Nastassia Samal

Just over five months ago, I wrote on Sandstorm Gold (NYSE:SAND), noting that while the company had a very bright future, its 60% rally above $9.00 had left it trading with little margin of safety at 1.50x P/NAV. This suggested taking profits above $9.00 would be wise, with the stock no longer undervalued and trading well above its next support level. Since then, the stock has seen a drawdown of more than 40%, and it’s seen a significant change in its royalty portfolio, swallowing the highest-growth royalty/streaming company, Nomad, and scooping up another portfolio to take over the crown as the top company from a growth standpoint in its segment.

Despite this major upgrade to the portfolio at a reasonable price (Nomad acquired at barely 0.90x P/NAV), Sandstorm’s market cap has tumbled by $120 million from its peak, a significant deviation from the fundamentals (adding 60,000+ GEOs per annum). This is especially true given that the Sandstorm of today should trade at a higher multiple, being more diversified and Hod Maden more advanced. Instead, it trades at a cheaper valuation than in 2018, when gold sat below $1,300/oz.

Hod Maden Project (Sandstorm Presentation)

Today’s disconnect can be attributed to Sandstorm being in a sector that trades completely devoid of fundamentals due to despondency sector-wide after a violent 2-year cyclical bear market. I see this as a buying opportunity, with this pullback below $6.00 being a gift.

The New Sandstorm

It’s been a very busy year for Sandstorm. However, despite two transformative acquisitions (Basecore, Nomad) and the Horizon Copper deal to transform Hod Maden into a gold stream vs. a previous equity interest, the stock has made no upside progress, with investors able to buy at a lower market cap to before the Nomad/Basecore transaction. The result of these major acquisitions and the Horizon Copper deal is that Sandstorm adds 30 royalty/streaming assets and now holds a 20% stream on all gold produced from Hod Maden (156,000 ounces per annum), paying 50% of the spot price until 405,000 ounces are delivered (12% after that at 60% of spot). While adding 30 royalties/streams might not seem like much for a $1.0+ billion acquisition, the quality of these royalty/streaming assets cannot be overstated.

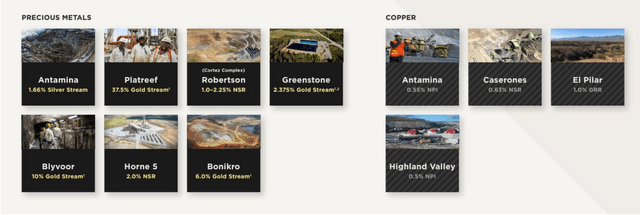

Portfolio Additions (Company Presentation)

As shown above, Sandstorm now has a 1.66% silver stream and 0.55% NPI on a top-5 copper mine, a 0.65% royalty on the Caserones Mine (20+ year mine life), a 37.5% gold stream on the Platreef Mine (25+ year mine life, #5 PGM mine once Phase 2 Expansion complete), and a 2.37% gold stream on Greenstone, set to be one of the top-10 largest gold mines in Canada. Other notable assets include a 10% gold stream on Blyvoor, which could contribute 20,000 GEOs per annum at full capacity, and a 2.0% NSR royalty on the soon-to-be-developed Robertson Mine, which is projected to produce up to 250,000 GEOs per annum (~5,000 GEOs attributable to Sandstorm post-2024). This will lead to significant growth, with Sandstorm able to launch itself from the mid-tier group to the #4 name in the precious metals royalty/streaming space.

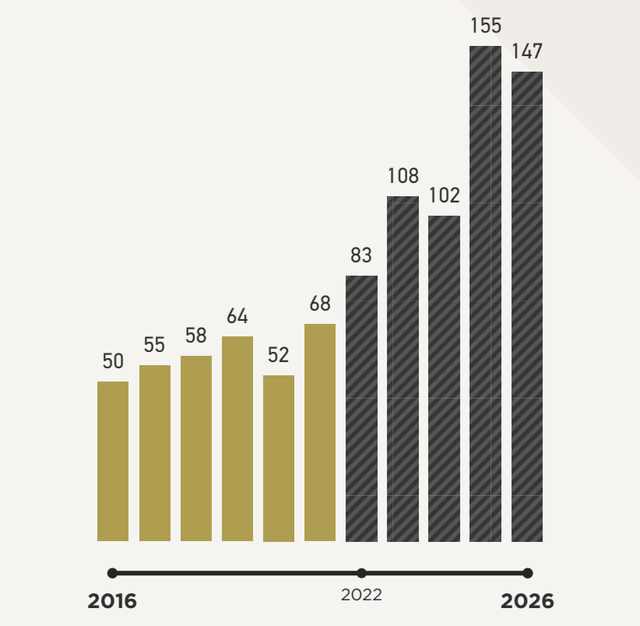

Sandstorm – Expected GEO Volume Growth (Company Presentation)

Looking at the chart above, we can see that attributable production will increase to 155,000 GEOs in FY2025, up from ~85,000 in FY2022. This represents a 22.2% compound annual growth rate. While production will dip in 2026 (Mercedes fixed ounce period), I expect this gap to be filled by another royalty/streaming deal, allowing Sandstorm to maintain a ~160,000-ounce attributable profile post-2025. There are also additional assets within the portfolio with the potential to fill in gaps. These include:

- higher production at Blyvoor, which appears to be modeled conservatively within this production profile

- a small contribution from Blackwater if it comes online by 2025, which looks likely

- a small contribution from Bayan Khundii, a high-grade open-pit gold development project in the process of financing construction

- a potential restart at Woodlawn, a zinc-copper mine in Australia

- a possible increase in production at Fruta Del Norte

- a small contribution from Gualcamayo in Chile

To summarize, even with a decline in contribution from Mercedes, I would not worry about FY2025 being peak production for the company, as the chart implies, with lots of time to fill in any gaps.

Fruta Del Norte Operations (Lundin Gold Presentation)

Valuation

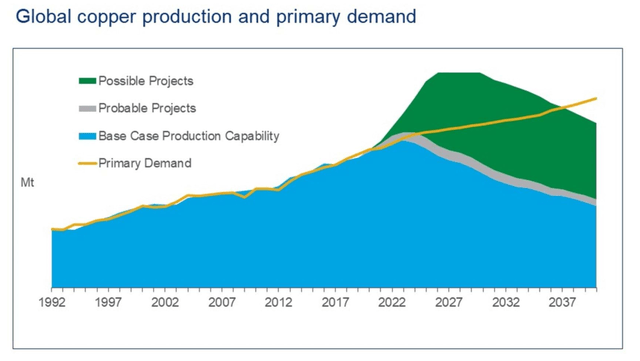

Sandstorm has 284 million shares outstanding (post-Nomad acquisition) and a share price of $6.00, translating to a market cap of $1.70BB. Comparing this to its estimated FY2025 cash flow generation of ~$170MM leaves Sandstorm trading at just 10x FY2025 cash flow estimates. However, this assumes a gold price of $1,750/oz, a silver price of $22.00/oz, and a copper price of $4.00/lb. These figures may be above spot prices, but I would argue that they are relatively conservative assumptions on a 3-year forward basis, especially copper, which has a very attractive supply/demand outlook given the recent trend towards electrification.

Global Copper Production & Primary Demand (Wood Mackenzie)

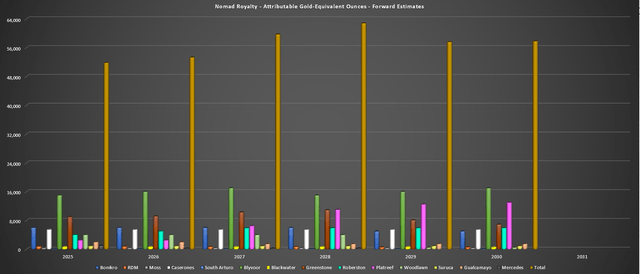

Currently, the larger royalty/streaming companies with less growth and diversification than Sandstorm are valued at 17-23x FY2024 cash flow estimates. Sandstorm’s FY2025 cash flow estimates assume that Sandstorm makes no future royalty/streaming acquisitions. It also assumes that the portfolio acquired from Nomad (previously expected to do 50,000+ GEOs in FY2026) underperforms its previous estimates. The chart below shows Nomad’s expected attributable GEO production (pre-acquisition), showing that production could easily surpass 50,000 GEOs and head closer to 60,000 GEOs in a best-case scenario.

Nomad – Attributable Production Estimates (Author’s Chart & Estimates, Company Filings)

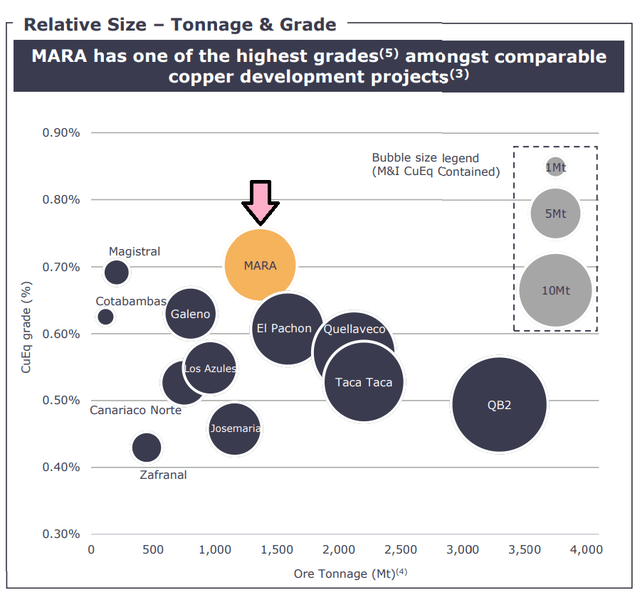

Meanwhile, not included in the outlook and a post-2026 opportunity is the MARA Project, which is shared by Glencore (OTCPK:GLCNF), Yamana (AUY), and Newmont (NEM). Sandstorm currently has a 0.25% net smelter return on the project but has the right to purchase 20% of gold production at 30% of spot prices. For those unfamiliar, MARA is a mammoth-sized project with a 28-year mine life that’s expected to produce 107,000 ounces of gold per annum. As shown below, Mara stands out from a grade and scale standpoint, and it benefits from the existing infrastructure at Alumbrera, making it less capital-intensive than other projects like Los Azules (Argentina), Zafranal (Peru), and Josemaria (Argentina).

Mara Project Grade (Yamana Gold Presentation)

If the assets were in production today, this would translate to ~21,400 ounces of gold attributable to Sandstorm at the cost of just $540/oz, translating to more than $20MM in additional cash flow per annum. So, while SAND’s attributable production will hit 155,000 GEOs in FY2025, I see the potential for ~180,000 GEOs by 2028 (13.3% attributable production CAGR from 2022-2028), with the Platreef Phase 2 Expansion and the possibility of production from MARA. Therefore, I expect Sandstorm to maintain its industry-leading growth rate even if growth does decelerate post-2025 following the lumpy growth from Hod Maden, Robertson, Greenstone, and Platreef.

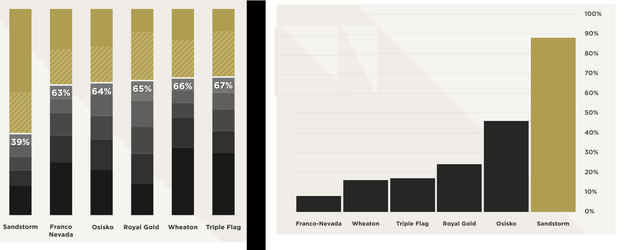

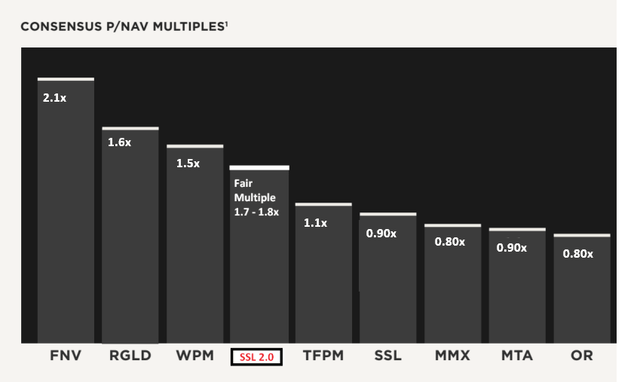

Sandstorm is even more attractively valued on a P/NAV basis, which better reflects the portfolio assets. This is because it has an estimated net asset value of $1,790 million, leaving the stock trading at 0.95x P/NAV. Based on what I believe to be a fair multiple of 1.70x P/NAV, I see a fair value for the stock of $3.04 billion or $10.70 per share. As shown below, applying this multiple would still leave Sandstorm trading at a discount to its largest peers, which might make sense from a scale standpoint (it doesn’t quite measure up in ounces even at 2025 levels), but makes little sense from a diversification standpoint, with Sandstorm having only 38% of NAV from its top-5 assets, which is superior to its peer group at 66%.

Sandstorm – Diversification & Growth Profile vs. Peers (Company Presentation)

Sandstorm Valuation Relative To Peers (Company Presentation, Author’s Notes / Drawings Based On More Recent Valuation Figures)

To summarize, even after Sandstorm’s slight outperformance since its Q2 results, I see considerable upside for the stock, with fair value sitting 78% higher at $10.70 per share. Also worth noting is that the company is likely to increase its dividend meaningfully over the next two years (1.0% currently or $0.06 annualized), given the expected sharp increase in cash flow over the next two years. This could be another catalyst to attract funds to the stock, with Sandstorm boasting the best growth profile sector-wide and what could be one of the highest dividends, just behind Osisko Gold Royalties (OR) at 1.65%.

Summary

While the previous Sandstorm investment thesis (pre-2022) left a little to be desired (non-pureplay royalty/streaming model, no dividend, and lumpy growth/significant NAV attributed to one asset with progress moving at a snail-like space), the new Sandstorm investment thesis is near-unparalleled sector-wide. This is because it boasts an 80% attributable production growth profile (FY2025 vs. FY2022), industry-leading diversification from a NAV standpoint, royalties/streams on some of the lowest-cost assets globally, and the addition of multiple Tier-1 size assets (Platreef, Greenstone, Antamina).

Most importantly, Hod Maden appears to be making progress in terms of putting a concrete timeline on its initial production (all permits in place, early works underway), meaning that this enormous piece of the story has also been de-risked. Given Sandstorm’s several favorable attributes combined with a dirt-cheap valuation, I see the stock as a must-own name for investors looking for gold exposure, especially given that it is one stock that will grow cash flow and dividends per share despite where precious metals prices trade given its organic growth profile. Hence, I have started a new position in the stock below US$6.00 and would consider adding to my position if we see further weakness.

Be the first to comment