J. Michael Jones/iStock Editorial via Getty Images

By Callum Turcan

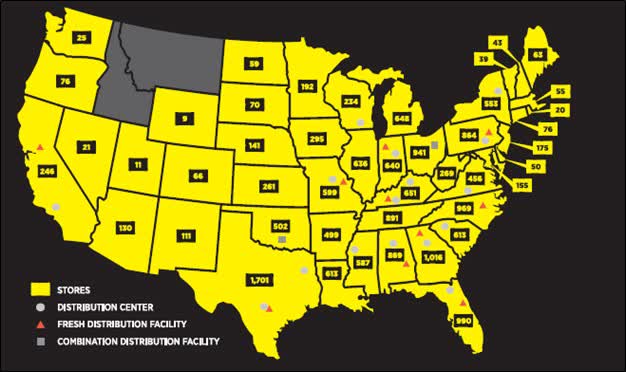

We like the niche that Dollar General Corp (NYSE:DG) has carved out for itself in the incredibly competitive retail discount store industry. The firm targets towns and cities in the U.S. with populations of 20,000 or less as these are regions where e-commerce economics are not attractive due to hefty fulfillment costs, and often are underserved in terms of shopping options. Dollar General operates over 18,100 stores across 46 U.S. states. We are big fans of Dollar General and view its capital appreciation upside favorably.

We appreciate the niche Dollar General carved out for itself in the competitive discount retail industry in the US. (Dollar General – Fiscal 2021 Annual Report)

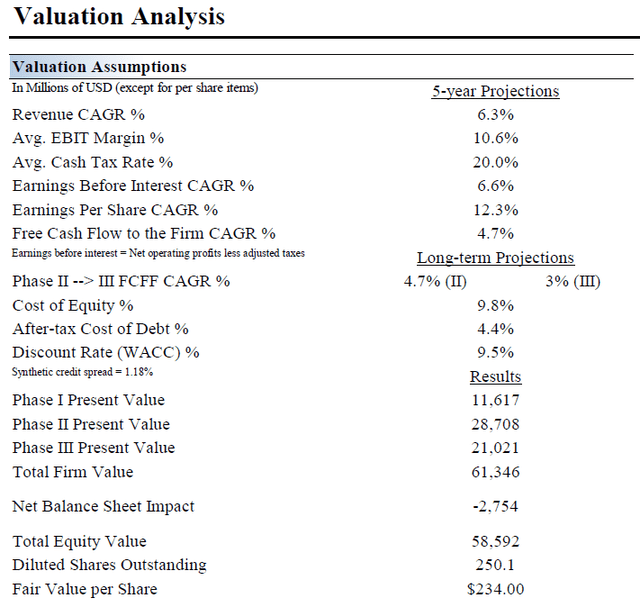

Valuation

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows (defining free cash flow as net operating cash flow less capital expenditures). Dollar General has a fair value estimate of $234 per share under our “base” case scenario, and under more optimistic assumptions (our “bull” case scenario), we value DG up to $281 per share.

An overview of the key valuation assumptions used in our base case scenario covering Dollar General. (Valuentum Securities)

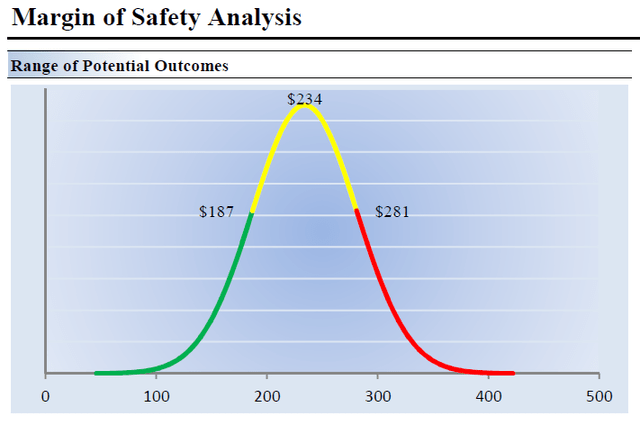

Although we estimate Dollar General’s fair value at about $234 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. In the upcoming graphic down below, we show this probable range of fair values for Dollar General. We think the firm is attractive below $187 per share (the green line), but quite expensive above $281 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

The top end of our fair value estimate range sits at $281 per share of Dollar General under our bull case scenario. (Valuentum Securities)

Two Big Growth Strategies

Dollar General has launched several initiatives that seek to increase its growth runway including the rollout of its pOpshelf store concept (unveiled in October 2020) and its expansion into Mexico that was announced during an earnings call held in December 2021. We are intrigued by both strategies.

