FinkAvenue/iStock Editorial via Getty Images

As noted in previous posts, a number of fears are driving concerns about the future returns of emerging markets (EM) sovereign debt in the midst of interest-rate hikes by the U.S. Federal Reserve (Fed).

Having examined two of those fears—that possibility that EM debt’s sensitivity to rising interest rates could hurt performance and the possibility that EM debt spreads could widen as interest-rate hikes hurt global growth—we now consider three more fears.

Could outflows accelerate as fixed-income and risk assets become less attractive? Could the U.S. dollar (USD) strengthen as interest-rate differentials between EMs and developed markets narrow? And could rate hikes could squeeze liquidity and accelerate EM debt restructurings?

Could Outflows Accelerate as Fixed-Income and Risk Assets Become Less Attractive?

The perception persists that as rates rise, fixed-income investments—particularly those with longer durations—become less attractive. This, common wisdom holds, leads to a cycle of outflow and underperformance.

It is hard to draw any conclusions about the first two rate-hiking cycles, because the data is unreliable. However, during the 2015-2018 rate-hiking cycle, inflows were solid. Assets managed against the EM hard currency benchmarks actually grew by approximately 20% on strong inflows without any period of appreciable negative drawdown. Assets then grew again by another 10% in the year following the first rate hike (2016).

Our verdict: While flows are currently down, they should improve.This is supported by a 2021 International Monetary Fund (IMF) paper concluding that growth optimism is not a key driver of hard currency bond flows. These flows, the paper argues, have historically been more sensitive to global risk sentiment. Moreover, one of these factors is not necessarily a determinant of the other.

In recent years, flows into dedicated EM hard currency bond funds have been positive despite negative headwinds stemming from COVID-19. This year has been the exception. In 2022, we have already seen net outflows of reasonable size as global liquidity conditions have tightened. These have been quite persistent but fell in size as we entered May.

The outflows we have seen thus far this year repriced EM hard currency assets well ahead of those in other credit markets, resulting in lighter positioning from both dedicated investors (who are now holding very high cash balances) and crossover investors. Average bond prices in the benchmark J.P. Morgan EMBIGD are now around $85, which is below their COVID-19 lows registered in 2020.

Our expectation is that as valuations continue to improve, flows will return to the asset class, which may act as a catalyst for higher prices.

Could the USD Strengthen as Interest-Rate Differentials Between Emerging and Developed Markets Narrow?

The fourth fear driving concerns about the future returns of EM sovereign debt is that the USD could strengthen as interest-rate differentials between EMs and developed markets narrow.

Conventional wisdom holds that the ongoing Fed tightening cycle will magnify the strength of the USD, and with the USD trading persistently stronger, it is certainly understandable for investors to be concerned about the role of the USD in driving asset-price returns.

However, USD strength has not been a key historical driver of EM debt spreads. If anything, USD strength has a marginally positive correlation with tightening spreads.

Looking back at previous Fed tightening cycles, there is little information available about the impact of higher U.S. interest rates on USD strength and the subsequent impact on EM sovereign debt spreads.

1999-2000: USD Strong. During the 1999-2000 rate-hiking cycle, the USD did strengthen, but this was primarily due to speculation that the euro would collapse shortly after its launch.

2004-2006: USD Weak. The 2004-2006 rate-hiking cycle, meanwhile, was a weak period for the USD against the euro, given concerns about the U.S. trade deficit and investor focus shifting to monthly trade data. In this period, it was difficult to detect any positive impact on the USD from the rate-hiking cycle.

2015-2018: USD Mixed. In the initial part of the 2015-2019 rate-hiking cycle, currency volatility was quite low and the USD strong—until European Central Bank (ECB) President Mario Draghi gave his speech in March 2017, which turned around the euro crisis and priced the euro sharply higher against the USD.

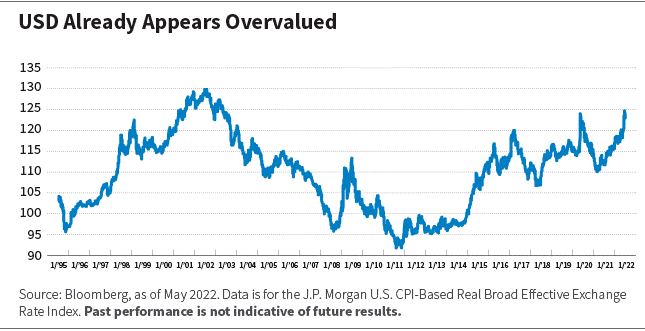

Our verdict is that it’s too soon to tell. But investors who are worried that the strong USD is bad for EM debt spreads can take some solace in the possibility that it might weaken. As we entered the 2022 rate-hiking cycle, the USD was already overvalued, with positioning one-sided, as the below chart shows.

Bloomberg

Could Rate Hikes Squeeze Liquidity and Accelerate EM Debt Restructurings?

The fifth fear driving concerns about the future returns of EM sovereign debt is that rate hikes, and a subsequent reduction in the Fed’s balance sheet, could reduce access to the market for lower-quality EM debt investors, causing a flood of defaults and restructurings. We believe this risk is already overpriced in the market, for a number of reasons.

First, multilateral and bilateral support for EMs suffering economic difficulty is extremely high, with the IMF alone currently providing about $250 billion of support. And that is only a quarter of the IMF’s $1 trillion available lending capacity.

Second, aside from 2020, when EM sovereigns experienced a relatively high level of restructurings, historical defaults and restructurings in EM debt have been extremely low. This has been true even during previous Fed rate-hiking cycles, which have not caused a glut of defaults. Moreover, when restructuring has been necessary, recovery values have averaged 55 cents on the dollar,[1] a level far higher than that of corporate bonds.

We saw a shift away from bonds trading at a price of 100 or more at the end of 2021. The J.P. Morgan EMBIGD is also more diversified in 2022 than it was in previous Fed rate-hiking cycles, reducing the concentration risk of an isolated default.

[1] Source: Moody’s and J.P. Morgan, from December 2000 to December 2020; refers to the J.P. Morgan Next Generation Markets Index (NEXGEM).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment