Galeanu Mihai/iStock via Getty Images

Introduction

A few months have passed since I covered fertilizer companies. As it’s a quickly developing topic, it’s time to once again dive into one of the most important global macro trends: Fertilizer prices and shortages. What started in 2020 as a simple demand-drive uptrend in fertilizer prices has turned into a full-blown crisis made worse by energy shortages and the war in Ukraine. Even worse is that we’re at a very tricky point in the cycle. Some are starting to bet on easing energy prices as we’re past peak panic. Unfortunately, we’re far away from normalization, as the energy crisis isn’t over. Even worse, supply is expected to remain tight, which will put a floor under agriculture commodity prices. It’s a “death by a thousand cuts” scenario, which is almost uninvestable for traders trying to time the market. Investors with a long-term view are in a better position.

In this article, I will update you on the fertilizer crisis and explain how I’m dealing with the two largest fertilizer holdings in my portfolio: CF Industries (NYSE:CF) and The Mosaic Company (NYSE:MOS).

So, bear with me!

The Importance Of This Crisis

Or, why I cannot sh*t up about agriculture.

Back in 2020, the agriculture bull case was fun. The demand came back after the 2020 lockdowns. This included higher demand for meat, ethanol/biofuels (corn, soybeans), and higher imports from countries like China. Crop prices rose, but inflation was still contained. Everyone was having fun, so to speak.

Then, things changed. The energy crisis became a thing. The energy supply wasn’t able to keep up with demand. This was made worse by the war in Ukraine and the related export stop of natural gas from Russia to Europe.

Before we continue to talk about these issues, let me explain why this agriculture discussion is so important.

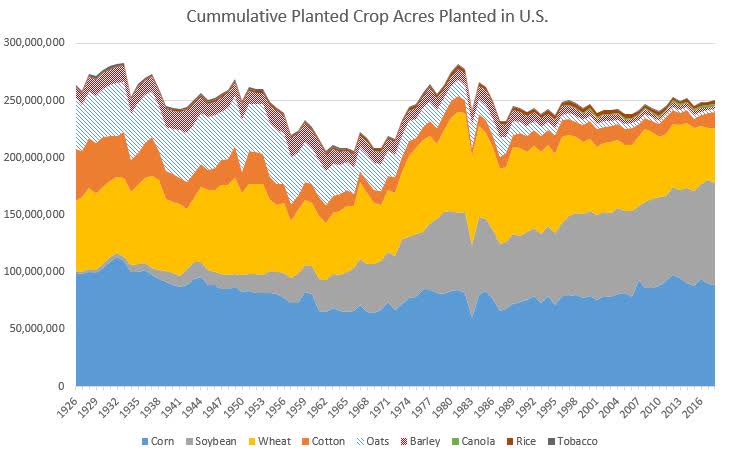

Using corn as a proxy, we see that planted acres of the US’ most important crop has been steady since 1926. Currently, the US plants roughly 90 million acres of corn. In 1926, that number was similar. Incorporating all key crops, planted acres are even down. That makes sense as the US has become highly industrialized with large metropolitan areas, reducing arable land.

Jayson Lusk (jaysonlusk.com)

Needless to say, since 1926, the global demand for crops has exploded. Back then, the world population was just 2 billion. It’s 4x bigger now.