The firm’s pOpshelf concept is its attempt to target consumers in metropolitan areas (urban, suburban, exurban) as compared to its core consumer base in rural areas. Its pOpshelf operations include standalone and store-within-a-store concepts that sell home, beauty and body, arts and crafts, toys, and other products. Dollar General’s plan to enter the Mexican market represents its first international store expansion strategy. The company’s growth runway in Mexico could be immense, and it can leverage the scale it has built up in the U.S. to support its efforts here.

Investors are clearly cheering on Dollar General’s expansion plans. Through the end of normal trading hours on April 12, shares of DG are up ~3% year-to-date on a price-only basis while the S&P 500 (SPY) is down ~7% during this period. Shares of DG yield a modest ~0.9% as of this writing, and future payout growth offers incremental upside to its capital appreciation potential.

Earnings Update and Outlook

On March 17, Dollar General reported its fourth quarter earnings for fiscal 2021 (period ended January 28, 2022) that missed both consensus top- and bottom-line estimates. Investors, however, are looking towards the future. The company issued favorable guidance for the current fiscal year (fiscal 2022) that calls for net sales growth of 10% (aided by a ~200 basis point boost due to the 53rd reporting week), same store sales growth of 2.5%, and diluted EPS growth of 12%-14% (aided by a ~400 basis point boost due to the extra reporting week).

Furthermore, Dollar General announced it had increased its quarterly dividend 31% on a sequential basis in March 2022, bringing it up to $0.55 per share or $2.20 per share on an annualized basis. The company also plans to repurchase $2.75 billion of its stock this fiscal year. Dollar General is incredibly shareholder friendly.

Keeping the tough year-over-year comparison in mind, Dollar General’s performance in fiscal 2021 was impressive. Its same-store sales declined just 3% year-over-year in fiscal 2021 after rising 16% in fiscal 2020 due primarily to the impact the coronavirus (‘COVID-19’) pandemic had on household shopping habits. The company’s GAAP net sales grew 1% year-over-year in fiscal 2021.

Dollar General’s margins are facing sizable headwinds from inflationary pressures and supply chain hurdles. Its GAAP operating margin slipped to 9.4% in fiscal 2021 from 10.5% in fiscal 2020 due to a modest reduction in its GAAP gross margin and rising operating expenses as a percentage of net sales. The company’s GAAP diluted EPS fell 4% year-over-year in fiscal 2021, though management expects Dollar General’s earnings will rebound sharply this fiscal year.

Initiatives to Strengthen Underlying Business

The discount retailer has embarked on numerous initiatives that will help it offset inflationary pressures and preserve its margins, to a degree, while supporting its sales growth trajectory. Dollar Generals’ plans involve growing the sales of its higher margin non-consumable products (aided by its new pOpshelf store concept), improving its logistics and distribution operations (shifting towards the self-distribution of fresh and frozen foods), streamlining the checkout process (adding self-checkout kiosks), and improving its in-store selection (additional cooler and freezer capacity, more fresh produce options). Price increases are another way Dollar General is attempting to preserve its margins, and we appreciate the firm’s efforts to navigate inflationary pressures, supply chain hurdles, and other headwinds.

During the company’s latest earnings call, Dollar General reiterated its goal to open up to ten stores in Mexico by the end of fiscal 2022. The firm also announced plans to almost triple its pOpshelf store count this fiscal year, bringing it up to ~200 (including both standalone and store-within-a-store concepts) after ending fiscal 2021 with roughly 75 pOpshelf store locations. The company’s initial pOpshelf stores are operating at favorable gross margins according to recent management commentary and that could improve Dollar General’s company-wide margin performance over time. The firm aims to develop up to 1,000 pOpshelf store locations by the end of fiscal 2025.

