ipopba

A Quick Take On Marin Software

Marin Software (NASDAQ:NASDAQ:MRIN) reported its Q2 2022 financial results on August 4, 2022, expanding its automation tool offerings while producing lower revenue.

The company provides enterprise marketing software for advertisers and agencies to better manage their digital advertising efforts.

Given the firm’s revenue contraction results in recent quarters, increasing operating losses and cash burn, I’m in a wait-and-see mode, so I’m on Hold for MRIN for now.

Marin Software Overview And Market

San Francisco, California-based Marin was founded in 2006 to develop a suite of digital advertising and marketing software for organizations to improve their search, social, and e-commerce advertising effectiveness.

The firm is headed by founder, Chairman and CEO Chris Lien, who was previously COO of Adteractive and founder and Chairman of Sugar Media.

The company’s primary offerings include its MarinOne performance platform that unifies data from multiple advertising platforms into one system that enables identification and analysis of marketing performance.

The firm acquires customers through direct sales and marketing efforts as well as through partner referrals.

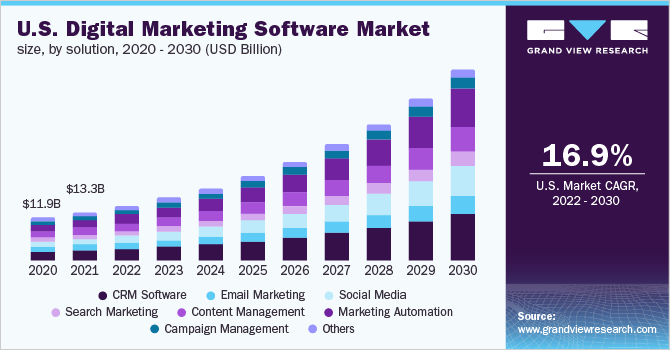

According to a 2022 market research report by Grand View Research, the market for digital marketing software was an estimated $56.5 billion in 2021 and is forecast to reach $272.5 billion by 2030.

This represents a forecast CAGR of 19.1% from 2022 to 2030, an extremely high estimated growth rate.

The main drivers for this expected growth are an expanded use by enterprises of various aspects of customer relationship marketing [CRM] software as well as the changes wrought by the major mobile platforms moving away from advertising identification functions.

Also, the chart below shows the historical and projected future growth trajectory for digital marketing software in the U.S.:

U.S. Digital Marketing Software Market (Grand View Research)