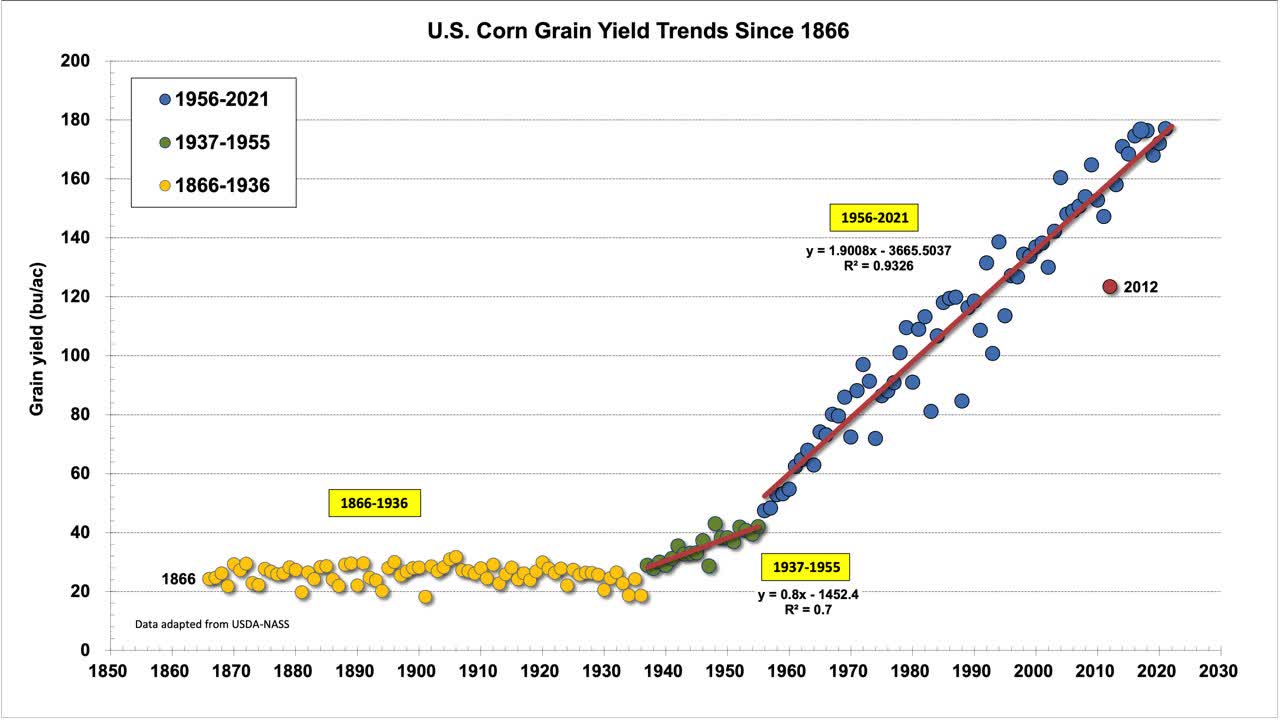

Hence, the chart below is one of the greatest charts I’ve seen in a very long time. Once you understand what’s going on in the chart below, you know why I cannot stop talking about agriculture.

What you’re looking at below is the corn yield per acre. In the 1930s, farmers harvested roughly 20 bushels of corn per acre. That number rose to 40 shortly after the Second World War. It then started a huge uptrend to roughly 180 bushels per acre. In other words, the US is producing 9x more corn compared to 1930 without increasing planted acres.

Purdue University

Now, the important thing is understanding why that is. After all, 1930s farmers weren’t stupid. They just didn’t have access to that one important thing.

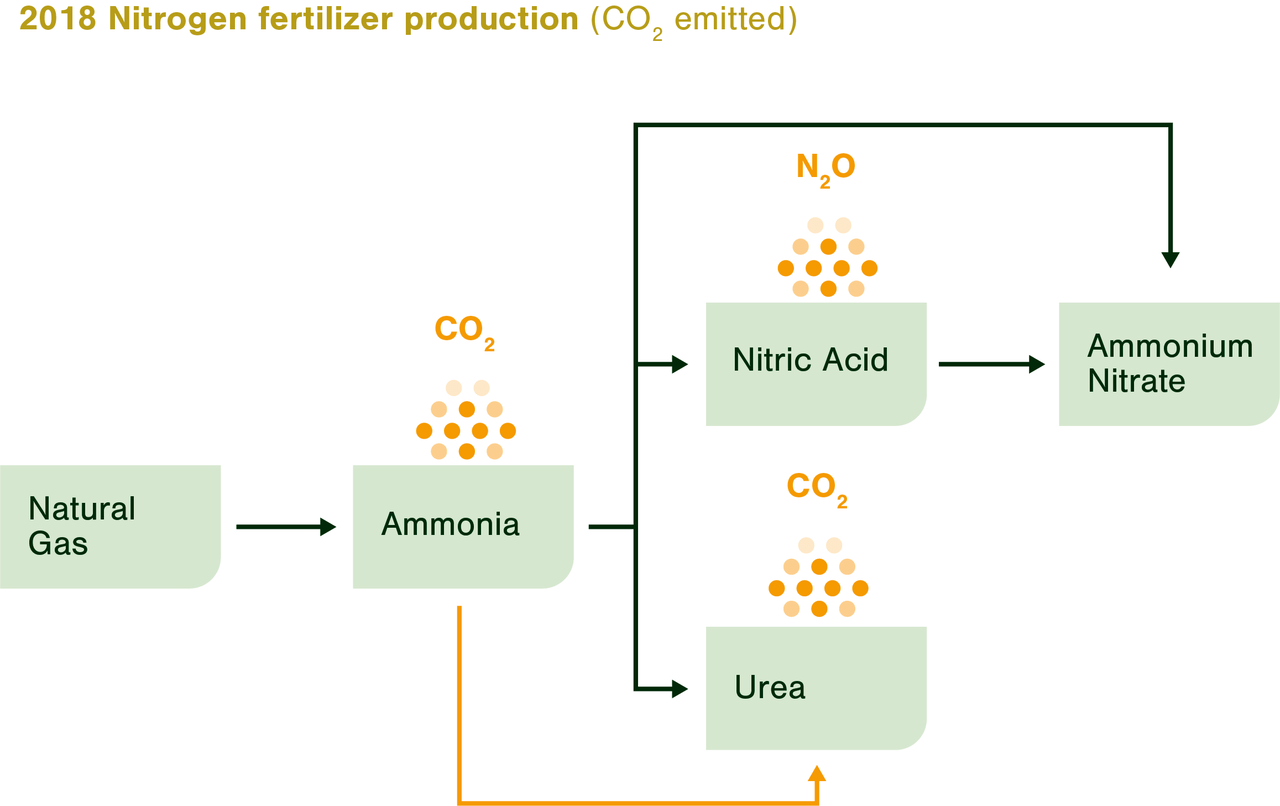

That one thing is fertilizer – among other things.

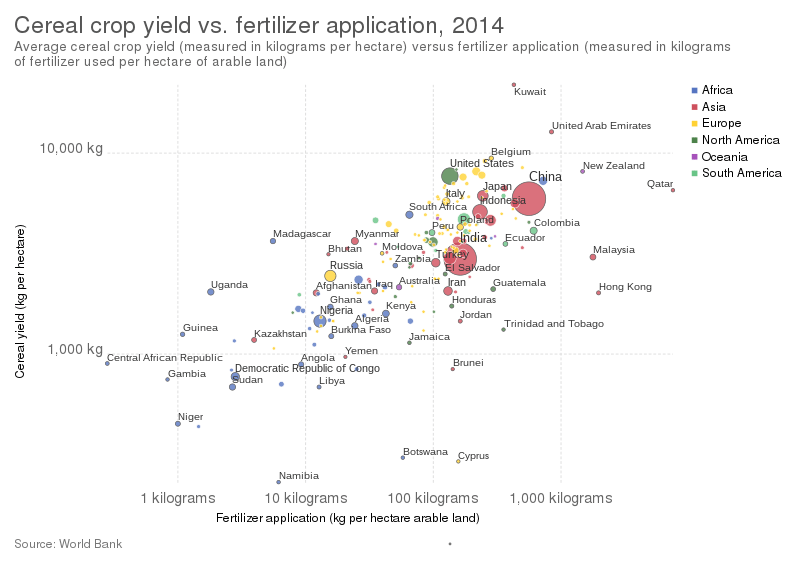

Earlier this year, Goehring & Rozencwajg wrote a terrific paper on risks in agriculture. They highlighted the difficulty to model expected crop yields due to the influence of so many factors. After all, drivers of higher yields include fertilizers, GMO crops (better seeds and bigger plants), as well as precision farming techniques.

However, they were able to use machine learning to research the impact of fertilizers (in this case nitrogen).

Their findings are nothing short of impressive:

[…] we estimate that as much as 40% of coarse grain yield increase since 1961 can be attributed to increased nitrogen application.

Moreover:

We believe that a 5% reduction in nitrogen application could result in an immediate 1 to 2% reduction in global grain supply. Given the existing tightness, such a drop will have an outsized impact on supply-demand balances going into the 2022-2023 planting season.

Let me give you a few more numbers. Using rice as an example, we’re risking a 10% drop in yields versus normal levels due to fertilizer shortages. That would be a loss of 36 million tons or 7% of the world’s rice supply. That lost supply could feed 500 million people.

A cut of 20% in Brazilian potash application could decrease the important soybean crop by 14%.

World Bank

And, that’s not everything. The Mosaic Company summarized scientific findings, which show a dire picture – in light of the scarce fertilizer supply:

A survey of U.S. crop production estimated that average corn yields would decline by 40 percent without nitrogen (“N”) fertilizer. Even greater declines would occur if other macronutrients, phosphorus (“P”) and potassium (“K”) were also limited. Numerous long-term studies have also demonstrated the contributions of fertilizer to sustaining crop yields. For example, long-term studies in Oklahoma show a 40 percent wheat yield decline without regular N and P additions. A long-term study in Missouri found that 57 percent of the grain yield was attributable to fertilizer and lime additions.

What’s New?