Dollar General is also rolling out an initiative built around larger store concepts with a greater selection of health care products, though there is a chance that certain health care services may become part of this strategy down the road. Here is what management had to say on the issue during Dollar General’s latest earnings call:

Turning now to an update on our expanded health offering, which consists of up to 30% more feet of selling space and up to 400 additional items as compared to our standard offering. This offering was available in nearly 1,200 stores at the end of 2021 with plans to expand to a total of more than 4,000 stores by the end of 2022. As we move toward becoming more of a health destination, particularly in rural America, our plans include further expansion of our health offering with the goal of increasing access to basic health care products and ultimately services over time. — Jeffrey Owen, COO of Dollar General

Its health care push is a relatively new initiative, and we are keeping a close eye on Dollar General’s strategy here. The company is also focused on growing its private label product sales, improving its sourcing strategies, driving supply chain efficiencies, and implementing shrink reduction schemes.

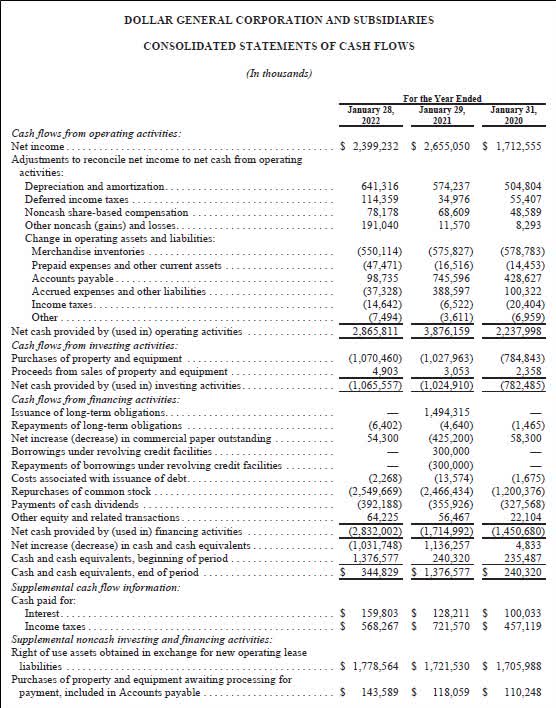

Rock-Solid Free Cash Flows

In fiscal 2021, Dollar General generated $1.8 billion in free cash flow and spent $0.4 billion covering its dividend obligations along with $2.5 billion buying back its stock (which as noted previously is expected to come in at $2.75 billion this fiscal year). The discount retailer expects its capital expenditures to rise to $1.4-$1.5 billion in fiscal 2022 from $1.1 billion in fiscal 2021 as Dollar General “plans to execute 2,980 real estate projects in fiscal year 2022, including 1,110 new store openings, 1,750 remodels, and 120 store relocations” according to its latest earnings press release.

Dollar General is a tremendous free cash flow generator. (Dollar General – Fiscal 2021 Annual Report)

At the end of fiscal 2021, Dollar General had a net debt load of $3.8 billion with no short-term debt on the books though it does have sizable operating lease liabilities to be aware of. The firm’s $0.3 billion in cash on hand at the end of this period provides it with significant liquidity to meet its near term funding needs, though we would appreciate it if Dollar General pared its net debt load down over time. Dollar General had $5.6 billion in ‘merchandise inventories’ on hand at the end of fiscal 2021, up from $5.2 billion at the end of fiscal 2020, which should help the company meet robust demand in the face of supply chain hurdles.

Concluding Thoughts

Dollar General is working hard to improve its operations while extending its growth runway. The company’s guidance for fiscal 2022 indicates its growth story is expected to continue in earnest this fiscal year. We appreciate Dollar General’s rock-solid free cash flow generating abilities and its shareholder friendly management team. Shares of DG have been on a nice upward climb of late, and we see room for additional capital appreciation upside going forward. Dollar General is a high-quality enterprise worth keeping on your radar.

Be the first to comment