Feverpitched

Introduction

The immense free cash flow Vermilion Energy (NYSE:VET) generated late in 2021 and early 2022, allowed them to enjoy an acquisition spree and as my previous article highlighted, this increased the outlook for a dividend spree coming in the future. Thankfully, this already appears to be underway with their latest quarterly dividend receiving a one-third increase, although there is still plenty more room for more as their yield is still only a very low circa 1%, depending upon exchange rates. Despite the growing consensus for a recession coming within the next twelve months being concerning for many companies, metaphorically speaking, it seems they did not get the memo given their unique resilient outlook, as discussed within this follow-up analysis that also reviews their subsequently released results for the second quarter of 2022.

Executive Summary & Ratings

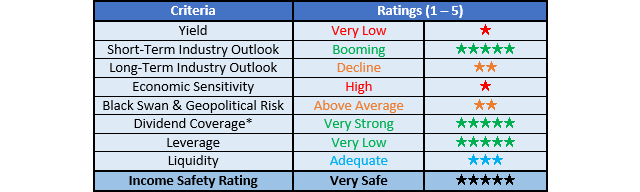

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

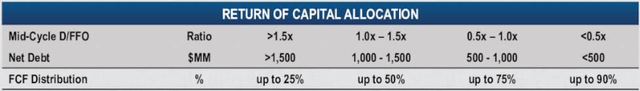

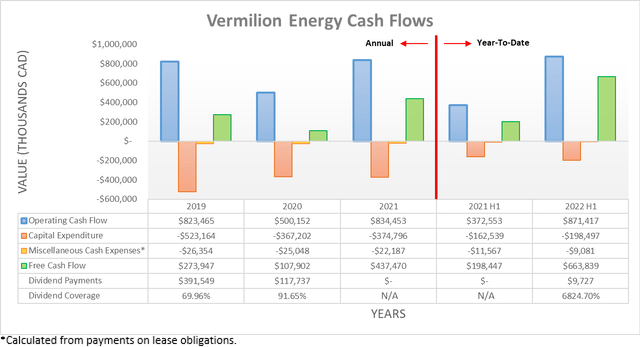

Following their very impressive cash flow performance during the first quarter of 2022, it was no surprise to see stronger performance during the second quarter on the back of the even higher oil and gas prices. This saw their operating cash flow land at C$530.4m during the second quarter, up from C$341m during the first quarter to make C$871.4m for the first half, which led to massive free cash flow of C$663.8m. As this was not materially impacted by temporary working capital movements, it annualizes to C$1.328b and given their current market capitalization of approximately C$5b, this sees a massive free cash flow yield of near 27%. Thankfully management also accompanied these very impressive results by rolling out a new shareholder returns policy, as the table included below displays.

Vermilion Energy Second Quarter Of 2022 Results Presentation

Under their new shareholder returns policy, the portion of free cash flow they allocate to shareholder returns increases as their net debt decreases, ranging from <25% to <90%. If reviewing their guidance for their new policy, as per slide four of their second quarter of 2022 results presentation, their still very low quarterly dividends will initially be topped up with share buybacks to reach their targeted return of capital. Whilst I would have personally preferred a larger weighting towards dividends, at least they also flagged special dividends may be forthcoming in the future. More importantly, their direct exposure towards European gas actually reduces the downside risk of their focus on share buybacks compared to most of their peers, as the graphs included below display.

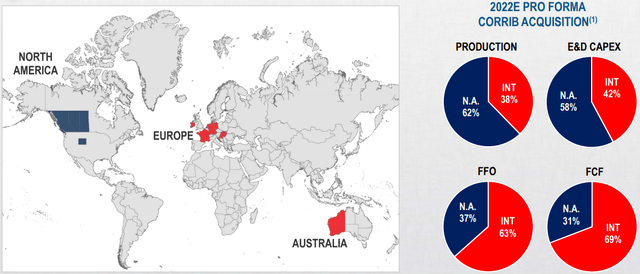

Vermilion Energy September 2022 Investor Presentation

By now, essentially every investor would have heard about the energy crisis that Europe faces as they deal with Russia heavily reducing their gas supplies, which sees a severe shortage for both industrial and electrical use, thereby sending prices surging to never before seen levels. It can be seen that their free cash flow is heavily driven by their international production, as it forms 69% of the total but only comprises 38% of their total oil and gas production volumes. If zooming into their international production, it is advantageously weighted towards gas with the second quarter of 2022 seeing it comprise circa 55%, as per their second quarter of 2022 MD&A report. This weighting will grow even heavier towards gas after they complete their gas-focused Corrib acquisition later in 2022, which will also boost their already very impressive financial performance, as discussed in my previously linked article.

Apart from helping drive their free cash flow right now, it also creates a stronger medium to long-term outlook compared to their locally-listed peers that generally speaking, have minimal direct exposure to European gas. Since the energy shortage in Europe is unlikely to be rectified anytime soon, this should better support demand and thus pricing for their international production throughout any economic conditions than elsewhere in other geographical regions, thereby reducing their downside risk versus their peers. Even though I always prefer dividends over share buybacks, this nevertheless increases their appeal because it lessens the risk of them being conducted at cyclical highs right before a severe downturn that sees them cease at the same time as their share price is lower.

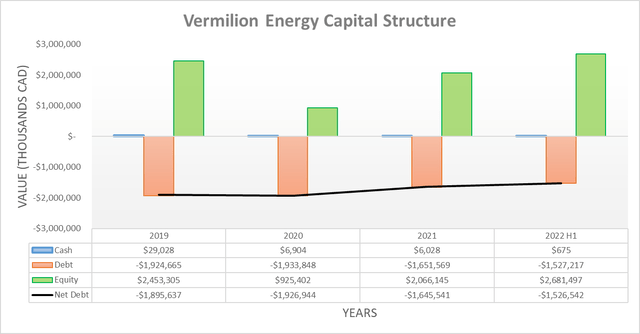

Despite their massive free cash flow during the second quarter of 2022, their net debt still increased to C$1.527b versus its level of C$1.376b when conducting the previous analysis following the first quarter due to the completion of their Leucrotta acquisition. This now sees their acquisitions totaling C$522.8m during the first half, up from only a relatively immaterial C$6.7m during the first quarter. If any new readers are interested in further details regarding their acquisitions, please refer to my previously linked article as they were the focus at the time and nothing material has subsequently changed.

When looking ahead into the second half, they expect to close their Corrib acquisition in the fourth quarter before ending the year with their net debt at C$1.2b, as per slide five of their previously linked second quarter of 2022 results presentation. If they achieve this target, which I see no reason to doubt, they should enter 2023 returning <50% of their free cash flow given their new shareholder returns policy. At their current free cash flow and market capitalization, this would see a very high circa 13% shareholder yield, even without counting any contribution from their upcoming Corrib acquisition. Their guidance also expects 2023 to end with net debt of C$850m, which seems realistic given their massive free cash flow and exposure to the European energy crisis, which means their shareholder returns should increase to <75% of their free cash flow and thus given rise to a circa 20% shareholder yield on current cost, once again, not including any benefits from their Corrib acquisition.

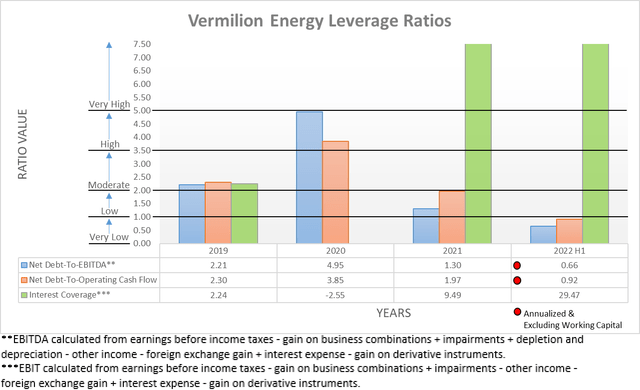

Thanks to their stronger financial performance during the second quarter of 2022, their leverage barely increased despite their higher net debt. This now sees their respective net debt-to-EBITDA and net debt-to-operating cash flow only increasing to 0.66 and 0.92 versus their respective results of 0.62 and 0.86 when conducting the previous analysis following the first quarter. Whilst higher in a numerical sense, they both remain well below the threshold of 1.00 for the very low territory, which should remain the case going forwards as they continue deleveraging, thereby posing no risks. Even though management wishes to deleverage even further, which is not necessarily bad, in my view it is also not particularly required but thankfully, shareholders are still paid handsomely in the interim and the wait until later in 2023 is not too long.

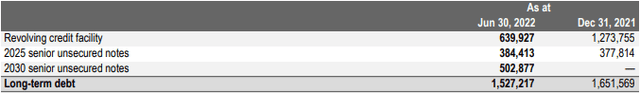

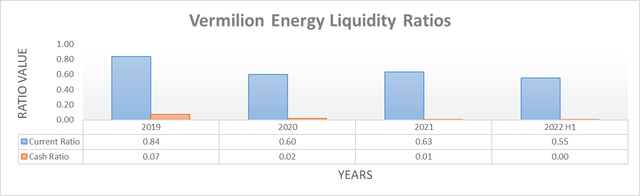

Since they have continued directing all of their free cash flow to either deleveraging, acquisitions or shareholder returns, their liquidity did not improve materially during the second quarter of 2022. As a result, their respective current and cash ratios are still only 0.55 and 0.00 versus their respective results of 0.52 and 0.00 when conducting the previous analysis following the first quarter. These are obviously on the low side but nevertheless, their liquidity is still adequate due to their massive free cash flow. The main difference in their liquidity during the second quarter stems from the issuance of their 2030 senior notes that effectively refinanced a large portion of their credit facility, as the table included below displays. Although positive, due to the borrowing base being reduced from C$2.1b to C$1.6b, the total amount of availability only increased slightly to C$951.9m versus where it ended 2021 at C$851.2m.

Vermilion Energy Q2 2022 Financial Statements Report

Conclusion

The risk of a recession on the horizon is certainly not welcome news for investors, especially in what are normally economically sensitive industries, such as oil and gas. Thankfully in this unique situation for a locally listed company, their direct exposure to European gas creates a more resilient medium to long-term outlook that helps reduce their downside risk. When combined with their continued very impressive financial performance, its resulting massive 20%+ free cash flow yield and outlook for increasingly higher shareholder returns, it should not be surprising that I believe maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Vermilion Energy’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment