jetcityimage/iStock Editorial via Getty Images

Introduction

I’ve been very excited to write this article for one major reason: we’re dealing with a dividend growth opportunity that’s actually cheap with a good risk/reward. My most recent Cummins Inc. (CMI) article was written in July of 2021, which means it’s about time for me to cover the stock again. Back then, I wrote that the company was facing potential headwinds:

Unfortunately, the biggest risk investors have to deal with is further deteriorating economic expectations. This could happen if the pandemic causes major economic hubs to slow down again (i.e., through new lockdowns) or if China is unable to continue its post-pandemic growth streak.

Right now, the stock is down close to 23% year-on-year with a dividend yield closing in on 3%. Given economic cycles and Cummins’ cyclical stock price on top of the company’s ability to generate shareholder value, I’m extremely happy to see that the valuation has come down. We’re looking at a great opportunity for dividend growth investors who don’t shy away from industrial dividend stocks. In this article, I will give you the details!

Cummins Stock – Seasonal Behavior And Valuation

Normally, I do this at the end of each article. Yet today, I start with it as it’s the reason that got me to write this article.

With a market cap of $27.6 billion, Cummins is one of the world’s leading producers of engines, components, distribution, and power systems. It sells most of its annual $24.0 billion revenue in North America ($13.4 billion), Europe ($3.3 billion), and APAC ($3.2 billion).

The company’s products include engines and related solutions for tractors, busses, trucks, heavy construction machinery, trains, and even ships. While high-performance diesel engines are the company’s bread and butter, it is investing in next-gen energy sources like hydrogen. To date, Cummins has invested roughly $1.0 billion in new power through research & development, merger & acquisitions, and internal CapEx. Yet, in 2021, new power accounted for just $100 million in revenue, which is less than 0.5% of total sales.

So, for now, we’re stuck with a relatively straightforward business model: high-quality engines. There’s more to it as I will explain in this article but for now, that’s what we need to know.

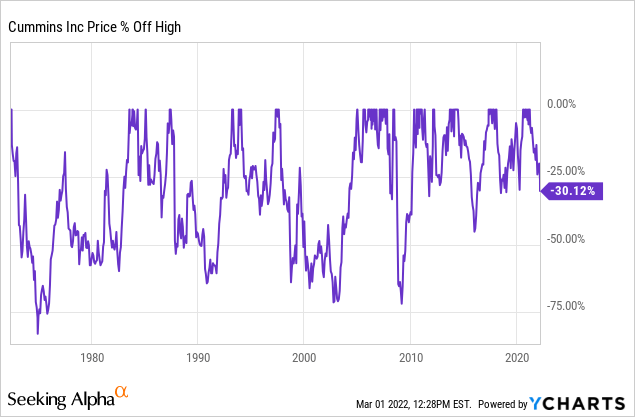

What you’re looking at below is an overview of Cummins’ drawdowns since the 1970s. When the company was less mature (prior to 2000), it used to sell off close to 60% on a regular basis. That is still the case with some machinery companies, but it does not apply to CMI anymore. What CMI does is fall 25% on a very regular basis with larger drops towards 40% when economic expectations decline more than usual. In 2015, for example, the stock entered a manufacturing recession. Currently, the stock is down because of slower economic growth, trouble in Russia, high inflation, and fears that the Federal Reserve may trigger a recession.

In Russia, the company has an agreement with truck maker Kamaz, which is 47% owned by the Russian government (indirectly). So, the ongoing war adds a whole new layer of uncertainty to an already weak stock.

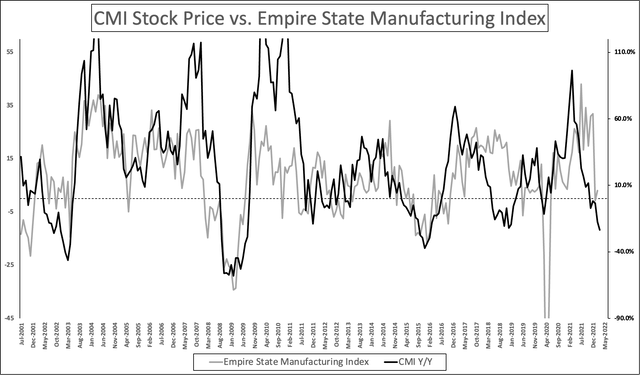

Based on this context, I want to present the graph below – the cornerstone of this article. Below, I’m comparing the year-on-year performance of the CMI stock price to the Empire State Manufacturing Index. Conducted by the New York Fed, it’s a survey similar to the ISM Index that displays economic expectations.

Needless to say, the correlation is beautiful – and it does make sense given the cyclical business model of CMI.

Growth expectations peaked in the second half of 2021. Right now, CMI is pricing in a significant decline in economic growth, which is good because a lot has been priced in already according to the graph.

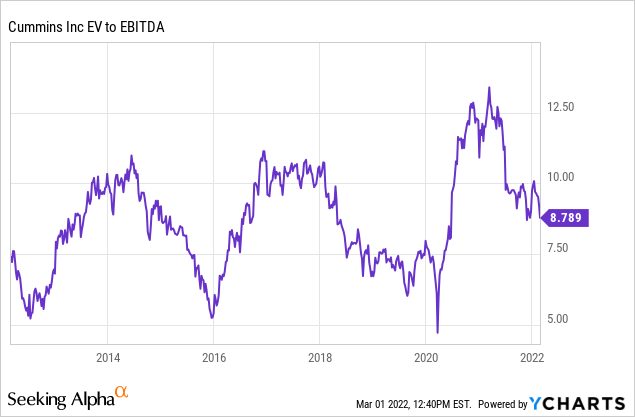

In terms of valuation, we’re now dealing with a $27.6 billion market cap and close to zero in net debt – hence, the company has a fortress balance sheet. Technically speaking, the company has $1.5 billion in net debt as of 4Q21, but free cash flow expectations are high (I’ll get to that in this article) and the company has high working capital. Therefore, analysts expect a net debt decline to just $100 million in 2022. Analysts also expect FY2022 EBITDA of $4.0 billion, which gives us an enterprise value of $27.7 billion and a 6.9x EBITDA multiple. Next year’s EBITDA is expected to be $4.4 billion, which would lower the valuation to 6.3x EBITDA. Yet, for the sake of slower growth expectations, I’m going to refrain from using higher EBITDA estimates.

Using that valuation, we get an attractive valuation close to the lower bound of the (cyclical) valuation range.

CMI Shareholder Value

I’m not done explaining why CMI is attractively valued. I just wanted to use a different section for free cash flow.

In general, the machinery industry is competitive. There are a lot of players on the market and starting reliable long-term relationships with suppliers is hard. That’s in general, and it does not apply to CMI. The company, founded in 1919, is well established and able to operate with high margins and free cash flow.

In this case, free cash flow, or FCF, is net income adjusted for non-cash items and capital expenditures. It’s cash the company can spend on buybacks, dividends, debt reduction, and related.

As it turns out, the company, which supplies almost every single truck and related company (see overview below), is really good at generating free cash flow.

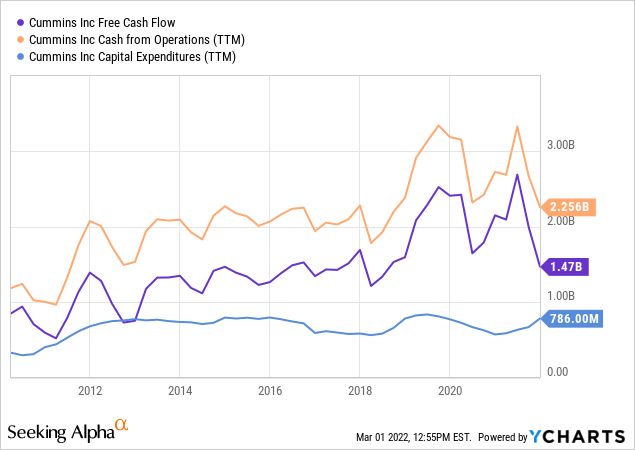

Cummins runs an annual CapEx budget close to $790 million. That is not expected to change by a lot, although higher investments in new technologies will slowly push this number to the high $800 million range. This means that higher economic growth allows higher operating cash flow to result in higher free cash flow as the graph below shows.

In 2021, free cash flow was close to $1.5 billion. This year, it’s expected to be $2.2 billion. Next year, analysts are looking for $2.4 billion with $2.6 billion in 2024. While all of this is prone to extreme economic uncertainty, it gives you an idea of what analysts expect CMI to be capable of when economic growth is accommodative. Right now, it also helps that commodity prices are high, which supports off-highway engine demand.

Using the $27.6 billion market cap, we get an implied FCF yield of 8.0%. Right now, the company’s dividend yield is 2.8%, which means there is a LOT of room to increase the yield – even if FCF does not grow anymore. That won’t happen, but it’s an example of how much FCF the company is generating. Hence, I was able to give the company close to zero in net debt this year in my EV/EBITDA valuation as total FCF after dividends is enough to turn net debt into net cash very soon.

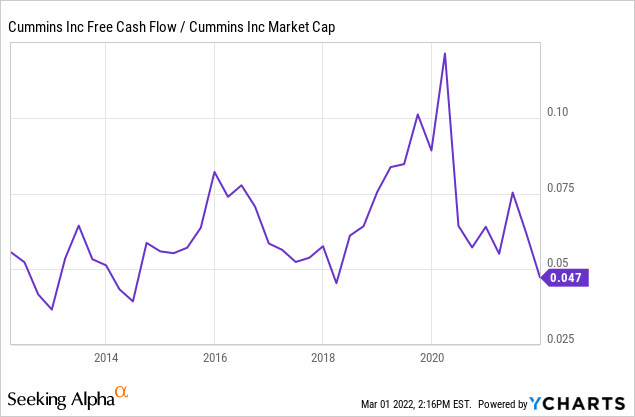

The graph below shows that the company tends to be cheap when (implied) free cash flow comes close to 7.5%. That’s currently the case, even if FCF falls a bit due to slower economic growth.

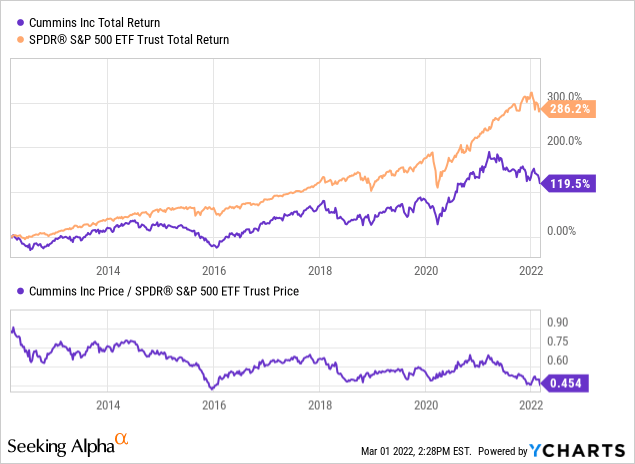

Moreover, the ratio between CMI and the S&P 500 (lower half of the graph below)is at multi-year lows. Usually, these lows are buying opportunities. The upper part of the graph shows the total return (meaning including dividends) of the past 10 years. Unfortunately, Cummins was unable to beat the S&P 500 since the Great Financial Crisis. The same goes for peers like Caterpillar (CAT), which I own.

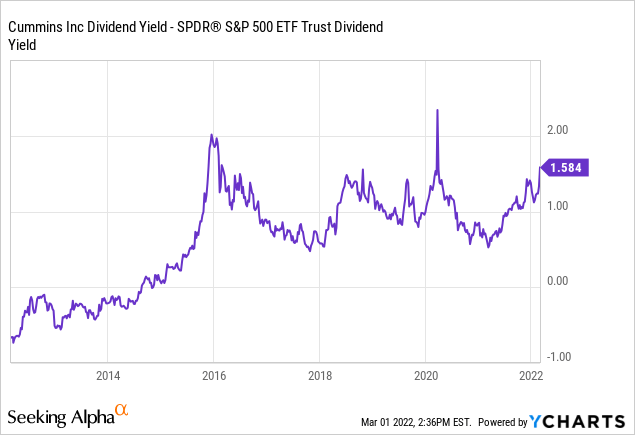

That’s not an issue if investors buy because of dividend growth. Since 2014, annual dividend growth has averaged 10.4% according to Seeking Alpha. Moreover, the yield spread over the S&P 500 is at 160 basis points (graph below). That’s one of the highest in recent years and another indicator that makes the “valuation” more attractive. Adding to that, the company has repurchased roughly 13% of its shares outstanding since 2017.

Takeaway

I’ve liked Cummins for many years. It’s a terrific long-term investment with close to double-digit annual dividend growth, a fortress balance sheet, and long-term relationships with all major machinery producers. While Cummins is slowly evolving as it is investing in hydrogen and related technologies, it remains highly dependent on diesel engine (and related) demand for the time being. So, cyclical growth dominates secular growth.

This explains why the stock is currently in a steep drawdown. Slower economic growth expectations and ongoing uncertainties regarding Ukraine are doing a number on the stock, which is bad news for people expecting to make a quick buck with the stock. Yet it’s great news for long-term investors who want to initiate a position or add to an existing one.

While the stock could fall another 10% if we are about to enter a manufacturing recession, I believe we’re at attractive prices that warrant stock purchases. If you’re not yet long, I would start by buying a small position. EV/EBITDA is attractive without incorporating high future growth. The same goes for the company’s implied free cash flow yield of 8%.

Once investors take into account that CMI is very cyclical and the risks that come with it, I think we’re dealing with an interesting opportunity to buy some quality dividend growth with a yield close to 3%.

(Dis)agree? Let me know in the comments!

Be the first to comment