Hammad Khan

Situation Overview

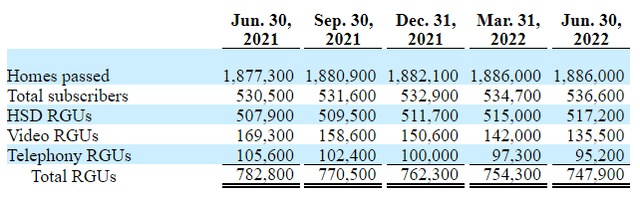

WideOpenWest (NYSE:WOW) is a small publicly-traded overbuilder. After a couple of divestitures to right-size the balance sheet, WOW now passes through ~1.9 million homes and have a HSD penetration rate of ~27%. WOW serves 15 markets primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia.

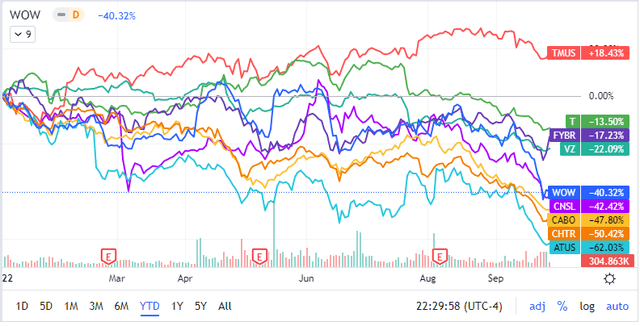

Along with its cable peers, WOW sold off heavily YTD. There are a couple of industry-wide concerns. First, cable will lose market share to fiber-to-the-home (FTTH) as the latter is technically superior. Second, cable will also lose market share to fixed wireless access (FWA) as the latter is cheaper and adoption barrier is lower.

My view is that while FTTH is indeed a futureproof technology, cable technology will continue to expand the bandwidth in the coax cable wire to match the performance of fiber. FWA is not an incredible threat to cable since it can’t match the user experience of a wired connection.

Thesis

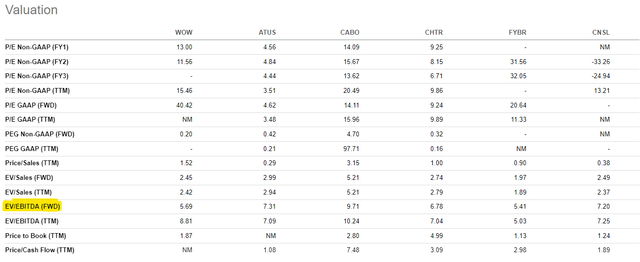

WOW is trading too cheap for the quality of the business. At <6.0x forward EBITDA, WOW is the cheapest cable name. It’s even trading cheaper to the fiber builders who face major execution and financing risks.

Margin – On the margin front, WOW was able to work through dis-synergy due to the major asset sales and achieved a 40% margin in the most recent quarter, which is comparable to its larger peers such as Charter (CHTR) and Altice USA (ATUS).

Competition – On the competition front, because WOW is an overbuilder, they will by definition not be the only internet service provider in their market. There are generally an incumbent cable operator and an incumbent telecom operator, and the majority of the incumbent telecom operators are still DSL. At least for now, the management doesn’t see significant fiber buildout in their footprint precisely because the level of competition is relatively higher in a three-player market (two cable operators including WOW, and a telecom operator). Fiber is better off deploying buildout capital in areas with only one other player (i.e. duopoly).

When compared to FWA offerings, WOW is generally able to beat out the FWA competition with a similar price level but with higher speed and more reliable service. For example, Verizon’s FWA has a speed range of 25 to 50 Mbps and T-Mobile’s FWA has an even wider range: 33 – 182 Mbps. Both plans cost $50/month standalone (i.e. without an attached mobile plan) while WOW’s Internet 200 cost $29.99/month.

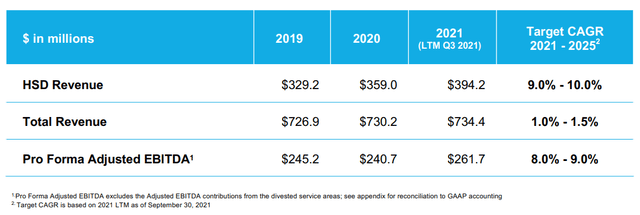

Growth – the management reiterated their conviction around the HSD revenue target CAGR of 9-10% through 2025 recently at an investor conference. The drivers of this anticipated growth are (1) higher take rate of customers taking 500 Mbps and above speed and more importantly (2) greenfield, where WOW enters into a non-adjacent market to challenge the cable incumbents with fiber new build, backed by a lot of competitive intelligence.

Leverage – WOW has the lowest leverage ratio among the cable operators (2.6x) vs. other cable operators running leverage above 4.0x because of the resilient cash flow.

Valuation

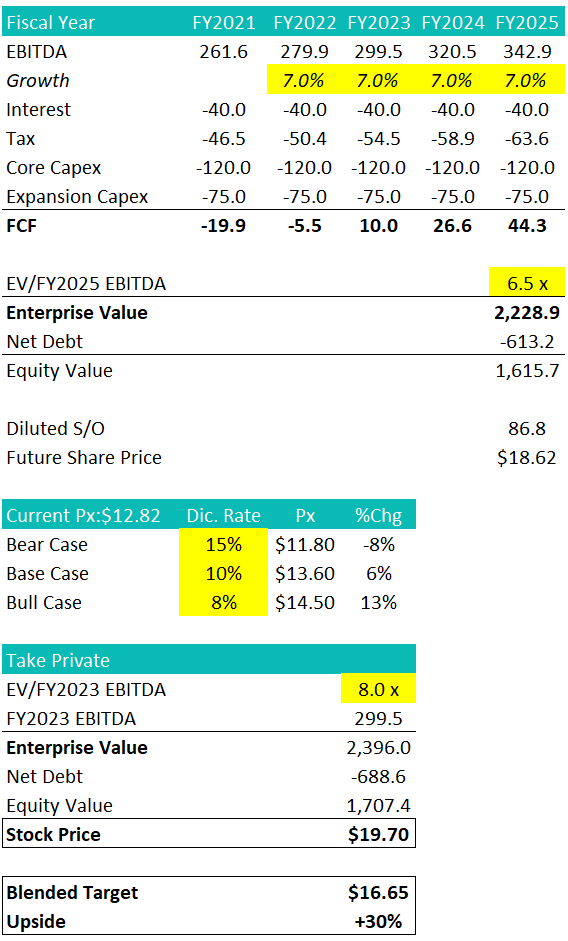

Building off of the management’s long-term EBITDA growth guidance of 8-9% (I used 7% to be conservative), WOW’s FY2025 EBITDA can hit ~$342.9 million. Assume the current depressed multiple moderates slightly to 6.5x, the future enterprise value of WOW in FY2025 is ~$2.2 billion, adjusting for net debt and cash buildup over the next 3 years, the future equity price is $18.62. Discounting is back at 10% (my base case cost of equity) I arrive at a fair price for WOW of $13.60. The way to interpret this is that if you buy WOW stock today at $12.82, you have 6% upside in addition to earning 10% annually until 2025.

In a take private scenario, I assumed a 8.0x multiple and can easily get to a takeout price of close to $20/share. The blended target of these two scenarios (one being the management executes on the greenfield growth plan, and the other one being a take-private transaction), I believe the stock has an upside of 30%.

Author’s Calculation

Risks

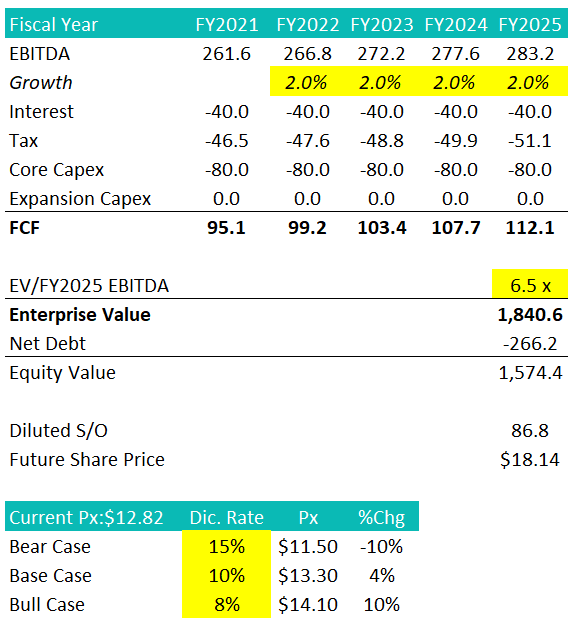

Valuation Risk – I believe at ~$13/share (~5.7x EBITDA) the downside is well priced in. Multiple of sub-5.0x is typically associated with companies in financial distress (and WOW is far, far away from being distressed). In my bear case, I took growth down to 2% and eliminated the expansion capex. With a 15% discount rate, I get to a 10% downside. I’d argue 3-up-and-1-down is a good risk/reward.

Author’s Calculation

Execution Risk – the 8-9% growth rate relies heavily on the success of greenfield expansion, which requires new build expertise. As an overbuilder, this is not a new adventure for WOW as they are well versed in entering new markets and figuring out how to compete with the incumbents. Plus, the principal shareholder Crestview (owns +30% of the stock) is going to keep a tight ship to protect their investment.

Catalysts

One obvious catalyst is a take-private transaction. There are rumored to have at least two parties interested in WOW. There are a number of infrastructure focused PE funds closed recently. WOW’s relatively low leverage gives a potential financial buyer a lot of flexibility. Crestview could potentially take over (or under?) the shares that they do not own, but it should be at a decent premium to recent trading range.

Moreover, I believe the market needs to see a few quarters of stabilizing net add to re-rate these cable names again. In my opinion, I’d buy any cable names at ~6.0x multiple all day long – this is a defensive corner of the market, with recurring cash flow and ~40% EBITDA margin, and the already strong demand for data is only getting stronger as the world becomes even more connected. For a focused player like WOW with still plenty of growth runway, I think a multiple in the 8-9.0x is very reasonable.

Conclusion

WOW is trading too cheap for the quality of the business. It has a margin profile that rivals its larger peers, a lower levered balance sheet, and an above-industry growth profile, yet it’s trading like it’s the junkiest of the group. I believe a take private transaction is still in play, but even as a standalone entity WOW deserves a higher multiple than the current sub-6.0x.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment