alicat/E+ via Getty Images

Earnings of Wintrust Financial Corporation (NASDAQ:WTFC) will most probably dip this year due to higher provisioning expenses for loan losses amid a high interest-rate environment. On the other hand, decent loan growth and margin expansion will likely lift earnings. Overall, I’m expecting Wintrust Financial to report earnings of $7.03 per share for 2022, down 7% year-over-year. Compared to my last report on Wintrust Financial, I have slightly revised upwards my earnings estimate because I have revised upwards both my net interest margin and my noninterest income estimates. The year-end target price suggests a high upside from the current market price. Therefore, I’m upgrading Wintrust Financial to a buy rating.

Rise in Interest Rates May Increase Credit Costs

Growth in provisioning for expected loan losses will likely be the chief contributor to an earnings decline this year. I’m expecting higher-than-normal provisioning in the year ahead because of the faster-than-expected monetary tightening. Borrowers who were already stretched to the limit due to inflation may start defaulting following the interest rate hikes.

The Federal Reserve projects the target Federal Funds rate, which is currently 1.50% – 1.75%, to reach around 3.0% – 3.5% this year. The last time the federal funds rate was higher than 2.0% (from 3Q 2018 to 3Q 2019), Wintrust Financial’s nonperforming loans made up 0.44% – 0.55% of total loans (source: old 10-Q Filing). In comparison, nonperforming loans made up just 0.16% of total loans at the end of March 2022, as mentioned in the earnings presentation. The chances of nonperforming loans almost tripling from the current level may push Wintrust Financial to significantly add to its reserves.

The fear of a recession may also trigger higher provisioning for expected loan losses. Moreover, additions to the loan portfolio will require further provisioning. I’ve discussed my loan growth assumptions in more detail below.

Considering the factors mentioned above, I’m expecting the provision expense, net of reversals, to make up 0.22% of total loans in 2022. In comparison, the net provision expense averaged 0.16% of total loans from 2017 to 2019, and 0.20% of total loans in the last five years. In my last report on Wintrust Financial, I estimated a net provision expense of $60 million for 2022. I have now revised upwards my net provision estimate to $84 million.

High-Single-Digit Loan Growth Possible

Wintrust Financial’s loan portfolio grew by 1.4% in the first quarter of 2022 (5.7% annualized), which missed my expectations. The management mentioned in the latest conference call that it expects mid-to-high single-digit loan growth for this year.

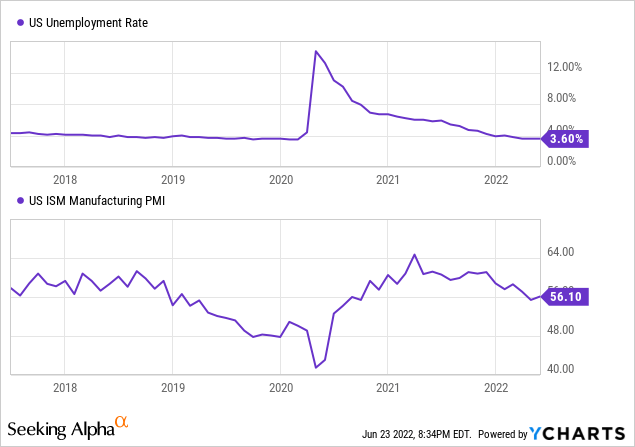

In my opinion, loan growth will likely accelerate from the first quarter’s level because the pipelines have grown, as mentioned in the conference call. Moreover, certain economic factors, like the strong job market and manufacturing activity, as measured by the PMI, bode well for loan growth.

Considering these factors, I’m expecting the loan portfolio to increase by 2.25% in each of the last three quarters of 2022, leading to full-year loan growth of 8.4%. Compared to my last report on Wintrust Financial, I have not changed my loan growth estimate for the last three quarters of this year. However, because loan growth missed my expectations in the first quarter, my full-year loan growth estimate is now lower than before.

Meanwhile, I’m expecting deposit growth to almost match loan growth in the last nine months of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 21,503 | 23,668 | 26,643 | 31,760 | 34,541 | 37,448 | |||

| Growth of Net Loans | 9.5% | 10.1% | 12.6% | 19.2% | 8.8% | 8.4% | |||

| Other Earning Assets | 4,098 | 4,685 | 6,935 | 9,801 | 12,252 | 12,836 | |||

| Deposits | 23,183 | 26,095 | 30,107 | 37,093 | 42,096 | 45,134 | |||

| Borrowings and Sub-Debt | 1,218 | 1,213 | 1,783 | 2,638 | 2,426 | 2,581 | |||

| Common equity | 2,852 | 3,143 | 3,566 | 3,703 | 4,086 | 4,308 | |||

| Book Value Per Share ($) | 50 | 55 | 62 | 64 | 71 | 74 | |||

| Tangible BVPS ($) | 41 | 44 | 50 | 52 | 59 | 62 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Loan Mix Makes the Topline Quite Rate-Sensitive

Wintrust Financial’s net interest margin is quite sensitive to interest rate hikes. This sensitivity is mostly attributable to the well-positioned loan portfolio. Around 53.6% of total loans will re-price within three months and an additional 26.4% of total loans will re-price within 4 to 12 months of an interest rate hike, as mentioned in the presentation. Altogether, a whopping 80% of the total loan portfolio will re-price in the year following the rate hike.

Further, Wintrust Financial has high levels of cash and cash equivalents which give the company the flexibility to quickly benefit from interest rate hikes. As mentioned in the presentation, the management has intentionally maintained a high level of interest-bearing cash to limit locking in low interest rates. Interest-bearing deposits with other banks, which is the biggest cash component, made up 8.5% of total earning assets at the end of March 2022.

On the other hand, the large securities portfolio will hold back the average earning asset yield as interest rates increase. Investment securities made up 14% of total earning assets at the end of March 2022. Moreover, around 58.6% of the deposit book will re-price soon after every rate hike, which will hurt the net interest margin. In the last interest rate hike cycle, which was from the third quarter of 2015 to the second quarter of 2019, Wintrust Financial had quite a high deposit beta of 44%, as mentioned in the presentation. This means that every 100-basis points increase in interest rates increased the deposit costs by 44 basis points.

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis points gradual increase in interest rates could boost the net interest income by 11.2% over twelve months. Considering these factors, I’m expecting the margin to increase by 40 basis points in the last three quarters of 2022, from 2.6% in the first quarter of the year. This will result in the average margin for 2022 being 20 basis points higher than the average margin for 2021. In my last report on Wintrust Financial, I estimated the margin for 2022 to be 15 basis points higher than last year. I have revised upwards my margin estimate mostly because of the latest Federal Reserve projection which is more hawkish than I anticipated.

Expecting Earnings to Dip by 7%

The growth in provisioning will likely drag earnings this year relative to last year. Moreover, the noninterest income will likely be lower this year because higher interest rates will end the benefit of mortgage refinancing. Compared to my last report on Wintrust Financial, I have revised upwards my noninterest income estimate because the mortgage banking income for the first quarter of the year exceeded my expectations.

The anticipated loan growth and margin expansion will likely support the bottom line. Overall, I’m expecting the company to report earnings of $7.03 per share in 2022, down 7% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 832 | 965 | 1,055 | 1,040 | 1,125 | 1,340 | |||

| Provision for loan losses | 30 | 35 | 54 | 214 | (59) | 84 | |||

| Non-interest income | 320 | 356 | 407 | 604 | 586 | 555 | |||

| Non-interest expense | 732 | 826 | 928 | 1,040 | 1,133 | 1,221 | |||

| Net income – Common Sh. | 248 | 335 | 347 | 272 | 438 | 408 | |||

| EPS – Diluted ($) | 4.40 | 5.86 | 6.03 | 4.68 | 7.58 | 7.03 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on Wintrust Financial, I estimated earnings of $6.81 per share for 2022. I have revised upwards my earnings estimate partly because of my net interest margin estimate revision. Further, I have revised upwards the noninterest income estimate following the first quarter’s surprise.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

Upgrading to a Buy Rating

Wintrust Financial is offering a dividend yield of 1.7% at the current quarterly dividend rate of $0.34 per share. The earnings and dividend estimates suggest a payout ratio of 19% for 2022, which is easily sustainable and close to the five-year average of 17%. Therefore, the outlook of an earnings dip presents no threat to the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Wintrust Financial. The stock has traded at an average P/TB ratio of 1.49 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 41.1 | 44.0 | 48.5 | 52.1 | 58.9 | |

| Average Market Price ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historical P/TB | 1.81x | 1.95x | 1.43x | 0.92x | 1.33x | 1.49x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $62.5 gives a target price of $92.9 for the end of 2022. This price target implies an 18.3% upside from the June 23 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.29x | 1.39x | 1.49x | 1.59x | 1.69x |

| TBVPS – Dec 2022 ($) | 62.5 | 62.5 | 62.5 | 62.5 | 62.5 |

| Target Price ($) | 80.4 | 86.7 | 92.9 | 99.2 | 105.4 |

| Market Price ($) | 78.5 | 78.5 | 78.5 | 78.5 | 78.5 |

| Upside/(Downside) | 2.4% | 10.4% | 18.3% | 26.3% | 34.2% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.7x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 4.40 | 5.86 | 6.03 | 4.68 | 7.58 | |

| Average Market Price ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historical P/E | 17.0x | 14.7x | 11.5x | 10.2x | 10.3x | 12.7x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $7.03 gives a target price of $89.5 for the end of 2022. This price target implies a 14.0% upside from the June 23 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.7x | 11.7x | 12.7x | 13.7x | 14.7x |

| EPS 2022 ($) | 7.03 | 7.03 | 7.03 | 7.03 | 7.03 |

| Target Price ($) | 75.4 | 82.5 | 89.5 | 96.5 | 103.5 |

| Market Price ($) | 78.5 | 78.5 | 78.5 | 78.5 | 78.5 |

| Upside/(Downside) | (4.0)% | 5.0% | 14.0% | 22.9% | 31.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $91.2, which implies a 16.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 17.9%.

In my last report as well, I determined a target price of $91.2 per share for December 2022. At the time my last report was issued, the market price was quite close to the target price. Therefore, I adopted a hold rating on Wintrust Financial. Since then, the market price has plunged leaving a higher implied price upside. As a result, I’m upgrading Wintrust Financial to a buy rating.

Be the first to comment