CalypsoArt/iStock via Getty Images

My followers know I am a big fan of holding a well-diversified portfolio built for the long-term. Part of any well-diversified portfolio should be dividend paying stocks and of course there are various strategies in this regard. These include owning individual stocks, funds, focusing on various sectors such as REITs or energy (for example), focusing on “high yield”, or a mixture of all of the above. Today I will take a closer look at the SPDR S&P Dividend ETF (NYSEARCA:SDY) and evaluate its suitability as a potential dividend-income holding for the ordinary investor’s diversified portfolio.

Investment Thesis

Dividend-income investing is popular because investors typically receive a dependable quarterly income stream which they can reinvest in the stock (or fund), take in cash and save, spend, or redeploy in other ways. In general, dividend-paying stocks typically exhibit less volatility than do non-dividend paying stocks and there is research showing that investing in “Dividend Kings” and “Dividend Aristocrats” can outperform the S&P500 over the long-term.

The other side of the coin is that as stock prices rise, dividend yields generally fall. That is important to consider given that we have just lived through the biggest bull-market of our lives. Another factor to consider is that retired investors who have been trained (brainwashed?) to focus on a very rigid investment “strategy” of only investing in dividend paying stocks can significantly lag the market (see my Seeking Alpha article Retirees Beware: Dividend Investing Is Overrated). Don’t get me wrong, dividend investing is a critical component of the well-diversified portfolio. However, over-emphasizing only dividend paying stocks means neglecting the “growth” category of a well-diversified portfolio and means you have most likely missed out on some of the best growth stocks of our time, including companies like Amazon (AMZN) and Google (GOOG).

With all that as background, let’s take a closer look at the SPDR S&P Dividend ETF and see how it could fit in your portfolio.

Top-10 Holdings

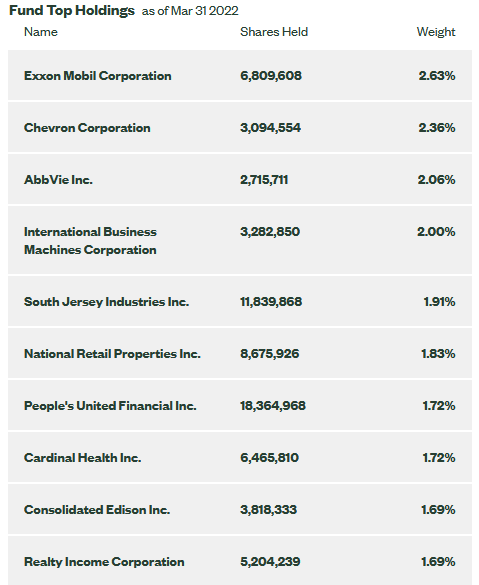

The top-10 holdings in the SDY ETF are shown below and equate to what I consider to be a very well-diversified portfolio of 114 companies:

SDY ETF Top-10 Holdings (State Street Global Advisors)

Well known energy companies Exxon Mobil (XOM) and Chevron (CVX) are the top-two holdings, in aggregate represent about 5% of the fund, and have current yields of 4.3% and 3.5%, respectively. These stocks have been performing very well given the current macro environment – Chevron was the leading performing in the DJIA during Q1 (up 40%+).

The #3 holding with a 2.1% weight is pharmaceutical company AbbVie (ABBV), which currently yields 3.5%. ABBV is up nearly 50% over the past year but still trades at a relatively attractive forward P/E of only 11.4x.

National Retail Properties (NNN) yields 4.7%, is the #6 holding in the fund, and equates to 1.8% allocation. NNN is a retail REIT that owns over 3,000 properties across 48 states with gross leasable area of ~32.4 million square feet that have a weighted average remaining lease term of 10+ years.

Global healthcare provider Cardinal Health (CAH) is the #8 holding with a 1.7% weight. CAH yields 3.5% but the stock is down 6.7% over the past year.

Eastern U.S. utility company Consolidated Edison (ED) is the #9 holding with a 1.7% weight. ED yields 3.3%, is up 26% over the past year, and is currently trading at a 52-week and all-time high level. The company’s Q4 EPS release in February was a strong beat on both the top- and bottom lines as revenue beat consensus estimates by over half-a-billion dollars.

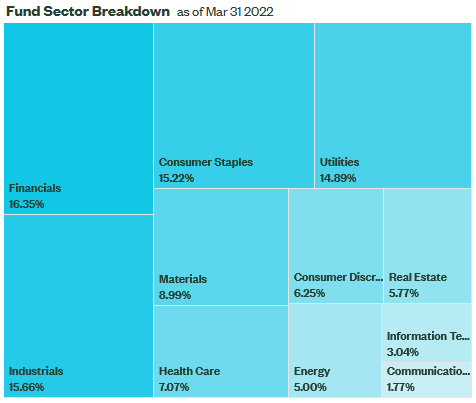

As mentioned earlier, the SDY portfolio is heavily weighted toward financials:

SDY ETF Sector Allocation (State Street Global Advisors)

As I recently wrote in a Seeking Alpha article on the Vanguard Financials ETF (VFH), a rising interest rate environment is typically a bullish tailwind for the financial stocks. In addition, the relatively high weighting in the Consumer Staples and Utility Sectors will – all things considered – give the SDY portfolio a general bent toward lower-volatility as compared to the overall market.

Yield

Considering SDY is a dividend ETF, investors obviously are curious about the fund’s yield. The SDY website currently reports the SEC 30-day yield is 2.32% while the fund’s distribution yield is 2.59%. That will likely disappoint many investors who invest in individual dividend-paying stocks and are achieving significantly higher yields.

Also, note that SDY’s expense fee is 0.35%, which I consider to be expensive for this type of fund, and which equates to a fairly high-percentage of the fund’s yield as well.

Performance

SDY has an admirable 10-year average annual return of 12.52%.

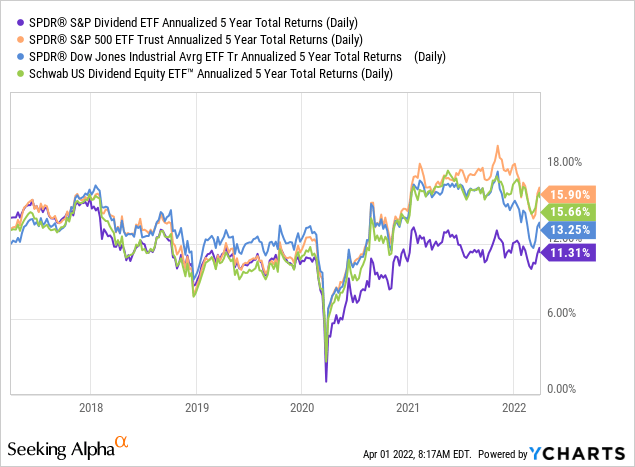

The graphic below compares the 5-year annualized total returns of SDY against the broad market averages as represented by the (SPY) and (DIA) ETFs, as well as its peer – the Schwab Dividend Income ETF (SCHD), which currently yields 2.9%:

As can be seen, the SDY ETF lags the others by a significant margin. I would also note that SCHD’s expense ratio is only 0.06%, a whopping 29 basis points lower than the SDY’s expense ratio. So not only is SCHD outperforming SDY, but it is considerably less expensive as well.

Summary & Conclusions

While the idea behind a dividend ETF makes sense, in my opinion the SDY ETF is the wrong vehicle. It is a relatively expensive option in the space, and its average annual returns over the past 5-years significantly lag that of the broad market averages and is ~4% less than that of its dividend-oriented competitor SCHD, which is also considerably less expensive.

All that said, when it comes to dividend investing, the ordinary investor might want to take time to analyze and choose individual stocks. While I do own the SCHD ETF, I also own individual dividend paying stocks – mostly in the energy sector – that blow away the yields thrown off by ETFs like SDY and SCHD. In addition to XOM, CVX, and ConocoPhillips (COP), I also own Enbridge (ENB). Despite being up 26% over the past year, ENB still yields 5.9% – more than 2x either SDY or SCHD.

Bottom line for investors looking for dividend income: if you are looking for a well-diversified ETF, SCHD is clearly a superior option. For individual stock picks, the energy sector is tough to beat right now, but could face some longer-term headwinds from global warming, ESG, and the transition to EVs and clean energy.

Be the first to comment