FactoryTh/iStock via Getty Images

Specialty chemicals maker Huntsman Corporation (NYSE:HUN) has so far reported steady quarterly performance with revenues, and gross profits increasing sequentially.

Huntsman Corporation quarterly revenues, gross profits, and gross margins

|

Quarter |

Revenues |

Gross Profits |

Gross margin % |

|

Dec 2021 |

2307 |

469 |

20% |

|

Sep 2021 |

2285 |

483.00 |

21% |

|

June 2021 |

2024 |

431.00 |

21% |

|

Mar 2021 |

1837 |

392.00 |

21% |

|

Dec 2020 |

1,668.00 |

362.00 |

22% |

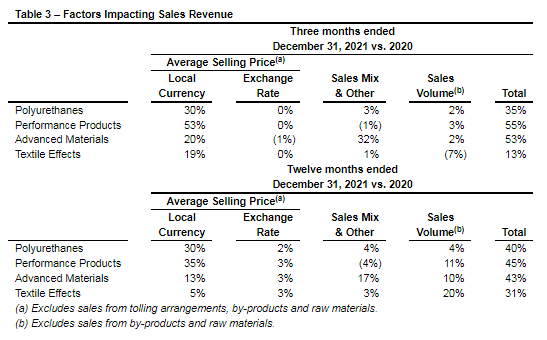

The company reports Q1 2022 results on 28 April 2022. Chemicals peers have so far come out strong; Dow (DOW) reported a 28% YoY growth in sales for Q1 2022, while net income was up 54% YoY. Preliminary figures released by German chemical giant BASF (OTCQX:BASFY) reveal a 19% YoY increase in sales for the company in Q1 2022. Net income however declined 29% due to writedowns of loans extended by its affiliate Wintershall Dea to Nord Stream 2, the halted natural pipeline project from Russia to Germany. Both companies benefited from higher prices, and strong end-market demand, which helped outweigh rising raw material and energy costs. Huntsman has so far demonstrated pricing power as evidenced by the company’s 2021 financial performance; revenues rose 40% YoY to USD 8.5 billion, gross profits rose 61% to USD 1.78 billion, and gross margins improved to 21% in FY 2021, from 18.3% the previous year. Except for Textile Effects whose performance was largely due to volume growth, all other reportable segments largely benefited from pricing increases during the year, helping them notch double digit YoY revenue growth rates. Huntsman’s Polyurethane segment, which manufactures Methylene diphenyl diisocyanate (MDI), and polyurethane-related products reported a 40% YoY increase in revenues. Performance Products, which makes specialty amines, ethyleneamines, and maleic anhydride, reported revenue growth of 45% YoY. Advanced Materials which makes a variety of adhesives, composites and formulations including specialty resin compounds, polyurethane-based formulations, specialty nitrile latex, alkyd resins and carbon nano materials, reported a 43% YoY increase in revenues for the year. Textile Effects which makes textile dyes and inks reported a 13% YoY increase in revenues.

Huntsman Corporation

Going forward, as lockdown restrictions ease and macroeconomic activity increases, chemical demand is largely expected to benefit as well which suggests positive tailwinds in the coming months.

Strategic Long Term Portfolio Repositioning

Over the past few years, Huntsman has been working towards repositioning its portfolio which saw the company divest commodity businesses and intensify its focus on higher-margin downstream and specialty product lines. Huntsman divested its stake in Venator Materials (a commodity TiO2 business) in 2020, and exited the ethylene oxide and propylene oxide business in 2019. Furthermore, in December 2021, the company initiated a strategic review of its Textile Effects segment, its smallest business by revenue, and its lowest margin segment. Huntsman noted a possible sale of the segment, which could potentially improve margins.

|

Revenues (USD millions) |

EBITDA (USD millions) |

EBITDA margin (%) |

|

|

Polyurethanes |

5,019 |

879 |

17.5% |

|

Performance Products |

1,485 |

359 |

24.2% |

|

Advanced Materials |

1,198 |

204 |

17% |

|

Textile Effects |

783 |

97 |

12.4% |

Intensifying its specialty chemicals businesses, Huntsman acquired specialty chemicals maker Gabriel Performance Products in 2021, and in 2020 acquired specialty chemical manufacturer CVC Thermoset Specialities.

Meanwhile, the company is also pursuing organic growth opportunities; last August Huntsman’s Performance Products division – its most profitable business segment – announced the expansion of its manufacturing facility in Hungary. In its core Polyurethanes business, the company’s US MDI splitter facility is expected to complete construction this month, and begin operations by late Q2 2022. MDI is largely used for polyurethane foams which account for about 80% of global MDI consumption. Polyurethane foams are used to make a variety of products such as mattresses, cushions, refrigerator insulation, and insoles.

Upsized Share Repurchase Program

Huntsman announced last month a doubling of its existing share repurchase program from USD 1 billion to USD 2 billion over the next three years. The additional USD 1 billion authorized repurchases, or USD 1.9 billion in total, reflects approximately 25% of the company’s market capitalization as of March 2022.

The upsized share repurchase program would suggest about USD 600 million spent annually on share repurchases over the next three years (about three times the USD 200 million spent on share buybacks last year). Last year, the company generated about USD 900 million in operating cash flows, and spent about USD 500 million on capex and acquisitions. That left about USD 400 million for share repurchases, and dividends (about USD 150 million last year), which suggests that if operating cash flows do not increase in the coming years, the company may have to hold back on acquisitions and/or increase debt to finance the buybacks as well as dividends (at the end of FY 2021, the company had about USD 1 billion in cash, USD 1 billion in receivables, and USD 2 billion in current liabilities, and expects to spend about USD 300 million in capex in FY 2022). Huntsman however has a relatively strong debt position with a debt to equity of 35.5, slightly better than BASF’s 47, and considerably better than Dow’s 80.8, Eastman Chemical’s 92.8, and Celanese Corp’s 92.

Risks

Rising interest rates could put a lid on economic activity which would therefore affect the specialty chemicals sector in general. Federal Reserve officials have signaled a potential rate increase next month. The Bank of England has echoed a similar hint.

Financials

Huntsman is largely comparable to peers in terms of revenue growth. Peers however have better profitability with Huntsman’s gross margins and return on assets being on the lower end of the spectrum.

|

Latest fiscal year |

|||||

|

Revenue growth YoY % |

40% |

33% |

43% |

24% |

51% |

|

Gross margins % |

21% |

25% |

19.6% |

24% |

31.4% |

|

Return on assets % |

5.5% |

5.6% |

10% |

7.4% |

11.2% |

|

P/E |

8.6 |

8.3 |

8.6 |

11.44 |

9.3 |

|

Short interest |

2.4% |

– |

1.6% |

1.2% |

1.5% |

Summary

Huntsman Corporation has so far navigated supply chain challenges and cost inflation quite well and with economies opening up, the coming months could potentially be robust. There is the risk however that rising interest rates could potentially put a lid on macroeconomic activity, dampening financials for specialty sector players in general.

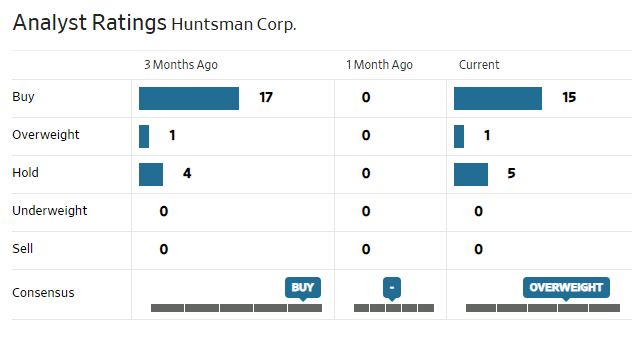

Longer term, Huntsman is strategically rebalancing its portfolio towards higher margin businesses which could improve profitability. With a P/E of just 8.5, Huntsman is comparable to peers (however a short interest of 2.4% suggests some bearishness). Analysts however are generally bullish on the stock.

WSJ

Be the first to comment