Australian Lifestyle Images/iStock via Getty Images

Introduction

Markets are in a very tough place. The S&P 500 is stuck in a volatile bear market as the Federal Reserve is eager to fight high and persistent inflation in an environment of slowing economic growth. This alone is toxic. It gets even worse considering what all of this does to interest rates. It’s pretty much a perfect storm for the consumer as we will discuss in this article. As a result, we’re now at a point in the cycle where companies are reporting the impact of these developments on their own financials. One of them is America’s biggest used-car company, CarMax (NYSE:KMX). The stock price crashed more than 20% in a single day as every single market participant, journalist, and trader seemed to have reached the same conclusion: people aren’t buying cars anymore.

In this article, we’re going to take a look behind the curtain. As usual, combining macro developments and CarMax’s numbers.

So, bear with me!

Everyone Agrees, The Consumer Is In A Very Bad Spot

Headquartered in Richmond, Virginia, CarMax is the nation’s largest used-car dealer. In the fiscal year ending February 28, 2022, the company sold more than 920 thousand used vehicles. The company is also the nation’s largest operator of wholesale vehicle auctions with more than 700 thousand vehicles sold during the aforementioned time period.

Related, the company is also the nation’s largest provider of used car financing, servicing roughly 1.1 million customer accounts in its $15.7 billion portfolio of receivables. Again, as of its 2022 fiscal year.

The company’s massive size means at least one thing: it is driven by macroeconomic development. There is no way a company this large can avoid macro weakness by making smart decisions. The same goes for companies like Ford (F). They can produce great cars, but if the consumer is in a bad place, it won’t do well sales-wise.

On September 29, the company released its FY2Q23 (I’ll go with 2Q23 hereafter) earnings, which came in at $0.79 per share (GAAP EPS). That’s a miss of $0.58. Total revenue came in at $8.14 billion, which missed analyst expectations by $410 million.

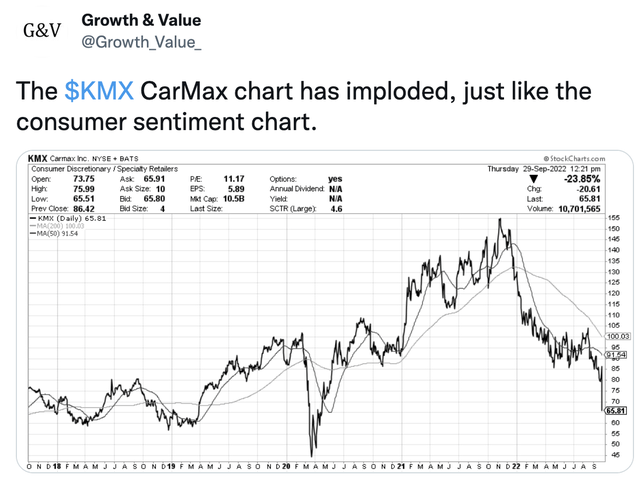

The price reaction that occurred afterward reminded me of pretty much every consumer sentiment chart I’ve seen in the past few months.

After all, CarMax is more or less a proxy for consumer sentiment. Especially when it comes to big-ticket items. TVs or other discretionary spending is a slightly different story.

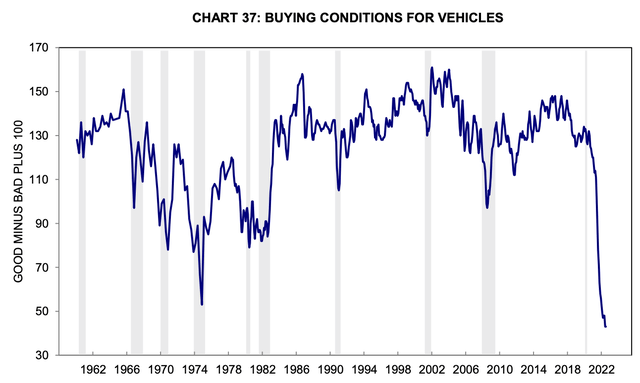

The chart below shows the University of Michigan consumer sentiment. In this case, buying conditions for vehicles. Not only did sentiment quickly deteriorate, but it is also falling below anything we’ve seen in the history of this indicator. This chart makes the Great Financial Crisis look like just another bad year instead of the crisis that tested the global financial system.

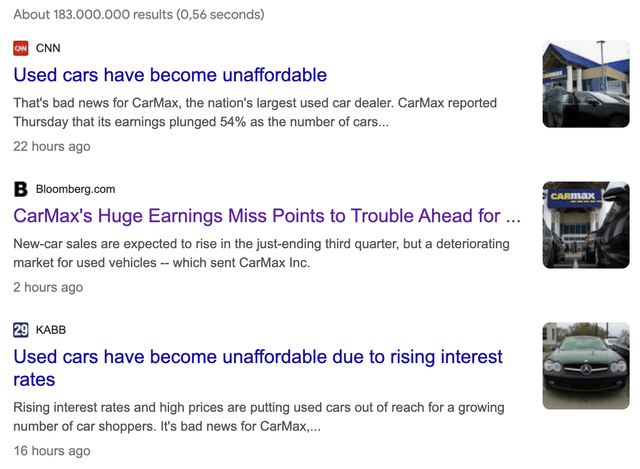

While most analysts and investors were aware of these developments before CarMax released its numbers, it seems that CarMax’s terrible earnings really triggered a wave of headlines when people realized how bad things were.

This is what I got when I Googled “used cars”:

While I wouldn’t compare CarMax to Lehman, the only thing these two events have in common is that it was a wake-up call. Back then it was much more severe. This time it really showed that the consumer is, in fact, not in a good spot, to put it mildly.

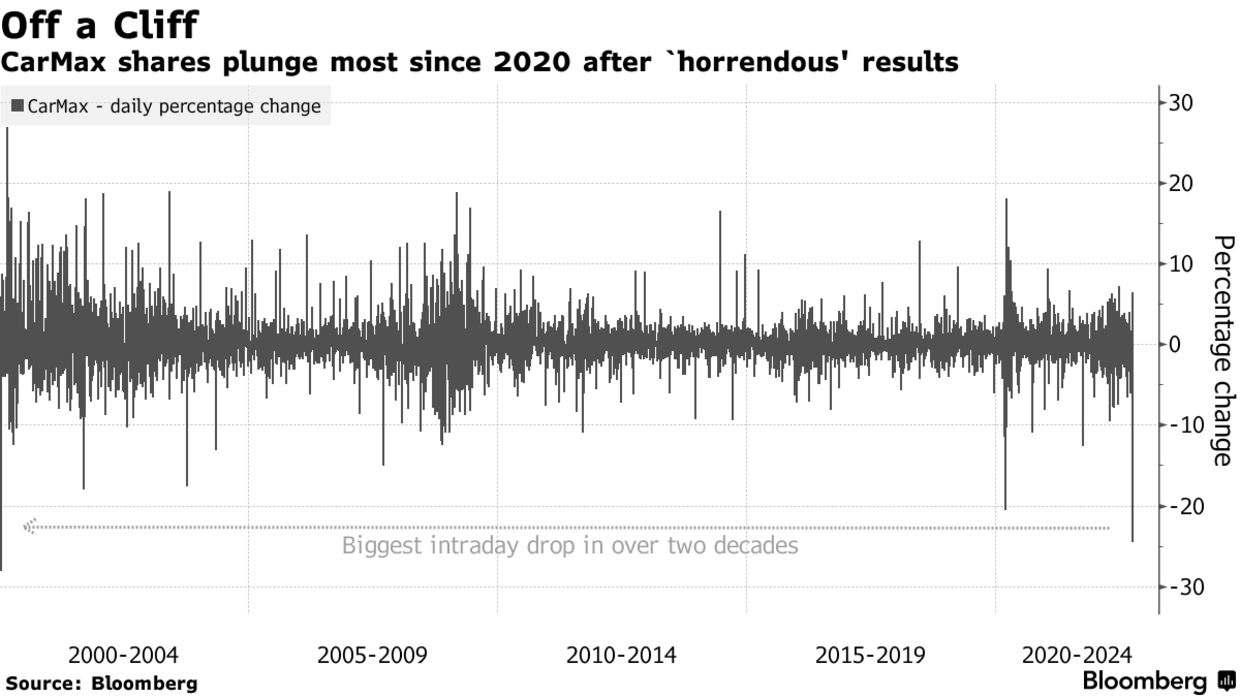

The dealer’s stock price reaction was the worst in more than 20 years as the chart below shows.

Bloomberg

That said, in June of this year, I also took a look at CarMax, noting that:

[…] I’m not that eager to buy KMX. I expect used car prices to come down as weaker demand and better supply turn into headwinds. Moreover, loan quality is coming down as a result of a weaker consumer on top of lower (expected) margins for KMX’s lending business.

