HT Ganzo/iStock via Getty Images

With uses across multiple industries, some of which are in the process of explosive growth, boron looks set to experience a supercycle of its own. While the major EV battery metals have stolen much of the spotlight shone on critical materials, boron has quietly become recognized as a strategic material for most of the Western world. This article aims to examine the growing market for boron and its strength moving forward.

Uses and Demand

The best place to start with the boron market is with its simplest application, which is fertilizer. There are tons of different fertilizer formulas, some of which are boron-rich, many of which aren’t. Most often, fertilizers are associated with the “big three” of plant elements, nitrogen, phosphorus, and potassium. However, boron is one of the elements that may be commonly overlooked and boron deficiencies can lead to plant death. Boron deficiencies also contribute to lower plant uptake of the big three elements, meaning boron-infused fertilizers improve efficiency and allow planters to use less. According to research from Michigan State, it’s fairly common to see deficiencies in soil boron levels if not artificially supplemented.

Boron deficiency is typically categorized by soils with less than 1 ppm of boron, yet most soils in the Americas have a natural boron content in the range of .5 ppm – .6 ppm, except for alfisols, which typically have a natural boron content of between .6 ppm and 1 ppm. This issue is present at varying levels throughout most regions in the world, thus being the crux of the demand for boron-infused fertilizers. For agricultural purposes, fertilizer with high boron content is most effective with legumes, root vegetables, tree fruits, and more, which are particularly sensitive to boron deficiencies. Boron is also useful for ant control and is rather effective with most grasses, which includes wheat, barley, rice, oats, and corn. Yet, currently, only about 25% of crops meet the recommended threshold to overcome natural boron deficiencies, likely impacting crop yield by a significant amount. This underutilization means that there is likely significant room for growth within the fertilizer market for boron products. Fertilizer may not be the most glamorous product, but it is a nice source of demand for the metalloid, around 20% of its total demand, and boron’s place within it looks to be on the rise.

Moving up in product complexity, we come to boron’s application in ceramics and glass. For centuries, boron has been a critical element in the creation of ceramics and enamels due to its propensity to reduce glass viscosity. Lowering glass viscosity enables the creation of smoother surfaces and reduces thermal expansion. Boron also increases the shine of the products that are made with it, forming a protective coat that increases durability and resistance to chemicals. This makes its use common in tiles, including clay roof tiles, as well as many porcelains. In glassware, such as pyrex, boron plays a critical role in thermal management. Boron typically makes up between 8% and 20% of the final product’s weight. So, think of the glass in your phone, or the windows of your car, or house, odds are they’ve been manufactured with the assistance of boron to increase durability.

New material science has expanded the market for boron products with the advancement of highly-durable ceramics. Boron carbide is the third-strongest known material and has many uses, from tank armor and bulletproof vests, to control rods in nuclear power generation. Given its low density, boron carbide is seeing greater adoption in a variety of different industries and seems to be in a similar state as carbon fiber in the late 90s. Boron nitride, another ceramic, is the second-hardest known material, behind diamond, and holds some other advantages over boron carbide. While boron carbide begins to oxidize at 400°C to 500°C, boron nitride doesn’t start to oxidize until 1,900°C. This is far above diamond, which begins to oxidize at 800°C. Because of this, one of its primary applications is in cutting tools, as it can withstand high temperatures created when trying to cut through particularly hard materials.

Boron nitride is also used as an electrical insulator due to its low electric conductivity and crucibles due to its high oxidation temperature and thermal conductivity. The material’s high thermal resistance and impressive hardness has also made it a useful product for aerospace applications. Both ceramics are fairly young in their product life, meaning adoption will likely grow as it becomes more commercialized. These applications may extend to being used as an additive to high-strength composites, like carbon fiber, or in use as a structural component in infrastructure. Due to the material’s high durability, and flexibility, it makes a solid candidate to be used in the blades of wind turbines as well, as it can flex with the wind and keep the structure very light.

Boron’s use in glass also extends to solar panels, in which it plays a critical role. While silicon is widely accepted as the important element in a PV solar panel, boron is perhaps the second-most important as it is responsible for generating an electrical charge. This charge is generated by the electron imbalance created by boron and silicon, which is then inverted by a phosphorus-silicon imbalance. Because boron has one less electron than silicon, and phosphorus has one more, electrons get transferred and, thus, create electricity.

Boron can also be used as an additive to the panel’s glass to reduce its reflectivity, increasing the efficiency of the panel. The solar is market set to explode, growing at over 20% per year until 2026. Furthermore, up to 70% of the world’s electricity is expected to be generated by wind and solar by 2050. With electricity generation also rising 2.5x by the same period, boron’s utilization in both technologies will likely be a tremendous boon for the industry.

Finally, boron is a key element for the formation of neodymium magnets. Neodymium magnets are a powerful type of permanent magnet that comprises neodymium, iron, and boron. By weight, iron is the most significant element in a neodymium magnet and boron is the least, accounting for just 1%. That may not sound all too significant and, in small volumes, it’s not, but the demand for neodymium magnets looks set to skyrocket as they become the default choice for use in EV motors.

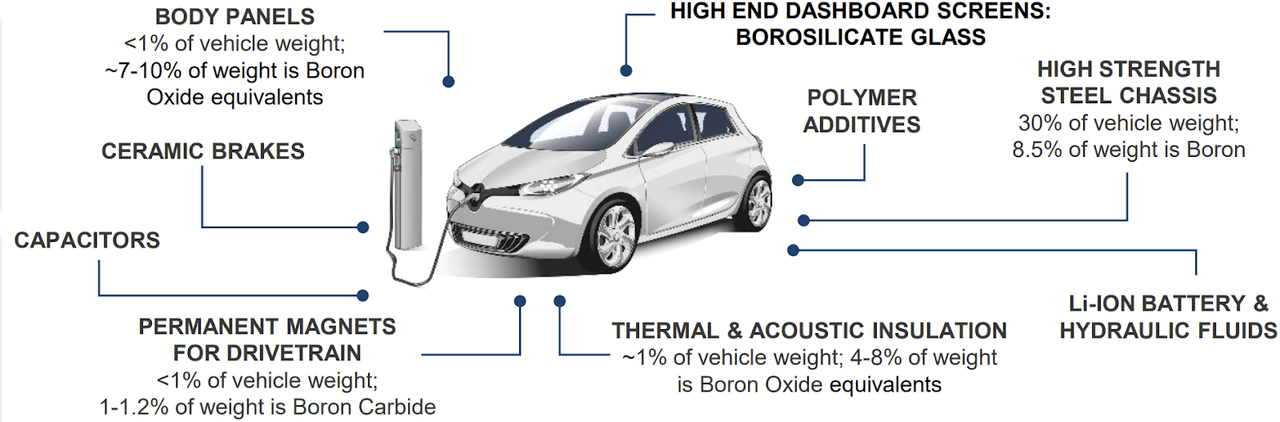

Boron’s use in EVs also isn’t just limited to permanent magnets. According to estimates from 5E Advanced Materials (FEAM), between 2.5% and 3%, or between 46 kg and 50 kg, of an EVs weight is various boron compounds. With expectations that the EV market will rise from around 6.3 million units sold in 2021, to between 26.8 million and 34.8 million by 2030, boron usage in EVs looks to be yet another area of explosive growth for the material. Though, EVs aren’t the only application for permanent magnets.

5E Advanced Materials

Tangentially related to EVs, permanent magnets are utilized for electricity generation via turbines. Growth in wind and hydro energy generation looks to offer solid sources of growth for permanent magnets, as existing infrastructure is modernized and new infrastructure is constructed. Moving outside of the energy sector, permanent magnets play a significant role in the medical sector. Most commonly, this is due to their usage in MRI machines, though they can also be utilized in surgeries to extract foreign objects from the body. Accounting for 10% of the demand for neodymium magnets, medical devices aren’t insignificant, though motors are still the largest source of demand for permanent magnets.

EVs aren’t the only vehicles that utilize permanent magnets, as all modern vehicles utilize them to an extent. ABS is controlled by permanent magnets, as are locks and windshield wipers. Additionally, permanent magnets can aid in fuel efficiency by assisting in crankshaft rotation. Other niche applications include various electronics, disk drives, and actuators manufacturing. The most popular alternative to neodymium magnets is samarium-cobalt magnets, though they’re typically only utilized in the defense and aerospace sectors. Currently, at a value of $16.4 billion in 2021, the market for permanent magnets is expected to grow to $23.4 billion by 2027.

5E Advanced Materials

Currently, it seems that the general expectation is that the boron market will grow steadily, but not at any sort of breakneck pace. At a 7% CAGR until 2027, it’s not as if boron is breaking records here, but it isn’t too bad either. However, this doesn’t tell the full story of the boron demand issue. Boron production is slowly falling as existing deposits get burned through, creating a demand imbalance. This has caused prices to rise to as much as $1,250 per tonne, well over previous projections of $739 per tonne. Credit Suisse now projects that demand for boron will overcome supply within the next three years. Thus, demonstrating that the relative demand for boron seems to be growing rather quickly and these elevated prices should persist.

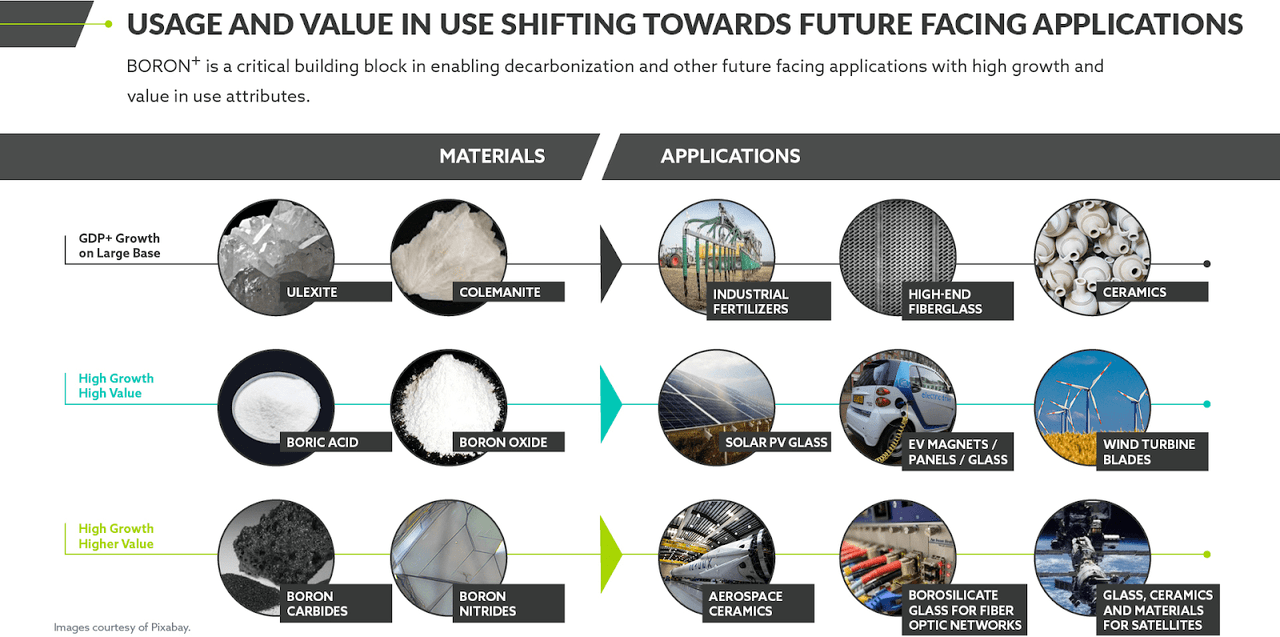

With glass and ceramics manufacturing accounting for about 50% of boron’s commercial usage, and fertilizer about 20%, there is lots of room for growth with boron’s emerging uses. Solar panels, neodymium magnets, and advanced materials advancements all offer explosive growth opportunities that seek to dramatically reduce the element’s reliance on existing revenue streams. Even the fertilizer market has room for growth, as boron’s utilization increases to match its agricultural ideal threshold. However, there may be even more opportunities for boron’s use to grow as new uses for the element are discovered.

Credit Suisse expects that, under a high-growth scenario, demand for boron could 10x by 2050. At that point, over 90% of the demand for boron would come from decarbonization technologies. A sector that is currently just a fraction of boron’s current demand, is set to grow to become, by far, its most significant. So, perhaps it’s not the next five years that investors should concern themselves over. Point being, the next several years look fairly promising, but the next couple of decades could be transformative for the industry.

Supply Profile

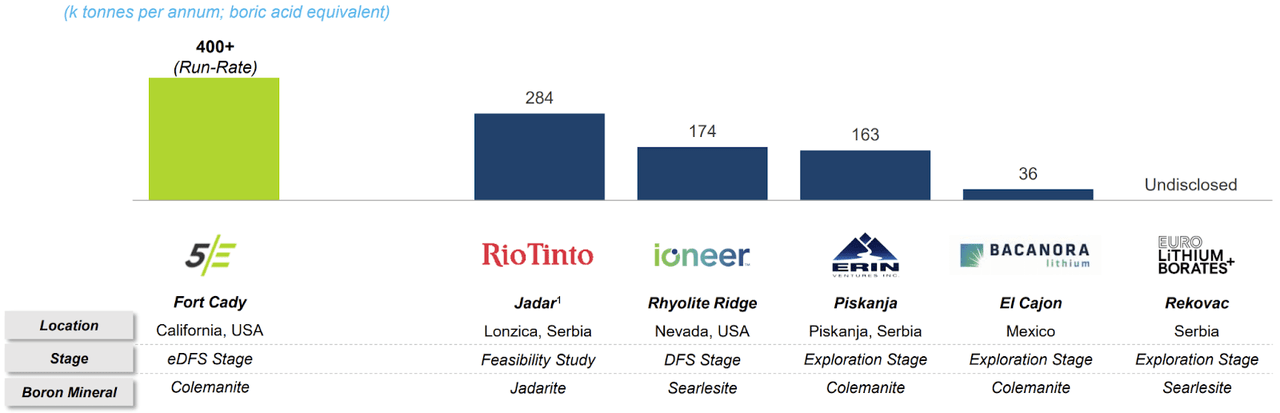

As alluded to earlier, the supply chain for boron is pretty weak at the moment. Turkey currently accounts for 62% of the world’s boron sales, with production controlled by the state-owned Eti Maden. Eti Maden and Rio Tinto (RIO), which produces most of its boron in the United States, control 85% of the world’s boron supply between the two of them. As Tim Daniels, CEO of Erin Ventures (OTCPK:ERVFF), explains “You can literally count all the boron deposits in the world on one hand.” The figure below shows all of the boron projects that aim to enter production in the near future which, as you may note, is not very many at all.

5E Advanced Materials

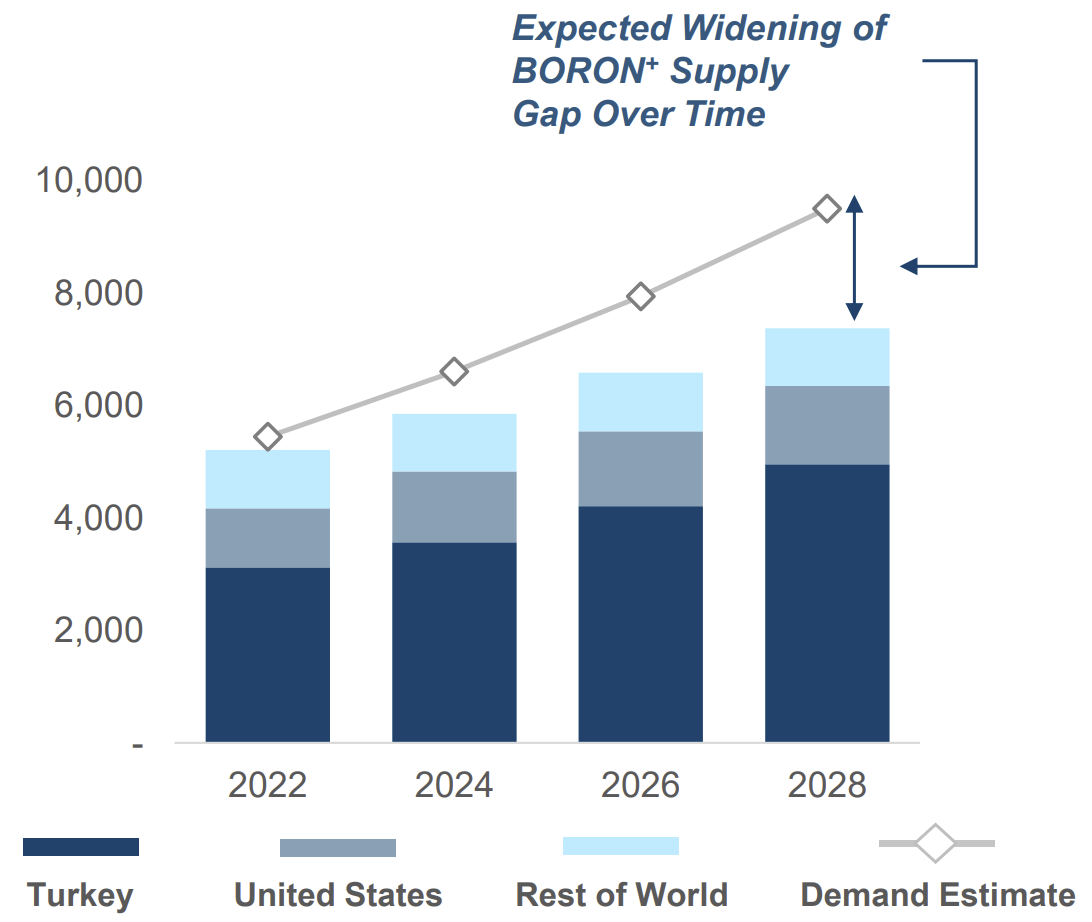

Now Daniels’ comment is a bit of an exaggeration, though his comment was largely in reference to major deposits. Many of the boron deposits around the world only produce the element in small quantities, and wouldn’t exactly be considered major boron deposits. As one of the most abundant elements in the world, this may seem a bit counterintuitive. However, boron’s rarity comes from its fairly uniform distribution, meaning there are very few areas that contain a significant concentration of the element and even fewer that contain a significant concentration at scale. Additionally, with 16 naturally-occurring allotropes, compared to carbon’s tendency to form either graphite or diamonds, it can sometimes be difficult to process the material as a potential by-product. The figure below adds some context to the above figure. Even if all 1,057,000 tonnes of new boric acid production come online, supply is incapable of matching demand.

5E Advanced Materials

With boron production even falling a bit over the past couple of years, moving towards a supply shortage, it’s clear that boron supply isn’t exactly the most flexible. Now, if supply is so stiff that it struggles to cope with 4.5% annual growth in annual boron sales, imagine how 10x growth will impact the market. With limited mining prospects available and minimal investments being made in the space, the ability for supply to keep up with demand seems rather improbable.

To understand why the supply is so stiff, it is worth exploring the two companies that dominate the supply chain. Rio Tinto only has about 20 years left in their flagship boron deposit, which they’ve been mining since 1927, so there’s not really too much room, or desire, to increase output. Eti Maden has a bit of a different issue. The state-owned mining company has been at the mercy of rampant inflation, which surpassed 20% at the end of last year and was up to almost 50% just before Russia’s invasion of Ukraine. In 2021, the Turkish lira lost 44% of its value, yet things have only worsened since Russia’s invasion of Ukraine. Since then, inflation has hit 61.14%. So, given the current turmoil in the region, we may not be able to rely upon a steady supply of boron from Turkey. Though, even if Eti Maden is able to maintain its current output, supply will struggle to meet demand.

Much like in the lithium supply chain, downstream processing is currently dominated by China, despite its low natural reserves. This presents yet another geopolitical risk within the supply chain, especially as countries like the United States use boron carbide for defense applications. Because of this inadequate supply chain, and boron’s use in decarbonization and defense applications, the EU has designated boron as the only non-metal to receive high critical status.

Federal Involvement

The United States has been making quite the push towards self-sufficiency in its critical material production over the past year, which has only picked up since Russia’s invasion of Ukraine. However, currently, boron is not considered a critical material in the States. Though, recently, a prospective boron producer, 5E Advanced Materials, had their boron project deemed critical infrastructure by the U.S. Cybersecurity and Infrastructure Security Agency (“CISA”). So, while not yet included in the list, it’s clear that the government is aware and given the significance of boron in EVs, emerging energy technologies, defense applications, and advanced materials, I wouldn’t be too surprised to see its inclusion in the near future.

Investor Takeaway

Too often, people will turn a blind eye to a stellar investment opportunity due to a lack of patience. Now, this isn’t exactly my original opinion, but boron certainly seems to be in a similar place as lithium was ten years ago. A fairly limited supply chain, with extraction pretty much exclusively in South America and Australia, and dominated by just a few companies. Demand wasn’t too high and applications offered limited growth, so there wasn’t very much investment in the sector. When EVs started to become popular, the market was shocked into action and the lithium market strengthened tremendously.

Whenever a “scarce” mineral becomes important, it tends to become a lot less scarce pretty quickly. The purpose of this article isn’t to say that we’re going to run out of boron, rather that the market will likely strengthen significantly in the coming years. Back in 2010, lithium was selling for $5,160 per tonne. While spot prices are now over $100,000 per tonne, the long-term contract price of lithium seems to be closer to $22,000 per tonne. This is the same sort of future I see for boron moving forward. Though, I should also note that boron deposits appear to be far more scarce than lithium.

Earlier in this discussion, I said that investors often miss out on good opportunities due to a lack of patience. And while I believe that this thesis is really most effective as a long-term investment strategy, the projected supply shortage within the next three years offers fairly significant near-term investment strength. In 2020, boron prices were as low as $569 per tonne, the growth to $1,250 per tonne this year indicates that the market seems to be bracing for the upcoming shortage and should only strengthen through the near future.

This conjures memories of an old article I wrote on Lithium Americas (LAC), in which I included Goldman Sachs’ pessimistic outlook on the lithium market as a low-end estimate for the company. For those inside of the industry, those estimates seemed to be clear low-balls. The investment firm projected long-term lithium carbonate prices of just $7,200 per tonne. But I included it because I knew there were those that felt the lithium market was overhyped. The comments of an article I published just before that one, where I projected long-term lithium carbonate prices of $13,000 per tonne, confirmed those suspicions. It was a sign of the times. Even on the verge of electrification, most still doubted the long-term potential of lithium. Yet here we are, in a market where $13,000 per tonne for carbonate is looking like a very conservative estimate.

Continuing with this comparison to lithium, it too exhibited oligopolistic tendencies in its younger days. However, as lithium demand rose, a number of juniors entered the space and new deposits cropped up at a rapid pace. Now, the majority of these juniors are likely full of it, and most of these deposits aren’t much, but a similar thing may happen in the boron space.

The question now becomes how investors can capitalize off of this market. While Rio Tinto is a major player in the industry, its boron business makes up the vast minority of its revenues. Eti Maden is a Turkish state-owned mining company, meaning it’s not a viable investment option either. However, perceptive readers may have noticed one company showing up throughout this article time and again.

I’ve been looking into 5E Advanced Materials over the past few weeks and it’s quickly emerged as my favorite way to play the boron market. 5E is a junior boron miner, looking to develop a boron project in Southern California. With the largest known boron deposit, not owned by Eti Maden or Rio Tinto, 5E will become the third-largest boron producer upon reaching production. Commercial production is expected to start in 2024, just as boron is entering its most critical period. Those interested can expect an article on it very soon.

Be the first to comment