The Q2 Earnings Season was a rough one for the Silver Miners Index (SIL), with several companies reporting a sharp decline in margins as they lapped the benefit of higher silver (SLV) prices combined with a sharp increase in costs (labor, steel, energy, fuel). Due to easy year-over-year comps in Q2 2021 from a cost standpoint and a solid quarter for production, Endeavour Silver (NYSE:EXK) bucked this trend. However, this won’t be the case in H2 2022. In fact, Endeavour’s margins are set to dip into negative territory. Given the rough Q3 and Q4 results on deck, I continue to see far better bets elsewhere in the sector.

DarioGaona

Endeavour Silver Operations (Company Presentation)

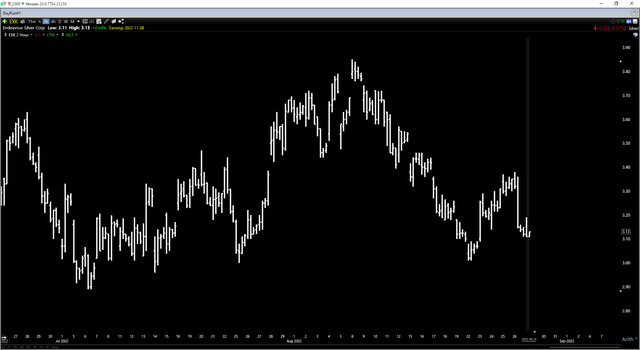

Just over six weeks ago, I wrote on Endeavour Silver (EXK), noting that while the stock was sitting in a low-risk buy zone at $3.00 from a swing-trading standpoint, rallies above $3.75 before October would be profit-taking opportunities. Since then, the stock did rally sharply to relieve its oversold condition but peaked at $3.85, unable to maintain its upward momentum in a turbulent market environment with silver prices unable to get up off the mat and reclaim the $20.00/oz level. While we’ve now returned to the same price level, EXK remains in a much weaker position than its peers, making it a riskier buy-the-dip candidate. Let’s take a closer look below:

EXK – 3-Month Chart (TC2000.com)

Q2 Production & Sales

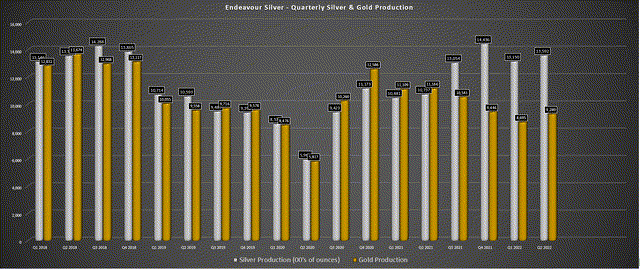

Endeavour Silver (“Endeavour”) released its Q2 results earlier this month, reporting quarterly production of ~1.36 million ounces of silver and ~9,300 ounces of gold, with both ahead of my estimates. Impressive grades helped this at Guanacevi (465 grams per tonne silver) and better silver grades at its Bolanitos Mine. The solid performance prompted Endeavour to raise its full-year guidance by ~10% at the mid-point, now expecting 7.6 – 8.0 million silver-equivalent ounces [SEOs] vs. a previous outlook of 6.7 – 7.6 million SEOs, a commendable achievement in a challenging period for many miners (labor tightness, COVID-19 exclusions).

Endeavour Silver – Quarterly Metals Production (Company Filings, Author’s Chart)

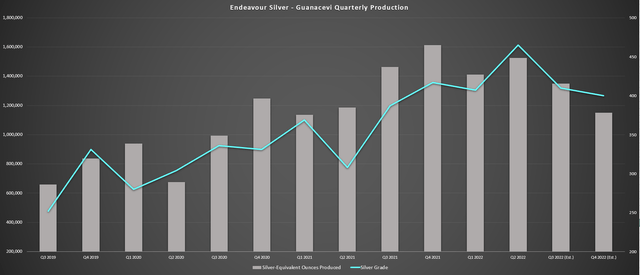

While this might have some investors cheering, it’s important to note that Endeavour is expecting lower production in H1 based on this updated guidance, with the potential for grades to moderate at Guanacevi after a phenomenal H1 performance. Assuming grades dip closer to 400 grams per tonne of silver with a slight offset from higher throughput, we should see Endeavour’s SEO production decline by 10% on a consolidated basis from H1 2022 to H2 2022. This is not ideal from a cost standpoint, with Endeavour noting that cost pressures are expected to continue, with higher steel, reagent, energy, and labor prices impacting its costs and costs already well above the industry average despite the elevated production levels.

The only offset is that if silver prices stay at these levels, Endeavour will see a slight benefit from a royalty standpoint, with royalty rates at El Curso (Guanacevi) dipping to 9% on sub $20.00/oz silver prices vs. 13% previously ($20.00/oz – $25.00/oz).

Endeavour Silver – Guanacevi Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

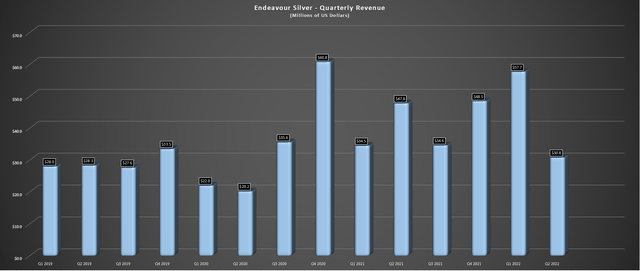

From a sales standpoint, the higher production certainly wasn’t reflected in revenue, which fell 35% year-over-year to $30.8 million. This was because the company withheld considerable inventory for sale due to lower silver prices. During the period, Endeavour noted that it sold just 602,900 ounces of silver (~45% of payable ounces) and ~9,800 ounces of gold (107% of payable produced ounces), leaving it with an inventory of ~1.4 million ounces of silver worth ~$27 million at Q3 average realized silver prices. So, while the revenue shortfall was disappointing, this was largely due to Endeavour’s strategy of withholding a large portion of inventory in the soft periods and selling it in stronger periods.

After adjusting for this silver inventory, revenue would have increased by more than 20% year-over-year despite operating one less asset.

Endeavour Silver – Quarterly Revenue (Company Filings, Author’s Chart)

Costs & Margins

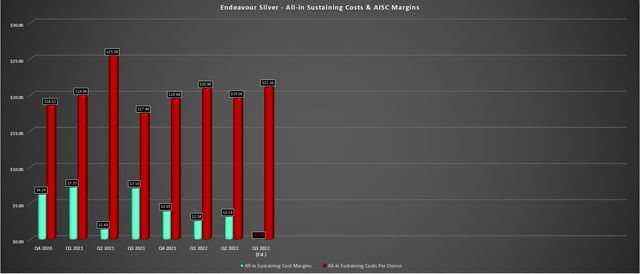

Looking at Endeavour’s costs, the results were much less pretty, with the company reporting all-in-sustaining costs [AISC] of $19.56/oz in Q2 and AISC of $20.22/oz year-to-date. While this translated to higher AISC margins on a year-over-year basis in Q2 ($3.16/oz vs. $1.43/oz), this was only due to Endeavour being up against brutally easy year-over-year comps, lapping a quarter with AISC of $25.39/oz (Q2 2021). On a year-to-date basis, though, AISC margins declined to just $3.73/oz, but that’s due to benefiting from an average realized silver price of $23.95/oz.

Endeavour Silver – All-in Sustaining Costs & Margins (Company Filings, Author’s Chart)

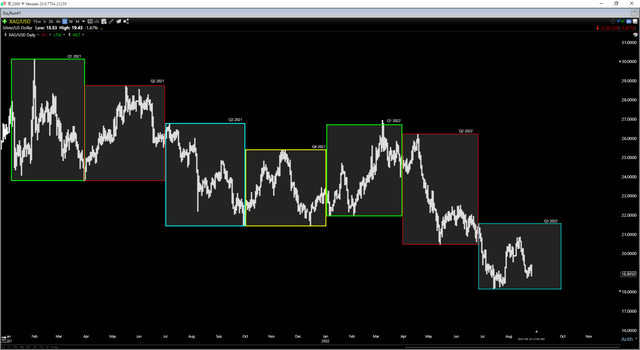

While these margins might not seem all that bad, and they beat my estimates in Q2 due to higher production in Q2 than I had anticipated, the slim margins that the company was enjoying have been wiped out in the recent silver price swoon. This is because the silver price is currently sitting below $19.00/oz, and Endeavour has guided FY2022 costs to come in at the high end of its guidance range ($20.00 – $21.00/oz). This suggests that Q3 costs are likely to come in at $21.60/oz+, resulting in AISC margins of (-) $1.30/oz even if Endeavour sells at an average price of $21.30 in Q3. This looks unlikely, given that the silver price has averaged $20.00/oz quarter-to-date.

