what the equity analyst service calls “credit risk.”

AlphaValue

The company has a few main products/services.

The biggest by far of these is the Wise Transfer, the main product. This product/service enables individuals to send money to relatives or their own accounts using a multitude of different currencies. The company claims a fee saving of 8x cheaper, and that their turnaround time is faster than banks (38% instantly and 83% in less than a day vs. 2-3 days for banks). As a user, you can confirm this even when handling trans-Atlantic transfers. This is also the product that is responsible for bringing most customers into the company.

The Wise Account is a secondary product which allows users to have FX accounts. The user is allowed to hold multiple currencies in the same account and allows the individual to pay in different currencies in different countries.

Because of this, a user can use a Wise-tied Visa card to pay in the US, Canada, Germany, and Sweden – and Wise will automatically choose the currency of the country you’re paying from and make sure the payment is processed in that currency if the account holds such currency. This makes the payment significantly cheaper than with an alternative card.

Wise Business offers companies a complete FX product, but obviously on a business scale, and also ties this to invoicing, payment solutions, and accounting facilities.

The Wise Platform is the way the company ties its services with banks, credit unions, and financial institutions. This partnership means that banks can provide customers with seamless access to the company’s cross-border services.

These qualities have made Wise one of the primary services used by so-called “digital nomads” and other people working from a mobile situation while traveling or living anywhere in the world.

Wolf has a friend from school who works as a programmer from his catamaran currently moored in Grenada, who has no issues receiving payments in USD, EUR, and SEK while paying for his necessities locally using his Wise card.

Wise does not report service-specific revenues but instead reports every number under either “personal” or “business” transactions. This means that it’s virtually impossible to consider or calculate the efficiency of the products, and the company’s results are viewed in terms of high-level macro success as opposed to product-specific success.

The company’s technology is tied to the use of powerful algorithms that ensure that the company has enough capital in every locality in order to cover and settle transfer requests and amounts (given that, as I said, money actually never crosses borders).

Personal transfers are about four times as large a source of revenue as business transfers at this time. The company’s primary exposures are to Euro and GBP, but there’s also a great deal of USD and Emerging Market currencies in the mix as well.

The company’s secret sauce, its success if you will, is the fee it charges its customer for transactions. The company has some flexibility with these fees, and it’s tailored to the local costs required to facilitate the transfer. What this means, the cheaper it usually is to transfer money inside target and origin country, the cheaper it is to transfer using Wise.

It’s likely that cross-border transaction fees will shrink further with time, as Wise can be considered a first-mover that’s currently doing all the right things by establishing powerful relationships with banks, and thus is getting some advantages of scale.

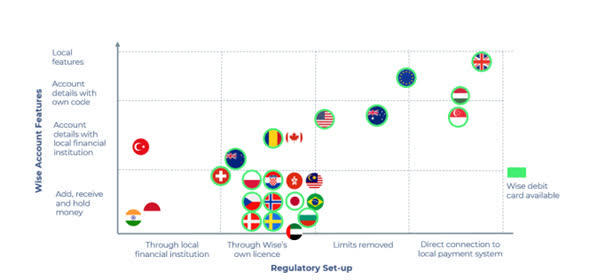

When launching in a new country, Wise first partners with local banks in order to accept/enable money transfers. This incurs a cost that Wise passes onto customers. With time, Wise can plug its software into the local scheme, enabling it to end local bank partnerships (75% of the cost of sales), further decreasing the cost of transactions, and increasing the speed of processing.

The company currently has the following regulatory partnerships and structures.

Wise IR

The key to Wise’s success is payment processing speed. Because of its integrated model, once a nation becomes directly tied to Wise, the company virtually has no costs for the transaction. For instance, transferring money inside Sweden is 100% free – but the company could still charge a fee for this if the remittance occurred from outside of Sweden.

The primary impact on earnings and revenue volatility is the FX risk, given the company’s multi-FX exposure. Also, we want to keep a firm eye, given that Wise is a growth company in its early stages, on share-based comps and dilute the SO accordingly in order to impact shareholder value.

Wise has very low leverage (net cash position), and therefore the EBITDA to FCF conversion rate is outstanding (86% expected 2022 year-end).

The other side of Wise – risks and considerations

Expect a fairly comprehensive risk analysis when it comes to Wise – because there are, if not direct concerns with the company, high-level considerations to be made.

First, this company isn’t currently comparable to processors like Adyen (OTCPK:ADYEY). Wise runs an extremely tight business model, very small capex, and a model that theoretically could benefit massively from economies of scale once local integration into payment schemes is achieved.

The tricky part is that even as payment fees decrease, the company’s forecastability in terms of cash flow is very low, compared to a legacy payment processor like Adyen, in this comparison. Adyen grows with its customers (merchants), coupled with an inelastic as opposed to elastic demand for its transactional services. Be very clear that when you look at Wise, the forecastability of cash flows is considerably lower than most of the payment processing peers.

Wise is a player in the growing Remittance market, a market that’s expected to grow by around 5% per year until 2026, with the personal segment at around 10% per year.

However, competition exists in the form of other remittance services, such as Revolut, Payoneer, Moneygram, Remitly, etc. While Wise is larger than some of these, all of these provide some competence in the market.

So, competition is a risk as well, and the visibility for the company can be considered comparatively low. The other thing, and perhaps bigger, is how it intends to grow. The company’s overreliance on the remittance market might work at this time, but in order to grow as a business, Wise needs multiple streams of recurring revenue. The stream we can see that it needs to tap further to start to lessen this reliance is the business market.

We don’t often talk about crypto, but the democratization process in terms of cryptocurrency could also be considered a risk to the business model as they offer essentially a similar service. Still, it seems unlikely that such a process should happen soon, or easily.

Wise in its current form is a business that is about:

- Cutting fees

- Increasing the speed of transfers faster than its competition

- Gathering volume/market share

- Impose a moat/entry barrier

The fourth point there is the hard part, though given volume, new partners and time, and as the market becomes more and more crowded, this seems likely to happen.

Wise is an early mover with incredibly good fundamentals and a good starting position. It has managed to bite off significant market share in an attractive market. It now remains to be seen if the company can translate that into growth outside of the remittance market.

Let’s look at company valuation next.

Wise stock valuation

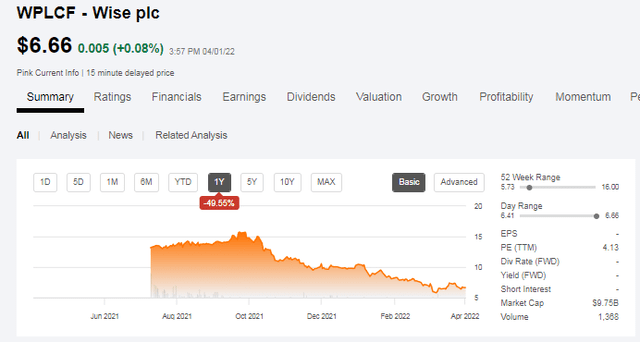

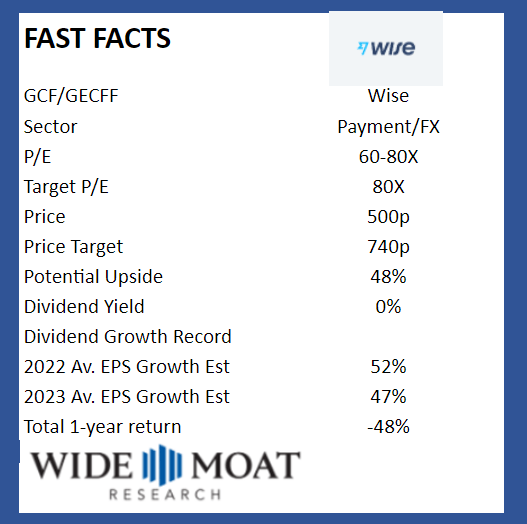

Establishing a good fair-value target is integral to a good fundamental thesis. Wise has significantly underperformed since its IPO in 2021 and currently stands at 499p for the LON symbol WISE. This is a one-year drop of 48.29%.

Seeking Alpha

The ADRs for Wise are WPLCF and WIZEY.

We will look at Wise from a perspective of peers/comps, other analysts, DCF and NAV, as well as multiples in order to establish a conservatively-adjusted FV target for the business.

Beginning with DCF, we’re neutralizing working capital adjustments/changes as these reflect deposit transfers, and they have very little actual impact on corporate cash.

We forecast a somewhat lower EBITDA margin going forward, as Wise’s battle cry is a reduction of fees. Reduction of fees does not transfer well into increased EBITDA margins.

Over the longer timeframe, we expect margin stabilization as software integrations increase and as Wise gets a volume processing advantage. Overall, we expect a margin somewhere in the 28%-29% range for the terminal period, but a decrease to 24% or below for this coming fiscal.

On the basis of this, and a WACC of 8.2% with sales growth assumptions of 15% and EBITDA of 14-18%, we get an implied EV/share of between 690-780p/share.

The company’s current valuation is 499p per share, implying a significant upside on a DCF basis. We would be careful just how much credence we put in DCF here though, given the poor forward visibility for the company.

We’re not discounting it, but we’re lowering the weight we’re giving DCF to the aggregate share price target.

Peers are harder.

We would value Wise compared to Adyen, Block (SQ), and perhaps PayPal. Most of the company’s direct remittance peers are not actually publicly listed. This would give us an average, massive high P/E of around 42x P/E, almost 55x EV/EBITDA, and a P/book average multiple of almost 11x.

We know from other articles that peer averages in this sector, based on extremely high-valued Adyen and Block, are bound to be high.

As are Wise’s multiples.

This company trades at an average P/E ratio based on a 2021E 6p EPS of almost 80x, even after dropping significantly. While this ratio drops quickly as we start accounting for company growth – less than 40X on a 2024E 14p EPS, it all comes back to the same point – growth, and how likely that growth is.

The company has a plan.

They win customers by cutting the cost of remittance services faster than anyone. However, rising rates and global economic uncertainty have caused the share price to plummet, and unlike most of its peers, it has not yet recovered. I believe the valuation hit the company has taken is mostly due to the backdrop of rate increases and fear of general market disruption. The acceptance rates for risk have decreased dramatically over the past year or so.

We value the company’s NAV using an EV/Capital Employed = ROCE x EBIT multiple, coming to around £9B in gross assets, which comes to around 890p for the latest share count of 1037M.

We can see that in every single valuation method apart from yield, which the company does not have, it scores high marks in undervaluation to what the market would consider a fair-value PT and what we, using similar methods, would consider a fair value target as well.

S&P Global has seven analysts following the company, giving the business a current average target range of 660-1150p, with an average of 835p. While this may sound great, only two out of the seven, despite no analyst actually believing 499p being overvalued, have “BUY” ratings for the business.

1 analyst is a “SELL” and four are at “HOLD” here.

How this squares with their price targets, or the fact that these targets have been cut by around 20% on average in less than six months, we will leave it up to them.

When we set my PTs, we set them at levels where we would buy the company.

While PayPal seems likely to face revenue growth challenges, we believe that Wise’s approach of getting remittance customer volumes/business will actually work. It’s in line with what we view as the future of transfers and payments in a digitized world – and it works.

Wolf Report can obviously, using the service, vouch for this.

In establishing a target for Wise, we aggregate the methods mentioned – and then cut the company by 15%, just to add that touch of conservatism we like to take in my investment approach.

The resulting PT is 740p/share. That means that at current valuations, we rate Wise plc a “BUY” with a bullish view.

We believe the current pressure for growth stocks might very well discredit some of the players that are likely to succeed going forward – and we consider Wise plc to be a company that actually could succeed well – because it’s shown historically that it’s able to do so.

That’s my current valuation view on Wise.

Thesis

There’s no sugarcoating the fact that investing in Wise means investing in the company’s vision, as well as its founders. Co-founder and CEO Kristo Kaarmann holds 41% of the voting rights in the company.

The differentiator from other businesses, and the thing to really keep an eye on, is that Wise acts quickly enough to integrate fully with local schemes and payment routes, in order to capture market share in the Fintech battle.

Wolf Report tried other remittance services – such as Revolut – and he can say with confidence that in terms of features, cost, availability as well as ease of use, nothing beats Wise as of the publishing of this article, even if Revolut apparently boasts a larger brand name.

However, comparing the two closely might be moot, because Revolut intends to become a bank. Wise has no plans, as of now, to do this. Also, Revolut is not actually a profitable company, with net losses close to £150M, recording nearly £300M of accumulated losses and equity of around £420. In today’s world, Revolut will need to show investors it can profit – as relying on fundraising won’t be possible ad infinitum.

As investors, we’ll have to make sure that the positives for Wise continue going forward.

It’s a common misconception that we’re opposed to growth stock investing.

We’re not opposed to it – we just want our risk/upside aligned, and we don’t want to overexpose any position. Wolf Report’s stake in Wise is relatively small for the time being, but he expects good things out of the company, and we both believe it’s being traded at a discount compared to what it could actually achieve going forward.

Wolf only owns three stocks in his portfolio that do not pay a dividend. Wise is one of those companies, and he firmly believes that the demand for the services that Wise offers will only grow, not decrease, and that legacy payment operators such as PayPal will continue to post stagnant growth rates.

When it comes to a growth company, it’s crucial to be absolutely clear in what you expect out of the company. What we want to see is:

- Continued massive leadership expansion in the remittance sector through adding and integrating more localities and schemes, and further lowering fees.

- Continued customer growth.

- Firm expansion into the business segment, to diversify its revenue streams.

As long as this continues, we believe Wise to be a worthy investment.

Here are our targets for the company.

iREIT on Alpha

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment