Marko Geber

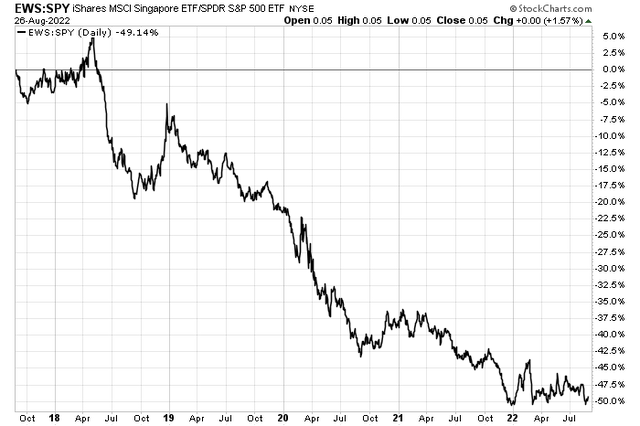

Emerging Asia stocks rallied last week while the S&P 500 spilled 4%. The iShares China ETF (FXI) nearly climbed back to even on the year with U.S. large caps after a summer struggle. Singapore equities, too, are nearly on par with domestic stocks amid a turbulent 2022. The iShares Singapore ETF (EWS) is heavy into Financials and Real Estate, but one Singapore-based Communication Services firm featured a late-week pop ahead of its key earnings date on Monday night.

Singapore Stocks Struggle Vs. US Equities

JOYY Inc (NASDAQ:YY) together with its subsidiaries, operates social media platforms that offer users engagement and experiences across various video and audio-based social platforms. According to Bank of America Global Research, YY was founded in 2005 and listed on the NASDAQ in Nov. 2012. JOYY is one of the more experienced live-broadcasting platforms with user-generated content (UGC). It has a high share of revenue/time spent and rides the growing popularity of live broadcasting and new content. It has been introducing new features and interactive games into its live broadcasting content and expanding overseas via acquisitions and organic growth.

The $2.2 billion market cap Singapore-headquartered Interactive Media & Services industry company within the Communication Services sector has negative earnings over the last 12 months, but it pays a very high 6.3% dividend yield, according to The Wall Street Journal. Ahead of its earnings date, the stock also features a 6.1% short float.

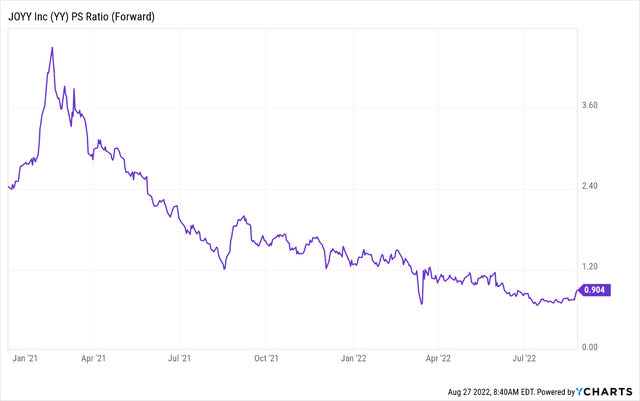

Shares of JOYY have gotten slaughtered from their peak in early 2021. That is when both emerging Asia equities and meme stocks hit a high. YY fell 84% from the all-time high near $150 to its July 2022 low under $24. As a result, the stock’s price-to-sales ratio plunged from above four to just 0.9 today. That’s a more reasonable valuation given its 11% expected revenue growth rate, according to Seeking Alpha data. But Seeking Alpha has an F rating on its overall valuation.

JOYY Price-To-Sales Ratio History: Much Cheaper Today

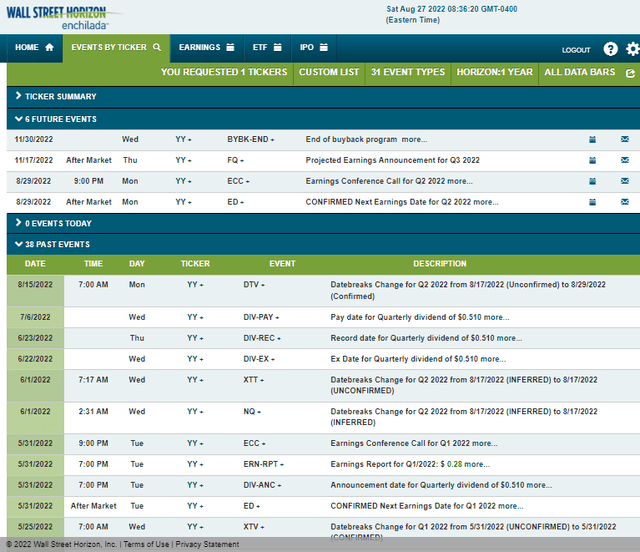

Looking ahead, JOYY’s Q2 earnings date is confirmed for Monday AMC with an earnings call at 9:00 pm EDT. You can listen live here. YY’s Q3 earnings date is projected for Thursday, November 17 AMC. Finally, the corporate event calendar from Wall Street Horizon shows the company’s buyback program ending on November 30.

YY’s Corporate Event Calendar

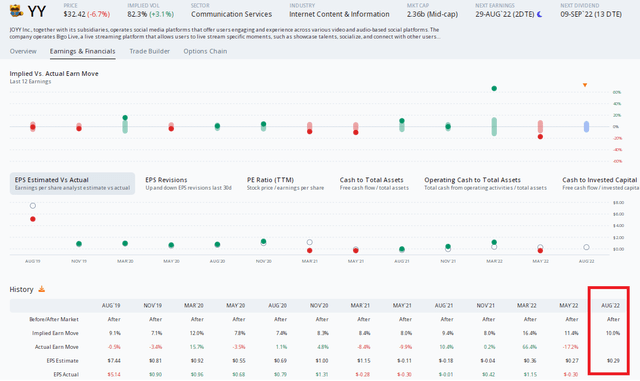

Digging into earnings expectations, data from Options Research and Technology Services (ORATS) show a consensus earnings forecast of $0.29 per share which would be a positive turnaround from negative EPS reported in the same quarter a year ago. In terms of expected stock price moves, the options market has priced in a 10% earnings-related swing using the nearest-expiring at-the-money straddle. The last two earnings releases resulted in massive swings in YY shares.

JOYY Earnings Outlook: A 10% Implied Move With A Volatile History

The Technical Take

YY finds itself at a pivotal resistance area on the chart after a rebound last week. The stock jumped from near $26 Wednesday morning to nearly $35 at the open on Friday. Alas, sellers took profits right where you would expect them to. YY cratered to the close last Friday, finishing just shy of $32.50. The bulls want to see the $34 to $36 area breached to the upside. It is a sell until that happens, in my opinion. Going into earnings, I would be cautious.

There’s support in the $28 to $29.50 range, though. If we indeed see a 10% pullback post-earnings, look to scoop up the stock there with a stop under $26. Unfortunately, it might take a few attempts to truly crack into the prior congestion area between $34 and $43. So this stock has a lot of work cut out for it.

YY: Rejected At Its First Attempt To Climb Above $35

The Bottom Line

YY might have found a floor during July and August. Still, there’s big resistance in the $34 to $43 range that creates headaches for those long. I’d approach its earnings date with a ‘buy the dip, sell the rip’ mentality, purchasing the stock only if it falls to near $28. Profits should be taken in the mid-$30s for now.

Be the first to comment