Fahroni/iStock via Getty Images

QuidelOrtho Corporation (NASDAQ:QDEL) has had a lot going on lately, as it continues to work on the integration of Ortho, where costs synergies have improved, won a piece of the $803 million defense contract for COVID tests, and advances its R&D projects Savanna and Sofia.

QDEL is an interesting company because it has grabbed business associated with the outbreak of COVID-19, which while giving it a significant boost in revenue and margin, also can skew the results of the company when business from COVID dries up and earnings results plummet in response to the decline in business from the pandemic.

For that reason, the company has to report two different sets of earnings, so investors understand how its business outside of COVID is doing, as well as the contributions it is getting from that market segment.

In this article we’ll look at the latest report on the improved cost synergies associated with the acquisition of Ortho, progress being made with Savanna and Sofia, recent earnings numbers, and the implications of the new win for COVID-19 tests.

Some of the numbers

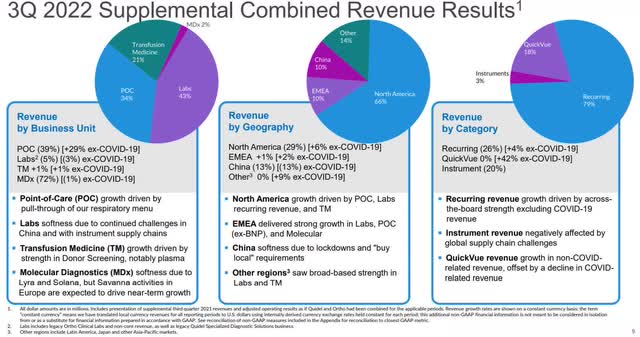

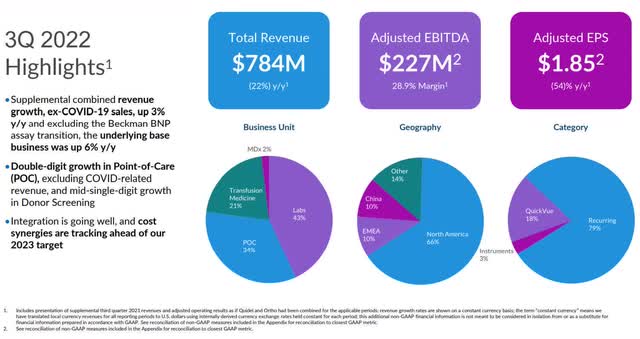

Not including COVID business, revenue in the third quarter was $613 million, up 3 percent year-over-year. Total revenue in the reporting period was $783.8 million. For the first nine months of calendar 2022, revenue was $2.4 billion, significantly up from the $1.06 billion in revenue recorded in the third quarter of 2021.

To give an idea of company growth outside of COVID, total revenue was up 8 percent excluding COVID-related revenue.

Adjusted EBITDA in the third quarter was $227 million, with adjusted EBITDA margin of 28.9 percent. Adjusted EPS in the quarter was $1.85, up 54 percent year-over-year.

Gross profit margin in the third quarter was 56.9 percent, down 540 bps from the third quarter of 2021, primarily from the decline in high-margin revenue from COVID, along with FX impacts.

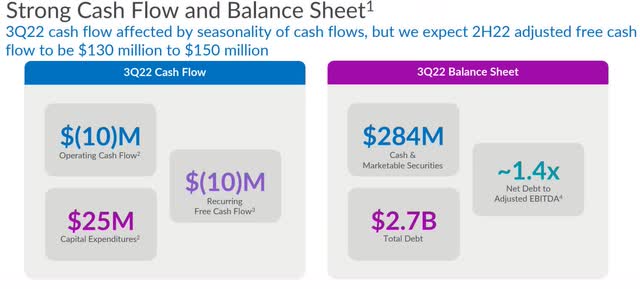

On a GAAP basis, operating cash flow in the reporting period was negative $9.7 million. After $25 million in CapEx and “adding back $26 million in acquisition-related costs,” free cash flow ended up a negative $10 million in the third quarter. Guidance for adjusted free cash flow in the second half of 2022 was lowered from $130 million to $180 million to $130 million to $150 million.

At the end of the third quarter, including marketable securities, QDEL had cash and cash equivalents of $284.3 million, with total debt of $2.7 million. On a supplemental combined basis, the company had a 1.4 times net debt-to-EBITDA leverage ratio at the end of the reporting period.

Synergies from Ortho acquisition

Chairman and CEO Douglas Bryant talked a lot about the integration process concerning the acquisition of Ortho. For the most part things have been going well there, and expectations are things will continue to go fairly smoothly going forward.

The major reason things are proceeding with less friction than most acquisitions are because there is no consolidation of manufacturing facilities, there is no product overlap, and its sales team doesn’t have to start selling certain products in favor of others.

Consequently, the costs of the transition are lower because there was no need to hire a lot of third parties to facilitate the transition, nor transition services typically used in these circumstances.

More important, as the transition process has gone forward, the company has found cost synergies have improved from the previous $30 million to a new target of approximately $50 million in 2023.

R&D projects

While QDEL has a large pipeline of about 100 R&D projects being worked on. With so many projects being worked on, the company engaged in a review in the third quarter for the purpose of optimizing its focus and spend in order to prioritize the allocation of resources “for the most important projects.”

Among those, probably the two most important in the near term are Savanna and Sofia, which are both part of its in vitro portfolio. We’ll look first at Savanna.

Savanna

QDEL announced it has completed development activity for all the Savanna panels it intends to launch in 2023.

Taking into account the limited opportunity for launching molecular panels in the latter stage of the U.S. respiratory season available to the company, along with some uncertainty surrounding changes in the “expedited regulatory path for FDA emergency use authorization,” it is focusing on introducing the panels in Africa, Europe and the Middle East first, where there is strong demand for the panels.

With its sales team already in place and Savanna already cleared by governments, the company believes its strategy of targeting international markets first will allow it to meet the revenue targets it has set for 2023, especially in Europe.

As for the U.S. market, it appears the regulatory path for emergency use authorization by the FDA has changed, and the company sees the quickest path to full authorization for Savanna panels and instruments is to include immediate 510(k) clearance and CLIA waivers. Management said it’s shifting its U.S. strategy in order to bring Savanna to the U.S. market as fast as it can.

Sofia

Now that peak respiratory virus season has just started, the CDC has reported “increasing positivity rates of respiratory diseases, including COVID-19, influenza and RSV.” The flu season has also started sooner than normal in parts of the U.S., including the Mid-Atlantic and Southeast, with cases in the Midwest accelerating.

With positivity rates climbing to 25.5 percent, the highest level in 31 months, and continuing the increase, test revenue from influenza has been higher than expected in what is usually considered a non-flu quarter.

Because of the unanticipated early flu season, distributors hadn’t stocked up yet with a meaningful number of influenza tests, although they did with strep and RSV tests, which don’t generate near the volume flu tests do. As it relates to Sofia, it now has 83,000 instruments placed, up 3,000 from the prior quarter, and points to the possibility demand could significantly increase over the next year or so. Continuing to focus on Savanna and Sofia are priorities for the company because of the significant number of end-users it can provide tests for. Allocating more resources to them to improve and market them is important for the short-term growth of the company.

Finally, demand for in vitro diagnostics has been historically immune to difficult economic environments, so it works very well as a defensive and offensive strategy for the company as it works on growing market share in this important segment of the market.

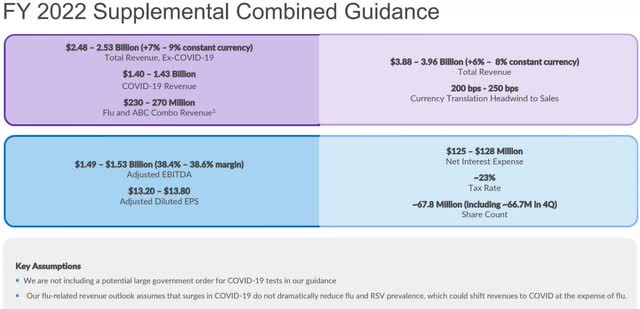

Consequently, revenue related to the flu is guided to increase to a range of $230 million to $270 million, an increase from prior guidance of $200 million to $260 million.

One caveat here is if there is a surge in COVID-19 cases, which would result in a shift in revenue from flu and RSV to COVID.

Recent COVID win

Since COVID test kits generate superior margins than other tests, there were concerns over the performance of QDEL if it was to lose much of that business.

Those concerns, at least in part, can be assuaged because the U.S. Department of Defense announced the companies that will participate in the $803 million contract for over-the-counter rapid antigen COVID-19 test kits, with QDEL being among those that were contracted for delivery of the test kits.

Terms of the contract are that the company must complete the contract by November 21, 2023. This is a good win and will be a nice tailwind complementing the incremental growth of QDEL, while improving its top and bottom lines.

This revenue can’t necessarily be counted on long term, but it will continue to boost the performance of QDEL, taking into consideration investors, in their modeling, need to separate the performance of the company from its regular product line as measured against the addition of the revenue and earnings from COVID test kits.

QDEL didn’t include additional COVID revenue in its most recent guidance, so the numbers are likely to improve significantly, depending on how much of the $803 million contract it won.

With that in mind, full-year 2022 revenue guidance, excluding COVID-related sales, is projected to be in a range of $2.48 billion to $2.53 billion, below the prior revenue guidance of $2.49 billion to $2.57 billion. The decline in outlook is primarily from FX headwinds.

Guidance for revenue related to COVID is $1.4 billion to $1.43 billion for full-year 2022, much higher than previous guidance of $1.29 billion to $1.34 billion.

Assuming a rapid rollout of COVID test kits associated with the contract, those numbers should bump up nicely.

Conclusion

QuidelOrtho has a lot on its plate right now, as it works on integrating the two companies, prioritizing its R&D projects, and continues to benefit from COVID-19 test kit demand, which has attracted taxpayer dollars.

On an organic basis, I like what I see with Savanna and Sofia, and it’ll be instructive to see what the impact those products will continue have on the company.

Taking into consideration all the moving parts outside of COVID-related products, growth is probably going to be in the high single-digits over the next couple of years.

With the company rebounding from its 52-week low of $66.88 in the latter part of September, the major question is how much is already priced in. I don’t foresee any big move one way or the other in the near term, but over the long term it looks like it’ll grow its share price incrementally as the results of the merger are understood over time, how much Sofia and Savanna add to the top and bottom lines, and how much COVID-related business it can continue to win.

Be the first to comment