Galeanu Mihai

Cerberus Cyber Sentinel Corporation (NASDAQ:CISO) differs from other IT security companies by its relatively small size. However, in addition to cybersecurity protection to prevent malicious attacks by hackers, it also provides compliance and forensics services.

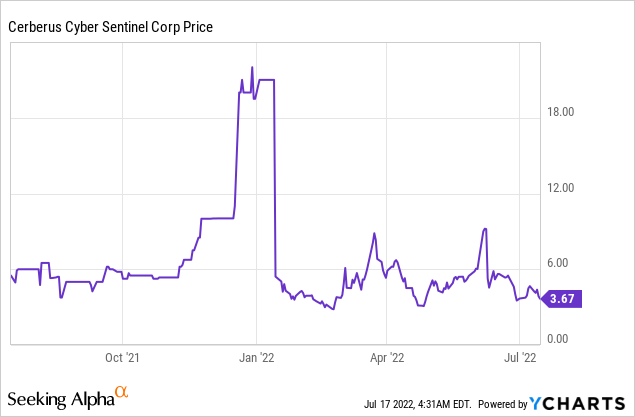

Currently available at around $3.52 a share, the stock has suffered from a vertiginous 600% drop since its January 13 high of $48. This makes it a tempting investment, but for investors, I assess whether it constitutes a buy by analyzing the financials and competitive positioning.

First, I start by elaborating on how the company has positioned itself to address the global threat scenario.

The Importance of Cybersecurity

Since the beginning of Covid-19, employees have changed their habits considerably and have been increasingly working from home on their laptops. There, they do not necessarily benefit from the same level of IT security protection compared to their offices which are located behind strong network firewalls. At the same time, people have been spending more time sitting on their sofas to play online games.

In parallel, more businesses have undergone a digital transformation, and their IT workloads reside in the cloud. Looking at security, the shift to digital has conversely increased risks of cyberattack as hackers now have more potential targets. In terms of figures, about $6 trillion was lost to cybercrime in 2021 alone, which translates to about $11.4M per minute.

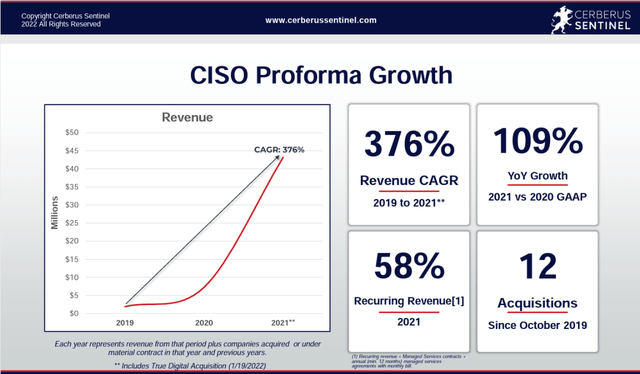

To protect themselves, corporations depend on the solutions offered by cybersecurity companies including Cerberus whose astounding CAGR revenue growth rate of 376% from 2019 to 2021 shows that it has been winning customers at a frantic pace.

Company presentations dated April 2022 (www.cerberussentinel.com)

In addition to its products gaining rapid adoption, the main reason for the rapid growth is acquisitions, namely of Arkavia Networks SPA, a Chilean cybersecurity services provider in December 2021. This was followed by Atlantic Technology Systems, a managed service provider which enabled Cerberus to get a foothold in the IT monitoring and security domain for the financial services industry. This remains a highly regulated industry requiring differentiated solutions.

The subsequent addition of VelocIT contributed significantly to Cerberus’ ability to provide integrated risk-managed services, namely consulting for security services while CyberViking broadened Cerberus’s knowledge of the healthcare sector and industrial control systems.

The company has made 12 acquisitions since October 2019, which also enabled it to gain access to the forensics market. Here, contrary to cybersecurity protection which is about protecting sensitive data, cyber forensics, which has a similar aspect to the Police crime forensics department, aims to assess which data was stolen or compromised, by what hacker group, and the modus operandi. Additionally, Creberus’ certified investigators can assist stricken companies with insurance claims.

However, cybersecurity remains a highly competitive industry.

Competition and Risks

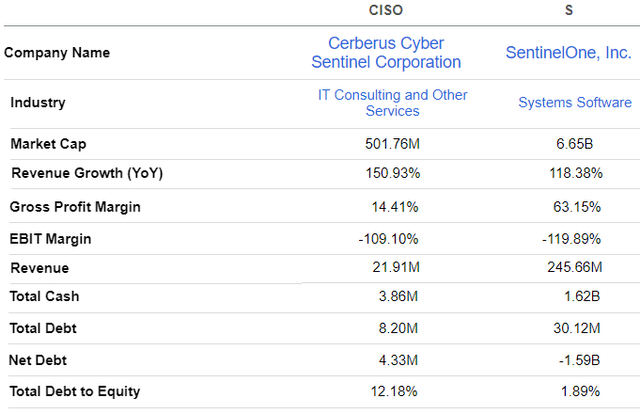

Looking for competitors, Cerberus competes with SentinelOne (S) which also provides cybersecurity protection with its Vigilance Respond and Watchtower products. It also provides compliance solutions, which is about verifying whether corporations are adhering to standards. The company is also involved in cyber-forensics and focuses on AI tools to filter out the actual threats from the thousands of alerts that flood monitoring systems every day.

On the financial side, it is Cerberus that exhibits higher growth, but Sentinel One has delivered better gross profit margins largely due to its higher revenue level. In terms of EBIT margin, both companies have a negative value due to excess costs of operations, but Sentinel One is ahead of Cerberus in terms of cash, and has lower debt too.

Comparison with a peer (www.seekingalpha.com)

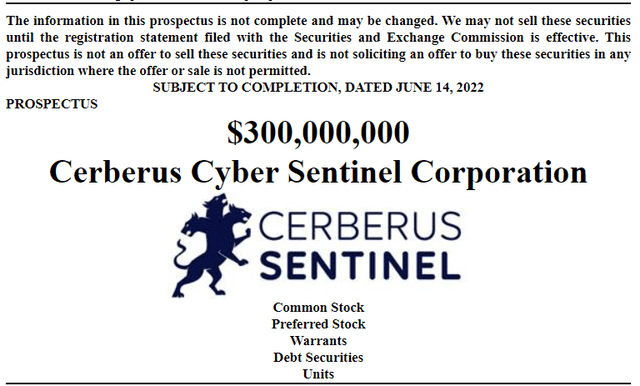

Now, Cerberus which is relying on inorganic growth needs money to fund acquisitions. For this purpose, it plans to raise up to $300 million through a combination of the stock offering, preferred stocks, and debt. This is shown in the exhibit below.

Funding prospectus (seekingalpha.com)

This is a big amount considering the company’s market cap of $502 million and revenues of only $21.9 million generated in 2021, and the operating loss status. Thus, there may be a deterioration in the fundamentals in case the company does not sustain its high revenue growth throughout 2022. This point of view appears to be shared by investors since the stock slid after the funding announcement on June 14 which is synonymous with share dilution, and a more leveraged balance sheet.

As a result of the downside, valuations have become more favorable.

Valuations

To obtain an idea of the degree to which the value went down, consider that the company trades at less than $4, or more than 50% below its June 6, 2022 closing price of $9. For this matter, on June 14, the company proposed to sell 11,111,111 shares of its common stock at $9 each.

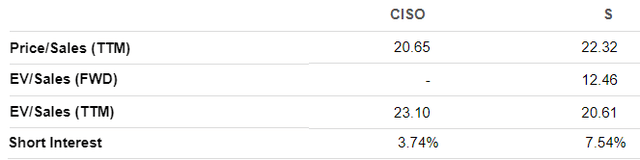

As for valuations, Cerberus’ price-to-sales multiple of 20.65x, is slightly less than sentinel One’s 22.32x. Hence, based on a comparison with Sentinel One, a target price for Cerberus would be $3.8 (22.32/20.65 x3.56) based on its current share price of $3.52.

Valuations metrics (www.seekingalpha.com)

Also, short interest in the company indicates that it is less likely to suffer from any brutal market moves downwards, as was the case when it acquired Creatrix, which possesses a decade-long experience with biometrics systems, for fingerprint identification in enterprise environments.

Furthermore, with this acquisition, Cerberus should deliver an even higher sequential growth in the June quarter compared to the one ending in March 2022. This will ultimately depend on how fast it is able to integrate the newly acquired company.

Thus, from a valuation perspective, the company is investable, but I am not bullish.

Discussion and Conclusion

The reason is that this is a stock market where the value strategy prevails and where investors are giving more credence to the profitability metric instead of the growth one. Consequently, the stock could fall further as high inflation fears give way to recession concerns.

On the other hand, demand for cybersecurity remains high as more aspects of our lives are becoming digitally transformed. Moreover, one factor which could help the company achieve positive operating margins is higher recurring revenues, as these are synonymous with more stable income. These can also bring higher gross margins as there is a larger revenue base to spread fixed costs. Currently, recurring sales form 58% of total sales and there are three factors that should further increase this percentage.

First, Cerberus has the SentryPRO-managed data protection service whereby it proposes backup, restoration, and testing services to customers who do not have the staff for doing the job or want to outsource the service.

Second, customers can also outsource their IT security monitoring and threat response tasks to Cerberus’ SOC (security operations center) on a 24/7 basis. Going one step further, there is CISO-as-a-Service whereby customers who do not have the expertise can avail the experience of top-notch experts in the security field.

Third, subscription-based services make economic sense for smaller companies that do not have the means to recruit teams of engineers for a SOC-type arrangement or larger ones who prefer to outsource instead of recruiting a dedicated IT security professional.

Consequently, empowered by its managed services offerings whereby customers can subscribe to its platforms, there are prospects for more recurring revenues.

Finally, growing rapidly through acquisitions, the company has a well-defined strategy of offering the complete range of cyber services and is product agnostic, implying that it does favor any particular brand. Its presence across several industry verticals also makes it more immune to weakness impacting a particular economic sector. However, the way it is raising finances is not being well digested by the market, especially given the fact that it is not profitable. In these circumstances, it is better to wait for clear signs of recurring revenues continuing to elevate and reaching the 70%-75% level before buying the stock.

Be the first to comment