sankai

“The machines have finally come for the white-collared, the college graduates, the decision makers. And it’s about time.

-Grandmaster Garry Kasparov, Deep Thinking.

In 1997, chess master Garry Kasparov faced off against IBM’s “Deep Blue” chess computer in New York City as millions followed online. Deep Blue won, effectively ending the era of man and ushering in the era of the machine. Today, you can download chess programs like Stockfish on your smartphone that will wipe the floor with the best chess players in the world. And now, the Internet is awash with speculation after the release of a bombshell AI chatbot from OpenAI. I’ve tested it out and it’s scary good. The bot has gathered over 1 million users in less than a week (Instagram, for example, took about 3 months!). Prominent venture capitalists have issued stark predictions that AI could put Google (NASDAQ:GOOG) (NASDAQ:GOOGL) out of business. It feels a million miles away from the quiet Mediterranean town I’m currently writing this from, but having tried out the chatbot, there’s an unmistakable feeling that there’s something big happening here. I’m going to defend Google here due to the company’s incumbent status and heavy investment in AI.

I recently went on the popular Millenial Investing Podcast and gave a full-throated recommendation for Google stock. For reasons we’ll get into below, I believe Google will be the most valuable company in the world in five years’ time and could keep the crown for decades. This is partially despite advances in the AI space and partially because of them.

But first, a poem.

The stock market rises and falls, like the ebb and flow of the sea,

It can bring great wealth to some, but also financial misery.

With every boom and every bust, it keeps us on our toes,

The investors who can weather the storm, are the ones who ultimately succeed, I suppose.

So if you dare to play the game, be prepared for the ups and downs,

The stock market is not for the faint of heart,

But for those with a strong will and steady hands.

So, I actually didn’t write this poem–ChatGBT wrote it for me. This feels like Star Trek with some of George Orwell’s 1984 and Aldous Huxley’s Brave New World potentially thrown in.

- Students are having ChatGBT do their homework.

- Professors are giving them A grades.

- The machine wrote a Seinfeld episode.

- It likes to make jokes about politicians.

- It’s able to solve complex tasks in Microsoft Excel and Python.

It gets crazier when you actually test it out. And what better way to test its social skills than asking for advice on talking to girls!

The bot recommended simple, friendly dialogue and focusing on shared interests. Actually not bad! It also recommends buying your potential “soulmate” a drink if in a bar or club. If the conversation goes well it recommends buying them another, although the computer steps in to warn you to be aware of your limits with consuming alcohol (lol). It’s uncanny how the AI is able to understand things like social situations but is also able to do high-level mathematics or write poems for you. It’s wrong sometimes, sometimes hilariously so, but the potential is there for any number of applications in a business setting.

I asked my friend Hailey Yoon, co-founder of Dubai-based tech startup IO21 about this, and to my surprise, she said that this is not overblown– she believes ChatGBT is a bona fide threat to Google. She went on to say that the documentation for the chatbot is excellent, which is rare for this type of product. This makes the bot even more powerful than it appears at first glance because it can rapidly learn and improve.

I’m not saying it will completely replace Google istelf, but ChatGBT is a huge threat for sure. It has the potential of offering a more accurate and suitable search result.

-Hailey Yoon, co-founder/CTO, IO21.

I’m much more constructive on Google’s future than some industry observers, but it’s fascinating to see the opinions of very successful people in various industries on the potential of this. Garry Kasparov suggests that AI could replace a surprising number of white-collar college-educated employees, much in the way that globalization crushed manufacturing employees previously. On a bit of a darker note, Twitter users have been able to seek advice on committing burglary and hacking the Pentagon by convincing the computer it’s just for a screenplay. Also, dare I say, after engaging it in some conversation, I believe the machine has taken on some of the politically correct, corporate-liberal tendencies of Silicon Valley. It’s not necessarily a bad thing for a chatbot to be polite, but it gets back to age-old debates over censorship, critical thinking, and the ability of minorities to dissent from the majority.

I asked the chatbot the best way to make a million dollars in the stock market and it recommended buying and holding a widely diversified portfolio of stocks. That’s not a bad answer, but there’s no real insight to be gained there – the machine has simply reverted to conventional wisdom. I pressed it on whether it would recommend any more specific strategies and it demurred, basically saying it wasn’t up-to-date enough to answer. I guess my own career is safe for now. I’d be more worried if I were a pharmacist or an entry-level software engineer.

But with this in mind, let’s dig more into Google and whether AI is a threat or an opportunity for them.

Open AI Is Not Likely To Crush Google

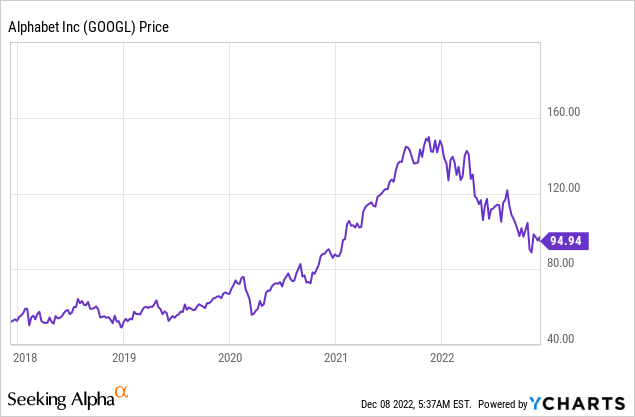

Google is down a lot this year, but it’s from worries over the macroeconomic picture and the Fed, not fears of being put out of business by AI. One thing that AI probably doesn’t understand is that if you’re a venture capitalist, you have a strong incentive to make bold claims on Twitter. The main reason that this is so is that you charge investors 2% management fees and 20% of profits if they invest in your “disruption fund” or whatever you choose to call it. OpenAI’s chatbot is spooky good, but Google has massive market share already, has invested substantially in AI with projects like DeepMind and AlphaGo, and has a fundamentally different purpose than the chatbot. One Google engineer was even put on leave for claiming that their AI was “sentient.”

The main issue with the chatbot in my mind is that it lives and dies by its algorithm to generate an answer, whereas Google presents different sources which are generally ranked by how many other websites have linked to it. This makes Google search an extremely effective tool for finding accurate information by cross checking different sources. Google really shines when consumers are searching for information about their needs and Google is able to match them with businesses that can match those needs. Google makes the lion’s share of its money from advertising, hence the dire warnings from various VCs about their business.

For an example of a cash-cow keyword for Google, let’s say someone searches “personal injury attorney Miami-Dade County.” Personal injury attorneys are big business in Miami, consumers generally search for them with the intent to do business, and Google is the dominant search provider. Therefore, law firms are willing to pay big bucks for clicks from search terms like “car wreck attorney” or “personal injury lawyer.” OpenAI could potentially compete here, but Google already has an elegant system set up. Firms compete for placement based on their SEO which Google monitors to make sure the playing field is fair, or businesses can place ads and pay per click. This is an extreme example because the clicks here are incredibly valuable, but it goes to show that Google generally does a good job of giving users what they’re looking for. There’s a lot of debate now over whether the content created by OpenAI would be attractive to advertisers. Time will tell.

Also consider Google’s ownership of YouTube, which takes a completely different approach from AI-generated content. Instead of an omniscient AI, millions of users are able to upload content on everything from how to run an Airbnb (ABNB) business, to how to hit a sand wedge, to gardening, to fitness. YouTube has a dominant share of the online video market and a massive network effect, and AI isn’t designed to be used in the way YouTube is. ChatGBT is incredibly powerful, but I’m still figuring what the best uses are for it. For Internet research where there are differing opinions, conflicts of interest, or time sensitivity, Google seems to be king. However, according to itself, the AI is capable of generating deeper answers than search engines and is able to create and generate content, rather than just query it. Consider also that Apple could have attempted to replace Google as the default search engine for iPhones, but hasn’t done it, because they can’t create a better product than Google can. But the history of tech shows that as the incumbent, Google is perfectly capable of harnessing AI and turning a threat into an opportunity. Think of Google as the library, whereas the AI chatbot is the librarian.

Google Could Benefit From The “AI Threat”

In a typical article, we’d dive mainly into Google’s financials, whereas in this article we mainly have assessed whether AI is an existential threat to the company. But I believe that if anything, AI is as much of an opportunity for Google’s business as it is a threat. Google spends heavily on R&D, including in the AI space. Google has a dominant market share in search. The company is capable of waging a micro-level battle against competitors by hiring away talent to work on AI for Google, as well as macro-level tactics such as acquiring competitors. Tech companies are vulnerable to disruption – that’s the nature of the beast. Instagram posed an existential threat to Facebook (META), so Zuckerberg shelled out a billion dollars for the company. It ended up being a great deal for Meta, which was able to benefit from the disruption of its own business.

Disruption is inherent to the technology business, and this threat never really goes away. A few farsighted VCs will continue to make fortunes from spotting these trends, while the industry at large will mostly make money from fees. And that’s what I really see here – a few technologists have made crazy fortunes by adding value, but we can probably learn more about human nature and business from the past than we can on speculating about the future.

Is the main threat to investors a competitor that disrupts you out of business, as Apple (AAPL) did to Research In Motion (BB)? Or is the real threat when investors pay 100x earnings for a business and the growth doesn’t work out as planned–losing 90% of investor capital? I’ll reiterate, AI is likely to be just as much of an opportunity for Google as it is a threat. The difference for Google is that you can buy the company for a mere 18x 2023 earnings estimates and get analyst expected growth going forward of 12 to 15% per year. Earnings estimates for 2023 have been revised down on account of the economy and they may be revised down some more still. But contrast this with Apple, where analysts expect mid-single-digit growth going forward at a higher valuation than Google. Google is simply not a recession-proof stock, and that’s why it’s down sharply off of all-time highs. Could AI be a long-run threat to Google? It certainly could be, but I think Google is one of the last businesses I would worry about being crushed by automation and AI. If you think this is going to be a megatrend, I’d think the disruption will occur more to brick-and-mortar businesses that deny the utility of AI and data and are still stuck in their ways.

Thematic Ideas In Big Tech

When you look at the numbers, I believe Google has the best long-run growth prospects and the best risk-reward profile. The main point of my appearance on the Millenial Investing Podcast was to take some deep dives into big tech. They’ve had actual famous people like billionaire David Rubenstein on there, so it was an honor for me to go on and be able to talk markets with them. I’ll draw up my key insights below for readers.

- I believe Google is currently the best big tech stock based on valuation and growth prospects. Google has several share classes, and class A stock under the ticker GOOGL is superior to class C stock (GOOG).

- Google is a better play than Apple, which is historically far more prone to sales downturns despite being today’s premiere tech juggernaut. If you do like Apple, you’re better off buying Berkshire Hathaway (BRK.B). 40% of Berkshire’s market cap corresponds to the value of its Apple holdings, setting up a very interesting semi-arbitrage where you get a bundle deal on Apple by buying Berkshire, plus a lot more cash flow compared to the purchase price. To buy Apple as a standalone, I honestly think you need to pay <$100 to get enough compensation for your risk.

- Microsoft (MSFT) is on the borderline of being at the price where it would offer above-market compensation to investors, in my opinion. Somewhere around $210 is where I think you can snap some up and get comfortably above-market returns.

- Amazon (AMZN) and Tesla (TSLA) are vulnerable not because of epic disruption coming out of left field, but because they could fall another 50% and still not be cheap on a P/E or cash flow basis. This is old-school thinking!

- Meta is dirt cheap and could be worth a shot for patient investors at the current price, but there’s a lot of idiosyncratic risk (i.e. problems) there.

What do you think about which big tech stocks are worth buying? And will AI be a category killer or a benefit to existing companies like Google? As always, feel free to share your thoughts in the comments!

Be the first to comment