Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Baidu, Inc. (NASDAQ:BIDU) reported a hugely underwhelming FQ4 card that demonstrated a significant slowdown in its online ads business. The impact was even more pronounced than what Alibaba (BABA) and Tencent (OTCPK:TCEHY) experienced in one of their worst quarters on record.

However, its fledgling AI business (cloud & autonomous driving) saved the day for Baidu. Baidu is the well-recognized AI leader in China. Notably, its AI cloud and autonomous driving have made significant progress over the past year. In addition, its robotaxi platform has continued to expand. Therefore, it’s becoming increasingly clear that its AI business will power Baidu’s future.

Nonetheless, its stock has also been battered, like its Chinese tech peers. The weak macro environment has crimped consumer discretionary spending significantly. The regulatory crackdown had also exacerbated online ad spending in verticals like education, real estate, and travel. Given Baidu’s online ads focus, it has suffered even more than Alibaba and Tencent. Add in the discount from the potential delisting and ongoing regulatory risk, BIDU stock has also floundered.

Moreover, investors should also note that the market still places significant weight on Baidu’s ads business. Therefore, investors shouldn’t buy into Baidu solely for its AI-powered optionality. If investors have little conviction over its online ads business, they should abstain from investing in BIDU stock.

Nevertheless, we discuss why we reiterate our Buy rating on BIDU stock.

China’s Macro Environment Should Improve In H2’22

The Chinese government communicated that it’s committed to focusing on improving macroeconomic conditions in 2022. Furthermore, it had also set an ambitious 5.5% GDP growth target before the spate of COVID flare-ups recently. Therefore, Chinese tech stocks have reacted negatively over the last few weeks. Coupled with the delisting rhetoric that saw a massive capitulation in Chinese tech stocks, many institutional investors bailed out in droves.

However, China has since calmed the markets down by committing to “complete” its rectification adjustments on its tech companies. Furthermore, the Chinese cabinet has also committed to leveraging appropriate monetary policies in spurring the weakening economy. However, several analysts and economists have grown increasingly concerned about whether Beijing can still attain its initial GDP growth target.

Bloomberg reported on Wednesday that Chinese Premier Li Keqiang repeated his emphasis on increasing monetary stimulus for China’s economy. It added (edited):

China’s State Council signaled it will step up monetary stimulus for the economy, acknowledging that domestic and global risks are now bigger than previously expected.

Officials will use multiple monetary policy tools at an “appropriate time” to support the real economy. The “complexity and uncertainty of domestic and foreign environments have intensified, and some have exceeded expectations.” – Bloomberg

Therefore, we believe that the government would actively support the economy and its companies to help navigate worsening macro conditions. As a result, we think it’s still possible that we should see China tech stocks’ weakness bottoming out in H1’22 before recovering with higher conviction in H2’22.

Why Is The Market Ignoring Baidu’s AI Business?

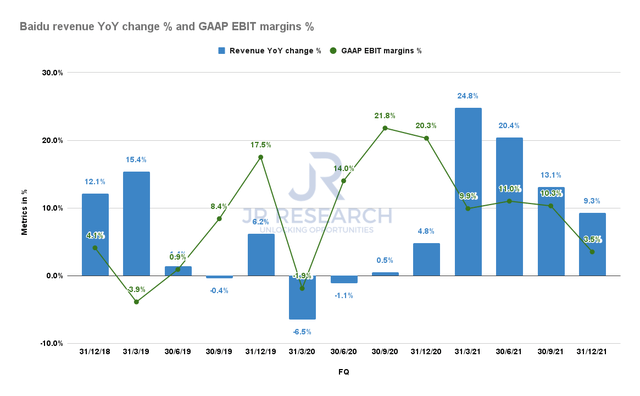

Baidu revenue YoY change % and GAAP EBIT margins % (S&P Capital IQ)

As seen above, we can easily observe the significant impact on Baidu’s revenue growth and GAAP EBIT margins. But, none of this should be surprising, given the observations over the past year. Furthermore, we also discussed the respective impact on Alibaba’s and Tencent’s recent earnings.

Notably, Baidu’s online marketing revenue increased by just 1% YoY to 19B yuan in FQ4. Notably, it represented a significant 57.5% of Baidu’s FQ4 revenue. Crucially, Baidu’s most significant business underperformed compared to Alibaba and Tencent. Specifically, Alibaba’s revenue grew 9.7% YoY, while Tencent’s revenue increased by 7.9% in their recent earnings card. Hence, we think Baidu has markedly underperformed. In addition, the company doesn’t have the broader diversification that Tencent and Alibaba possess. Furthermore, its online streaming business has continued to struggle.

Nevertheless, Baidu’s non-ads business grew 63% YoY to 6.9B yuan. Notably, it was powered by its AI cloud and autonomous driving initiatives. Its non-ads segment represented 26% of revenue, up from 18% in the previous year. Therefore, Baidu’s AI business has undoubtedly been gaining clout.

But investors need to contemplate the impact on its EBIT margins. The company was somewhat reticent to disclose the operating margins of its AI business on the earnings call. However, it’s clear that the margin impact from its non-ads business affected its EBIT margins, despite the more robust growth. We believe that Baidu’s online-ads business has discernibly higher profitability at the moment while Baidu scales its AI business.

Moreover, software revenues are recognized ratably and not recognized upfront. Therefore, it would be meaningful if Baidu could at least provide ARR metrics on its autonomous driving revenues for investors to pore over.

Consequently, it’s clear why the market has yet to “appropriately” recognize Baidu’s AI business. There are plenty of execution risks involved, coupled with uncertainty over its online ads business.

Furthermore, the weight of the valuation is still on its online ads business. For example, DBS Research’s SOTP framework ascribed about 54% of its valuation to its online marketing business. That’s still the main profit driver for Baidu, and investors should not ignore the realities. As a result, we believe the market would continue to evaluate BIDU stock’s valuation based on its online ads earnings power.

Until BIDU can prove the scale of its AI businesses, we think the “massive” re-rating that investors expect is unlikely to occur.

Is BIDU Stock A Buy, Sell, Or Hold?

BIDU stock price chart (TradingView)

BIDU stock is a Buy. As mentioned earlier, we think the pessimism over its stock has been priced in. Furthermore, the stock capitulated a few weeks ago, as seen above, supported above S1.

But we believe that the stock could continue to trade in a range resisted by R1 in the near term. But, more robust performance from its online ads business could spur a re-rating to break above its R1 resistance level.

However, investors should not expect the heady 2021 days to reappear again. Remember, Archegos Capital Management, and the “disorderly expansion of capital” is gone for good.

Therefore, if you buy BIDU stock, be prepared to hold for the long term.

Be the first to comment