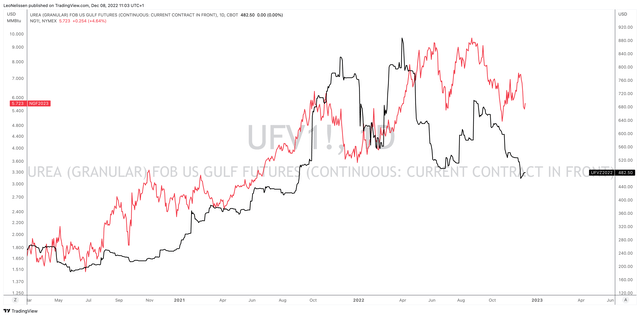

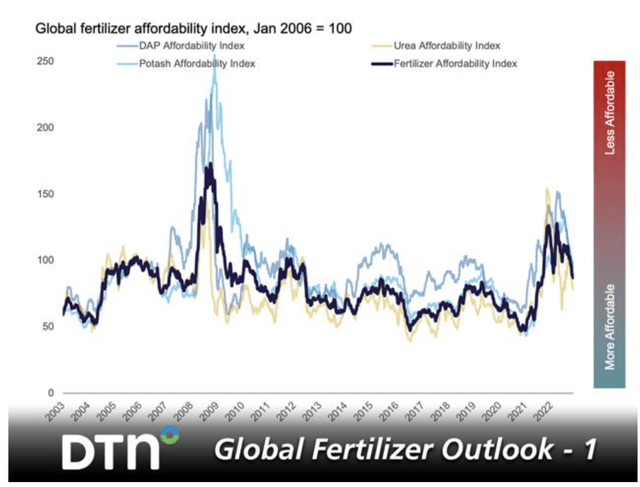

The good news is that the crisis isn’t as bad as it was earlier this year when Russia’s invasion of Ukraine started. The chart below shows that Urea (nitrogen fertilizer) futures have come down. Urea is down almost 50% from its 2022 peak. This move is accompanied by lower natural gas prices, which is the key feedstock for the production of Urea-based fertilizers.

TradingView (Black = Urea, Red = Henry Hub)

It’s not just fertilizers and natural gas. Copper, oil, corn, wheat, and lumber (to name a few key commodities) are all coming down.

That’s why we’re now at such a difficult point in the cycle (as I mentioned in the introduction). The risk/reward for buyers isn’t as good as it was in 2020 and 2021. However, people betting on a trend to a price normalization might be betting on the wrong horse.

After all, this situation is far from resolved. The same goes for severe supply issues in natural gas and oil. As soon as economic growth expectations come back, I believe oil will be trading north of $100 again. The current environment is completely dominated by demand fears in light of the upcoming recession.

Unfortunately, problems aren’t over as Bloomberg summarized so well on Dec. 7.

Bloomberg

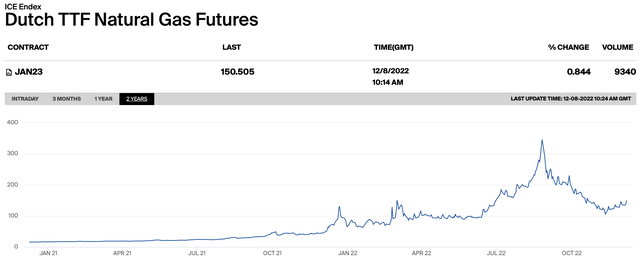

In September, 70% of European nitrogen fertilizer production was offline. Gas prices were so high that production was not profitable. While gas prices have come down, prices are still 7.5x higher compared to pre-crisis levels.

Intercontinental Exchange

The worst part is that these prices are extremely unlikely to normalize. Bear in mind, Europe had support from Russian gas flows in 2022 to boost gas inventories. They will not have that benefit going into 2023. Gas storage levels will be depleted in early Spring. Boosting these levels will be much tougher than anything we’ve seen so far in 2022.

At this point, Europe lacks 30% of NPK fertilizers (nitrogen, phosphates, potash).

Hence, to quote the aforementioned Bloomberg article:

The nitrogen fertilizer deficit can’t be plugged by imports of urea and logistics challenges in the first quarter are likely to underline the importance of local plants for European farmers, Bige said.

“There’s still a good chance to deliver good volume of yields this coming season if the right form of nitrogen is applied in right time and amount,” he said. “It will be crucial in the spring to have the product delivered on time.”

German agriculture paper Agrarheute confirms these findings (translated):

On the futures market in the USA, at any rate, prices for urea have recently risen again after falling to a 6-month low at the end of November. In early December, January futures went from $480 per tonne to $520, and March is back to $540 per tonne.

“With natural gas prices still high and major market disruptions due to the Russia-Ukraine war, we do not expect fertilizer prices to normalize in time for farmers’ 2023 crop planning,” said Kevin McNew, chief economist for the U.S. Farmers Business Network, in his own research on the fertilizer market going forward.

Progressive Farmer (DTN)

Allow me to add one more quote. In this case, Progressive Farmer shows the impact problems in Europe have on the global fertilizer market:

Some newer facilities probably restarted, but many older plants might not come back online. This would be a negative, Linville said.

He explained that west and central Europe produce roughly 5% of the world’s supply of urea, 21% of the UAN supply and about 8% of anhydrous ammonia supply. So, production supply concerns in Europe will filter down and affect supply and price in the global market, he said.

To summarize, we are likely in a situation where (global) fertilizer prices remain at elevated levels, prone to short-term price spikes. It will impact application rates and subdued yields in 2023 – and likely beyond unless something changes.

What This Means For Mosaic And CF Industries

CF Industries and Mosaic are two giants that both dominate the areas they operate in. They have a huge footprint in nitrogen and potash fertilizer production.

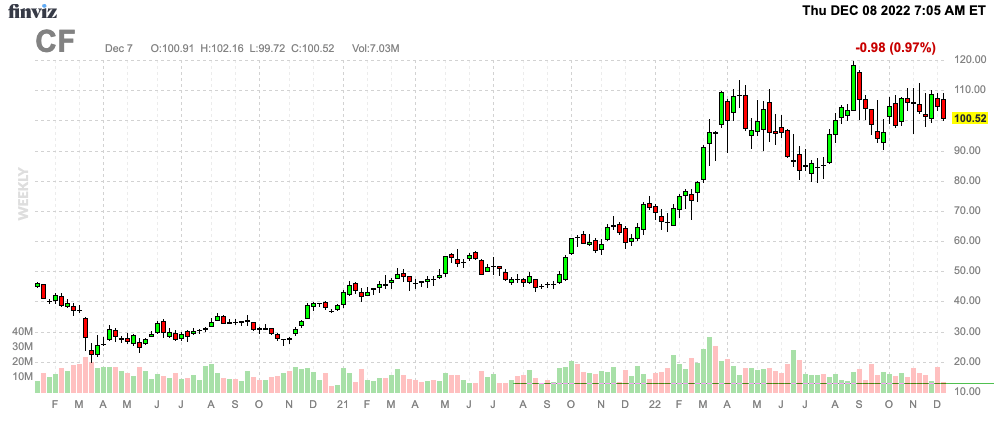

CF Industries

FINVIZ

Located in Deerfield, Illinois, CF is a major producer of nitrogen-based fertilizers. The company sells 78% of its products in the United States, where it operates five major plants producing ammonia and related products. The company also operates plants in Alberta and Ontario (Canada), as well as Ince and Billingham in the United Kingdom. It also holds a stake in operations in Trinidad.

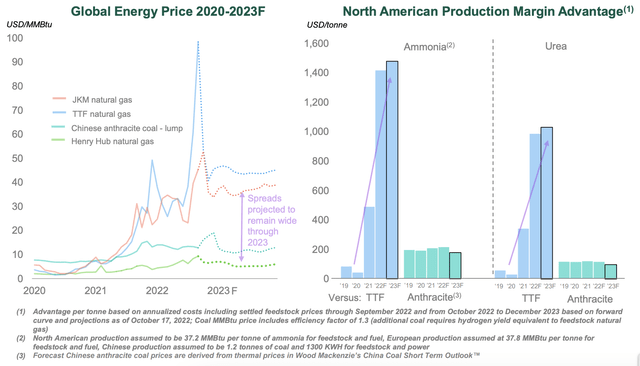

As natural gas is the key feedstock of Urea production, CF Industries benefits from one thing in particular: Favorable natural gas price differentials. While natural gas prices in North America are also up, they are still way more competitive than prices in Europe and Asia – to name two key markets.

EU ETS – Fertilizers Europe

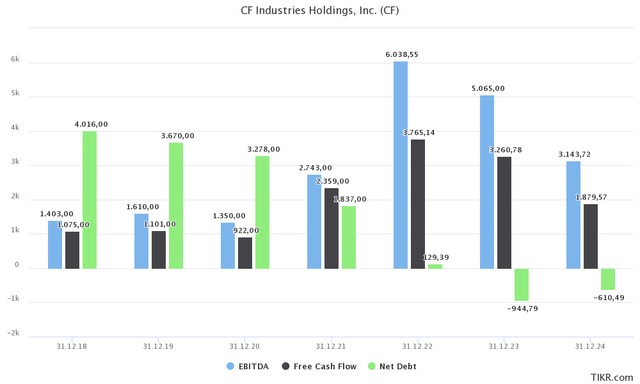

As reported in November, the company’s 3Q22 record results were supported by wide energy spreads. The company did $4.6 billion in adjusted EBITDA in the first three quarters of 2022. That’s up from $1.5 billion in 2021.