With that said, let’s look into the details.

Why Was It So Bad?

The company started its earnings call with a banger when it started by mentioning its biggest issues:

[…] this quarter reflects widespread pressure the used car industry is facing. Macro factors, including vehicle affordability that stems from persistent and broad inflation, climbing interest rates, and low consumer confidence, all led to a market-wide decline in used auto sales. In addition, wholesale values were affected by steep depreciation in the quarter.

Starting with unit sales, the company sold roughly 217 thousand used vehicles in the three months ending August 31. That’s 6.4% fewer units compared to the prior-year quarter. Wholesale units fell by 15.1% to 160 thousand units.

The good news is that average selling prices were up 9.6% to an average price of $28,657 for the average used car. The average wholesale vehicle sold for $10,179, which is 17.0% higher.

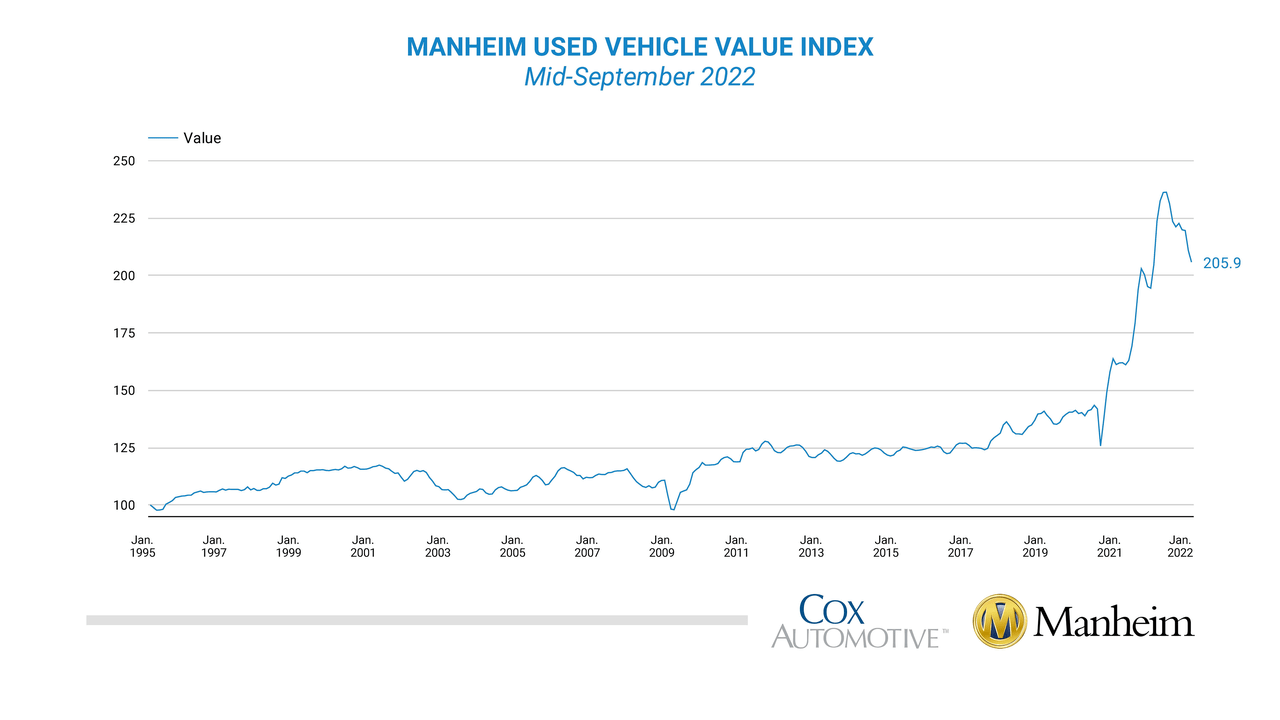

When looking at the famous (it really has become famous since the pandemic crushed auto supply) Manheim Used Vehicle Value Index, we see that while prices have come down quite significantly, they do remain at elevated levels, allowing companies like CarMax to offset some weakness in units sold.

Manheim

As a result, the company’s used vehicle sales, this time in dollars instead of units, rose by 2.9% to $6.3 billion. Wholesale sales were down 0.7%. Moreover, upselling was tough as the company saw declines in extended protection plans, third-party finance income, and lower advertising fees.

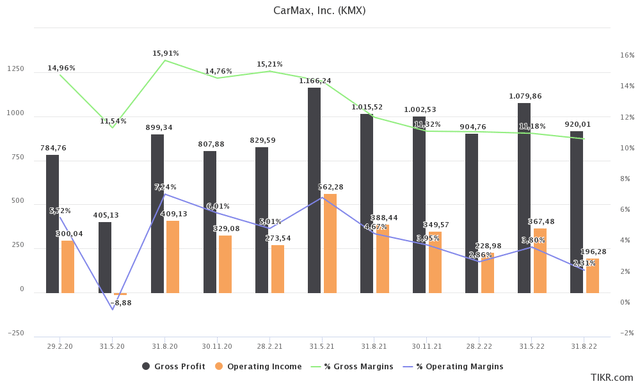

Unfortunately, that’s not everything. Higher costs ruined gross profit. The company encountered a 3.3% higher cost of sales as it spent 100 basis points more on the acquisition of used vehicles. This lowered gross profit from auto sales from $815 million to $737 million, paving the road for a 55% decline in net EPS.

As visualization is always better when discussing data, the chart below shows the company’s issues a bit clearer. It is now seeing gross profit margins barely above 10%. This is well-below post-lockdown numbers above 15.0%. Moreover, due to rising operating costs, the operating margin ended the quarter at just 2.3%.

Moreover, the company mentioned that a lot of vehicles it sources from customers do not meet the standards for its used car sales. These vehicles are sold wholesale at lower margins. In other words, while KMX does have a leading sourcing program for new supplies, it is now suffering from worsening car qualities. New car supply is down, people are in need of money, and more often than in “normal” times, this is now starting to hurt the company’s ability to buy and sell high-quality used cars – hurting margins even further.

Car financing also turned into a headwind. CarMax Auto Finance (often referred to as CAF) saw an income decline of 8.6% to $182.9 million as a result of higher loan loss provisions.

According to the company:

This quarter’s provision was $75.5 million compared to $35.5 million last year, which outweighed the growth in CAF’s net interest margin and average managed receivables. Last year, our loan loss provision was a significant tailwind as the overall performance of the consumer remained remarkably strong.

In the second fiscal quarter, the allowance for loan losses was 2.92% of ending managed receivables. That’s up from 2.85% as of May 31, 2022.

The total interest margin rose to 7.3%, up from 7.2% in the prior-year quarter. 41.2% of units sold were financed by CAF, up from 39.3% in the first quarter, but down from 43.0% in the prior-year quarter. This was not the result of better customer finances, but because customers used outside financing.

The average interest rate was 9.4%, up from 8.5%, which is very high.

So far, the company’s numbers are bad. Margins have come under significant pressure and the mix of falling unit sales and easing prices while expenses remain high is toxic. Moreover, it seems to be harder to get quality supply, which is no surprise as the new car supply has been constrained for more than two years now. That really hurts the quality of the average used car in the United States.

However, that’s not even the worst part.

Is KMX A Buy?

KMX shares are down 50% since the start of the year. This makes the situation very tricky as the market is basically telling us that while the situation is absolutely terrible, it has done us a favor and priced in a ton of weakness.

We now have two options. Option one is to make the case that a lot has been priced in, which makes KMX (somewhat) attractive. Option two is that we become extremely bearish and make the case that this economy will soon become a train wreck, which means there’s more downside.

Option three is doing nothing, staying far away from KMX, but we’ll get to that later.

