gguy44/iStock via Getty Images

Introduction

Southern First Bancshares (NASDAQ:SFST) is the holding company for the Southern First Bank in South Carolina. The bank has eight branches in SC, three branches in NC and one office in Georgia. While commercial and retail banking is an important aspect of the business, SFST also employs 37 people in its mortgage banking business where it originates loans which are subsequently sold in the secondary market.

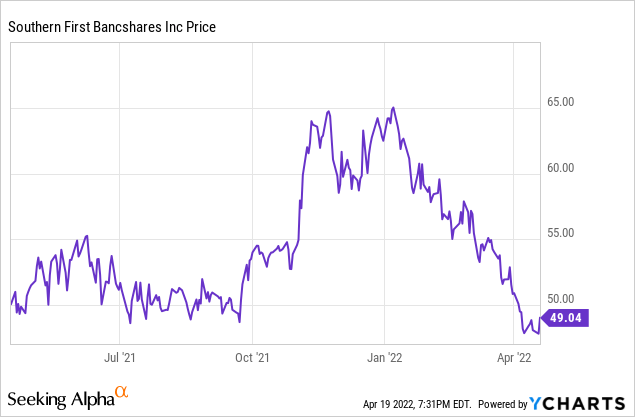

The underlying result in 2021 was weaker than in 2020

During 2021, the bank‘s balance sheet expanded but this did not result in an increasing interest income as the gross interest income decreased by almost 2% compared to FY 2020. Fortunately, the bank‘s interest expenses decreased by almost two thirds which helped the bank to generate a net interest income of almost $88M which is an increase of approximately 10% compared to the FY2020 result. The much lower interest expense has really saved the day.

SFST Investor Relations

The bank also reported a total net non-interest expense of just over $39M. That‘s a worse result than the net non-interest expense of around $26M in FY 2020 but SFST was much more active on the loan origination front as its mortgage banking income fell by approximately 40% in FY 2021.

The ‘normalized‘ income was approximately $48.4M in FY 2021 but this was subsequently boosted to $60.8M as the bank was able to add back $12.4M in loan loss provisions it recorded in the previous year. On an after-tax basis, the net income was $46.7M or $5.96/share. A great result but keep in mind the EPS was boosted by this (likely non-recurring) reversal of loan loss provisions.

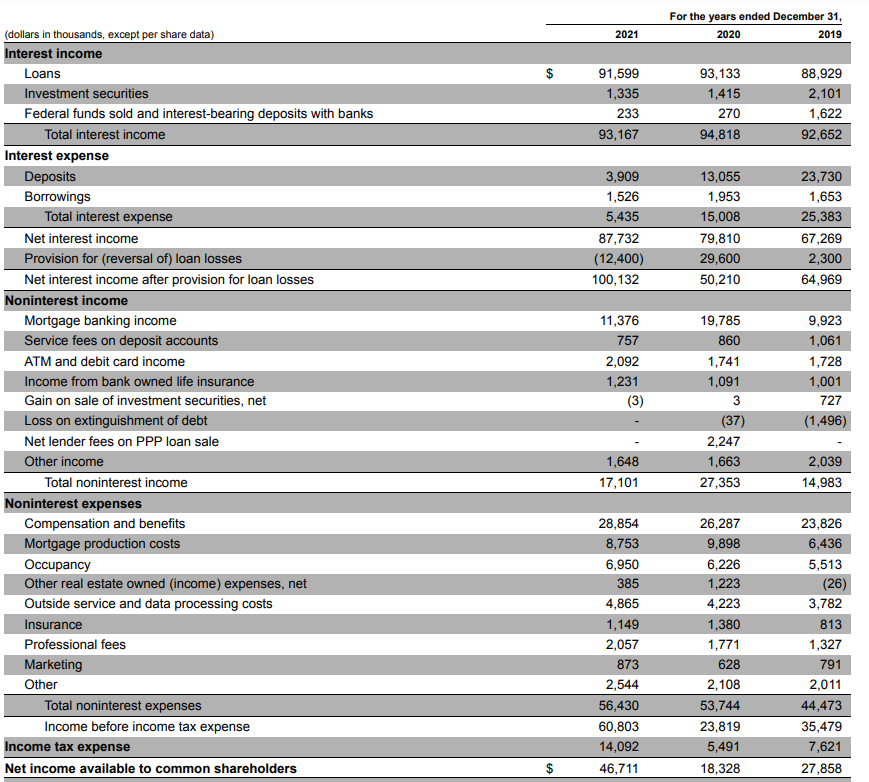

Southern First does not pay a dividend, so the earnings are integrally added to the book value of the bank.

SFST Investor Relations

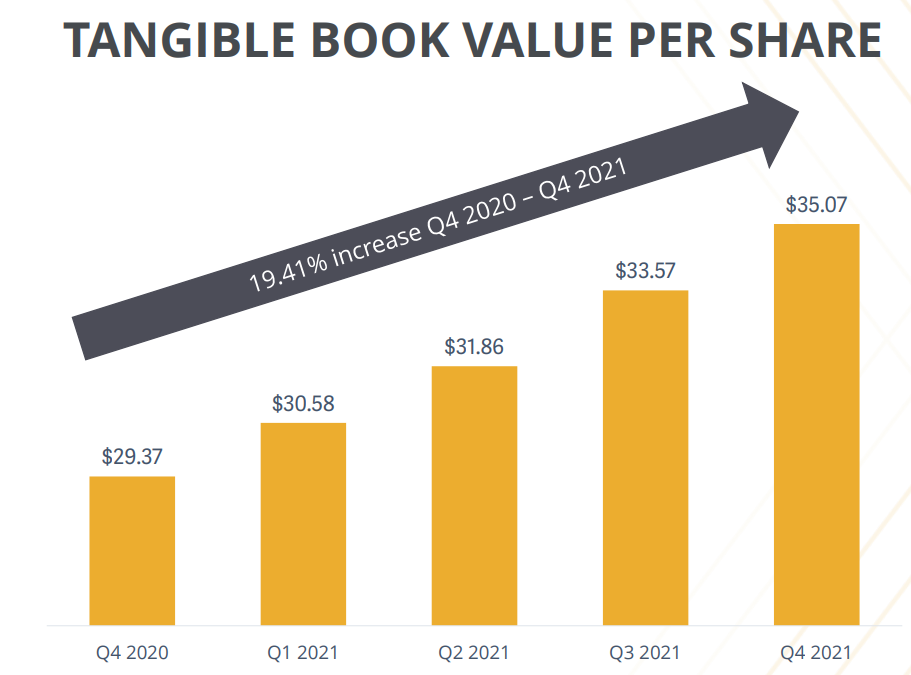

Less than 0.1% of the total loan book is ‘non-current’

It was interesting to see Southern First recorded a loan loss provision of almost $30M in 2020, and it was less surprising to see the bank was able to recoup a substantial portion of the previous year’s position in 2021. After taking back $12.4M in provisions, the total amount of loan loss provisions on the balance sheet was approximately $30.4M.

SFST Investor Relations

I think that still is a very comfortable level considering the loan book of Southern First seems to have an above-average credit quality.

SFST Investor Relations

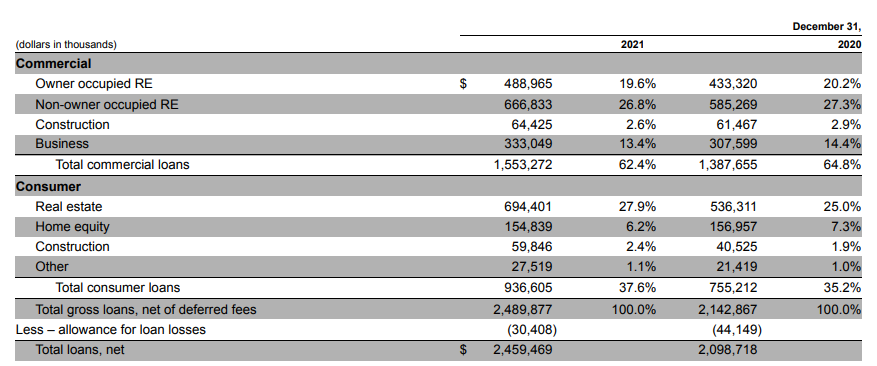

I’m always a little bit nervous when I see in excess of 60% of the loan book actually consists of commercial loans and seeing how commercial real estate makes up in excess of 45% of the loan book doesn’t really ease my concerns.

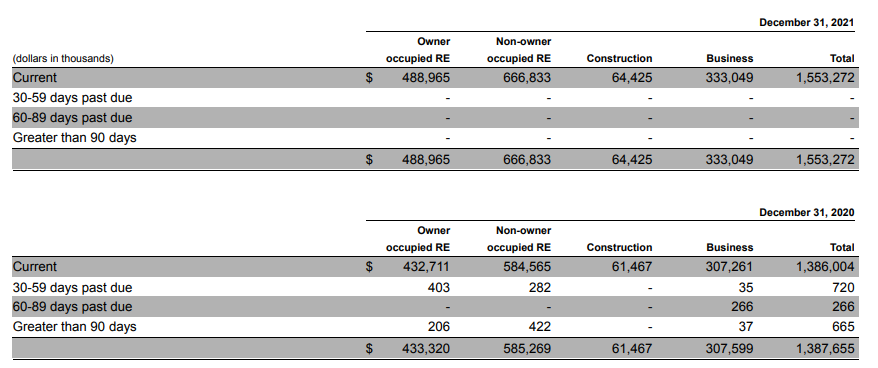

Of course there’s no reason to be concerned if every borrower pays its monthly mortgage. And that’s exactly why I’m impressed with Southern First Bancshares. As you can see in the image below, not a single loan in the commercial loan book was past due. Every single dollar of every single loan was classified as ‘current’ as of the end of 2021. And even at the end of 2020 the total amount of non-current loans was less than $2M. I have rarely seen a loan book as impressive as Southern First’s.

SFST Investor Relations

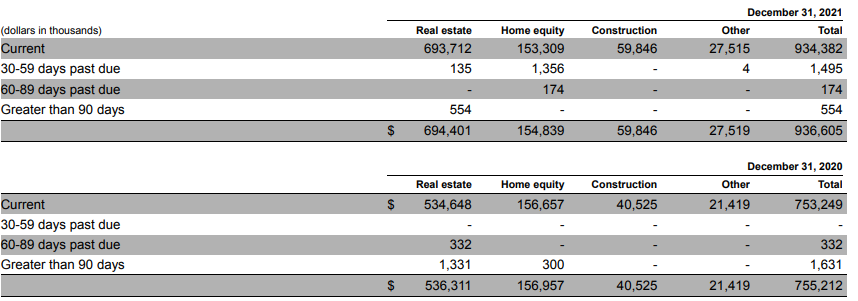

Looking at the status of the ‘consumer loans’ which mainly consist of mortgages and home equity loans, there are some loans past due but with a total amount of just over $2M in loans past due, this is extremely manageable as well.

SFST Investor Relations

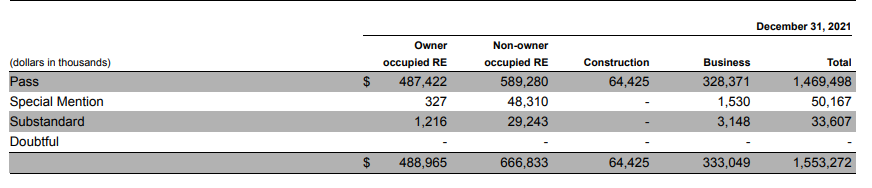

The bottom line is that SFST has a total loan loss allowance of in excess of $30M while almost all of its loans are current. I was wondering if the devil is in the details and I dug a bit deeper into the loan credit quality and the quality of the outstanding loans.

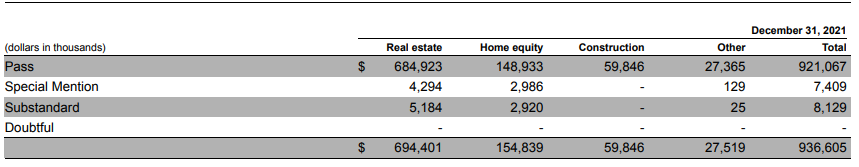

In the commercial loan book, about $84M of the loans are classified as special mention and substandard, which represents approximately 5% of the loan book. While those loans may need to be monitored more carefully, keep in mind that even if a borrower defaults it’s not very likely the bank will lose the entire amount as the borrower has obviously posted real estate assets as collateral. And for every additional month the borrower pays off its loan, the risk for the bank is decreasing.

SFST Investor Relations

The situation looks even better when looking at the consumer loans as less than $16M of those loans are not classified under ‘pass’. This means that of the total loan book of almost $2.5B, just under $100M of the loans is classified as special mention or substandard.

SFST Investor Relations

Investment thesis

Income-oriented investors will completely ignore this bank, but value investors may become interested. While the bank is trading at just over 1.3 times the book value, that very same book value is increasing very fast and will likely exceed $40 by the end of this year, further reducing the P/TBV to less than 1.2.

Southern First is not exceptionally cheap but the increasing interest rates should improve the bank’s net interest margin. And as 99.9% of its loan book is ‘current’, a potential recession should not have a major impact on SFST’s loan book. Sure, some loans will become riskier, but I think the existing loan loss allowance and profit engine are sufficient to mitigate the impact of a recession or economic contraction.

Be the first to comment