William_Potter

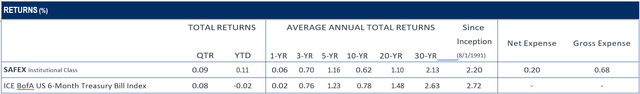

The Ultra Short Government Fund returned +0.09% in the second quarter compared to a +0.08% return for the ICE BofAML US 6-Month Treasury Bill Index (6-Month Treasury). Year-to-date, the Fund returned +0.11% compared to a -0.02% return for the index. In a year where positive investment returns have been scarce, even for ultra-short-term investors, we’re pleased to report even modest ‹green’ (positive) results for the quarter and year-to-date.

The Federal Reserve continued raising short-term interest rates in the second quarter of 2022 in an effort to slow (and eventually reverse) the relentless inflationary pressures in the U.S. economy. The quarter experienced the first back-to-back Federal Open Market Committee (FOMC) meeting hikes since 2006 and the largest increments (0.5% in May and 0.75% percent in June) in 22 years.

The Federal Funds Rate, which was 1.75% as of June 30, 2022, is forecast to continue increasing meaningfully, with some economists predicting a Fed Funds rate as high as 4% by year-end.

The Federal Reserve’s monetary policy decisions (e.g., changes in short-term interest rates) will continue to affect all investments within our opportunity set. As a result, our yield and return will invariably follow the path dictated by the Federal Reserve’s monetary policy, as we frequently reinvest maturities with holdings that mature in a short period of time.

As of June 30, 81.5% of our portfolio was invested in U.S. Treasury notes, 5.8% in investment-grade asset-backed securities, and 12.7% in a high-quality money market fund. The average effective duration decreased from 0.2 years on March 30, 2022, to 0.1 years on June 30, 2022. The Fund’s 30-day yield increased approximately 32 basis points in the quarter to 0.56% as of June 30. A more forward-looking data point is the Fund’s yield-to-worst (YTW), which stood at 1.4% as of June 30.

Given the Fed’s intentions to continue raising short-term interest rates (possibly at each of their four remaining meetings in 2022), the Fund’s 30-day yield will likely increase in the months and quarters to follow as we re-invest maturing investments at likely more favorable levels. The Fund’s historically low duration level on June 30 (0.15 years) will aid in actively taking advantage of improved forward return opportunities.

Under normal market conditions, the Fund will invest at least 80% of its net assets in obligations issued or guaranteed by the U.S. government and its government-related entities. The balance of Fund assets may be invested in U.S. investment-grade debt securities. Additionally, the Fund will maintain an average effective duration of one year or less. Duration is a measure of how sensitive the portfolio may be to changes in interest rates. All else equal, a lower-duration bond portfolio is less sensitive to changes in interest rates than a bond portfolio with a higher duration.

Over time, this shorter-term focus (duration of less than one year) is intended to generate higher total returns than cash or money market funds, while also taking less interest rate risk than a bond portfolio with a higher duration.

The Fund’s principal investment strategies and objectives of providing current income, protecting principal, and providing liquidity remain our primary goals.

Thank you for your investment and confidence in our firm.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment