KittisakJirasittichai/iStock via Getty Images

Investment thesis

Perella Weinberg Partners (NASDAQ:PWP) faces challenging business conditions for the short to medium term which is priced in the shares. Listing in the market peak for dealmaking in 2021, we see limited upside given the reset of M&A strategies by corporates and changing priorities, together with PWP’s relative weakness as a global firm. We rate the shares as neutral.

Quick primer

Perella Weinberg Partners is an independent global financial services firm focused on investment banking advisory services, providing expertise on M&A, capital solutions, capital markets advisory, and private capital placements. Founded in 2006, the company was listed in 2021 by merging with FinTech Acquisition Corporation IV, a Nasdaq-listed SPAC.

It has around 600 employees in 5 countries, specialize in six industry verticals (consumer & retail, energy, financial, healthcare, industrials, and technology), and has over 1,000 customers. Its key geographic focus is in North America and Europe.

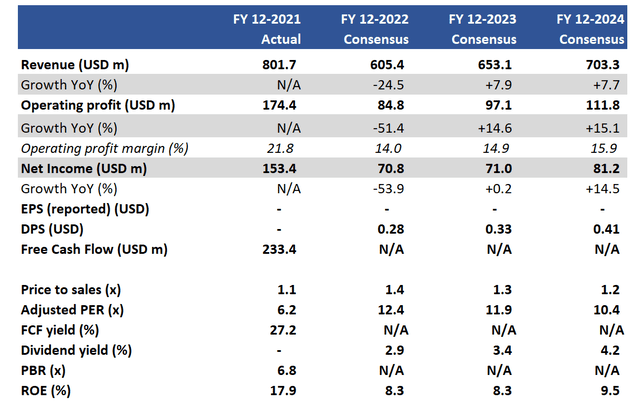

Key financials with consensus forecasts (with adjusted figures)

Our objectives

Perella Weinberg Partners booked record revenues in FY12/2021, but currently faces a challenging macro environment negatively affecting customer activity. Although the gross deal pipeline is said to be stable YoY and full, the announced backlog has declined YoY due to completion risk and a longer timeline to deal completion. With negative sentiment currently affecting corporate executives, in this piece we want to assess whether this is a buying opportunity for the shares.

Strong market positioning

The company has established itself as a market leader as a boutique corporate advisory business with a strong reputation. Often seen as the go-to advisor in key verticals such as technology, energy, and healthcare, the list of deals transacted is an enviable one, including the USD1.2 billion acquisition of Dot’s Homestyle Pretzels/Pretzels Inc by Hershey (HSY), the USD9.5 billion sale of Royal Dutch Shell’s (OTCPK:RYDAF) sale of its Permian business to ConocoPhillips (COP), the USD9.5 billion acquisition of the majority stake in WeWork (WE) by SoftBank (OTCPK:SFTBY), and the pending USD17.5 billion acquisition of a 51% stake in Deutsche Telekom’s (OTCQX:DTEGY) tower business by Digital Bridge. However, in the publicized transactions recent deal sizes have become progressively smaller, highlighting that corporate activity is dampening down in the face of higher rates and financing costs.

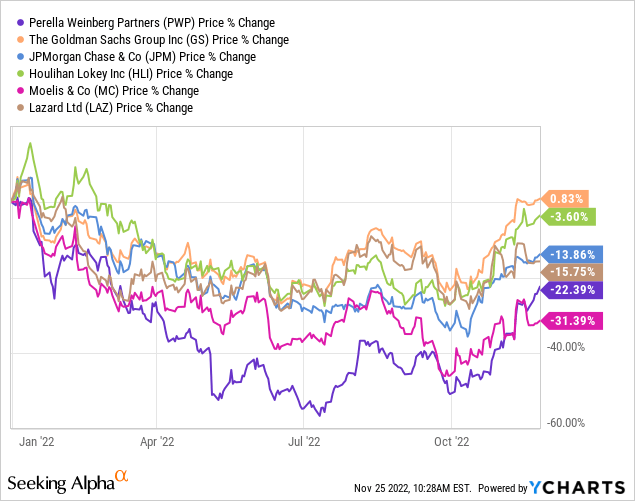

With PWP’s shares underperforming some key peers YTD, we note this highlights some relative weaknesses in the business. Firstly, the lack of geographic reach into Asia places it at some disadvantage versus more global players such as bulge bracket investment banks Goldman Sachs (GS) and JPMorgan (JPM), and specialists such as Houlihan Lokey (HLI) although they have a midcap skew. Secondly, the proportion of employee compensation to sales at PWP can reach relatively high levels even on an adjusted basis, recording 64% in Q1-3 FY12/2022 with plans to raise this by a few percentage points for the full year. This illustrates that the company wishes to motivate and retain its employees, but pays a premium which may result in lower returns for shareholders. Thirdly, although there is no breakdown disclosed, the fact that the company has three offices in Europe where the economy is expected to underperform the U.S. may act as a headwind to their recovery. Essentially, we believe PWP is a focused competitive player in its home markets but may suffer in a downturn versus more diversified peers.

Whilst we cannot make predictions about the global economy, we believe that when sentiment turns and large deals are back on the agenda, PWP will be on the front foot in a position to win business. However, the recent trend of highly-priced activity in the tech sector is unlikely to return (such as the Cloudera (CLDR) deal and WeWork) for the time being.

Limited expectations

We feel in the short term that corporate executives will prioritize capital preservation and keeping their powder dry, as opposed to a proactive assault into the M&A market. There may be more demand for restructuring work (such as asset sales) and liability management (paying debts on time). This may limit the volume of business it can write, but there should be demand given a growing need for private debt advisory as well as the need for companies to retrench.

The company has a net cash position and sufficient liquidity with access to an undrawn revolving credit facility. This should allow it to operate normally for the short to medium term. There have been no recent indications of staff cuts, which should place the business at an advantage once an upturn begins.

We believe company M&A strategies are being reset, with more focus on supply chain resilience and access to technology. The number of megadeals is expected to decline, with deal values falling generally as valuations come down. These characteristics are not positive for all deal advisors including PWP.

Valuations

On consensus forecasts, the shares are trading on an adjusted PER FY12/2023 11.9x, with a dividend yield of 3.4%. These are not expensive valuations but given what appears to be a challenging economic and geopolitical environment for the next 12-18 months, we do not feel compelled to invest in the shares. The company is proactive with share buybacks, but this in itself does not change our view.

Risks

Upside risk comes from a quicker-than-anticipated recovery in the global economy, with sentiment changing positively towards capital markets activity. A U.S.-driven recovery would place PWP in a strong position in its key home market.

Downside risk comes from a prolonged economic slowdown, with conservative dealmaking behavior by corporates. Strengthening headwinds to an economic recovery include sustained increases in interest rates, worsening geopolitical risks in Europe and Taiwan, and greater regulatory scrutiny over M&A. Key personnel leaving will be negative, with the shares available for disposal by staff post-lockup.

Conclusion

PWP is a strong franchise in corporate advisory, and its IPO was timed to perfection as the market peaked in 2021. Unfortunately, we believe it will take some time before earnings can reach previous highs, and the outlook for the short to medium term is one of gradual improvement. Whilst valuations are not demanding, we believe there is limited upside risk and recommend a neutral rating.

Be the first to comment