Adene Sanchez

The completion of the acquisitions of Celgene and MyoKardia has enabled Bristol-Myers Squibb (NYSE:BMY) to significantly increase the company’s revenue and net income in recent years. At the same time, the company has expanded its product portfolio in immunology, oncology, and cardiovascular diseases, allowing it to carve out a niche in high-growth therapeutic areas. Rising inflation and geopolitical instability in the world are making the markets nervous and thus putting pressure on the price of BMY shares. Despite this, the company is successfully bringing new generation medicines to market, increasing the number of product candidates and reducing debt, creating a fantastic opportunity for investors to consider Bristol-Myers Squibb as a long-term asset.

The outlook for BMY’s product portfolio and its impact on the company’s financial position

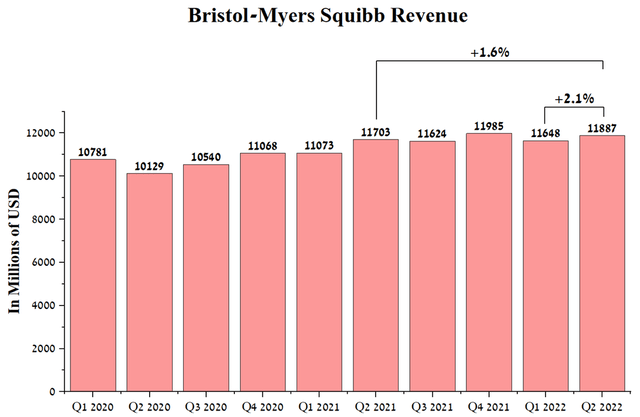

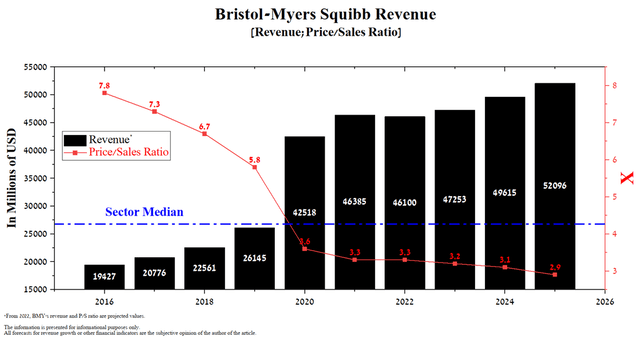

Bristol-Myers Squibb’s revenue came in at $11,887 million in Q2 2022, up 1.6% year-over-year. At the same time, the company’s P/S ratio is 3.28x at the end of June 2022, which is significantly lower than the average for the healthcare sector, thus indicating that BMY is undervalued by Wall Street.

Source: Author’s elaboration, based on Seeking Alpha

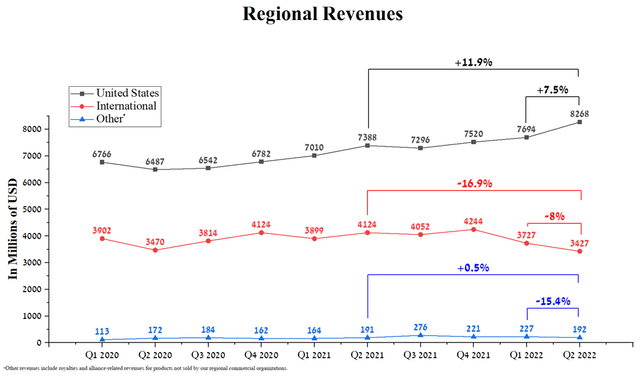

The reasons for the slight increase in Bristol-Myers Squibb’s revenue are the diverging dynamics of drug sales in the US and abroad, and the start of sales of Revlimid and Abraxane generics, which brought billions of dollars to the company before losing their exclusivity. In the US, BMY’s revenue was $8,268 million in the second quarter of 2022, up 11.9% year-over-year on strong demand for Eliquis and Opdivo. While international revenue was $3,427 million in Q2 2022, down 8% QoQ mainly due to lower demand for branded Revlimid and a significant depreciation of the euro and pound against the US dollar. In my estimation, currency risks will continue to negatively affect Bristol-Myers Squibb’s revenue growth until the military conflict between Ukraine and Russia ends and the energy crisis in Europe is resolved.

Source: Author’s elaboration, based on quarterly securities reports

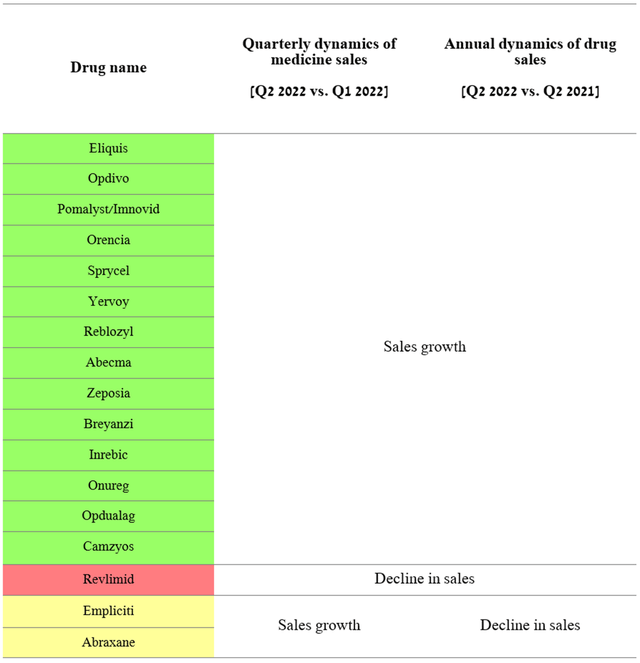

Except for Revlimid, Abraxane, and Empliciti, both quarterly and year-on-year positive sales trends for Bristol-Myers Squibb medicines were demonstrated, which indicates the use of effective strategies for their commercialization in the face of macroeconomic uncertainties in the world. In my estimation, the company will continue to show positive business momentum in the coming quarters with accelerated sales at Reblozyl, Orencia, Eliquis, and Abecma, which should offset Revlimid’s sales losses.

Source: Author’s elaboration, based on quarterly securities reports

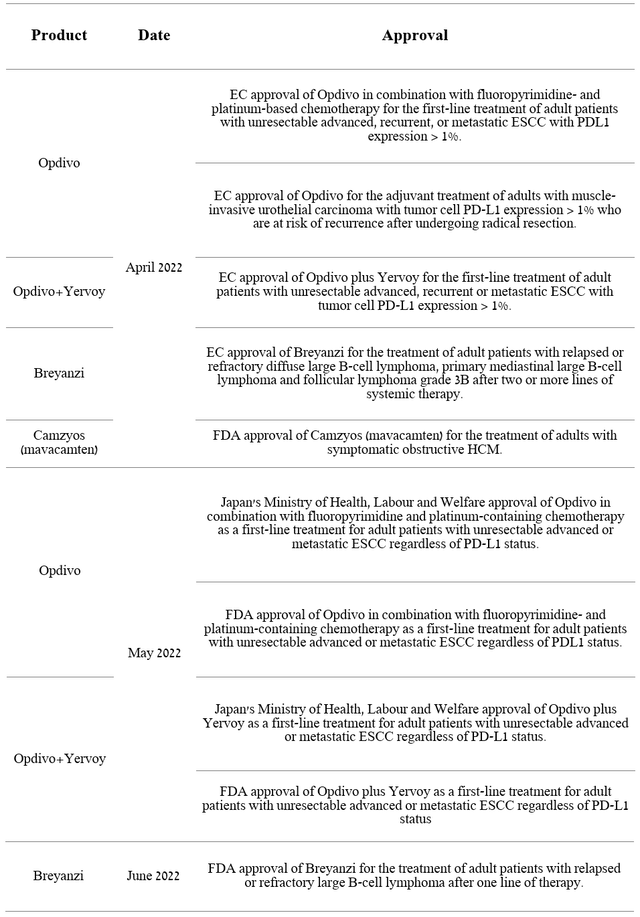

21.8% of the company’s revenue comes from sales of Opdivo and Yervoy, which are monoclonal antibodies that can effectively fight many types of cancer. In the first half of 2022, the combination of these medicines received several important regulatory approvals in Japan and the European Union, thereby increasing the potential number of patients who can be offered this treatment.