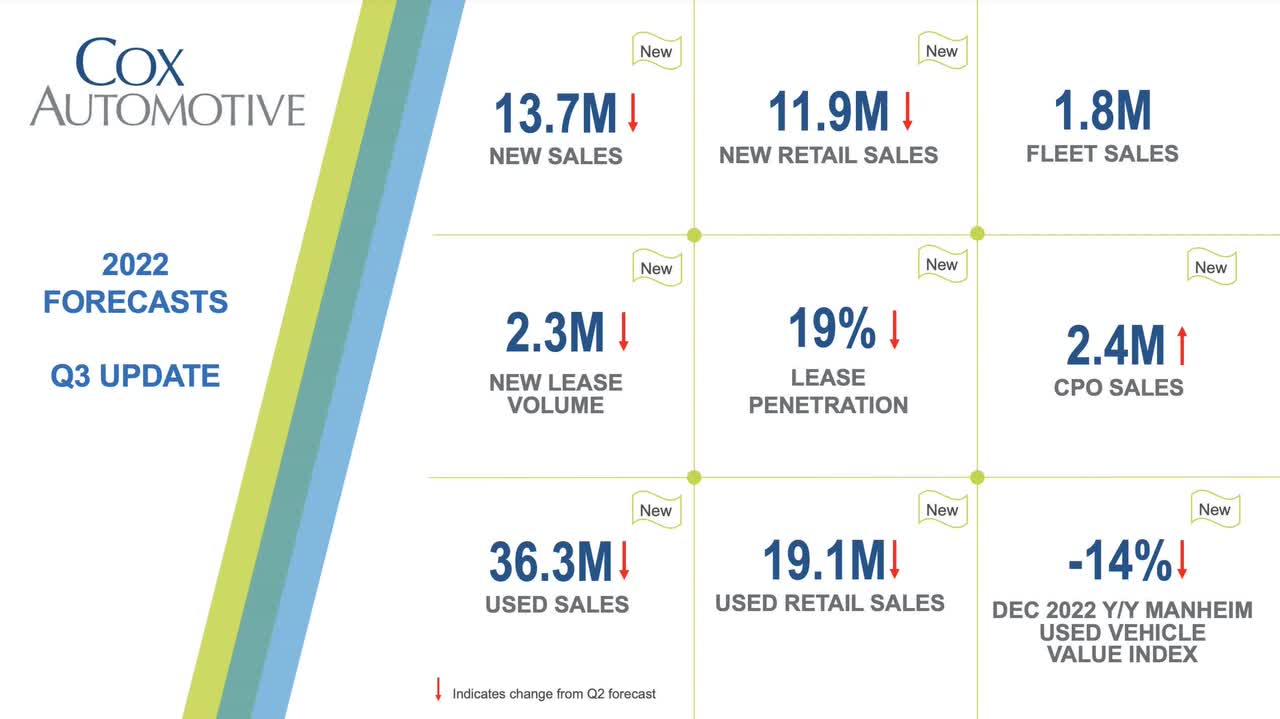

The problem is that fundamentals are further weakening. According to an automotive expert, Cox Automotive is projecting that wholesale used car prices will end the year down 14% with a higher-than-expected contraction in unit sales.

Cox Automotive

According to the same expert, the market has become so tricky that some customers are paying $900 a month for a 15-year-old car with 150K miles. While we can make the case that some people make rather “unintelligent” decisions or get ripped off, the market has become a minefield as rates are up, new car supply is still an issue, and good used cars are getting scarce.

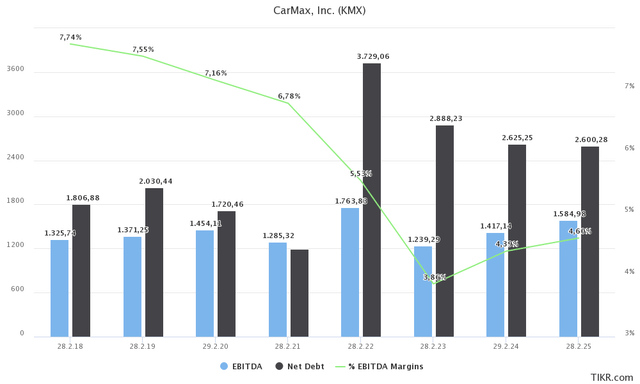

As the chart below suggests, FY2023 is expected to be the worst year since the pandemic, with roughly $1.2 billion in EBITDA. After that, EBITDA is expected to slowly recover to $1.6 billion in FY2025, with margins not recovering above 5%.

I think that’s a fair assessment as it fits my own longer-term macro outlook. However, given current conditions, I believe the biggest risks are to the downside.