Marin Software’s Recent Financial Performance

-

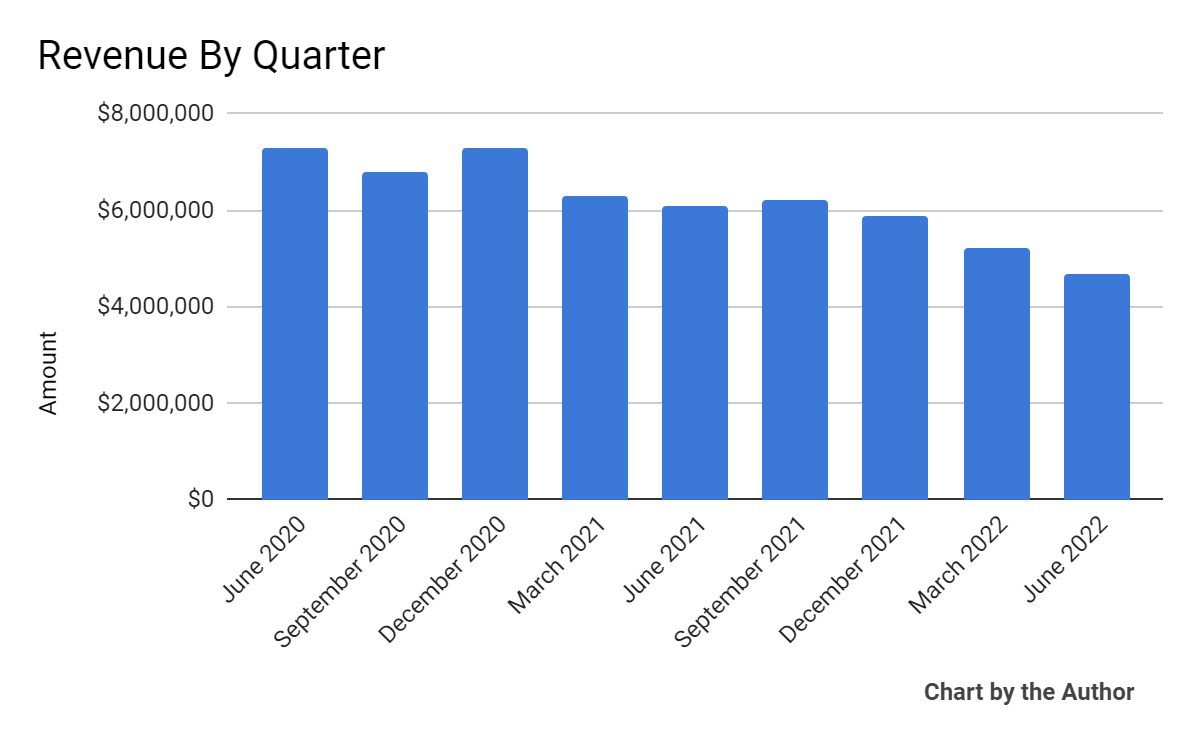

Total revenue by quarter has trended lower in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

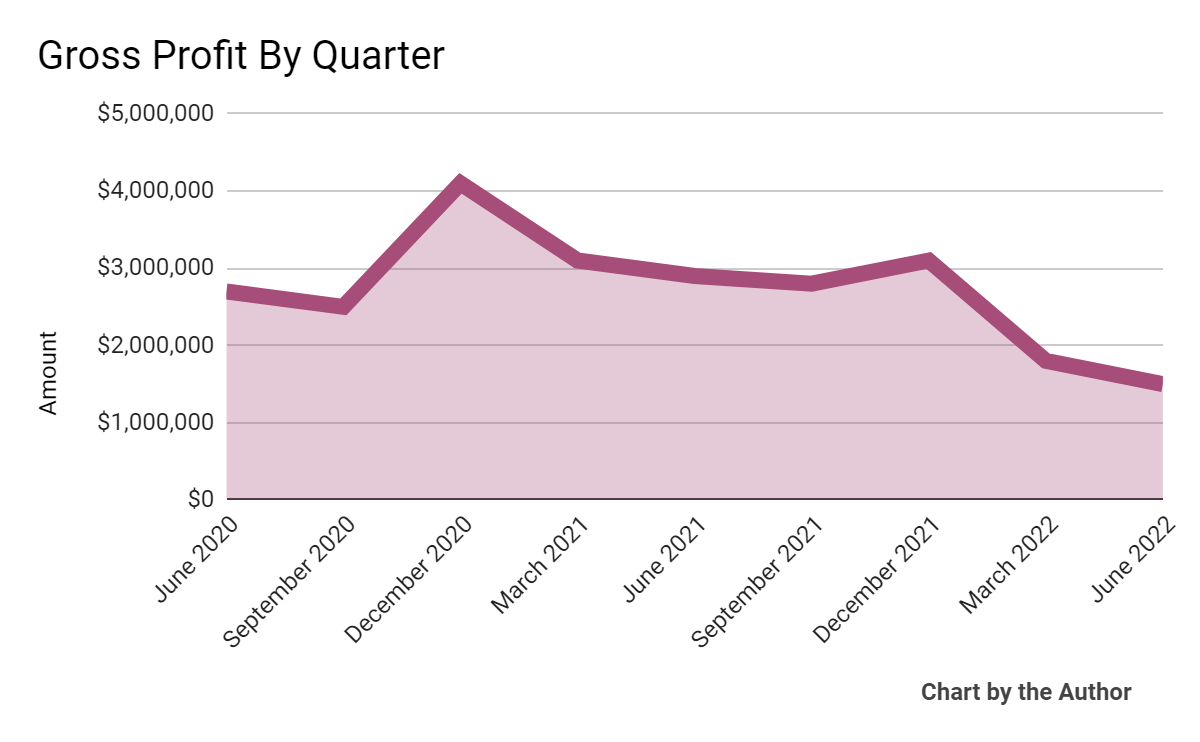

Gross profit by quarter has also dropped, as the chart shows below:

9 Quarter Gross Profit (Seeking Alpha)

-

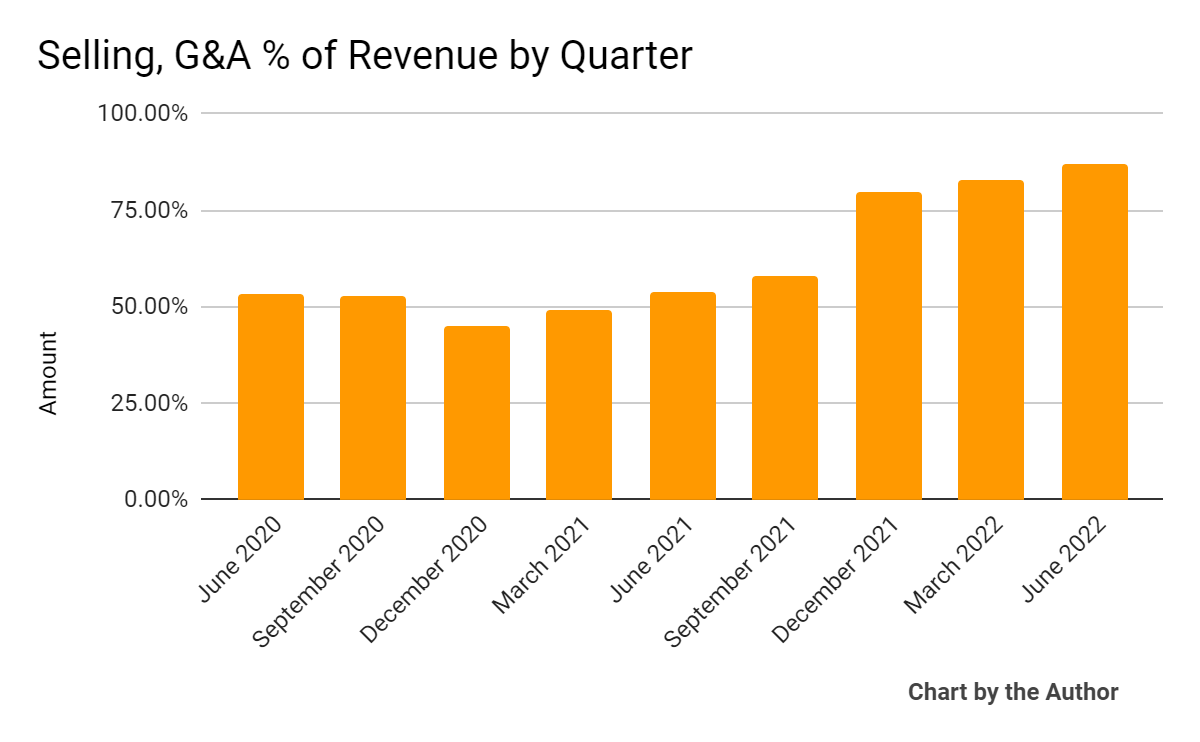

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

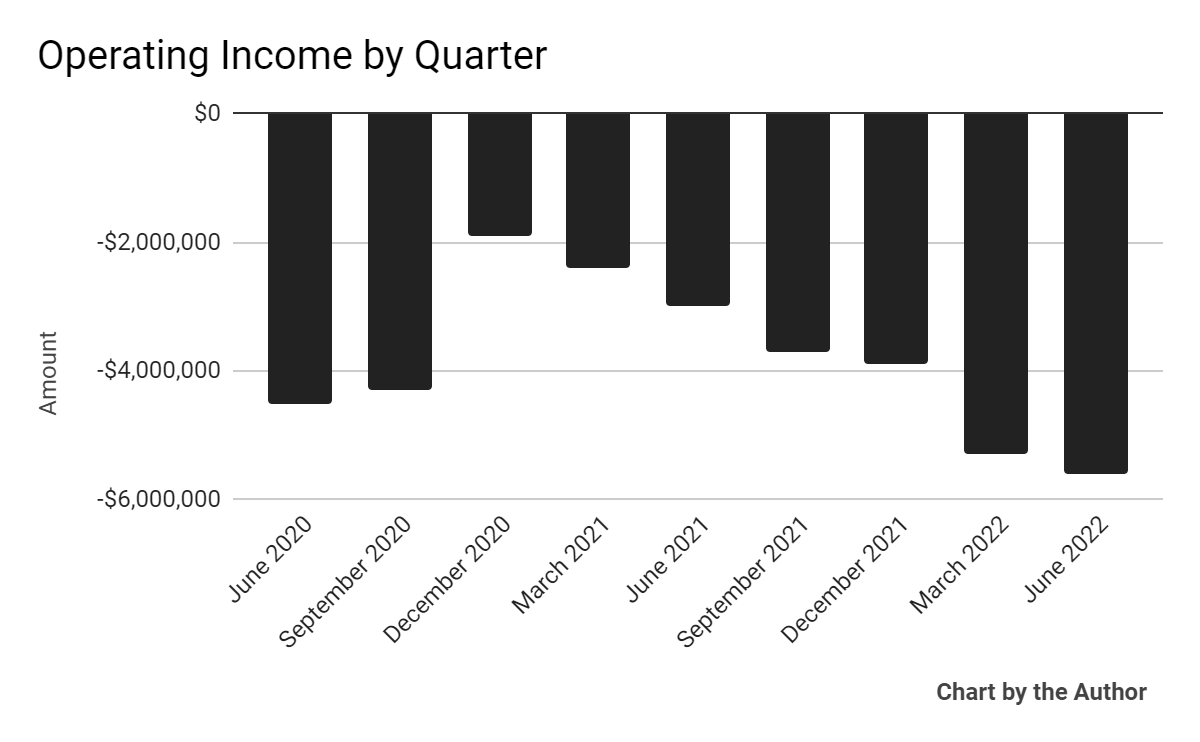

Operating losses by quarter have worsened lately:

9 Quarter Operating Income (Seeking Alpha)

-

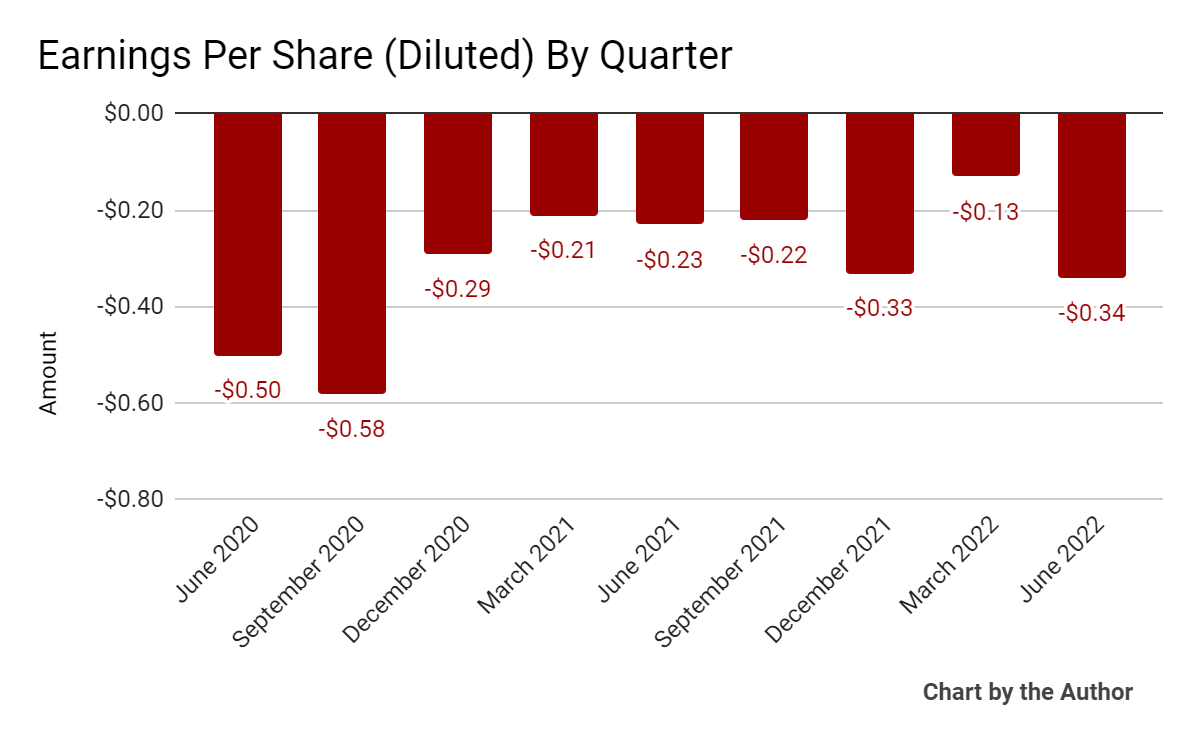

Earnings per share (Diluted) have also remained substantially negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

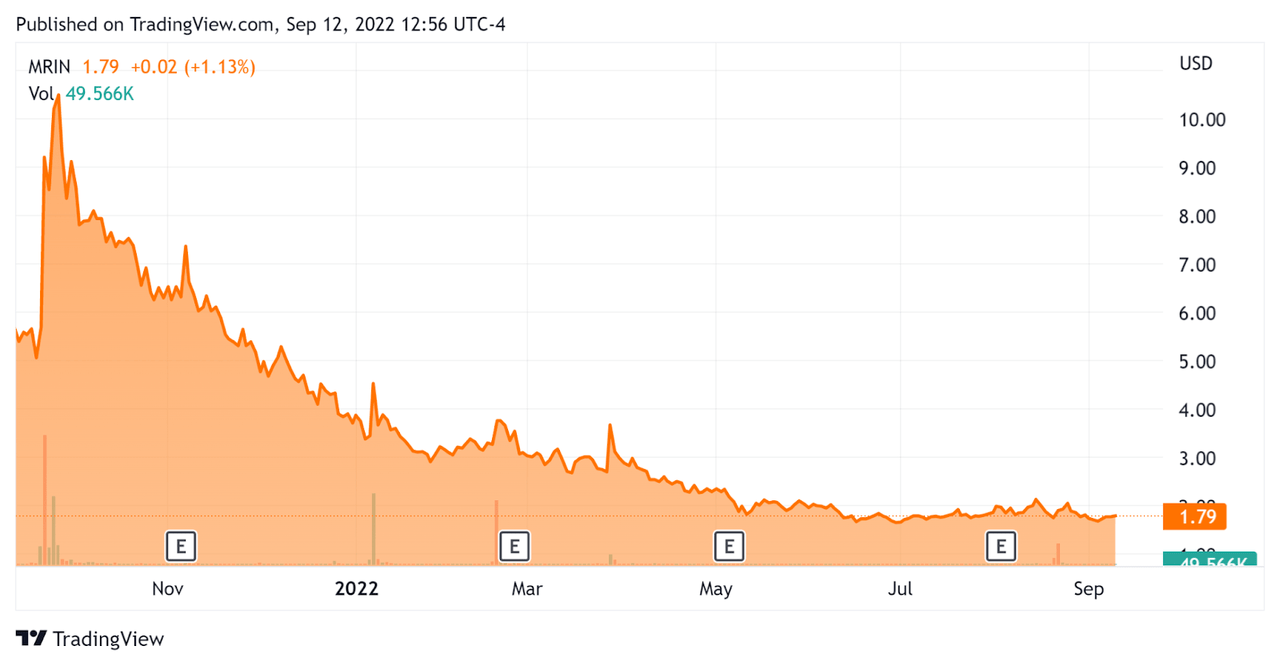

In the past 12 months, MRIN’s stock price has fallen 68.7% vs. the U.S. S&P 500 index’s drop of around 8.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Marin Software

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

-0.19 |

|

Revenue Growth Rate |

-17.2% |

|

Net Income Margin |

-71.3% |

|

GAAP EBITDA % |

-74.1% |

|

Market Capitalization |

$28,260,000 |

|

Enterprise Value |

-$4,110,000 |

|

Operating Cash Flow |

-$13,460,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.02 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MRIN’s most recent GAAP Rule of 40 calculation was negative (91.4%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-17.2% |

|

GAAP EBITDA % |

-74.1% |

|

Total |

-91.4% |

(Source – Seeking Alpha)

Commentary On Marin Software

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its intention to return Marin to growth as it reported a ‘moderation in our revenue decline on a year-over-year basis.’

The firm has experienced a decline in customer digital ad spending due to worsening macroeconomic conditions.

Advertising can be quickly reduced through a few clicks by customers seeking to lower their spending in an adverse economic environment.

No doubt the firm has also been negatively impacted by the ongoing changes in mobile platform advertising identification policies.

As to its financial results, total revenue continued to decline, down 23% year-over-year due to a reduction in customer spending and negative foreign exchange effects of a strong US dollar against the British pound and Euro.

Management didn’t disclose the company’s net dollar retention rate, other than by stating that it ‘saw an improvement in customer retention.’

MRIN’s Rule of 40 results have been highly negative, so the company is in need of serious improvement for this important metric.

Management did not detail any headcount or other expenditure reductions, perhaps because it may view the economic slowdown to be temporary.

In any event, SG&A as a percentage of total revenue rose as did operating losses.

For the balance sheet, the company finished the quarter with $37.5 million in cash, and over the trailing twelve months, it has used free cash of $13.5 million. MRIN has no long-term debt.

Looking ahead, management only provided guidance for Q3, expecting revenue of around $4.75 million at the midpoint of the range and non-GAAP operating loss of $4.7 million at the midpoint.

Regarding valuation, the market is valuing MRIN at an EV/Sales multiple of around negative (0.19x).

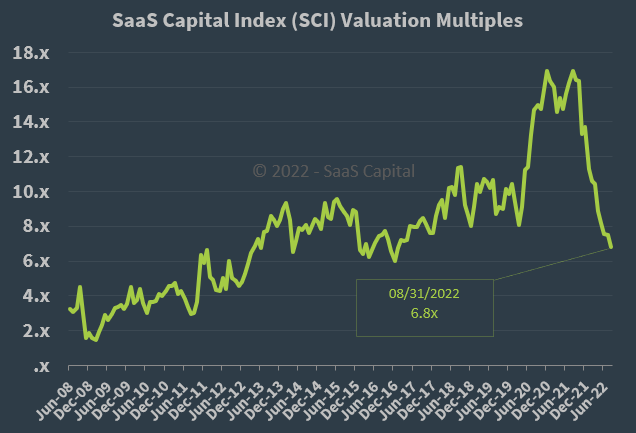

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x on August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, MRIN is currently valued by the market at a large discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which is slowing customer spending.

A potential upside catalyst would be a ‘short and shallow’ economic slowdown, bringing advertiser spend up sooner in that possible scenario.

However, given the firm’s revenue contraction history, increasing operating losses and cash burn, I’m in a wait-and-see mode, so I’m on Hold for MRIN for now.

Be the first to comment