Michael Buckner/Getty Images Entertainment

A contrarian approach is just as foolish as a follow the crowd approach. What’s required is thinking rather than polling. – Warren Buffett

Written by Sam Kovacs

Introduction – recent Outrageous claims

The Energy Cycle

As soon as 2 months into the pandemic, Robert and I were doubling down on our position in ONEOK (OKE), and suggesting to buy high quality energy companies.

For some of our readers, this was outrageous. One of them suggested is was a “High Risk Bet”.

Others thought we were “insane”.

Was it a time to run for the hills?

We didn’t think so, and stuck to our guns: we are net buyers of equities every single month of every year.

US equities are an evergreen proposition if you are willing to follow a common sense approach and not fear being “outrageous”.

Then, in late October 2020, we went out and said that the market was wrong, that energy was a brilliant investment in one of our best performing articles:

Clean Energy Vs. Oil & Gas: The Biggest Lie Of 2020

The article has received just short of 5,000 comments. If the average comment is even just 10 words, that would be enough words to fill 125 pages.

There were many outrageous comments made. This was unsettling to some, and the general feeling can be summed up in one comment which said:

“I have no idea how all this plays out, but many comments here will be laughed at.”

But that’s just it, right? In order to be right when others are wrong, the case needs to seem “outrageous” to some.

It needs to be out of the comfort zone. Most won’t go against the grain, and as a consequence remain just “average”. Asset management has become so packed with closet indexers who can’t afford the career risk of being wrong.

If you want to beat the market, you need to be both different and right.

The Delta Variant

During the summer, the big scare was that the Delta Variant would kill the reopening trade. It was seen as outrageous by some that I would suggest that “the market’s got it all wrong“. That article received over 7,000 comments.

But sure enough, the reopening trade wasn’t halted. We’re seeing a shift from growth to value happen in multiple stages and multiple increments. It seemed outrageous just a few quarters ago, but now it seems obvious.

By the time Omicron arrived, the markets took a breath, and then just plowed on.

The adverse economic impact on the demand of oil for instance, has declined with each new wave of the pandemic.

The growth to value shift

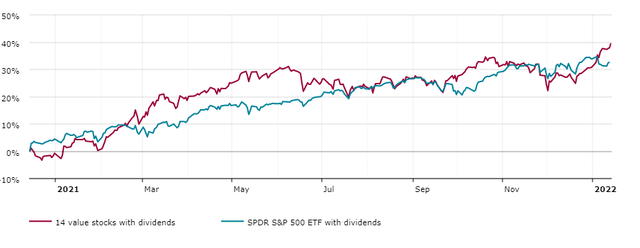

To some people, the idea of rotating out of value stocks was out of the order in December 2020. In one article I suggested 14 value stocks that would outperform in 2021.

According to one of our readers, this was quite outrageous. He challenged my picks with his own, which included Roku (ROKU), CrowdStrike (CRWD), Square (SQ), Cloudflare (NYSE:NET), and The Trade Desk (TTD).

He asked us to let him know how the picks did a year later.

And I must say, the proof is in the pudding. Since that message in December, our picks have gone in opposite direction.

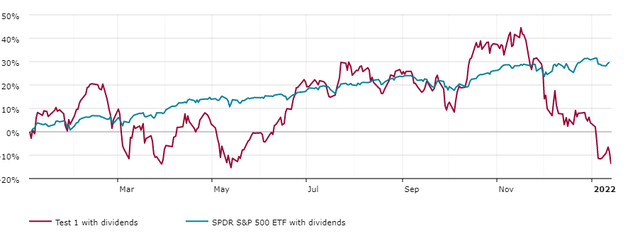

Here’s the performance (dividends included if applicable) of an equal weighted growth portfolio with the fellow’s picks vs the S&P 500 (NYSEARCA:SPY).

Since December 2020, that portfolio would have returned -13.7%.

On the other hand, an equal weighted portfolio of those 14 value stocks have returned just shy of 40% as of the time of speaking, beating the index.

Being outrageous isn’t enough

Being outrageous is surprisingly easy, despite the fact that we are trained to be politically correct and sit in our little box (made of ticky tacky).

But being outrageous isn’t enough. You also need to be right.

And to be right, you need to weigh rather than vote. Whatever the consensus is, it is emotionally driven in the short run, and converges to facts in the long run.

You need to be emotionally detached from the process.

For instance, I love innovation, tech gadgets, am a big fan of the tech and the ideas behind crypto and am actively involved in the scene.

But I don’t let that get in the way of my analysis of the markets.

There is always some place where the consensus gets excited too quickly, or too slowly. And this creates an opportunity for us to be both outrageous, and right!

2 Outrageous claims to beat the market in 2022.

Here are 2 claims that are guiding my thinking in 2022.

1. The system is bad at producing good investors.

It might sound outrageous, but I believe that the classical path of business school, sell side banking, then moving to buy side, isn’t great at creating individuals with the skills required to be a successful investor.

I know because I know dozens of bankers. They are highly productive and knowledgeable on their narrow of expertise, but this doesn’t translate into an ability as a stock picker.

And they recognize it.

This is because you can’t keep doing the same thing and expect different results.

When everyone is hiring either young people with a business school background, bulge bracket experience, or quant like profiles, then you’re going to get a lot of organizations which produce similar results.

There’s a reason that Templeton moved to the Bahamas, and a reason that Buffett stays in Omaha.

I understood the reason when I relocated to Bali, Indonesia.

The idea is to be far from the racket and the hype.

This creates a distance between yourself and the latest “hot” idea.

It also allows you to sample lifestyles and economic constraints in other areas of the world.

In Indonesia, the world’s 4th most populous country, it was apparent straight away that demand for oil was going nowhere, and that even once small niches of the US and Europe will have transitioned entirely to renewables, Indonesia would still be a long way from it.

That’s how I called out Cathie Wood. In February last year, I mentioned “the demise of ARK Innovation“. The flagship ARK Fund (ARKK) is down over 32% since I warned investors.

What did I realize?

Miss Wood, who grew up in L.A. before moving to New York to pursue her career on Wall Street, lacks a lot of world experience.

No amount of 2-week vacations can provide insight on the social and economic realities of other countries in other continents.

I realized that she, like many growth investors, was high on the promise of crazy acceleration and innovation.

The thing is, the future is already here, it’s just not spread out evenly. When you see the advances in medicine, robotics, AI, transportation, there is no doubt. The future is here.

But not only is it not spread out evenly, it is in fact concentrated in a small minority. The challenges that need to be overcome for a global adoption are a lot more complex than the spread of the mobile phone, as they will come with the consequence of technological dependence (imagine Tesla (TSLA) decides that its robots are going to strike at your factory?), as well as the unrest caused by disturbing hiring industries and ingrained structures.

Yet, the ultra growth people are forecasting that these technologies will be adopted at mass scale, in no time.

This year, I’ve spent significant time in 3 continents. The world still has a long way to go, before we live in an AI centric world.

Having non conventional experience, gives you the opportunity to see things differently. Yes, that means you should ignore 98% of people on Wall Street.

2. Wokeness needs to leave place to common sense

Being woke regarding your investments, using your money to “vote” for industries or stocks, is outright dumb.

I get the narrative. It’s an emotional decision. You don’t want to be involved in guns, oil and tobacco.

That’s fair, you’re free to invest the way you like. But you must realize that your emotional decision, when applied massively by market participants, creates an emotional distortion in market prices.

How does this play out? Let’s look at the example of energy. More money pursues clean energy opportunities like NextEra Energy (NEE), and less pursues dirty energy opportunities, like Chevron (CVX) or Exxon (XOM).

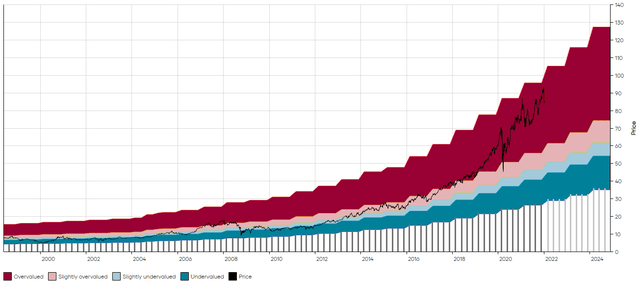

This causes large and persistent overvaluation in names like NEE, as you can see below.

Relative to its dividend history (which is a great proxy for a utility company), it now yields an extremely low amount.

The reason is obvious. More people want the “feel good” clean stock. So you pay a premium for those.

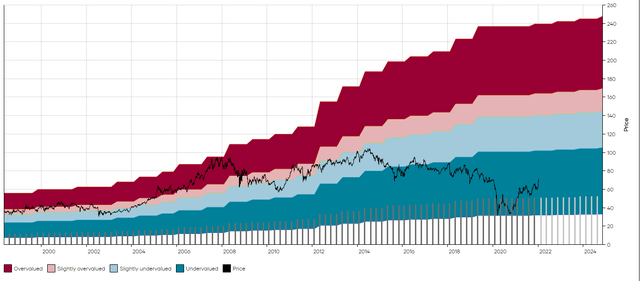

On the other hand, for XOM, the opposite is happening. Valuations are below historical norms.

No surprises, nobody wants the dirty stocks, so we have to discount them.

Common sense right?

With a tight OPEC+, banks not wanting to lend excessively to US Shale, and production controls still being seen across the industry, energy companies are printing cash.

EOG (EOG) is netting over $50 per barrel right now. Similar for Suncor (SU) and Imperial Oil (IMO).

Yet valuations remain depressed, as many institutions have backed themselves into a corner, with “politically correct” investment mandates.

Oh well, I’ll buy the cheap stocks with the big dividends and excess cash to return to shareholders.

I expect the wokeness will fade and common sense will prevail, when common sense continues to provide better returns.

Another example of this worth mentioning is tobacco. Phillip Morris (PM) has been undergoing a deep transformation, yet is being shunned. It is proactively working to deliver reduced harm products at scale and is being massively successful.

At some point, the market has no choice but to react.

Conclusion

Common sense, and a lot of critical thinking, will be required to continue doing well in 2022.

Being right too early is the same as being wrong if you don’t have the resources to see it through.

Keynes would say that we’re all dead in the long run.

Quality, growth and value are needed in your portfolios to do well in 2022. This unique mix of traits is only found in stocks where there is some disagreement, which is emotionally driven.

Be the first to comment