LazingBee

Investment Thesis

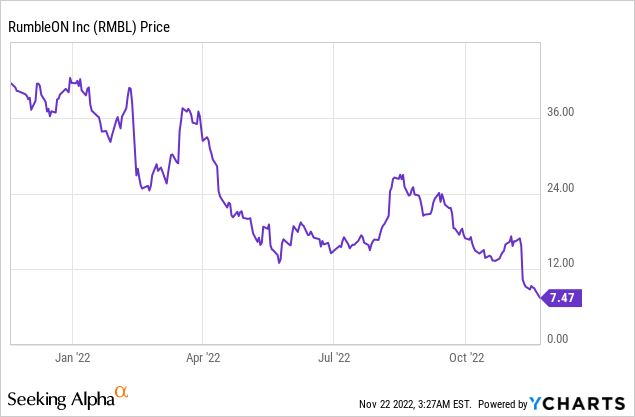

RumbleON, Inc. (NASDAQ:RMBL) runs an omnichannel platform that uses technology to acquire and sell used cars in North America. The company’s stock price has been steadily declining over the past year, dropping by more than 79% and significantly trailing the industry average by more than 64%.

The company’s financial situation is essentially to blame for its poor performance. A 240.23% year-over-year increase in revenue doesn’t mask the company’s dismal profitability and cash flow. The company’s balance sheet is highly vulnerable and needs strengthening.

When I look at the company’s finances, I see excessive debt levels and high operational expenses as the leading causes of the bad performance. Given that these concerns have not been addressed, I believe the company will continue declining. Though skeptical of the company in the near future, I have a positive outlook on the company in the long run due to the acquisition of RideNow.

Financials: Much Needs to be Improved

After reviewing the company’s financials in detail, I must say that I am not very optimistic about RMBL’s current financial health. The company’s top-line growth is impressive, but it hasn’t translated to any positive changes in profitability. As if the weak balance sheet wasn’t enough, its poor cashflows cause concern going forward.

Regarding revenues, RMBL has a YoY revenue growth of 240.23% and a 3-year CAGR of 32.34%. The healthy growth rate is primarily due to the resilient and robust demand in some of their segments, such as the new utility vehicles and used motorcycles, as reported in the Q3 transcript call.

Marshall Chesrown,” While demand for our offering is proving resilient, certain trends are beginning to surface for the most part in regards to vehicle type and price point. We saw continued strong demand in some segments such as new utility vehicles and used motorcycles.”

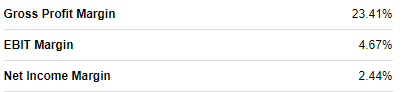

Despite the high revenue growth, the company has very slim profit margins. It has a gross profit margin of 23.41%, an EBIT margin of 4.67%, and a net income margin of 2.44%.

Seeking Alpha

These margins are low and below the industry median, further confirming the company’s weak profits in relation to its peers. The industry medians are 35.78%, 7.89, and 5.02, respectively. I attribute the poor profitability to the companies high and increasing total operating expenses. For instance, RMBL’s total operating expenses are trailing at $360M, which is 80% of the gross profit margin of $449.6M in the same period.

The high operating expenses further explain the poor cashflows recorded by the company. It has a total of $2.26M in cash flows from operations which are 0.0063X the total operating expenses TTM, and -89.87M in levered FCF. The inferior cash flow figures expose the effects of the high operating expenses and the company’s inability to generate future cash to meet its operating expenses effectively.

Further, the company’s balance sheet is extremely dire and needs much improvement. In terms of liquidity, it has a cash balance of $39.72M, which is 0.27X its market cap of $145.74M. The company’s weak liquidity is summed up by a current ratio of 1.49 and a quick ratio of 0.27, which explains the company’s inability to easily meet its short-term financial obligations and its inability to liquidate its current assets to meet its short-term liability if needed.

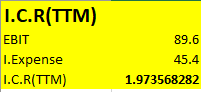

Besides the weak liquidity, the company’s debt level is very high and needs to be managed. In the MRQ, the company has a total debt of $714.07, which is 4.9X its market cap. Though this could be translated as high leverage to catalyze growth, I computed the company’s interest cover ratio. I arrived at a figure of 1.97, below the optimal value of 3.

Author’s Computation

The low-interest cover ratio signifies the company is at risk of defaulting on its debt, which should concern investors. Additionally, an interest expense of about 51% of the EBIT translates to many low earnings for investors.

In conclusion, RMBL has a lot to do as far as its financial health is concerned. The company must address the high operating expenses to improve its profit margins and cashflows. Additionally, it has to improve its liquidity and lower its debt to strengthen its balance sheet.

RideNow: Reversing My Skeptical View

During the third quarter earnings call, the company announced that it had completed the acquisition of RideNow. With over 40 fully-stocked retail locations in 11 states, RideNow is the largest Powersports retailer in the country. RumbleON’s e-commerce platform makes online shopping easy, fast, and transparent so that you never have to leave the house. Whether customers are looking to buy, sell, trade, or finance a vehicle, RumbleON makes the process easy and convenient for everyone involved.

The merger will revolutionize the customer search and buy experience for Powersports lovers everywhere by providing the quickest, easiest, and most transparent transaction procedure partnered with exclusive pre-owned sourcing. The combined company will be better able to support organic growth by combining and expanding the established RumbleON and RideNow models. It will also be able to do a better job of unifying the highly fragmented Powersports sector. Management at RideNow has over 70 years of experience in the vehicle retail business, which will be added to the existing 80 years of management experience at RMBL.

Besides the synergies arising from the management experience and the broad geographical location, what guided me towards changing my skeptical view is RideNow financial performance. In 2020, according to the source cited above, the company sold 45,527 powersport units. In the same year, they had a total revenue of approximately $899.4M, 2.2X the revenues of RMBL and $39.04M more than RMBL revenues in 2021, which is RMBL’s highest revenue in 4 years. Further, RideNow had a net income of $90.3[10%], which is 5X RMBL’S current net income margin.

With this information in mind, I believe this acquisition will boost RMBL’s operational efficiency and bottom line. In the short term, I will continue to be wary as I think it will take some time before the full benefits of the acquisition become apparent.

Conclusion

RMBL’s stock price has dropped by more than 79% in the past year, reflecting the company’s poor performance. The poor financial state of the corporation has been the main factor in the consistent drop in share price. High operating expenses are the primary cause of the company’s poor profitability, defined by low margins. Furthermore, it has weak cash flows, which calls into question whether or not it can meet its financial obligations. To make matters worse, its balance sheet is extremely fragile due to its lack of liquidity and excessive debt levels. For these reasons, I have serious doubts about the company’s ability to deliver in the near future.

The acquisition of RideNow in the 2020 fiscal year has given me hope for the company’s future. However, it will take RMBL another year to catch up to RideNow’s impressive financial achievements. I am confident that the company’s history and the synergies it creates will have a profound effect on RMBL’s operations and future success. Although I have a long-term positive outlook on the company, I currently have a negative outlook due to my concerns about its near-term viability. So, I think it’s a good idea to hold on to this stock for the time being, but it’s worth investing in the long run.

Be the first to comment