In the four quarters ending in 3Q22, the company generated $3.7 billion in free cash flow, which caused management to start a new $3 billion buyback program. This program aims to repurchase more than 15% of shares outstanding through 2025.

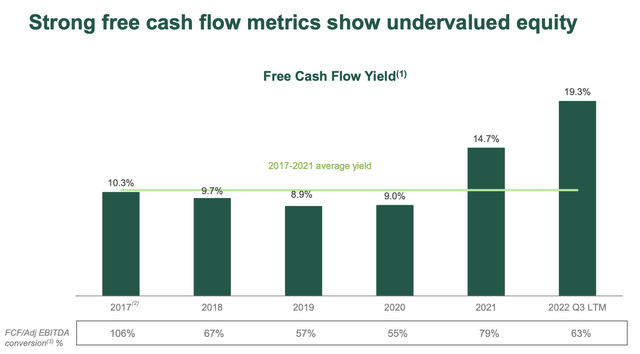

The company believes that its equity is significantly undervalued. One indicator of this is its high free cash flow yield.

CF Industries

Even better is that forward prices suggest that the company won’t lose its pricing advantage. If anything, 2023 could be better than 2022 when it comes to the margin advantage in the ammonia and urea markets.

CF Industries

Here are some notes from the company:

- Global nitrogen supply/demand balance to remain tight into 2025 due to agriculture-led demand and forward energy curves that point to persistently high energy prices in Europe and Asia.

- The need to replenish global grain stocks, which has supported high prices for corn, wheat, canola, continues to drive global nitrogen demand.

- Global nitrogen supply availability remains constrained as high energy prices in Europe and Asia caused curtailments of ammonia production; an estimated 60% of European ammonia capacity did not operate in Q3 2022.

Moreover, since September, analyst estimates have gone up. Next year, CF is expected to do more than $5.0 billion in EBITDA. These expectations are almost $200 million higher compared to two months ago. The same goes for 2024. The only major difference is that net debt is expected to be -$610 million in 2024. That’s up from -$3,690 million. The difference is $3.0 billion in buybacks. That will prevent net debt from falling, but it improves per-share results.

TIKR.com

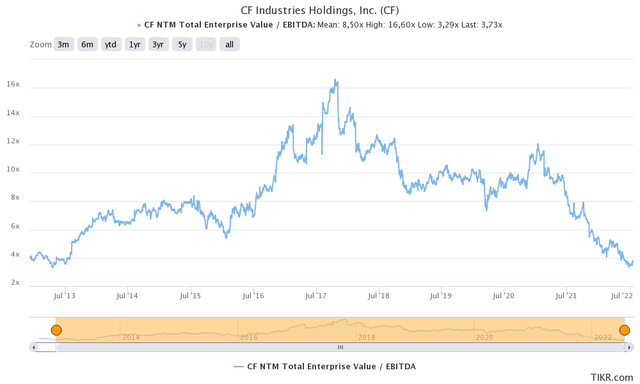

This also helps the valuation. CF is trading at 4.2x 2023E EBITDA of $5.1 billion. That’s based on its $19.7 billion market cap, $2.7 billion in minority interest, and $900 million in net cash (negative net debt).

TIKR.com

The valuation remains at one of the lowest levels since 2013, which means I will stick to my outlook.

Hence, I believe that if we’re indeed in a multi-year bull market for energy and agriculture, CF has room to double in the 2-3 years ahead.

The Mosaic Company

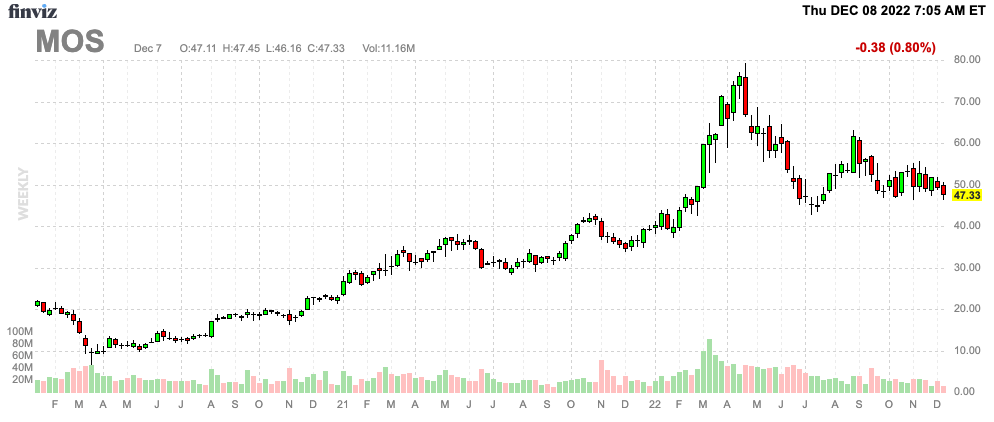

FINVIZ

Headquartered in Tampa, Florida, Mosaic is one of the world’s largest producers of potash and phosphates fertilizers (the “P” and “K” in NPK fertilizers).

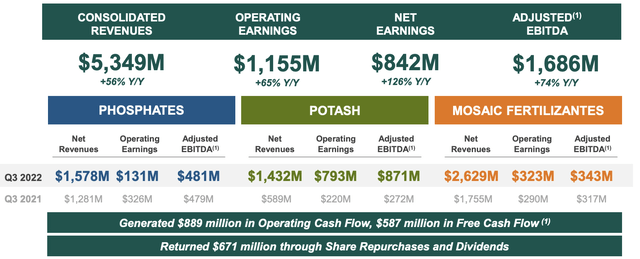

The Mosaic Company

While these fertilizers are less dependent on natural gas, they do benefit from strong pricing. In 3Q22, Mosaic’s adjusted potash EBITDA rose from $272 million to $871 million. $761 million of this was caused by a higher sales price.

In phosphates, adjusted EBITDA rose by $2 million to $481 million. Pricing contributed $356 million, which was partially offset by lower volumes and higher input prices.

In Brazil, the company generated $343 million in adjusted 3Q22 EBITDA. That’s up from $317 million. Pricing benefits were $1,114 million. Pricing headwinds (production costs) were $1,000 million.

What’s interesting is that Mosaic is now curtailing production at its Colonsay potash mine in Saskatchewan, Canada.

In early 2023, the mine will restart. This time with two mills, producing between 1.8 and 2.0 million tons of potash. That’s up from 1.3 million tons prior to the curtailment.

Mosaic is using slower demand and high inventory levels to boost output. While that may be bad news for the demand outlook (why is demand down in the first place?), the company remains upbeat about the future of demand.

“Our decision to temporarily curtail Colonsay reflects near-term dynamics and not long-term agricultural market fundamentals. Crop prices remain strong and continue to support healthy grower economics,” said President and CEO Joc O’Rourke. “After a year of reduced applications, we believe farmers are incentivized to maximize yields, which should drive significant recovery in fertilizer demand in 2023.”

Due to high prices, farmers reduced fertilizer demand. Now, demand needs to improve again to stabilize crop yields in 2023.

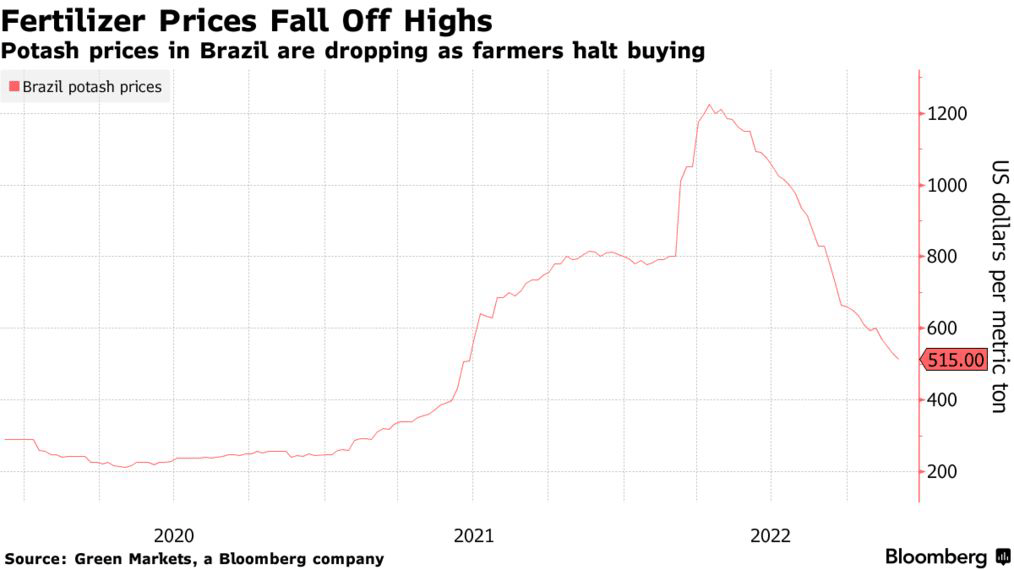

For example, in Brazil, farmers have stopped buying expensive fertilizers, which has caused the price to implode.

Bloomberg

Unfortunately (for global food security), the bull case isn’t over and farmers are not out of the woods yet.

Still, Mosaic and fellow fertilizer producer Nutrien Ltd. see a strong market ahead. Last week, Nutrien Chief Executive Officer Ken Seitz warned of looming shortages in coming years, with supplies from Russia and Belarus constrained. Nutrien plans to ramp up its capacity 40% by 2025.

Using the same source, it’s also hard to make the case that curtailing production is a bad move for Mosaic:

Cutting production could reduce Mosaic’s first quarter 2023 potash sales by 325,000 metric tons and cost the company $140 million in revenue, Bloomberg Intelligence analyst Alexis Maxwell said in a note.

[…] However, the move could help the market in the long term, Scotiabank analyst Ben Isaacson said in a note.

Bear in mind that about 60% of the new potash production that is expected to hit the market over the next five years comes from Russia and Belarus. This gives Russia a ton of leverage and makes it unlikely that western markets will benefit from a strong surge in supply.

Mosaic’s peer Nutrien (NTR) expects that farmers will soon buy more aggressively.

Nutrien is seeing prepaid sales of fertilizer — where farmers will buy ahead to secure product — about 15% to 20% higher than in 2020. Seitz is expecting farmers who didn’t buy this year and have used all their stored product to jump into the market and send prices high again.

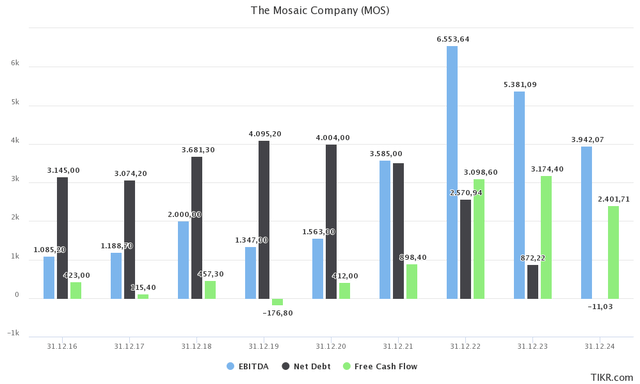

Just like CF Industries, Mosaic is attractively valued. The company’s implied enterprise value is $17.2 billion. This includes its $16.1 billion market cap, $870 million in expected net debt, and minor pension and minority interest items.

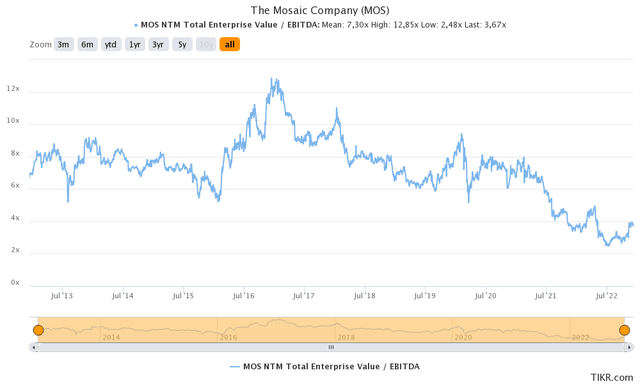

TIKR.com

Moreover, $3.2 billion in free cash flow implies a 20% free cash flow yield. That’s way too high (too cheap). The company’s forward multiple is close to 10-year lows. At some point, the market will have to face the facts and award MOS with a higher multiple.

TIKR.com

In other words, I stick to my $70 to $80 price target range for MOS.

Takeaway

The fertilizer trade has run unto resistance. Commodity prices, in general, have weakened as demand fears are now stronger than supply issues.

However, the biggest mistake would be to turn bearish based on historic patterns. While we’re beyond peak inflation, the bull case isn’t dead.

Fertilizer demand is improving (it has to!). Supply is not. 2023 is shaping up to be another year with tight supply and a desperate need for high application rates, given the pressure on crop yields (and we didn’t even talk about La Nina in this article).

Both Mosaic and CF Industries are poised to remain in a volatile long-term uptrend. Both are highly attractively priced and poised to move closer to their fair value once investors price in the fact that energy prices aren’t moderating anytime soon.

I believe that both stocks offer tremendous upside as the supply/demand imbalance remains one of the biggest issues facing the consumer in 2023 and beyond.

However, be careful when investing in fertilizer stocks. As good as the bull case may sound, we’re dealing with highly volatile investments. Keep that in mind. Also, right now, the market is more worried about global demand growth in light of high recession probabilities. This could provide us with another 10%-20% sell-off before we move higher in 2023.

Other than that, I think the risk/reward for both MOS and CF remains highly favorable.

(Dis)agree? Let me know in the comments!

Be the first to comment