BlackSalmon/iStock via Getty Images

Investment Thesis

Mosaic (NYSE:MOS) is priced at 4x free cash flow. An absurdly cheap valuation when you think about it.

There’s a myriad of factors that have distracted investors away from this stock. But the underlying fundamentals are now becoming increasingly better, rapidly.

There’s really a lot to be bullish about here. So let’s get to it!

The Agriculture Trade Cooled Off

The market isn’t the best at decimating a lot of information in one go. And it’s too easy to rely on past models to plot the course. What I’m referring to here is that the Russian invasion put a spotlight on many different areas of the market. There was oil, gas, agriculture, heavy metals, the list goes on.

Russia has the hard assets that the world needs. And for too long, investors avoided commodities, an area with notoriously poor returns, and embraced shiny new Silicon Valley ”stories”. We could call them disruptive companies, but that would conjure up images of too small a sector of the market.

I’m referring to capital flowing towards areas of potentially high returns. Investors, media, and executives, all got entranced and stuck on one path.

Then, the Russian invasion shone a spotlight on commodities. The market commodity market rallied, but in a few months it cooled off. Why?

Because investors got too excited and were expecting a lot of fireworks. Even though the fundamental idea was right, there were massive shortages for Mosaic’s potash and phosphate, the timing wasn’t to be counted in days and months, but rather it was quarters and years.

The Market Has Got This Wrong

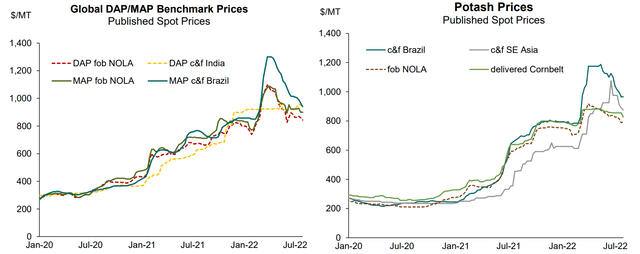

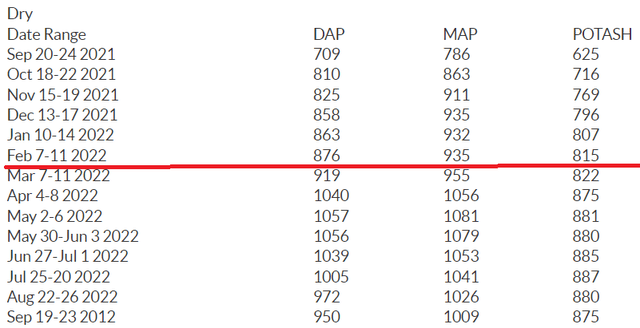

Allow me to describe the two graphics above. They show that Mosaic’s DAP/MAP (two phosphate variants) and potash rapidly accelerated and fizzled out over the summer.

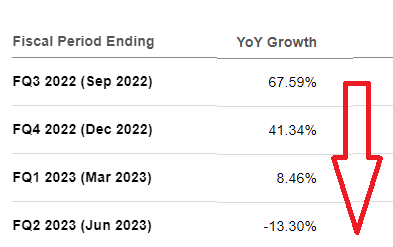

MOS’s revenue estimates

And an echo of that theme is seen here. In both instances, it’s a variation of the same idea. That the very near-term fertilizer pricing peaked, and that starting with Q4 2022, revenue growth rates will rapidly fizzle lower.

However, I categorically dismiss that idea. For now, analysts are expecting that their financial models mean revert to the average baseline. This is wrong. Unquestionably wrong. Why? Because it’s a financial model that isn’t based on reality.

The Reality at Play?

The problem here is both energy and fertilizer supply.

I’ll address the energy situation in the first instance, before turning to supply. The swings in the energy market have driven the market to the wrong conclusions.

The energy situation in Europe is catastrophic. And it has multiple ramifications that are impacting the whole commodity space.

And even though the looming US recession has led the spot market to believe that we won’t need energy going forward, the underlying reality is, we’ve been here before.

