JacobH

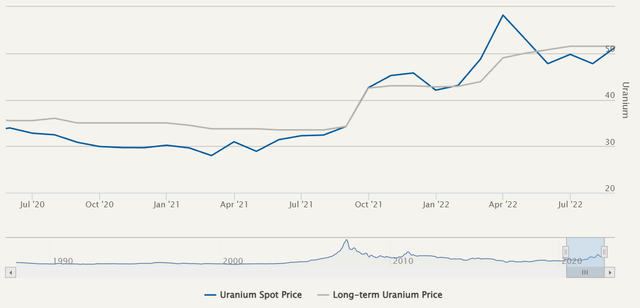

Back in March, I published a piece about Cameco Corporation (NYSE:CCJ) that rated the stock as a Sell. The Sell rating was heavily influenced by the sudden surge in geopolitical risk that stemmed from the outbreak of war in Ukraine. However, another important factor that contributed to the negative opinion was the composition of the company’s client contract mix. That’s because Cameco sells more uranium than it mines, forcing it to purchase material in the spot market in order to fulfill all of its client commitments. And while that’s not a bad strategy to employ in an environment where spot trades far below term prices, it can get a little dicey when the spot price at which you have to buy is significantly higher than the price at which you sell.

But a lot has changed since early March. Geopolitical risks have lessened significantly and the spot price of uranium has fallen back below the term price; meaning that the price disadvantage previously faced by Cameco has disappeared. In addition to that, the company is gearing up to restart production at its McArthur River property and it’s even raising a bit of money; leading me to believe that something might be in the offing. So, not only is Cameco no longer a “Sell,” but I have initiated a position in the stock and plan to accumulate it on any dips.

Increased Production

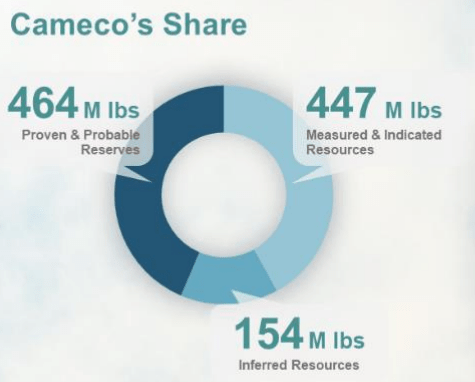

Cameco currently has three active properties that account for its 464M lbs (P&P) of reserves. Those include its McArthur River and Cigar Lake mines in Canada as well as its Inkai site in Kazakhstan. The company also has other deposits that sum to a total resource size of 601M lbs (M&I&I), but this article will focus on the three previously mention active properties; seeing as how the other sites are at much earlier stages of development.

Investor Presentation

It should also be noted that Cameco is currently not receiving shipments from its Kazak site. That’s because the concentrate that used to be shipped from Inkai was routed through Russia, and the war obviously put an end to that.

Inkai produces low grade, low cost U3O8 through the use of an situ recovery process. The project is a joint venture with Kazatomprom that is 40% owned by Cameco. It accounts for 112.5M lbs of Cameco’s reserves, but only has an average grade of 0.04%. Management is currently trying to secure alternate transportation through a different route, but shipments continue to be delayed in the meantime.

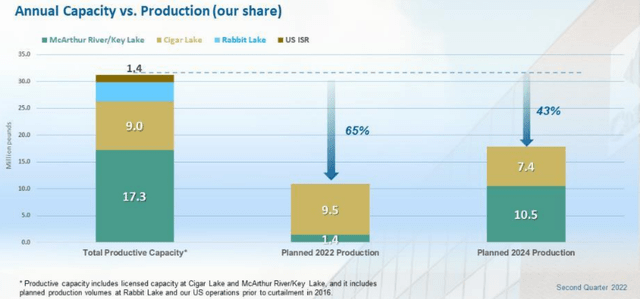

On a brighter note, Cameco is making progress towards reopening the McArthur River mine and Key Lake mill. The company is currently beginning early-stage commissioning at the site and anticipates first production to start in the fourth quarter. The start of production will see an eventual elimination of care and maintenance charges the company has been incurring since the site’s closure. Production at the property is expected to be 1.4M lbs this year.

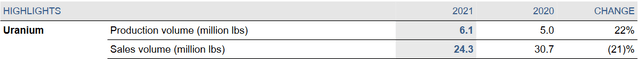

Adding those 1.4M lbs to the 9.5M lbs that Cigar Lake is anticipated to produce will see Cameco’s production come in at 10.9M lbs in 2022, 44% higher than last year’s production volume of 6.1M lbs. That’s a substantial year-over-year increase, but it won’t stop there as management intends to gradually ramp production to 10.5M lbs/y at McArthur River as total overall yearly production at the company reaches 17.9M lbs in 2024. And while those are impressive numbers, they will still be well below Cameco’s total annual productive capacity.

Contract Mix

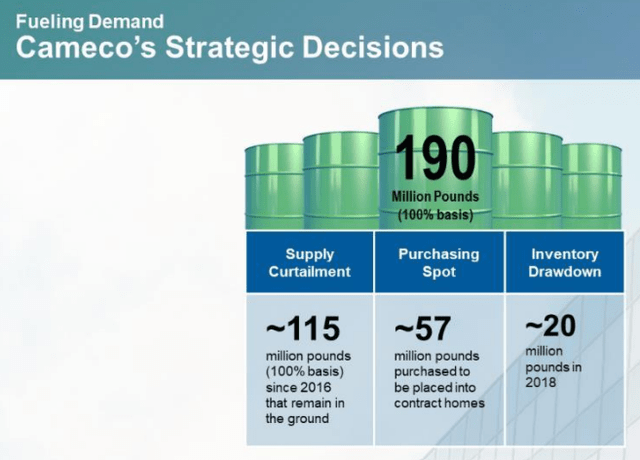

But what’s probably even more interesting than the company’s shifting production strategy are the changes occurring in its contract portfolio. As I briefly mentioned in the intro, Cameco has for several years been selling more uranium than it mines. And this was a deliberate and very reasonable strategy given the price environment in which the company operated.

That’s because, by mothballing a large portion of its productive capacity and instead choosing to fill client contracts with material purchased on the spot market, the company was able to limit the supply of U3O8 coming onto the market while simultaneously reducing the supply overhang. Employing the strategy also allowed it to keep more pounds in the ground, and these can be sold years from now when uranium prices are much higher.

As can be seen in the first exhibit below, production only accounted for 16% of Cameco’s total sales volume in 2020 and 25% in 2021. The second exhibit, taken from its Q2 FY22 presentation, shows how the strategy has allowed it to keep 115M lbs in the ground.

Cameco Filings Investor Presentation

The strategy is a good one, except when the uranium spot price rises above Cameco’s long-term average contracted price. That’s what occurred earlier this year and, as mentioned, was the subject of my previous article on the company.

However, spot prices have since fallen back and Cameco’s average long-term contracted price continues to rise. That rise results from both pricing mechanisms embedded in existing contracts that allow for some price adjustments as well as the signing of new agreements that reflect today’s higher U3O8 prices.

Cameco, which is currently in a much stronger bargaining position than in previous years, has added more than 45M lbs in new uranium contracts to its portfolio since the beginning of the year. That’s a considerable amount given that its total long-term contract commitments sum to 170M lbs. Its annual long-term contracted deliveries average about 22M lbs per year for the next five-years. The company seems to be shifting gears and positioning itself for a higher-priced uranium environment.

Shelf Offering

That shift may also involve a recent filing, whereby it intends to raise $1.5 billion. The company has not stated how it intends to use the money, but it’s not short of cash as over CAD$1.4 billion sat on its balance sheet at the end of Q2. It’s worth remembering that Cameco added to its stake in Cigar Lake this past Spring when it bought 4.5% of the project for $107 million from Idemitsu Canada. The transaction brought its total stake to just under 55%. Given the recent cap raise, it’s not too hard to imagine a scenario whereby Cameco decided to put in a bid for the remainder of the property.

Takeaway

Cameco is very well-positioned to benefit from the coming rise in uranium prices that will be driven by an increased use of nuclear power. And while the company did face some pricing pressures that largely stemmed from geopolitical risk back in March, those pressures have since subsided. Management’s long-term strategy to slowly increase production while simultaneously resetting the average long-term contracted price is sound. Cameco stock holds a lot of promise and should continue to rise along with uranium prices.

Risk

The primary risks to this thesis come from two sources, with the first of these being volatility in the price of uranium. No one can predict with 100% certainty where it will go, a sharp fall in the price of uranium could cause the stock of Cameco to plummet. Operational issues such as accidents and difficulty in finding staff are also a possibility, and the occurrence of such would delay the company’s planned production ramp.

Be the first to comment