Eoneren/E+ via Getty Images

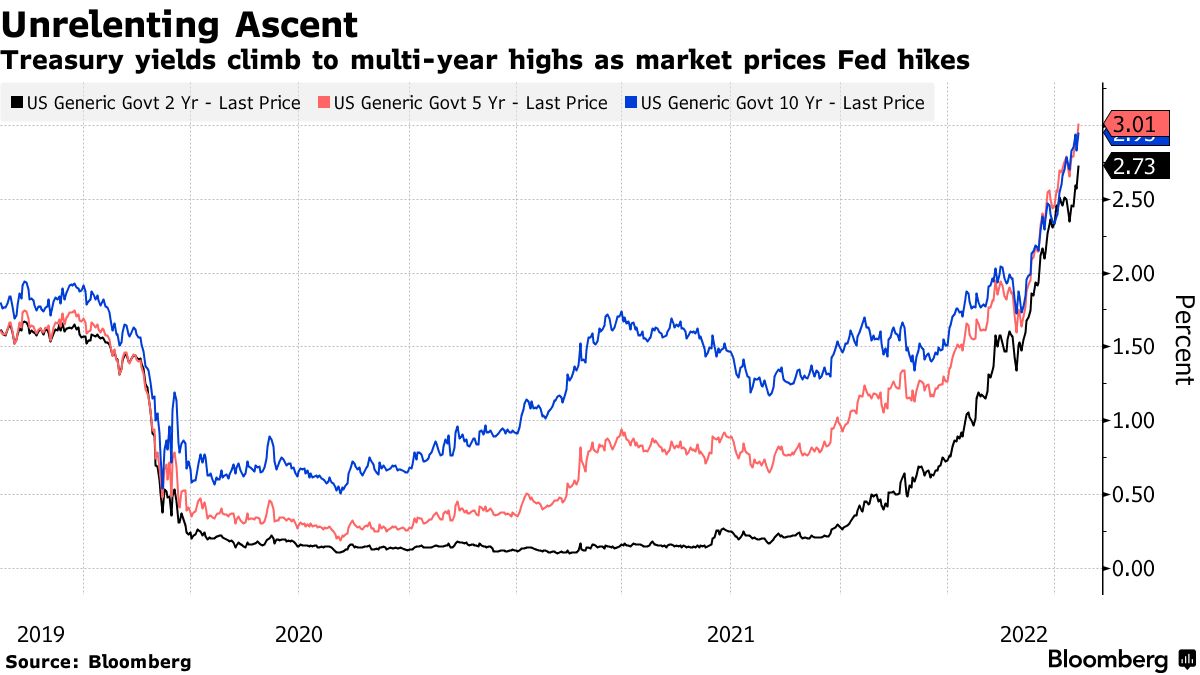

Stocks started out with a bang on strong corporate earnings reports but finished with a thud thanks to hawkish comments by Chairman Powell during a panel at the IMF. Interest rates rose at the short and long end of the curve, with the 10-year Treasury yield climbing to 2.9% and the 2-year hitting a new high of 2.68%. Yet Chairman Powell’s affirmation that we will see a 50-basis point rate increase at the Fed’s next meeting in May is not new news. Fed funds futures already had the probability of such at 93.8%.

Finviz

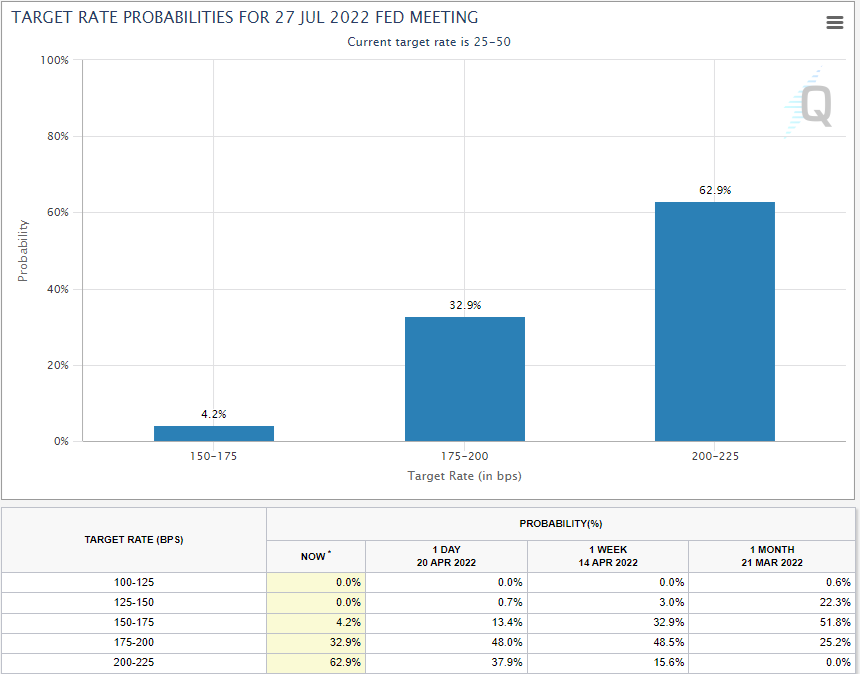

What did change is the probability of 50-basis point rate increases or more at each of the three next meetings in May, June, and July. The probability of a 2% Fed funds rate over this time frame rose from 37.9% the day before Powell’s comments to 62.9% afterwards, which is why 2-year yields rose a new high of 2.68% and stocks headed south. I think the market is extrapolating way too much tightening from Powell’s comments.

CME Group

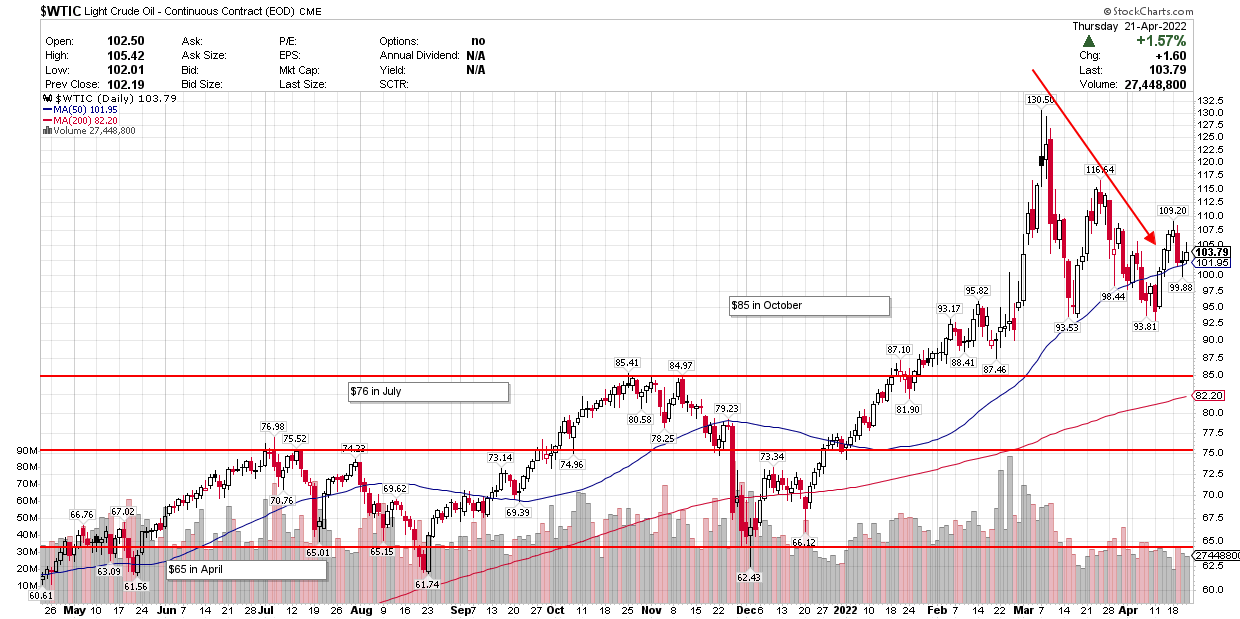

Provided the rate of inflation peaks before the July meeting, if it hasn’t already happened, then the Fed is very unlikely to raise rates by 50-75 basis points at that month’s meeting. The year-over-year price comparisons between now and then will become more difficult for several components of the Consumer Price Index. Consider that WTI crude was in the mid-$70s last July compared to the mid-$60s last April, and we have already seen oil come well off its March high of $130. Gasoline prices should follow, as have new and used cars prices.

Stockcharts

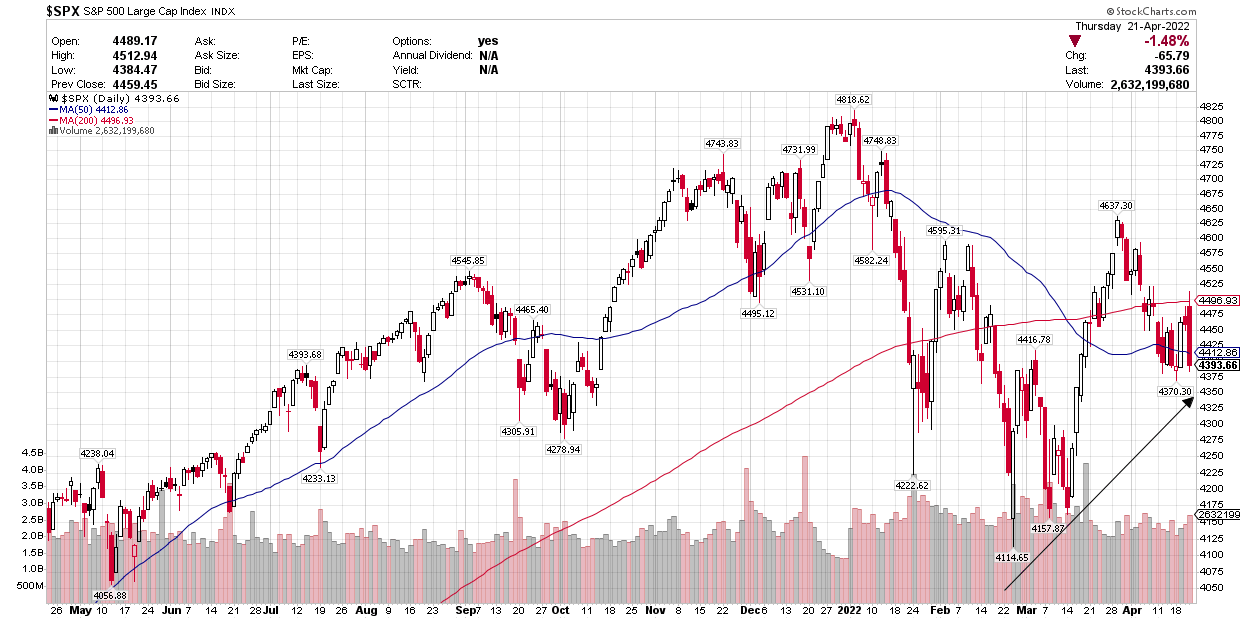

What I find encouraging is that despite the continued increase in both short- and long-term rates, which are anticipating increasingly tighter financial conditions, the S&P 500 continues to trend upward from its February low. This is because corporate earnings are running well ahead of expectations, and higher yields on bonds are not high enough to create a more attractive inflation hedge to stocks.

Stockcharts

The aggressive moves by the bond market to tighten in advance of the Fed’s policy decisions sets the stage for an easing of those expectations in the months ahead. I think that will be the fuel that helps the major market averages recover their year-to-date losses. The first signs of easing would be to see the 2-year yield start to pull back from its recent high. The first signs that inflation has peaked would be to see a leveling off of the 10-year yield at 3%. That is my expectation between now and July. At the same time, if corporate earnings can continue to grow sequentially throughout the year, we should recover this year’s losses in the major market averages.

Bloomberg

I am not blind to the possibility that long-term rates could climb well above 3% this year. It took a rate of 3.25% in the fourth quarter of 2018 to create a significant headwind for stocks, but the inflation rate was below 2% and real yields were in positive territory. I think the threshold is closer to 3.5 – 4% today, but we will have to listen to the market for clues should we breach 3.25%.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment