Joe Raedle

After I covered my bull thesis in the last article, Carvana Co. (NYSE:CVNA) has gone through a series of speculative ups and downs. We are also in a tough macro environment that future used car prices and sales are uncertain. While there are lots of obvious issues in profitability, debt, and macro volatility, I still believe CVNA’s management is capable of navigating this business. The recent 2022 Q2 showed lots of positive signs. I will specifically focus on cost control and efficiency.

CVNA showed improvements in efficiency and cost control

In the recent quarter, CVNA grew units sold sequentially by over 10%, and reduced SG&A by 5%. SG&A per unit was reduced by $850 to $5400. CEO Ernie shared an ambitious goal of hitting $4000 cash SG&A per unit in the 4th quarter (no ADESA included). The mid-term target for SG&A is $3000. Clearly, CVNA has made improvements on its cost issues. If it can cut $850 in this one quarter, it should not be hard to cut another $1400 in the next two quarters to reach its $4000 goal.

Moreover, this is actually CVNA’s first quarter with positive cash from operations ($106M) thanks to the extra inventories they built up last quarter. Capital expenditure is down from 220M to 141M. So CVNA almost achieved positive cash flow in the 2022 Q2 (Levered Free Cash Flow is already positive 267M). Cash burn is significantly slowed. Considering the current assets increased to 5.4B with 1.9B in cash & Receivables, CVNA should have lots of breathing room for bankruptcy risks.

Why more costs can be reduced

CVNA achieved these cost reductions while it also launched two new markets (the same launch amount as last quarter) in Bangor, ME, and Flagstaff, AZ. These launches are in relatively bigger cities and had large one-time fixed costs but no revenues yet. There are also so many initiatives going on in logistics, last-mile delivery, customer care, and advertising on the SG&A side which also drives profitability. Lots of the initiative impacts have not been reflected in the income statement yet. Given the progress CVNA made this quarter, there is no reason to believe it won’t continue during the rest of the year.

CVNA SG&A is still high at 721M. Most are from compensation/benefits (248M) and Others (243M) such as IT expenses, corporate occupancy, professional services, and insurance, limited warranty, and title and registration. Logistics actually only incurred 71M. The advertising cost is 131M. Many of these items are not directly related to existing services but for future capacity improvements and investments. Like setting up software servers, getting agreements done with a state title and registration work, training staff for a new hub, etc., all these costs should not be recurring items in the future. Once CVNA fixed them, they are not needed.

Another opportunity is the vending machines. According to CVNA chief brand officer Ryan Keeton, the vending machines are “a very low-cost way for us to get our name out there.”, like billboards. Having a Vending machine in the market will allow CVNA to give customers gift money to pick up their cars themselves. This saves lots of transportation and communication costs. CVNA currently only has 10% of hubs with vending machine pick-up options, they have more rooms to grow.

Variable costs vs fixed costs

CEO Ernie has said in an interview that CVNA’s model will have to invest lots of fixed costs while dealerships don’t have to. Dealerships generally rent a parking lot and get up and running profitably fairly quickly. However, CVNA should have $1500 less SG&A per unit on a variable basis than traditional dealerships after all investments in people and infrastructure are completed. CVNA saves labor costs associated with selling and sourcing functions that need more headcounts & benefits. CVNA’s logistic network requires more costs per unit sold but it provides opportunities to buy cars where they’re cheap and then sell them in locations where they’re expensive once they reach a certain scale.

In-house reconditioning offers way better quality standards and efficiency than outsourcing. They are also able to break down technicians’ jobs into different individual parts: change oil, change tires, paint, fix brakes, etc. Therefore, CVNA doesn’t have to hire master mechanics as traditional dealers do. This process is also good for speed and quality as they can hire people to become experts on one thing.

CVNA is making money for each extra car they sell

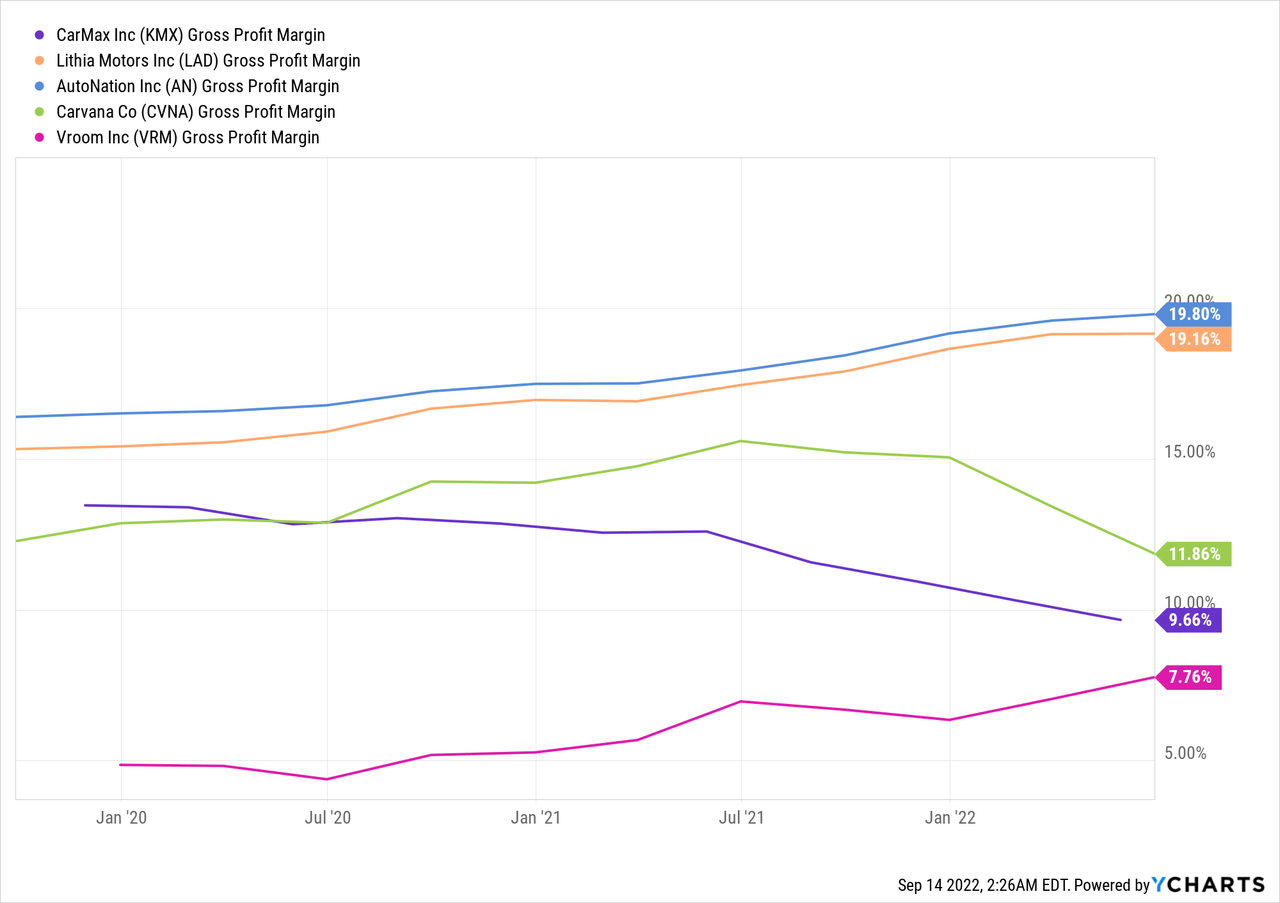

In Q2 2022, CVNA’s total gross profit per unit was $3,368, a decrease of $1,752 compared to last year but sequentially improved by $698 (consolidated). However, if you look at the gross margins of different car sellers (chart below), CVNA is actually not bad, and CarMax (KMX) has lower gross margins. In other words, for any extra car sold, CVNA receives more revenue than the costs it generates. And CVNA did better than KMX in this regard.

These Gross margins take into account costs including the cost to acquire, recondition, and transport vehicles associated with preparing them for resale. I agree with the management that the GPU will continue to improve because: 1, inbound transport costs have already been reduced but will take time to appear in the retail cost of sales. 2, As the vehicle price normalizes, there should be a more favorable finance attachment rate which CVNA estimates will have a 250 GPU contribution. 3, the industry-wide cost of funds has not yet passed through customers. CVNA expects an increase of $250 GPU as they pass through increased funding costs.

Bottom Line

CVNA is a disruptive force in the traditionally used car market. It continues building its brand and the trust of consumers. In the last quarter, its website unique visitors grew from 16,590k to 23,547k (42% YOY growth) while units sold grew to 117,564 from 107,815 last year (9% YOY). This is in the context that KMX declined 11%, AutoNation (AN) declined 9%, and VRM declined 53% of its unit sales. Yes, it is not profitable yet, and it has lots of debt. However, it is also setting up a very durable car buying experience that customers love (check this YouTube posted 5hrs ago). When we reach the day the CVNA finally got profitable, the stock price should already be very high, and that is the time to sell not buy.

Be the first to comment