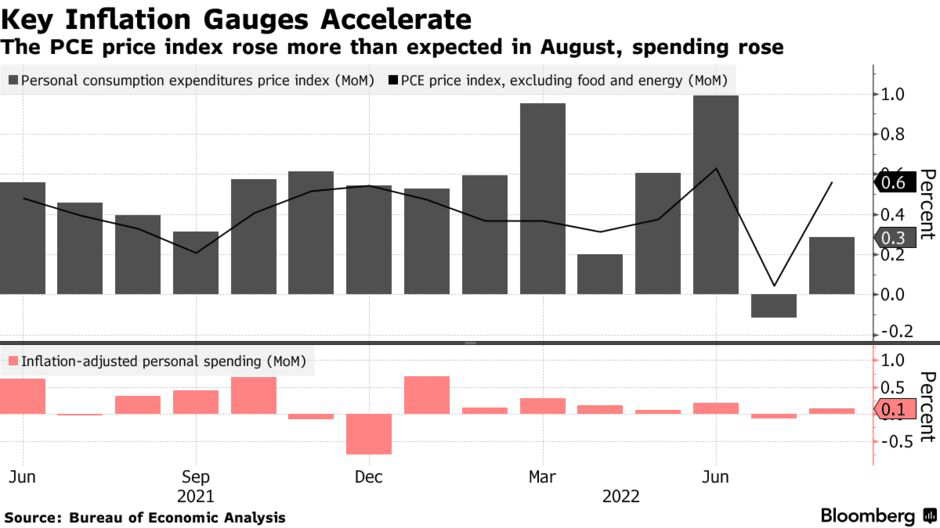

One of the reasons why I am making that claim is because it is unlikely that the Fed will turn into a tailwind anytime soon. The other day, its favorite indicator, the PCE price index rose faster than expected, hinting that its policies may not hurt the economy as much as the Fed may have “hoped” (in order to fight inflation).

Bloomberg

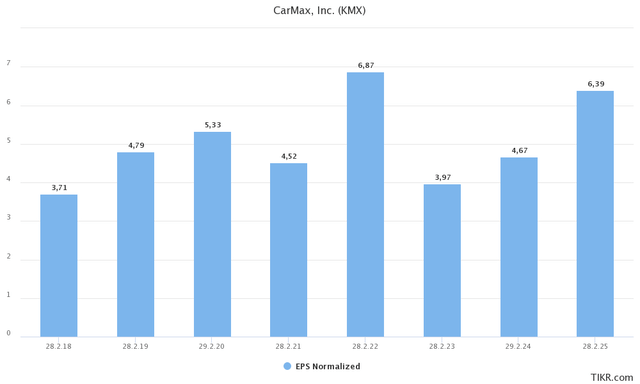

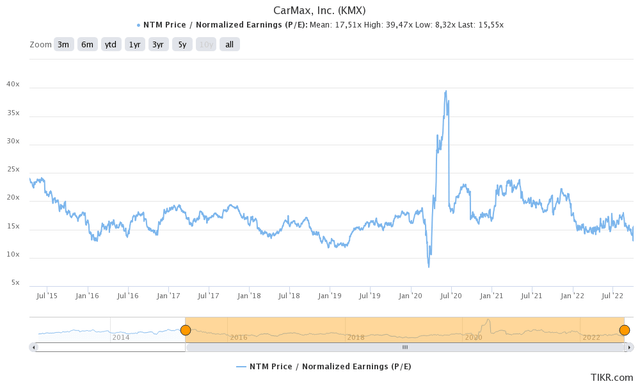

When it comes to the company’s valuation, KMX is trading at 14.1x FY2024 normalized EPS.

That’s a fair price, but it isn’t deep value for two reasons. Reason 1 is that the company usually trades at 16-18x EPS, which would imply a 27% upside if investors were to feel extremely generous for some reason. Reason two is that this valuation only becomes really attractive once we price in growth after FY2024. That’s fine for long-term investors, yet I believe there are better places to put money for the long-term. Especially because this bear market is causing even the “best” stocks to drop quite significantly. If KMX shares were down 24% after a one-off quarter that was really bad in an otherwise healthy economy, I think its shares would have been a buy.

With that said, here are my final thoughts.

Takeaway

In this article, I wanted to achieve two things. First, to discuss the economy, focusing on used cars and related consumer trends. Second, to assess what to make of the situation at CarMax, which has become the ground-zero of auto-related consumer weakness.

CarMax reported horrible numbers as it is now hit a mix of slowing used car prices, weak consumer demand, worse supply, and weakness in its financing segment. The worst part is that things could get even worse as used car prices have just started to fall. While this will help consumers down the road, it might be premature to become bullish as the Fed isn’t done hiking. This means financing conditions will remain an issue on top of the economic weakness that comes with it.

As a result, I cannot make the case that people should jump in and buy beaten-down KMX shares. Yes, there is a case to be made that KMX shares will trade (maybe much) higher 3-5 years from now.

However, I think there are better stocks to buy during this bear market, which I discuss on Seeking Alpha. I simply don’t like the risk-reward. Neither on a short-term basis nor on a long-term basis.

The best way to approach this situation is to keep a close eye on KMX as it will continue to tell us a lot about consumer health and related economic developments.

(Dis)agree? Let me know in the comments!

Be the first to comment