Source: Author’s elaboration, based on 10-Q

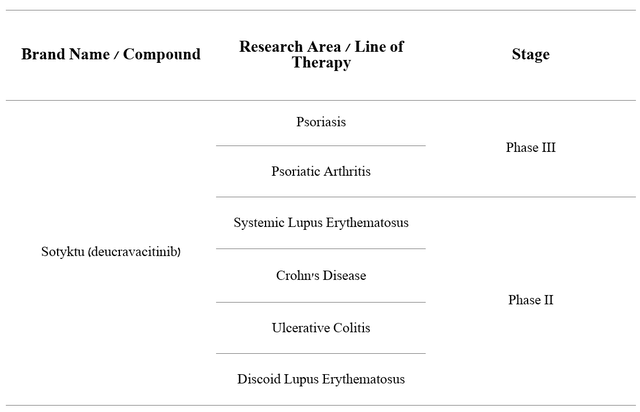

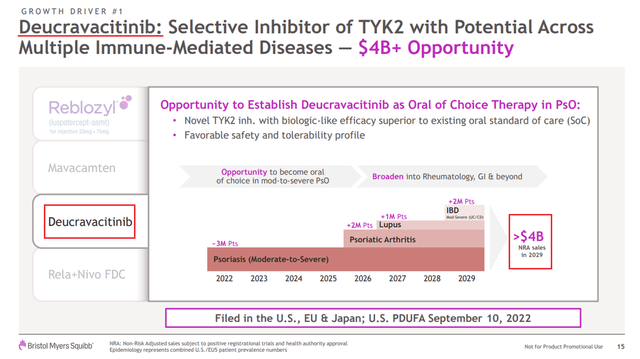

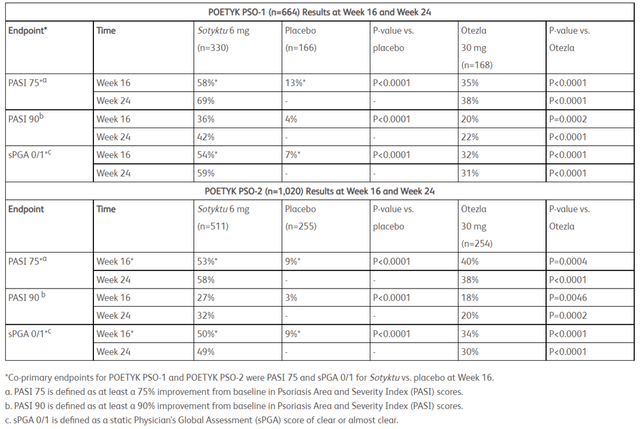

Bristol Myers Squibb does not stop there, and as early as Q3 2022, the FDA approved Sotyktu (deucravacitinib) for the treatment of adults with moderate to severe plaque psoriasis. In the US alone, about 7.5 million people have psoriasis, opening a window of opportunity for BMY, which is in dire need of rejuvenating its product portfolio. In phase 3 clinical trials, significantly more patients taking Sotyktu were able to achieve PASI 75 and sPGA 0/1 not only relative to placebo but also relative to Amgen’s Otezla (AMGN), which had $2.25 billion in sales in 2021.

In addition to being highly effective, Sotyktu’s competitive advantage is its oral route of administration, a relatively favorable safety profile, and the absence of a black box warning. As a result, it is highly likely that BMY’s drug could become the new standard of care for plaque psoriasis with relative ease. Sotyktu, being a selective allosteric tyrosine kinase 2 inhibitor, can be effective in the treatment of other chronic immune-mediated diseases, including psoriatic arthritis, Crohn’s disease, etc. The company is currently conducting several large clinical trials to evaluate the efficacy and safety profile of Sotyktu in the treatment of these diseases.

Source: Author’s elaboration, based on Bristol Myers Squibb’s pipeline

If the primary and secondary endpoints of these studies are achieved, the company’s drug could significantly improve the quality of life for tens of millions of people around the world. I estimate Sotyktu’s peak sales to be $4.2 billion by 2028, slightly more than Bristol-Myers Squibb’s management forecast.

Source: Author’s elaboration, based on JP Morgan Presentation

Given the company’s current portfolio of approved medicines and product candidates, I expect BMY’s revenue to decline slightly in 2022 relative to 2021. However, from 2023, revenue and EBITDA margin growth will accelerate due to increased demand for Sotyktu, Camzyos, and Reblozyl from patients and physicians.

Conclusion

Bristol-Myers Squibb maintains its leading position in the cancer medicines market and is gradually expanding its influence into the fast-growing market segments of medicines used to combat cardiovascular and immunological diseases. Thanks to Giovanni Caforio as the company’s CEO, BMY earned $11,887 million in Q2 2022, up 2.1% from the previous quarter. And thus, this once again proves to Wall Street the ability of the company’s management to offset the decline in sales of blockbusters Revlimid and Abraxane by increasing demand for other key drugs of the company. The impact of rising inflation, the weakening of the euro, the Japanese yen, and the pound sterling will continue to negatively affect the growth rate of Bristol-Myers Squibb’s cash flow. However, these negative factors are practically reflected in the company’s share price, reaching the strong support zone that was described in my previous article. Given the risks and catalysts described in this article, I’m maintaining Bristol-Myers Squibb’s price target of $101/share.

Be the first to comment