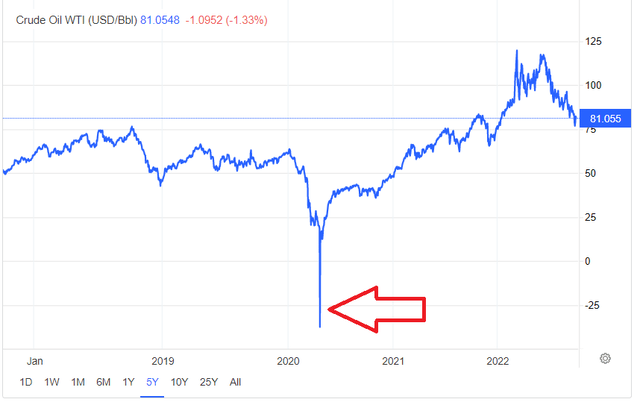

If you honestly want to believe in the spot market, don’t need to look further than oil prices in 2020.

What you see here is that oil prices turned negative, as investors believed that we wouldn’t need oil going forward. Oh my.

And here too, the facts on the ground are so different from the spot market. The energy prices are forcing European fertilizer companies to close their doors. This is the reality. Supply was already tight, and now, Europe can’t economically produce fertilizer at scale.

And this leads me to my second argument. Supply is incredibly tight. And as much as Mosaic, Nutrien (NTR) and others truly want to capitalize on this opportunity, they can’t.

And this is reflected in the table above, prices not coming down. As much as investors boldly proclaim ”demand destruction”, the facts don’t support that narrative. Prices have remained persistently high.

And rather than coming up with a new narrative, investors simply allow Mosaic to continue trading cheaply.

Before discussing Mosaic’s valuation, allow me to discuss something that’s close to my heart.

Getting Paid, for Real

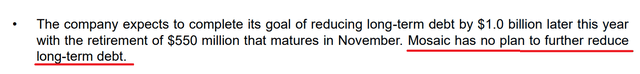

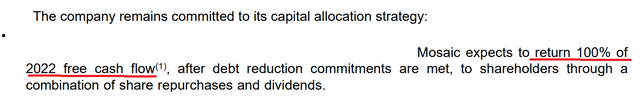

Mosaic has a clear capital allocation strategy. It will pay down $500 million of debt in November:

And that’s going to get done in just over 30 days. After that, the path is clear.

There’s very little ambiguity in Mosaic’s statement. 100% of free cash flow to shareholders, after debt payments. Mosaic not talking about strengthening its balance sheet. There’s no talk of a large capex cycle. It’s a very straightforward equation, free cash flow to shareholders.

MOS Stock Valuation – 4x Free Cash Flow

In my previous article, I laid out my assumptions for Mosaic’s free cash flow in 2022. I had assumed that Mosaic could make around $4 billion of free cash flow.

However, since that article was written, Mosaic announced earlier this month that potash sales volumes will be at the high end of its guidance. While phosphate volumes will be at the lower end of its guidance.

However, given that potash now accounts for more than 50% of Mosaic’s EBITDA profile, any news, good or bad, will have a more pronounced impact on Mosaic’s free cash flow potential.

Therefore, I believe that Mosaic could in fact see more than $4 billion of free cash flow in 2022. However, even without upwards revising this estimate, Mosaic is already incredibly cheap, at less than 4x free cash flow.

The Bottom Line

Investing is a brutal game. It never ends. And you are always learning new ideas. But one thing stays the same. The market has a habit of tricking you. Everyone gets carried away with an idea, and even if the idea is right, but the timing is wrong, everyone pulls back.

But the underlying thesis doesn’t require any heroics. The risk-reward here is compelling. It can be surmised as such, investors are not having to pay more than 4x this year’s free cash flow for Mosaic.

And the reason why this trade isn’t working out, yet, is that capital flows went back to tech names because everyone wanted to buy the dip in tech. Investors are too stuck buying the dip in tech stocks because they are secular growth stories that have worked a charm in the past 10 years.

And investing in commodities has clearly not worked for as long as anyone can remember. So why should investors expect anything to be different this time around?

For the reasons that I’ve argued. We are talking about global fertilizer. We can’t just write code and deploy it around the world at a moment’s notice.

In fact, consider this, when was the last time you heard of anyone showing any excitement to grow up and be a worker in the agriculture business? Or even, forget any excitement, when was the last time you even thought about the agriculture business?

There’s a very serious issue at hand, there is not enough fertilizer to meet the demand of a rapidly growing world population. Nobody wants to have a world where there’s not enough food. But the situation with Russia has taken this to a point where already low supplies have now become even more stretched.

And that driver of phosphate and potash demand isn’t going away. Not until people get positively excited about agriculture stocks and capital for capex dramatically increases. Something that the fertilizer companies are clearly not doing. Until then, there’s too much fertilizer in the stock market, but not enough where it should be, on the field.

Be the first to comment