alicat

By David R. Kotok

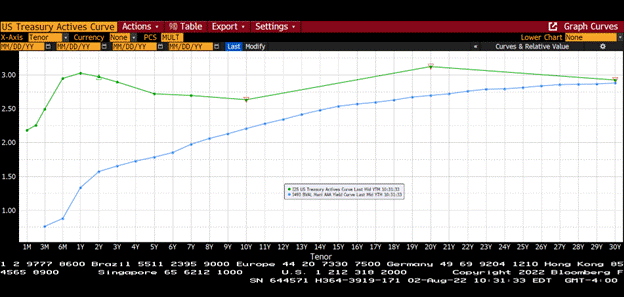

If you look at the US Treasury yield curve, you see an inversion; hence your conclusion may be a recession and lower future interest rates. See green line below.

If you look at the matching AAA muni yield curve (blue line), you see a steep upward sloping curve; hence you may conclude that there is no recession and interest rates are headed higher.

Which conclusion is correct? Why are they so different when both represent highest-credit-quality, US-dollar-denominated debt issued by sovereign governments with near-zero default risk, and the major difference is that munis are tax-free while Treasury debt is taxable for Americans?

Muni debt is mostly owned by tax-paying Americans, and their preferences determine the market prices of the debt in the blue curve. Treasury debt is owned mostly by foreigners or American institutions whose preferences are determined by legal restrictions or preferred-habitat investment decisions. Trillions in derivatives are tied to Treasury debt structures and are part of global transactions that ignore the yield curve outlook and trade against the Treasury yield curve. Munis don’t have that characteristic.

So maybe the muni curve is telling us a better story about future interest rates. We will find out. Note how yields are about the same for the longest maturity.

In our opinion, Short-term rates are heading higher. We’re scaling back duration. We would buy the tax-free muni at 4% plus. We won’t buy the 30-year Treasury.

As the saying goes, “You pays your money, and you takes your choice.” If we won’t buy a 30-year Treasury bond for ourselves, we certainly cannot in good conscience buy it for our clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment