JHVEPhoto

Earnings of Wintrust Financial Corporation (NASDAQ:WTFC) will most probably continue to surge next year on the back of significant margin expansion. Further, moderately high loan growth will boost the bottom line. Overall, I’m expecting Wintrust Financial to report earnings of $7.85 per share for 2022 and $9.79 per share for 2023. Compared to my last report on the company, I’ve raised my earnings estimates for both years, mostly because I’ve increased my margin estimates. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Wintrust Financial Corporation.

Margin Expansion To Slow Down After A Remarkable Quarter

Wintrust Financial Corporation’s net interest margin improved by a hefty 42 basis points in the third quarter, following a 32-basis points growth in the second quarter of the year. The margin’s growth so far this year has exceeded my previous expectations. The management expects the margin to expand even further in the fourth quarter, by more than 36 basis points. As mentioned in the conference call, the management expects the margin to be north of 3.70% during this quarter.

Wintrust Financial Corporation’s deposit growth was unable to keep up pace with loan growth in the first nine months of 2022. As a result, the company had to rely on costly borrowings to bridge the funding gap. Further, Wintrust Financial had to attract deposits by offering attractive rates, which led to a worsening of the deposit mix. Non-interest-bearing deposits dipped to 31.6% by the end of September 2022, from 33.7% at the end of December 2021.

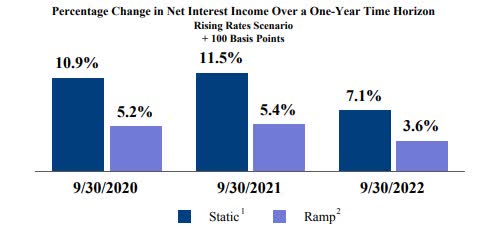

Due to the slight deterioration of the deposit mix, the deposit beta (rate sensitivity) is now much higher than before. As mentioned in the earnings presentation, the deposit beta has risen to 0.43% by the end of September 2022 from 0.16% at the end of December 2021. As a result, the net interest income is less risk-sensitive than before. Nevertheless, the net interest income is still slightly, positively correlated to interest rates. The results of the management’s interest-rate sensitivity analysis given in the presentation show that a 100-basis point hike in interest rates can boost the net interest income by 3.6% over twelve months.

3Q 2022 Earnings Presentation

Considering these factors, I’m expecting the margin to grow by 10 basis points in the last quarter of 2022 and 20 basis points in 2023. Compared to my last report on Wintrust Financial, I’ve increased my margin estimate because of the third quarter’s performance. Further, I’m now expecting the market interest rates to be higher than my previous expectations.

Loan Growth Likely To Be Sustained At A High-Single-Digit Rate

Wintrust Financial Corporation’s loan portfolio continued to grow at a high pace during the quarter. The portfolio grew by 3.0% during the quarter, or 12.2% annualized. Going forward, loan growth will likely slow down because of high-interest rates that will naturally temper credit demand.

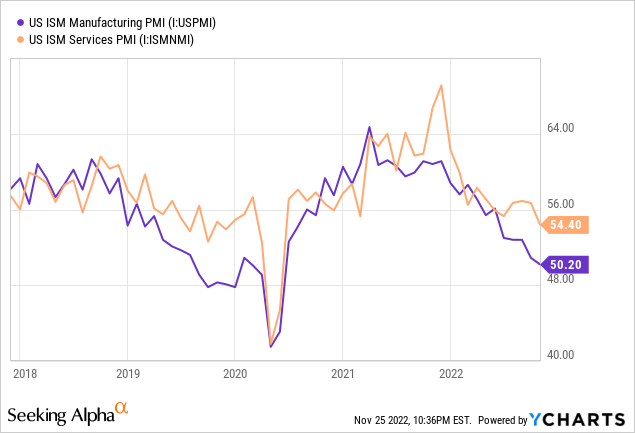

However, other macroeconomic factors will keep loan growth from falling too low. Wintrust Financial Corporation’s loan portfolio is well diversified geographically, but by loan segments, it’s concentrated in commercial real estate (“CRE”) and commercial loans. Therefore, the purchasing managers’ index is a good indicator of credit demand. As shown below, both the manufacturing and services indices are still in the expansionary territory (above 50).

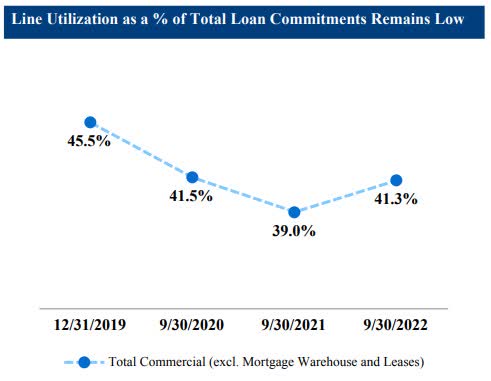

Further, there is still plenty of room for growth in lines of credit. Line utilization has improved over the past year but is still well below the pre-pandemic level.

3Q 2022 Earnings Presentation

The management mentioned in the conference call that it expects mid-to-high-single-digit loan growth. Considering the factors given above and management’s guidance, I’m expecting the loan portfolio to grow by 2.0% in the last quarter of 2022, taking full-year loan growth to 12.0%. For 2023, I’m expecting the loan portfolio to grow by 8.2%.

Meanwhile, I’m expecting deposits to grow in line with loans. However, the growth of securities and equity book value will trail loan growth because of the effect of high-interest rates on the market value of securities. The mark-to-market losses on the available-for-sale securities portfolio will bypass the income statement and directly erode the equity book value. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 23,668 | 26,643 | 31,760 | 34,541 | 38,680 | 41,868 |

| Growth of Net Loans | 10.1% | 12.6% | 19.2% | 8.8% | 12.0% | 8.2% |

| Other Earning Assets | 4,685 | 6,935 | 9,801 | 12,252 | 10,880 | 11,322 |

| Deposits | 26,095 | 30,107 | 37,093 | 42,096 | 43,653 | 47,252 |

| Borrowings and Sub-Debt | 1,213 | 1,783 | 2,638 | 2,426 | 3,471 | 3,541 |

| Common equity | 3,143 | 3,566 | 3,703 | 4,086 | 4,344 | 4,858 |

| Book Value Per Share ($) | 55 | 62 | 64 | 71 | 71 | 79 |

| Tangible BVPS ($) | 44 | 50 | 52 | 59 | 60 | 68 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Expecting Earnings To Surge by 25% Next Year

Margin expansion will likely be the chief earnings driver through the end of 2023. Further, the bottom line will receive support from moderately high loan growth. On the other hand, the non-interest income will likely decline going forward, which will restrict earnings growth. Due to the overall market rout, Wintrust Financial’s assets under management have declined from $35.8 billion in the first quarter to $32.8 billion in the third quarter of 2022, as mentioned in the presentation. Therefore, fee income from the wealth management division will be lower in the near term. However, Wintrust Financial has recently announced its plans to acquire North American asset management units from Rothschild & Co, which will boost fee income.

Meanwhile, the provisioning will likely remain at a normal level. I’m expecting the net provision expense to make up around 0.19% of total loans in 2023, which is close to the average for the last five years.

Overall, I’m expecting Wintrust Financial to report earnings of $7.85 per share for 2022, up 4% year-over-year. For 2023, I’m expecting earnings to grow by 25% to $9.79 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 965 | 1,055 | 1,040 | 1,125 | 1,460 | 1,826 |

| Provision for loan losses | 35 | 54 | 214 | (59) | 51 | 80 |

| Non-interest income | 356 | 407 | 604 | 586 | 469 | 390 |

| Non-interest expense | 826 | 928 | 1,040 | 1,133 | 1,175 | 1,284 |

| Net income – Common Sh. | 335 | 347 | 272 | 438 | 483 | 603 |

| EPS – Diluted ($) | 5.86 | 6.03 | 4.68 | 7.58 | 7.85 | 9.79 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Wintrust Financial, I estimated earnings of $7.41 per share for 2022 and $8.78 per share for 2023. I’ve raised my earnings estimates mostly because I’ve increased my margin estimates for both years.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Maintaining A Buy Rating

Wintrust Financial has been increasing its dividend every year since 2014. Given the earnings outlook, it’s likely that the company will maintain the dividend trend next year. Therefore, I’m expecting the company to increase its dividend by $0.02 per share to $0.36 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 15% for 2023, which is close to the five-year average of 17%. Based on my dividend estimate, Wintrust is offering a forward dividend yield of 1.6%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Wintrust Financial. The stock has traded at an average P/TB ratio of 1.41 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 44.0 | 48.5 | 52.1 | 58.9 | ||

| Average Market Price ($) | 85.8 | 69.3 | 47.9 | 78.2 | ||

| Historical P/TB | 1.95x | 1.43x | 0.92x | 1.33x | 1.41x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $67.9 gives a target price of $95.5 for the end of 2023. This price target implies a 6.4% upside from the November 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.21x | 1.31x | 1.41x | 1.51x | 1.61x |

| TBVPS – Dec 2023 ($) | 67.9 | 67.9 | 67.9 | 67.9 | 67.9 |

| Target Price ($) | 81.9 | 88.7 | 95.5 | 102.3 | 109.1 |

| Market Price ($) | 89.8 | 89.8 | 89.8 | 89.8 | 89.8 |

| Upside/(Downside) | (8.7)% | (1.2)% | 6.4% | 14.0% | 21.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 5.86 | 6.03 | 4.68 | 7.58 | ||

| Average Market Price ($) | 85.8 | 69.3 | 47.9 | 78.2 | ||

| Historical P/E | 14.7x | 11.5x | 10.2x | 10.3x | 11.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $9.79 gives a target price of $114.3 for the end of 2023. This price target implies a 27.3% upside from the November 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.7x | 10.7x | 11.7x | 12.7x | 13.7x |

| EPS 2023 ($) | 9.79 | 9.79 | 9.79 | 9.79 | 9.79 |

| Target Price ($) | 94.7 | 104.5 | 114.3 | 124.1 | 133.9 |

| Market Price ($) | 89.8 | 89.8 | 89.8 | 89.8 | 89.8 |

| Upside/(Downside) | 5.5% | 16.4% | 27.3% | 38.2% | 49.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $104.9, which implies a 16.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18.5%. Hence, I’m maintaining a buy rating on Wintrust Financial.

Be the first to comment