Silver Futures Price (TC2000.com)

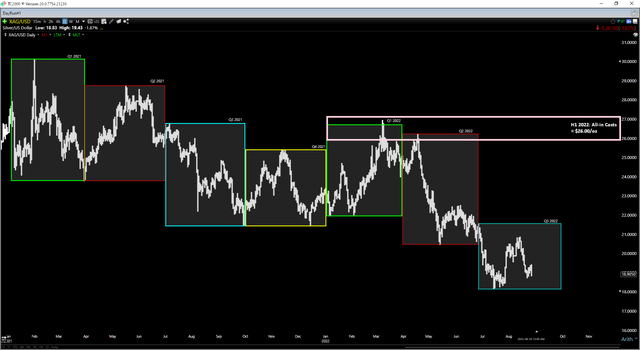

Some investors might forgive this margin pressure and choose to stay the course and remain invested, believing that a rise above $21.00/oz in silver will fix these problems immediately. However, as the chart above shows, Endeavour’s H1 2022 all-in costs (growth capital & exploration) came in at ~$26.00/oz and are likely to increase to more than $26.50/oz in H2 2022. The small pink box highlights the all-in cost estimates for FY2022 and shows how many days Endeavour was selling at a profit from an all-in cost standpoint. Clearly, with the silver price falling out of bed, even a 30% rally in the silver price would still result in selling at a loss on an all-in cost basis.

Silver Futures Price vs. EXK All-in Costs (TC2000.com)

This is important because while a company can get by on lower expenditures temporarily (growth capital, exploration), this isn’t sustainable long-term, and it’s not healthy for a depleting asset to scrape by on reduced exploration expenditures. That point couldn’t be more true in an inflationary environment where companies may have to rely on growth capital and higher-grade discoveries to help offset margin erosion. So, while the decline in silver prices below $20.00/oz isn’t the end of the world for Endeavour, an inability to get back above $22.00/oz for a prolonged period would be negative for its assets.

One risk is that Endeavour could potentially have to dilute shareholders further if it wants to invest appropriately in these assets. This is because its cash balance and debt will be primarily used up by funding Terronera, with upfront capex likely to come in north of $200 million ($175 million estimate with 15% cost escalation due to inflationary pressures). Let’s look at Endeavour’s valuation below:

Valuation & Technical Picture

Based on an updated fully-diluted share count of ~195 million and a share price of US$3.10, Endeavour has a market cap of ~$605 million. This translates to a P/NAV multiple of 1.23 compared to its estimated net asset value of $490 million (adjusted lower to account for higher operating costs at existing mines and higher construction costs at Terronera). Although this is the cheapest valuation that Endeavour Silver has traded at in years, Endeavour is also in the weakest position it’s been in for the past two years, set to report two consecutive quarters of negative all-in-sustaining cost margins.

Terronera Mineralization (Company Website)

The major differentiator for Endeavour vs. its other high-cost peers is Terronera, a high-grade and ultra-low-cost asset that could become the company’s third mine by Q2 2025. However, this doesn’t help Endeavour today and won’t help them in 2023 or 2024. So, while I think Endeavour could become investable at the right price or closer to Terronera’s initial production, I don’t see this being the case currently. This is especially true given that there’s some negative headline risk for Terronera if capex comes in well above planned levels ($175 million) due to inflationary pressures, even if this has been partially mitigated by purchasing some long-lead items.

Summary

Endeavour Silver may have one of the best-undeveloped silver assets in its portfolio from a margin standpoint, and there’s no question that this could be a very different company post-2024. However, with 26+ months to go until commercial production is reached, I see a higher risk of share dilution between now and commercial production if the silver price stays below $22.00/oz (assuming Endeavour wants to invest appropriately in its assets). There’s also a risk of reserve deletions, with Endeavour basing its mineral reserves on $23.00/oz and cut-off grades likely to rise due to inflationary pressures.

While I think these risks are partially priced in, and Endeavour has more torque than ever due to its even higher-cost profile, it isn’t easy to place a fair value on the company when the share count could be a moving target if silver prices don’t improve. Meanwhile, some headline risk could pressure the stock if Terronera’s capex is revised above $200 million and/or a disappointing reserve update in Q1 2023. Given these risks and with Terronera more than two years away, I continue to see EXK as un-investable and a much higher-risk way to play silver. If I were looking for silver exposure, my preference would be SilverCrest Metals (SILV), with ~55% AISC margins even at current silver prices.

Be the first to comment