tupungato

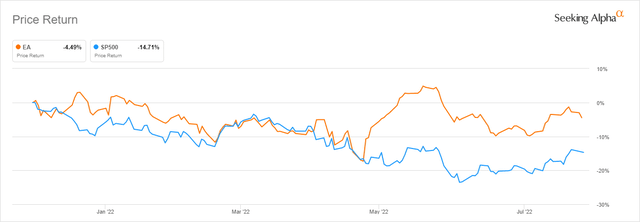

Out of all of the companies that we have expected to carry themselves well against the ongoing bear market sentiment and the recession-headed economy, video game publisher and developer Electronic Arts (NASDAQ:EA) was probably not one of them. However, one of the industry’s pioneers managed to generate respectable year-to-date and year-over-year results that can stand side by side with many defensively oriented stocks.

The industry veteran found itself in a tough environment with the cards largely stacked against it, considering the video game industry boom fueled by the lockdowns was starting to show signs of it winding down due to consumers cutting back on discretionary spending ahead of difficult times. Still, the company came out swinging with arguably unexpectedly good earning numbers yesterday, managing to beat top and bottom line estimates but also highlighted some worrying trends within the industry with its future guidance.

Electronic Arts YTD Results vs S&P500 (Seeking Alpha)

Latest quarterly report

The California-based videogame giant posted what might be considered an unexpectedly good earnings release last night.

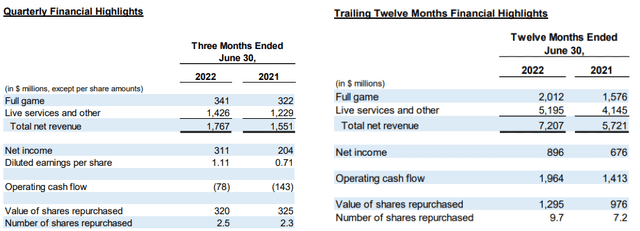

The company reported net income of $311 million for the three months ended June 30th, compared to net income of $204 million for the same period last year. It has also posted earnings of $1.11 a share, compared to $0.71 a share it earned in the same period last year. Results appear to be primarily driven by increases in the live services segment, as full game sales wound down, mainly due to the way EA’s games release pipeline is planned. Net bookings from the full game segment, in fact, declined 41% and are set at $165 million.

Live services, as the next step in the evolution of the video game industry, currently make up 73% of total net bookings for Electronic Arts. Live services net bookings grew by 8% when compared to the same quarter last year and 20% when taking the trailing 12 months into consideration. For the full year, overall sales grew 24.2% to slightly under $7 billion, and net bookings were up 21.4% at $7.5 billion. Among other highlights of the earnings release, the EA player network grew to nearly 600 million active accounts. All of these are signs that macroeconomic headwinds have largely bypassed the industry veteran for now.

EA Financial Highlights (Electronic Arts Earnings Release)

While the macro outlook remains fluid, every one of us at Electronic Arts is focused on the things we can control. Even amidst market uncertainty, more people than ever before are turning to games as their primary choice for entertainment. This is what they love to do more than anything else — and it’s how they want to connect and share experiences with people around the world. With gaming so central to our lives today, EA is uniquely well-positioned with the broad demographic reach of our portfolio, and the strongest content pipeline in our history. Leveraging the talents of the best teams in the industry, we are poised to lead this next chapter of entertainment, and to continue building long-term value in our company.

Andrew Wilson, CEO – Prepared Remarks

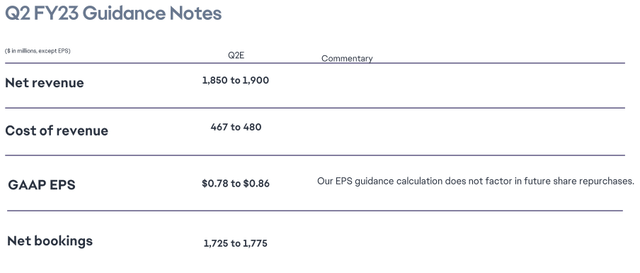

However, EA is still facing difficulties down the road, with the next quarter and full-year guidance displaying signs of the rapidly declining macroeconomic environment. For the second quarter of 2023, EA expects revenue of $1.85 billion to $1.9 billion, with a net income of $220 million to $242 million, and earnings of $0.78 to $0.86 a share. This falls short of analyst expectations that forecast sales of $1.83 billion, net income of $404 million, and earnings of $0.84 a share.

Q2 FY23 Guidance Notes (Q1 FY23 Earnings Results)

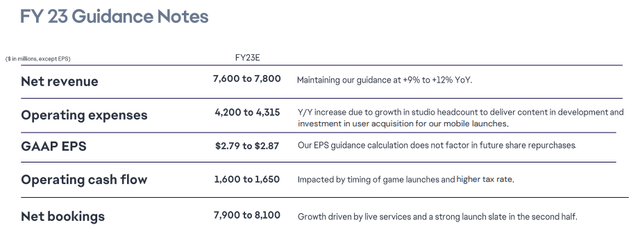

For the full year of 2023, the company provided revenue guidance in the range between $7.6 billion and $7.8 billion, with net income expectations of $793 million to $815 million. That leaves earnings per share in the expected range of $2.79 to $2.87 a share. This falls slightly short of analyst expectations that forecast revenues of around $7.98 billion, net income of $2.02 billion, and earnings per share of $7.17.

FY23 Guidance Notes (Q1 FY23 Earnings Results)

Valuation and competition

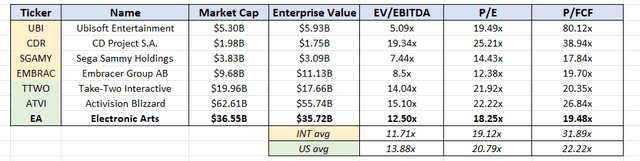

As previously mentioned, there is not much of a bear market discount that got applied to the company, with shares of EA trading relatively flat both year-to-date and year-over-year. The veteran video game developer and publisher is currently traded for $130.87 per share and is selling at an NTM EV/EBITDA of 12.50x, P/E of 18.25x, and a P/FCF of 19.48x. Again, it is important to point out that the IPs and franchises are a moat that are difficult to quantify and put into numbers, and EA definitely brings a lot to the table.

Industry Valuations (Author Spreadsheet, Capital IQ Data)

Activision Blizzard is now almost traditionally the closest competitor in terms of both valuations and range of IP remains ahead of EA, mostly due to the merger arbitrage that is currently being speculatively priced in. However, when comparing the company to US-based companies such as Take-Two Interactive (TTWO) and international companies such as Ubisoft Entertainment (OTCPK:UBSFY), CD Projekt S.A. (OTCPK:OTGLF), and others, we can see that Electronic Arts remains very competitively priced in terms of valuations. This is more emphasized when taking into consideration the depth and the quality of the IP EA commands, which are arguably miles ahead of the competition.

Still, this is where we arrive at a recently developed issue when it comes to evaluating EA. While it is a fact that it remains very competitively priced when compared to other developers and publishers within the industry, the lack of a more significant drawback over the past year raises certain questions when comparing the company to the rest of the market. At the moment, we have FAANG stocks with possibly better MOATs and business models selling for the same multiples. As an example, we have Alphabet (GOOG) selling at an NTM EV/EBITDA of 11.80x and P/E of 21.20x, while something like Apple (AAPL) sells for an EV/EBITDA of 19.80x and P/E of 26.08x. All of this raises a simple question, aren’t there currently much better choices among the beaten-down stocks in the market?

Waiting for the right buyer?

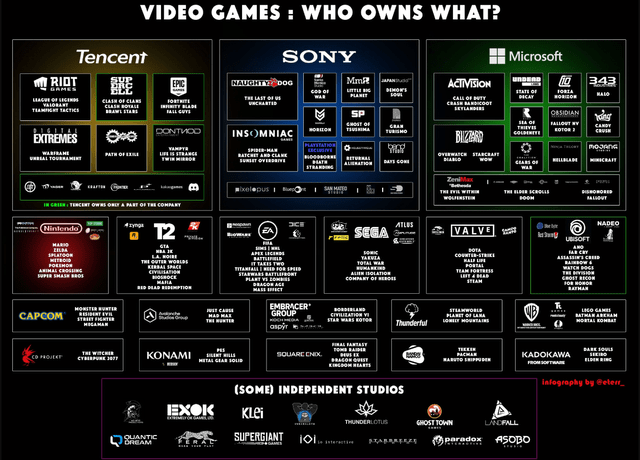

There might be another, more interesting reason why EA shareholders decided to stick with the company during these difficult times. With Activision Blizzard getting acquired by Microsoft (MSFT) at the beginning of the year in a deal that is still awaiting regulatory approvals, Electronic Arts has become arguably the most desired grouping of assets in the industry. This fact, combined with increased industry consolidation in the prior period, sparked many discussions about the future of the iconic company as a stand-alone developer and publisher. The slight irony here is that EA has had a long history and has managed to develop a reputation for acquiring developers in the industry. Such was the case with the legendary Westwood Studios, who made the original Command and Conquer RTS games, and BioWare, who are the creators of hit RPGs like Mass Effect and Dragon Age, Codemasters, the makers of the famous Rally series, and many others.

Video Game Industry Consolidation (Eterr)

With a current total enterprise value of $35.72 billion, we can speculate that a potential buyout would cost the acquirer something in the range of $48-$52 billion if a similar premium is to be applied as was the case with Activision earlier this year. One might say that with the current state of the market and the overall economy, far less would be necessary to get shareholders on board with the decision. To recall, shares of the company were selling under $65 per share once it was announced that Microsoft is buying it out at $95 per share, implying a 40% premium. It is also interesting to point out that the Microsoft acquisition caused EA’s share price to rise by almost 8% on the same day, meaning that speculators are obviously willing to throw the idea around.

Such a high enterprise value limits the list of potential acquirers, barring many from the industry from having even theoretical possibilities. On the face of things, the big three are the ones who would be the most logical choice, but Microsoft is already not worth considering given they are embroiled in a politically costly acquisition already. On the other hand, Sony (SONY) does seem to be the more obvious choice, with the company looking for ways not to be left behind. However, they do seem to be lacking the checkbook to keep up with Microsoft in these high-level acquisitions. Tencent (OTCPK:TCEHY) also remains well within the realm of possibilities when discussing its financial capabilities, but the deal seems unlikely given the deteriorating political relations between the US and China.

A far more interesting possibility arises when we look beyond the video game industry. The company has been rumored lately to be attempting to gain attention from the likes of Disney (DIS) or Amazon (AMZN). While the latter seems a rather fat stretch, the Disney acquisition makes much more sense considering how well a part of their portfolios would fit. An almost decade-long deal with Disney over the exclusive rights to develop games based on the Star Wars franchise is already in place. Either way, with industry consolidation rapidly increasing, we find it very unlikely that EA will remain as a stand-alone company for much longer, even though there are no guarantees the company will follow Activision’s path.

Final thoughts and conclusions

Electronic Arts came out swinging and delivered arguably an unexpectedly good earnings report given the rapidly declining macroeconomic situation that is bound to take its toll on the industry. The resilience of the live services segment took us back a little considering we have expected that the segment will fall behind given the current environment we find ourselves in. It remains to be seen how the live services segment will react to EA abandoning their FIFA license and what kind of impact that would cause. Overall, it remains immensely encouraging that the live services segment took up 73% of net bookings for the trailing twelve months, signaling that the veteran remains well ahead of the herd as the industry shifts to new business models. The sheer strength of the games portfolio based on the amazing IP that the company has successfully built throughout the years, creates a deep MOAT that draws a line between Electronic Arts and the rest of the competitors. While we still expect the company to continue to suffer from negative macroeconomic headwinds in the following quarters, they are much better positioned to handle the upcoming difficulties than many of its rivals. The recent developments surrounding industry consolidation that is taking place only serve to further emphasize their strengths. We still believe it will be unlikely that the industry veteran will enter the next decade as a stand-alone company. Given everything we have explained within the article, we maintain a cautiously bullish outlook on EA.

Be the first to comment