JHVEPhoto/iStock Editorial via Getty Images

Author’s note: All figures are in Canadian Dollars unless indicated

Investment Thesis

The Fed is gathering the most aggressive monetary tightening since 1994. Wall Street expects a 0.50% rate hike in May and more to follow if inflation remains rogue. Jeremy Powel proved his willingness to destroy wealth to achieve the Fed’s 2% inflation rate mandate. So, what do we do now? How does one invest in this environment?

First, prepare for the worst. The effect of rising interest rates extend beyond return tradeoffs between debt and equity. A recession is now the base case scenario for Deutsche Bank (DB). Like many, my investments are in the red and my strategy is to dollar-average these positions, gradually accumulating what I hope will become an adequate retirement fund. Find a strategy that matches your goals and financial objectives, and stick to it.

Second, take advantage of the current situation. Insurance companies make money when interest rates rise. Rising interest not only increases the industry’s profit, but also allows them to offer more products. In 2013, Aflac (AFL) suspended its college indemnity service because low interest made it too expensive to customers? Soon this won’t be a problem. Buy now before valuation rise.

Despite the recent selloff, insurance companies remained resilient. Manulife Financial Corporation (NYSE:MFC) offers a 5% dividend yield, which is quite attractive compared to peers. There are many moving parts when analyzing an insurer. A lot depends on management talent due diligence process. However, as the analysis below shows, the company has a strong balance sheet, stable core revenue, in addition to offering profitable exposure to rising interest rates.

Revenue Trends

MFC has multiple streams of revenue with different revenue drivers, volatility characteristics. Below are MFC’s four revenue sources.

- Insurance Premiums

- Investment Income

- Capital gain/loss (realized and unrealized)

- Wealth Management Fees

Insurance premiums offer a recurring, highly-predictable revenue stream, contributing to revenue stability. MFC’s 33 million customers generated $44 billion in insurance premium revenue in 2021, up 7% from the prior year. General economic conditions such as GDP, unemployment, and inflation affect sales. For example, premium payments dropped 20% between 2008-and 2010. Beyond extreme economic disruptions, this segment demonstrated resilience and stability. During the pandemic, most clients continued paying premiums, lessening concerns over Shanghai COVID-variant lockdowns.

Stability of insurance premium revenue is offset by variability of some sub-streams of MFC’s investment income. The company manages $435 billion investment portfolio, generating multiple income streams categorized as follows:

- Fixed Income: Consist of interest/coupon payments on bonds, and dividend on preferred equity.

- Realized and Unrealized Capital Gains

Most of MFC’s debt investments are investment-grade, with low default rates. The stability of fixed income revenue is offset by variations in Realized and Unrealized capital gains.

Every asset traded on the market changes in price, even the most secure such as treasury bills, which have been depreciating to factor in the Fed rate hikes. The same goes for corporate debt, equity, real estate, and everything in between. Each time there is market volatility, MFC’s investment portfolio prices will either go up or down, which is mirrored in the income statement’s capital gain section.

Investors should expect a capital Gain loss next earnings call. However, these are temporary challenges. MFC is adequately capitalized and relies on premium payments rather than capital gains to fund insurance claims.

MFC provides wealth management, consultation, and financial advisory services. In many cases, prices will depend on the size of the clients’ assets. On average, asset managers charge 2% on AUM, regardless of performance. It is also common to charge a 20% incentive fee based on capital gains. In 2021, MFC generated $11 billion in management fee revenue, constituting 18% of total sales.

Unless the company increases its AUM, I believe revenue from Wealth Management and Consulting service to suffer. Fair values of most asset classes declined in Q1, a warning of a challenging quarter regarding the Wealth Management revenue stream. However, the fixed-rate nature of asset management’s 2% charge limits the effect of these dynamics. These challenges also fade against the long-term benefits of rising interest rates, especially as MFC begins rolling over its fixed-income investment into higher-coupon-paying assets.

As one can see, there are many moving parts when it comes to insurance. However, the 5% dividend yield is enough to compensate for all the variability. This, combined with a solid balance sheet, offers an attractive investment proposition.

Balance Sheet

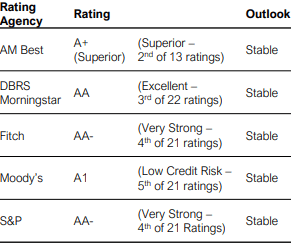

MFC has a long track record investment income performance, contributing to its investment-grade rating shown below.

Manulife Credit Ratings (Manulife)

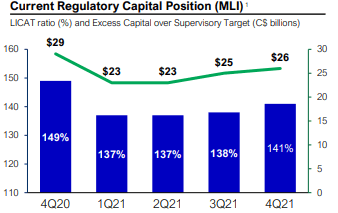

The insurance industry has been subject to increasing regulation, especially in the aftermath of the financial crises. Although these developments decreased profits, it made the industry safer. The company is well capitalized with a regulatory LICAT ratio 41% above target.

Regulatory Capital (Manulife)

These figures are consistent with peer averages as shown below.

Source: SEC Filings of MFC, GWLIF and SLF

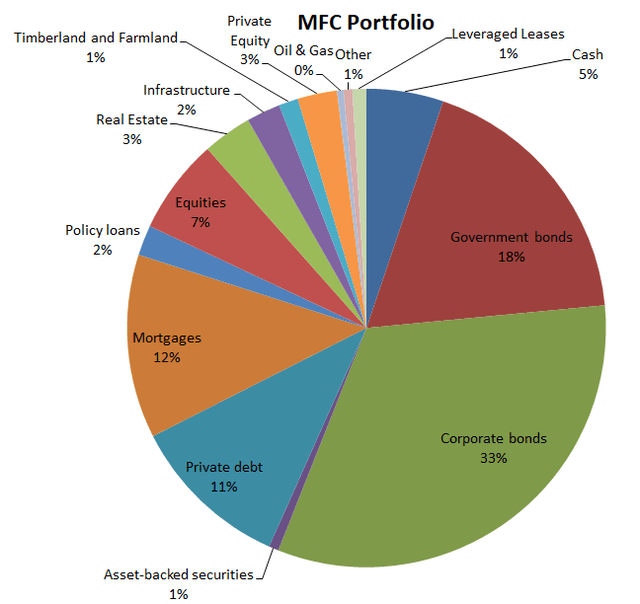

Total AUM of Manulife is $1.4 trillion. However, more than half is related to its Asset Management Business, segregated accounts with various investment mandates that don’t contribute to its insurance business. The company’s propriety capital related to its insurance business is $435 billion. Below is a breakdown of MFC’s core portfolio.

MFC Portfolio (SEC Filings – Table Created By The Author)

Historically, premiums collected were enough to cover claim expenses, and investment income acts more or less as a security net if claims go above premium payments. The company has gradually accumulated cash and enhanced its investment portfolio, reaching a stage where it distributes all excess capital to shareholders in the form of dividends and share repurchases.

Risks

The most significant risk is the effect of rising interest rates on fair value calculations of its $267 billion fixed-income assets, such as treasury bills, corporate bonds, etc. As interest increases, bond prices decline, whether a US Government treasury bill or a corporate bond. This has a detrimental effect on capitalization rates, which the government regulates. Companies like MFC cannot distribute dividends until they meet this capitalization rate. However, the insurance giant has ample cash buffer. Moreover, if push comes to shove, it will likely suspend its share buyback program before touching the much-valued dividend. Again this is the worst-case scenario, only mentioned to give you some perspective on what is influencing the share price.

Summary

Central banks worldwide are increasing interest rates in an attempt to fight inflation. Canadian insurance giant MFC has operations in the US, Asia, and Canada, rendering it susceptible to interest rate dynamics.

The fair value of the company’s portfolio will likely experience a decline, and the capitalization buffer is enough to absorb this temporary pressure. In the long run, rising interest rates will allow the company to secure higher fixed income on its portfolio, enhancing its revenue and net income.

The company has a shareholder-friendly capital allocation policy, manifested in share buybacks and a 5% dividend yield, augmenting the interest rate revenue tailwinds mentioned above.

Be the first to comment