gorodenkoff

Dear readers,

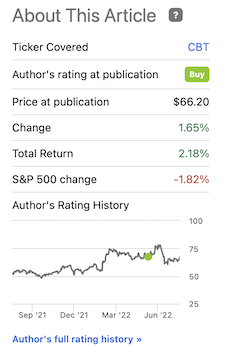

The fact is that since my last article, the company has actually outperformed the poor negative 2% performance of the S&P 500, with its 2.18% dividend-inclusive RoR that we’re seeing here. On that level, my stance and my investment in Cabot Corporation (NYSE:CBT) was actually one of relative success, even if a minor success.

Cabot Article Returns (Seeking Alpha)

In this article, we’re going to take a look at why I’m still bullish on this company – and why I indeed believe that Cabot investors might be in for a very substantial long-term upside at these valuations.

Revisiting the upside of Cabot Corporation

You may recall my stance and my work with Cabot corporation. I rotated profits some months back because the company reached a valuation that was high relative to expectations. The company declined, and I went back in, and the company has seen a 42% RoR since my last positive stance on the company here.

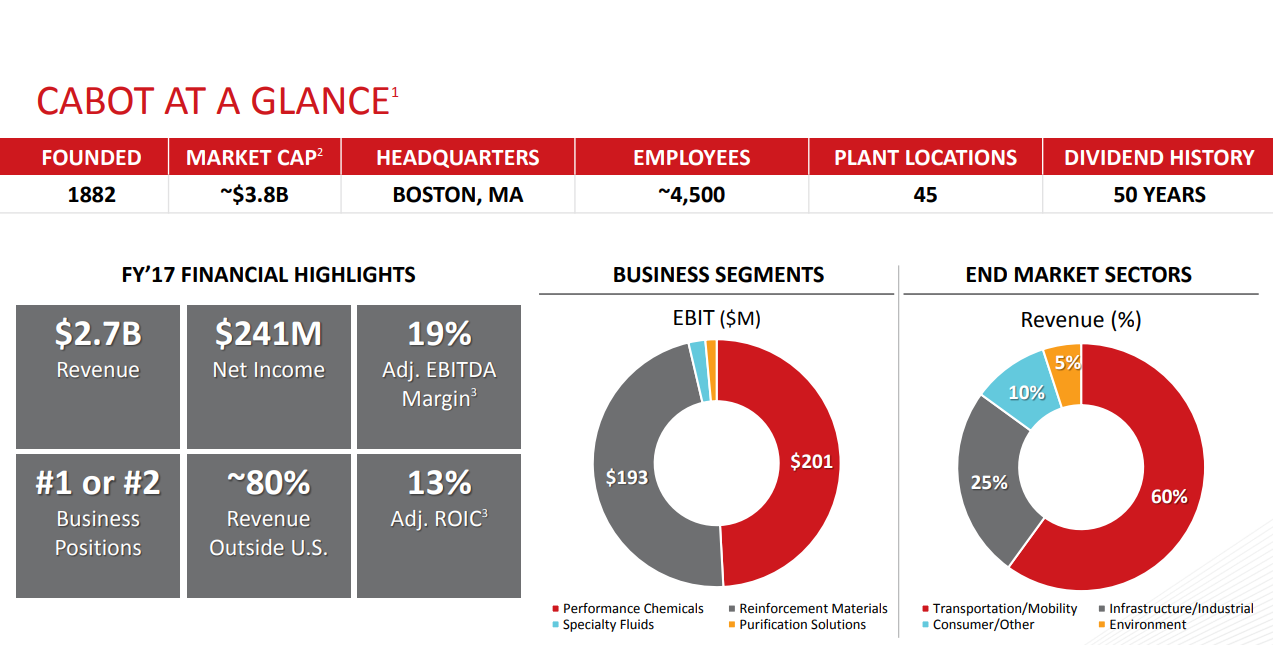

The company was founded over 130 years ago and is headquartered in Boston. It’s in the business of developing and manufacturing chemicals and performance materials for industries all over the world. A quick glance at the business tells us the following:

Cabot IR (Cabot IR)

The company is divided into four areas, two of which make up a very large portion of EBIT, and two end-market sectors making up over 75% of the revenue. CBT has a 50+ year history of dividend payouts, an eight-plus-year streak of consecutive increases, and many years without a dividend cut (Source). Its current yield is around 2.3%.

At 4,500 employees, this is smaller than the companies I usually have in my portfolio, but I believe CBT, despite its smaller market cap, warrants a second look.

Cabot Corporation is a strong player in China, making an investment in the stock an equally interesting one with exposure to our Asian neighbors. Cabot sees continued demand for its products here and considers itself a preferred supplier to industries it serves in China (Source).

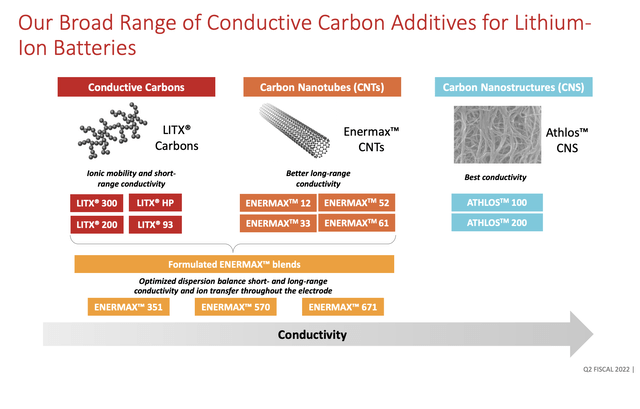

Cabot continues its streak of outperformance, delivering record EBIT for the fiscal 2Q22 in both Reinforcement mats and performance chemicals, driving a continued EPS outperformance of 22% YoY for the quarter. Cabot keeps winning contracts and sales of conductive carbon additive blends, factories using this are currently being constructed and put into use in Europe. The company completely divested its purification solutions business and continued paying back capital to shareholders in combined buybacks and dividends.

Batteries for ESG technologies and EVs are some of the core targets of the company.

The company is investing heavily in capacity despite the current macro, tripling its production capacity to meet the explosive demand for battery materials with a targeted timeframe of 2024E, with Chinese plants being started up in every part of the country. The volume growth for this material is up 50% YTD in 2022, and YTD EBITDA is up 80%.

The company continues to see very impressive numbers. Cash is up to over $200M, and the company has $1.2B+ in liquidity available, with a net debt/EBITDA that is now below a 2X level. Liquidity, cash, and funding is no problem whatsoever for this business – now or in the near future, if this continues. Discretionary cash flow is creeping up to $100M, which gives it closer to half a billion worth of annual FCF at a run rate.

The company’s various segments continue to outperform. Cabot is improving margins through pricing and volume both, even though fixed costs are increasing across the business. It’s not just one sub-segment, but every sub-segment in the company is improving its margin trends through pushing pricing, with a very strong demand for battery materials and other company products and commodities.

This is why I invest in chemical businesses. While they may at times be volatile, we come back to the fact that these commodities are necessary for every facet of our modern world. When a new development is taking place, such as battery revolutions, it’s chemical specialty companies that are leading the charge due to the required expertise.

Some people love investing in the software side of these things. Me, I prefer things I could theoretically touch, and chemical companies are usually major beneficiaries of these trends.

We see this in updated company guidance here. Cabot calls for continued improving EPS at a level of around $6.2 at a high level for 2022E. This is an increase of 30 cents compared to the previous guidance, and the company expects its margin to even continue improving on the basis of strong pricing and demand trends.

The company’s historical trends since 2015 have been very impressive, including both a reduction in shares outstanding, as well as cumulative dividends and overall share price repurchases.

There is continued momentum in Battery Materials, with an ever-growing demand for exactly these types of products. I don’t like using TAM as an indicator for anything, but the fact is that the world is seeing a higher and higher need for such materials going forward. This is underpinned by strong 2Q22 volume growth tacking on the first quarter, as well as the company being one of the broadest-spectrum additive producers on the markets.

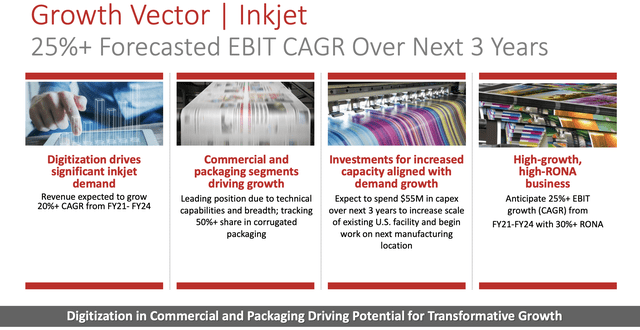

For some of the company’s other segments, you’d be surprised at the upsides we’re able to calculate. When you think inkjet/inks, you might think printers. But this isn’t really what we’re talking about – at least not photo jet printers.

Cabot inkjet vector (Cabot IR)

Simply put, the company is focusing on products and technology as well as sales areas that they consider to be crucial for the technologies of tomorrow, called high growth vectors while maintaining its core focus. This is a change from the company’s legacy approach, where the so-called high growth vectors were a very small part of sales, as opposed to a majority of it.

The current market, despite current negative trends, supports such a development. That’s also why the company hasn’t been dropping as much as broader indexes, and why the position I have remaining is one of the positions that’s very much in the positive for 2022 YTD.

I very much maintain this view as we move forward with this company and its overall trends and expectations.

Let me show this to you in valuation.

Cabot Valuation

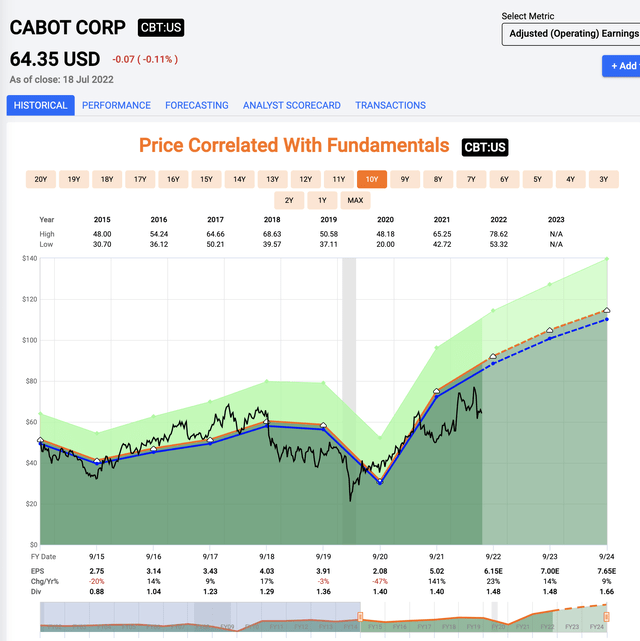

The valuation for Cabot is extremely favorable here, and I wouldn’t call it an exaggeration that you would do yourself a disservice by ignoring the upside present in Cabot corporation. The company is expecting a $6.2 EPS for the year, even with current FactSet expectations at 5 cents lower, that’s still a 23% YoY improvement in EPS on an adjusted basis. This is then expected to continue for the 2 following years albeit at a slower growth rate.

I consider these trends entirely realistic based on the continued upside we can find in the sales of battery materials and chemicals and similar, adjacent commodities in which Cabot specializes.

2020 was a bad year. The company’s EPS dropped 50%, or close to it. Since then, the company has been on a tear to prove doubters wrong. 2021 saw record EPS. 2022 is expected to bring yet another year of record EPS for the business.

The upside, if any sort of conservative 14-15X P/E is applied to these results, is an implied annualized RoR of 25-31%, coming to a total high-end RoR in 2024E of 84% with a targeted share price of $115, implying a 2024E 15X P/E based on a $7.65 EPS, or a 15% annualized EPS growth from 2021 and forward.

Not unrealistic, if you ask me, and you look at the market, and consider what Cabot has been able to do since inflation and macro trends has sunk its claws into the market and the companies that operate within it.

This company isn’t dirt-cheap. It’s heavily undervalued, but it could, of course, drop lower than we’re currently seeing. But upside is solid and well-established.

While analyst accuracy isn’t perfect, it’s more than 50% here both on a 1-year and 2-year forecast basis with a 10% margin of error. I would also like to remind you that aside from the pandemic drop in 2019-2020, this company’s earnings trends have been absolutely stellar. Outside of the pandemic, this company has been as high as 16-18X before.

What this means is despite some of the uncertainties, there is a lot to like about Cabot.

S&P Global analysts are equally positive on this company at this time. 6 analysts give the company a target range of $74 up to $93 with an average of $84.5, giving us an upside of 31% here, depicting that annual sort of upside I see. Also, all but one analyst does have a “BUY” or “Outperform” rating on the company here, so conviction for this investment is high. That target is even raised from the last time I took some time to write on Cabot and where I believe it might be headed.

I can’t help but continue to agree with the analysts here. Cabot’s transformation and focus on its growth vectors over the past few years has resulted in a company that’s in a superb position to capitalize not on momentary or temporary trends, but on fundamental changes in society.

That’s one of the reasons why I’m bullish here.

It doesn’t matter what company makes the products, such as the cars or the screens, they will have to source their raw materials from companies exactly like Cabot.

That’s why I have a preference for investing as “low” on the value chain as possible, with the possible exception of miners themselves. I’m here to make money, not to show brand/company loyalty. Cabot makes the “stuff” that companies need – it doesn’t matter what company makes the gadget.

This is what I like, and combined with investment-grade credit, a decent 2%+ yield, and an upside of over 30% here, I’m a “BUY” on Cabot Corporation.

Thesis

My thesis on Cabot is:

- This is an excellent play on necessary commodity chemicals. Cabot is a world market leader in key raw materials and technologies that are required by the modern world.

- Couple this with an attractive valuation, and I’m at a “BUY”, viewing the company with an upside to a target of 15X 2024E P/E, or a long-term PT in the triple digits close to $115.

- More conservatively and near-term, I would suggest Cabot is worth at least $80/share.

- I’m buying here, slowly adding to Cabot.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This company also fulfills several of my investment criteria and does bear watching.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment