svetikd

Dear Readers,

Investing in brokers like Interactive Brokers (IBKR) in an environment like this should only be done in an “eyes-open” situation. You need to know what you’re getting into. I’ve written about IBKR over the last year or so, and as I’ve said before, investing in brokers is a play on overall stock market activity. The result of this is that during market dips, things are liable to go down.

The company has already seen some relatively expected drops during this year – and now we’ll see how these impact the long-term appeal and if the company, since my last article, has grown more or less appealing.

IBKR – An update

When we move into volatility, it’s not unlike that we’ll see companies that have a high correlation to market volumes, trading, and similar metrics, do either worse or a lot better – depending on which way the wind is blowing. IKBR has been seeing this.

Why? Because we’ve seen global humanitarian, inflation, supply chain, and shortage issues that we haven’t seen for years, with inflation that we haven’t seen since before I was born in the 1970s.

IBKR does not believe that the issues such as inflation and volatility are going to fade quickly, and in this, I agree with their assessment. However, with volatility comes potential upside. As some say, when there’s blood in the street, you buy. Many seem to be following this, as IBKR has seen account and customer growth, with almost half a million new accounts on a YoY basis.

IBKR is a global broker – meaning its operations are targeted not only at the primary EU/US markets, but customers from virtually anywhere can open and fund accounts and start trading. The company provides automated trade execution, trading, and custody of securities, commodities, and FX 24/7 in 135 markets in 24 different currencies. It gives clients access to markets from 200 different countries or territories.

The company services individual investors (like you and me), hedge funds, proprietary trading groups, financial advisors, and others. With four decades worth of tech and fintech experience and one of the more sophisticated platforms on the entire market, IBKR is rated by many to be the #1 online broker available. I personally use their platform and services and find them to be easy to use, and customer service to be responsive.

With roots going back to 1977 as a market maker, the brokerage operations have been around for around 20+ years. It’s often been at the forefront of fintech development, among other things inventing the first floor-based handheld computer in 1983. It’s grown explosively over the past few years, and is now a firm with equity capital of almost $10B. The company has 2,400+ employees in various offices around the world, and it’s headquartered in Greenwich, Connecticut, but with offices around the entire globe.

The company has managed an impressive track record of delivering market-outperforming revenue and income growth during several market cycles. Clients’ accounts have more than tripled in 5 years, client equity has more than quadrupled, and daily trades have increased by almost a factor of 3x in the same time period. The CAGR of the three stats has been over 23% for each one, with client equity at a 34% 5-year CAGR.

While this pace has been slowing somewhat over the past few quarters, it does not change how the company has grown and what it “is” compared to what it was.

IBKR IR (IBKR IR)

As a broker, the company has a robust balance sheet with 99% in liquid assets. It still has no long-term debt, and over $6B in capital in excess of regulatory requirements.

In short, the company is extremely conservative and need not worry about any short-term risks with regard to this. The founder of the company also, to date, remains the chairman of IBKR.

Management is, therefore, absolutely solid.

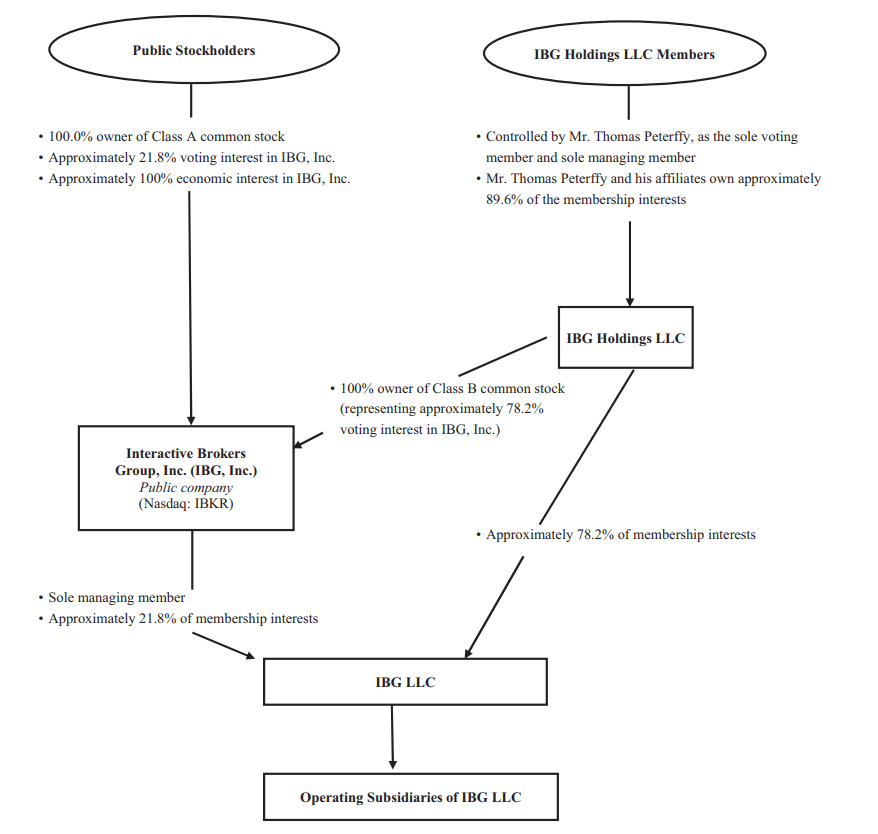

The current company structure is as follows.

IBG, Inc. is a holding company whose primary asset is the ownership of approximately 21.8% of the membership interests of IBG LLC, the current holding company for our businesses. IBG, Inc. is the sole managing member of IBG LLC.

(Source: IBKR)

IBKR IR (IBKR IR)

Now, the company’s most recent set of results continues to play to the company’s strengths. 2Q22 was released in July. On an adjusted basis, the company saw a 2 cent YoY increase in EPS, with an increase in revenues and reported EBIT as well (adjusted). Commission revenue increased 5% because customers were more likely to use options and futures, but tempered by lower stock trading volume. NII increased though, with the interest rate increases, by 27% YoY, offset only slightly by lending activity declines.

IBKR retains an EBIT margin of 60% and 63% adjusted – this is an overall decline of around 400 bps adjusted, but the company’s equity is up to $10.6B.

At the same time, the company saw increases in overall volumes – Customer accounts increased, the account equity increased, while average trades declined 6-7% during the quarter, and margin loans decreased 13% (but weighed up by higher interest rates).

Overall, the company communicates that 2022 is not going as the company was hoping. China is under an ongoing headwind due to the crackdown upon privately-owned businesses. The result is losses for many clients in the region – and that’s not even mentioning the current geopolitical troubles in Europe, which have gone a long way to chilling the overall temper of customers in that region.

Deficit spending in the U.S. has limited the government’s ability to respond to rising inflation with increasingly higher interest rates. As for each 1% hike, interest on U.S. debt increases by $300 billion as it gets refinanced. So inflation is likely to stay with us. The same difficulty in raising rates in the face of higher inflation and the same causes are also occurring in Europe.

(Source. Nancy Stuebe, IBKR 2Q22 Earnings Call)

IBKR also reports substantial customer losses, and IBKR faces the impact of customers withdrawing their funds from the accounts. The positive note that the company currently sees is a long-term focus on client needs, and the solution for many of these players and their clients is to involve IBKR and their platform, resulting in onboarding many new clients and the aforementioned growth in customer numbers. The company continues therefore to expect a customer growth of no less than 30%.

Uncertain and volatile markets mean that a broker’s capital base is of paramount importance, and IBKR has seen this rise over the past few quarters. The company has also come with some news, allowing for fractional trading in EU stocks. IBKR continues to add customer functionality to appeal to a wider base.

Overall, it’s fair to say that IBKR, despite the overall macro, is doing very well. When you’re investing in a broker, you’re even more at the mercy of the market in that the correlation to market performance can be very high. However, buying this company cheap means a very high potential upside.

Let’s explore that for a while and let me show you why I am long IBKR.

IBKR’s Valuation

IBKR is typically, highly valued in terms of its earnings. Also, the company’s dividend has typically stayed static and continues to do so, with no expectation for a current dividend increase, meaning the current yield of the less-than-inflation 0.65% should be taken as gospel for the time being.

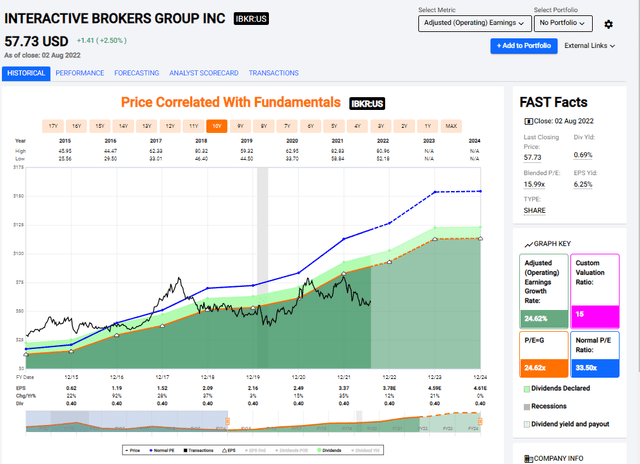

Still, IBKR has been able to improve earnings impressively on a 10-year basis.

F.A.S.T graphs valuation (F.A.S.T graphs)

Since we went into this macro, the company’s valuation has dropped to levels that can be considered attractive by most metrics. Trading at a P/E of just below 16x, this company is now significantly below its overall historical valuations, and any valuation is justified by a 10-year 25% CAGR. The company is currently forecasted to average 12% in 2022, and another 21% in 2023, which should justify continued valuation expansion here – and certainly above a 15x P/E.

Based on a flat forecast of around 15-16x, IBKR is expected to generate returns of around 10.5% annually here. Potentially market-beating, but not exciting compared to most investments, especially given the company’s no-growth, a static dividend of $0.4/share. It’s clear that dividends are not IBKR’s priority, nor perhaps should it be. We cannot view IBKR in a vacuum, however, and it needs to be compared to other potential investments.

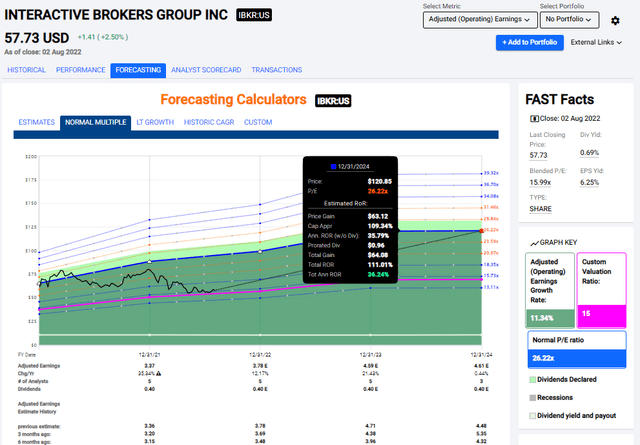

IBKR however, at this valuation, has the potential to generate realistic returns up to 36.2% annually or 111% in less than 3 years, if the company reverts to a valuation more in line with a 10-25% annual EPS CAGR.

While this may not seem like a realistic prospect today, I think it important to emphasize that we may see this return, given where the company has been trading before and given the tailwinds from interest income, new customer onboarding, and potential consolidation of brokerage services in the face of ongoing pressures across the world – with ongoing client onboarding already proof of such a trend occurring.

Given the static dividend, I find it a bit more tricky to allow such a high multiple for the company, and I view its operations as being fairly tightly tied to overall client market activity – which may dip if the market turns down. I, therefore, prefer to trade or buy IBKR as close to a fair-value 15x P/E as possible.

The last time this was possible was back in 2019. Returns until today would have meant about 35%+ RoR, even with the recent dip. The last appealing buy prior to that was all the way back in 2013, with the 6-year return coming to around 216%, or 17% annual RoR.

My view is therefore remains clear. I would prefer not to pay beyond 15x average weighted P/E for this business. However, when the first two multiple numbers are 15, that 15.99x doesn’t make the company a “bad” buy. it’s an undervalued broker – and I argue, one of the most undervalued and qualitative brokers out there.

Bullish investors on trading and IBKR overall could make between 11% and 35% annual RoR based on a 16-25x P/E premium, and this is now enough to interest me.

My conservative Price target for IBKR on an average earnings basis is between $55 and $60/share, which comes to well below the lower end of the current analyst target, but which is now valid, and being met. The current S&P Global average for this company is $92/share, which would give investors an upside of 60%. As I said, I’m far lower than this – far lower than the low end $77/share target for the company (Source: S&P Global)

Still, at current pricing, IBKR is a “BUY”.

Thesis

My thesis for IBKR is rather simple:

- The company is extremely qualitative and appealing on the basis of its role as a market-enabler for large parts of international investors.

- It’s qualitative, proven, and well-managed with the ability to handle most market environments with relative ease given its growth and current size.

- However, risks are tied to the yield/interest curve, market activity (which is flimsy in terms of stability), volatility (which is even flimsier), and similar variables.

- The result is that you want to buy the company cheap. Don’t go in much above 15xX average P/E. At current levels, that means around $55-$60/share. At such levels, I would start buying IBKR – and I am currently doing so.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This is how the company fulfills my current targets.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment