Justin Sullivan/Getty Images News

In April, SoFi Technologies (NASDAQ:SOFI) lowered its revenue and earnings guidance for FY 2022 due to an extension of the Federal Student Loan Payment Moratorium. The new guidance for this year led to a fundamental repricing of SoFi’s growth prospects, which I believe is misguided. I am going to elaborate on why I believe shares of SoFi remain a buy despite a revised earnings outlook for FY 2022.

Federal Student Loan Payment Moratorium: What you need to know

The extension of the Federal Student Loan Payment Moratorium in April was a setback for SoFi, but its impact on the firm’s valuation is likely overblown.

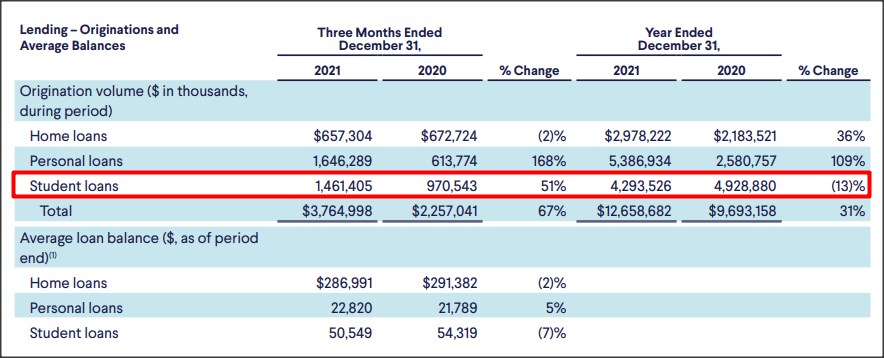

Earlier in April, President Biden and his administration extended the Federal Student Loan Payment Moratorium until the end of August 2022, meaning SoFi will not be able to collect payments on its growing pool of student loans. Student loans are a big part of SoFi’s lending business and the firm originated $1.5B in student loans just in the fourth quarter. Compared to Q4’20, SoFi’s student loan origination volume surged 51% year over year due to growing demand ahead of the Moratorium’s January deadline. Student loan originations represented 39% of all of SoFi’s originations in the fourth quarter and 34% of all originations in FY 2021.

SoFi

Guidance impact

The extension of the Federal Student Loan Payment Moratorium is going to have an impact on SoFi’s guidance for FY 2022. Because of the extension of the Moratorium, SoFi is now expecting net revenues of $1.47B and adjusted EBITDA of $100M which is below the firm’s previous FY 2022 guidance points of $1.57B in net revenues and $180M in adjusted EBITDA. The updated guidance reflects lower income chiefly from SoFi’s student loan book. Unfortunately, the refreshed FY 2022 guidance implies that SoFi will not be able to sextuple its adjusted EBITDA… a reason I cited previously to buy the stock.

Why the updated guidance is not a big deal

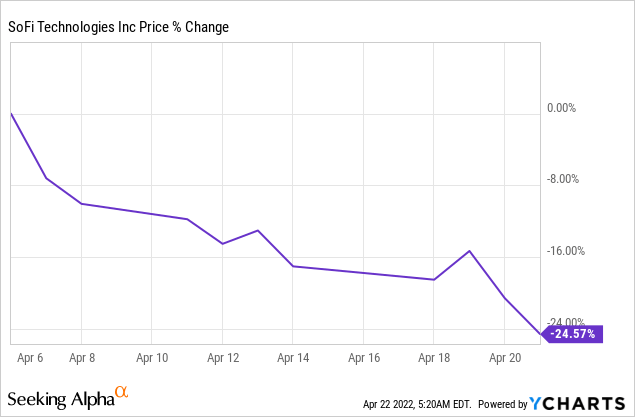

Shares of SoFi initiated a new down-leg after the update, but I believe the drop is unjustified. I believe the Moratorium is likely to end in FY 2023 at which point borrowers are going to have to resume repaying their student loans. This means that SoFi’s EBITDA growth, which was expected for FY 2022, will simply be pushed into the next year. The net revenue impact is also quite small with $100M and the guidance update should not have had the impact on SoFi’s valuation that it did. Since April 6, 2022, which is when the extension was announced, shares of SoFi have lost about 25% of their value.

SoFi’s key to success: Continual platform growth and financial services expansion

My previous work on SoFi highlighted two key areas that supported my bullish argument regarding the SoFi platform. The first reason is that SoFi signed on an insane number of new members in the fourth quarter, in both the consumer and enterprise business. SoFi acquired 523 thousand new customers in the consumer business in Q4’21 and the platform reached a new member record at the end of the year with 3.46M people using SoFi’s products and services.

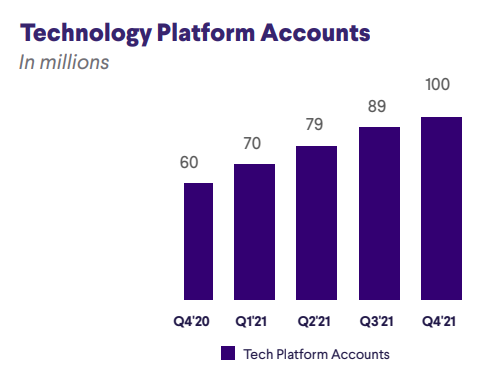

Additionally, SoFi’s Galileo brand is seeing strong momentum with accounts growing from 60M to 100M within just one year, due to organic growth and acquisitions. Galileo is a digital payments platform that targets small and medium businesses and covers SoFi’s enterprise side. Galileo accounts will continue to grow rapidly as small and medium-sized enterprises increasingly rely on financial technology platforms to run their businesses.

SoFi

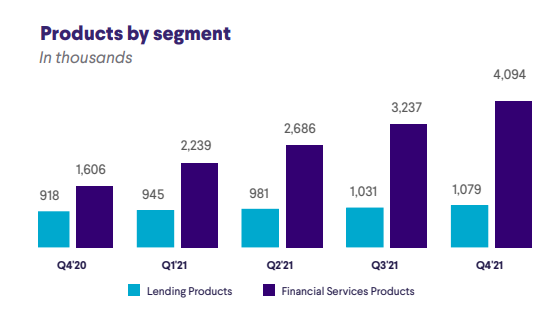

Secondly, SoFi is rolling out more and more financial services products which has been instrumental in the firm’s accelerating member growth. By the end of last year, SoFi had 4.1M financial services products available on its platform compared to just 1.6M FS products in the year-earlier period. It is worth pointing out that SoFi’s account growth is chiefly driven by the increasing number of financial services products on its platform which helps SoFi differentiate itself from other Fintechs. While the number of lending products has also risen sharply in the past, it is financial services products that are making the biggest impact on the firm’s growth.

SoFi

Going forward, I expect SoFi to continue to roll out new FS products and especially grow the enterprise side (Galileo) of its business. To accelerate growth in the domain for small and medium-sized companies, SoFi recently acquired Technisys, a technology stack that is expected to add up to $800M in revenues to SoFi’s top line over the next four years.

A price worth paying

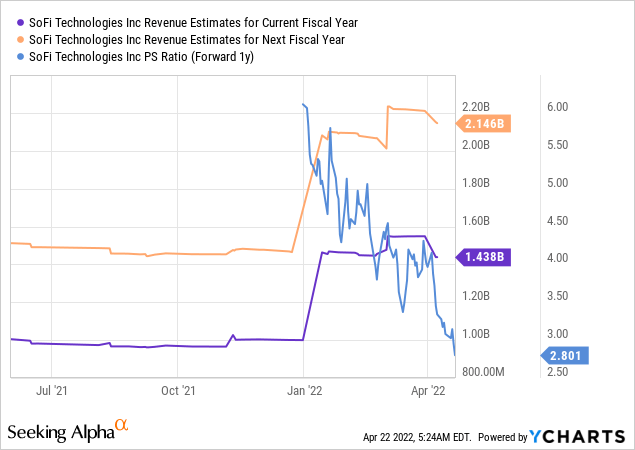

SoFi’s revenue growth is only slightly impacted by the firm’s adjusted guidance for FY 2022 and since SoFi, as a growth stock, should be valued based on its net revenue potential, I believe the stock remains highly promising in the near future. Shares of SoFi have a P-S ratio of 2.8 X, reflecting a discount of 60% compared to January. SoFi is expected to grow its top line 45% this year and 46% next year.

Risks with SoFi

The biggest long term risk for SoFi is growing competition in the market for financial services products. It is easy for customers to leave one bank’s ecosystem and move over to another platform, meaning margin pressures for SoFi are set to grow long term.

The biggest short term risk for SoFi clearly is another extension of the Federal Student Loan Payment Moratorium later this year. An extension in August, which I believe is very likely, could further impact SoFi’s guidance for FY 2022 so there is definitely a risk for the stock here. Longer term, however, borrowers will have to repay their student loans at which point I expect SoFi to see profit growth tailwinds.

Final thoughts

SoFi is not done yet. Although shares have dropped to new 1-year lows this week, SoFi has strong long term revenue growth potential based on its personal finance brand that continues to attract a significant number of new members into its ecosystem, on both the consumer and the enterprise side.

The unexpected extension of the Federal Student Loan Payment Moratorium soured SoFi’s guidance for FY 2022. However, the extension is only affecting SoFi’s earnings picture in the short term and the revenue impact is marginal. Longer term, SoFi’s growth potential is not impacted at all.

Be the first to comment