JHVEPhoto

Investment Thesis: I take the view that Rogers Communications will see little upside in the near-term due to continued uncertainty over the Shaw acquisition as well as a discouraging quarter with respect to churn and ARPU performance.

In a previous article back in October, I made the argument that Rogers Communications (NYSE:RCI) could continue to see downward pressure resulting from uncertainty surrounding the Shaw (SJR) deal – even if churn and ARPU (average revenue per user) metrics have been seeing an improvement.

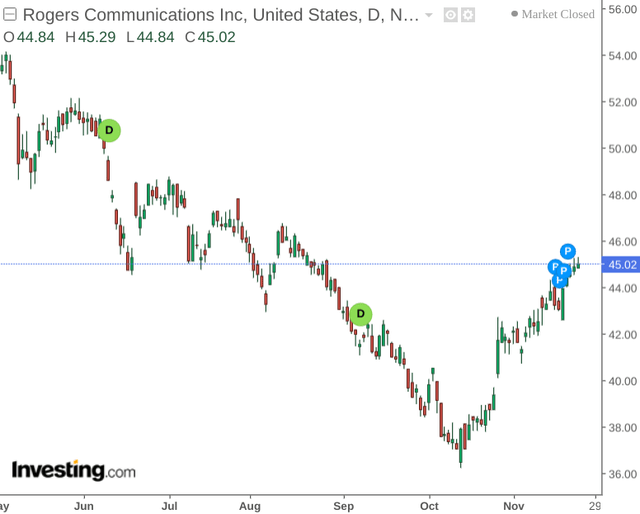

However, the stock has rebounded by nearly 20% since my last article:

The purpose of this article is to assess whether the recent rebound in upside that we have seen in the stock can continue.

Performance

With regards to the Rogers-Shaw takeover, regulatory concerns still do not seem to have been satisfactorily addressed.

Particularly, the Federal Competition Bureau has argued that the deal would result in less competitive pricing and a lower quality of service for customers, despite arguments by the company to the contrary.

Additionally, while the CRTC had approved Rogers’ acquisition of Shaw’s broadcasting services back in March – the Competition Bureau has yet to allow the acquisition to proceed.

While the ultimate outcome for the Shaw acquisition remains unknown – a popular adage in sales is that “time kills all deals”. Investors may increasingly take the view that the longer it takes for the acquisition to go through, the less likely that it is to ultimately do so – even if Rogers is hoping for the transaction to be concluded by the end of this year.

From this standpoint – given that Rogers’ share price is still significantly below that seen earlier this year – investors may have already priced in the possibility that the deal will not go ahead.

From a balance sheet perspective, we can see that the company’s long-term debt to total assets has increased from Q1 2021 to the most recent quarter:

| Q1 2021 | Q3 2022 | |

| Long-term debt | 15670 | 31550 |

| Total assets | 37452 | 54783 |

| Long-term debt to total assets ratio | 0.42 | 0.58 |

Source: Figures sourced from Rogers Communications Supplemental Financial Information Third Quarter 2022. Figures provided in millions of Canadian dollars except ratios. Long-term debt to total assets ratio calculated by author.

While the long-term debt to total assets ratio may have risen in part due to costs associated with the proposed Shaw acquisition – I take the view that investors will increasingly look for evidence of a reduction in long-term debt, particularly if the acquisition ultimately does not go through.

Additionally, for the three months ended September 30 – diluted earnings per share is down by 24% from the same period last year – from $0.94 to $0.71. On a nine month basis, diluted earnings per share is up just marginally from $2.27 to $2.28.

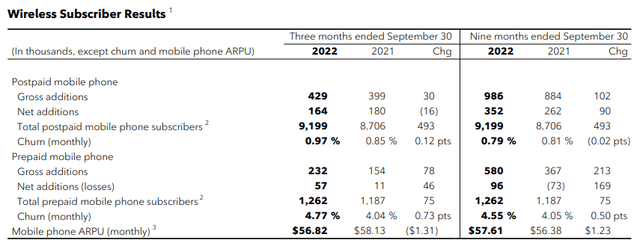

In addition, performance results across the Wireless Subscriber segment were not particularly encouraging, with mobile phone ARPU down by $1.31 on the same quarter last year along with churn up to 4.77% from a prior 4.04% in September 2021.

Rogers Communications Reports Third Quarter 2022 Results

From this standpoint, I do not see any particular bullish drivers that would justify further upside in the stock at this time.

Looking Forward

Going forward, Rogers Communications faces uncertainty as regards to whether the Shaw acquisition will ultimately go through. As mentioned, it is possible that the scenario that it will not has been priced in by investors and downside could be more limited under such an eventuality.

However, the reduction in churn and higher ARPU trends that we were seeing appear to have reversed this quarter – which is discouraging. Additionally, I take the view that investors will be looking for evidence of a reduction in long-term debt going forward. Even if revenue performance rebounds – a continued increase in long-term debt could make investors shy away from the stock.

Conclusion

To conclude, Rogers Communications has seen significant upside over the past month. However, I take the view that little upside for the stock remains in the short to medium-term on the basis of continued uncertainty over the Shaw acquisition as well as a discouraging quarter with respect to churn and ARPU performance.

Be the first to comment