Sashkinw/iStock via Getty Images

Given how far technology has advanced, precision engineering has become unbelievably important for ensuring that the technologies we use operate optimally. Some technology is not even possible without precision-engineered parts. While there are a number of companies that provide these types of offerings, one firm that recently came across my radar that deserves some attention is RBC Bearings (NYSE:RBC). In recent years, the financial trajectory of the company has been rather impressive. And so far, that picture looks set to continue this year. Having said that, shares of the enterprise do look incredibly pricey at this moment. In fact, considering how expensive shares are right now, I would even go so far as to say that a ‘sell’ rating is appropriate for the company at this time.

Bearing with RBC Bearings

According to the management team at RBC Bearings, the company operates internationally as a producer and marketer of highly engineered precision bearings, components, and essential systems that are used for the industrial, defense, and aerospace industries. To truly understand the company, we should dig into each of the key segments that it has. First and foremost, we have the Industrial segment of the company. Through this, the company produces bearings, gearing, and engineered components for a wide variety of industrial markets. This includes companies in the construction and mining spaces, in oil and natural gas extraction, in various transportation markets, and so much more. Some of its offerings are even used in the semiconductor machinery space. This is the largest of the company’s two segments, accounting for 60% of the firm’s revenue during its 2021 fiscal year. This segment was also, in that same fiscal year, responsible for 56.6% of the company’s profits.

The other segment we have is referred to as Aerospace/Defense. Through it, the company provides bearings and engineered components for use in commercial, private, and military aircraft, aircraft engines, guided weaponry, and more. On top of this, the segment is also responsible for the production of precision products for many of the aircraft OEMs’ product lines. Some of its components are even used in fighter jets, naval vessels, helicopters, gas turbine engines, and more. Last year, this segment accounted for 40% of the company’s revenue and for 43.4% of its profits.

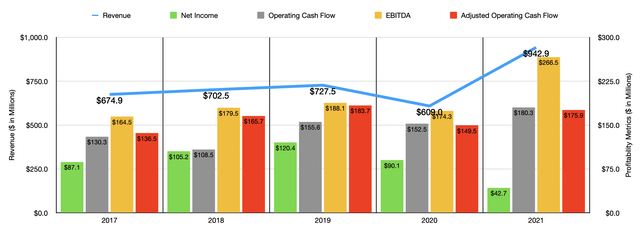

The overall financial trajectory experienced by RBC Bearings has been quite positive in recent years. Between 2018 and 2020, revenue for the company grew from $674.9 million to $727.5 million. In 2021, because of the COVID-19 pandemic, sales dropped some to $609 million. But in the 2022 fiscal year, the picture changed significantly, with revenue not only rebounding but surpassing pre-pandemic levels. In that year, sales came in at $942.9 million. Of the $333.9 million in additional revenue the company generated during its 2022 fiscal year, $291.9 million came from the firm’s acquisition of Dodge Mechanical Power Transmission That purchase was completed on November 1st of 2021 at a price of $2.91 billion. It is worth noting that the enterprise did have to restate its financial statements for the 2020 through 2022 fiscal years because of an error regarding non-cash stock-based compensation. That creates some issues of comparability prior to 2020. Based upon a look at the impact this had on the years for which the restatement occurred, I do not believe that the impact is all that material to shareholders to the point that we should exclude data from prior years from this analysis.

Profits for the company have been somewhat mixed over the years. For instance, between 2018 and 2020, net income rose consistently, climbing from $87.1 million to $120.4 million. In 2021, profits dropped to $90.1 million before plunging further to $42.7 million in 2022. Operating cash flow has been even more volatile, bouncing around between $108.5 million and $155.6 million in the four years ending in the 2021 fiscal year. In 2022, this number rose to $180.3 million. If we adjust for changes in working capital, the picture looks clear, with the metric climbing from $136.5 million in 2018 to $183.7 million in 2020. In 2021, it dipped to $149.5 million before jumping up to $175.9 million in 2022. And finally, we have EBITDA. That metric has also generally increased over time, rising from $164.5 million in 2018 to eventually hit $266.5 million in 2022.

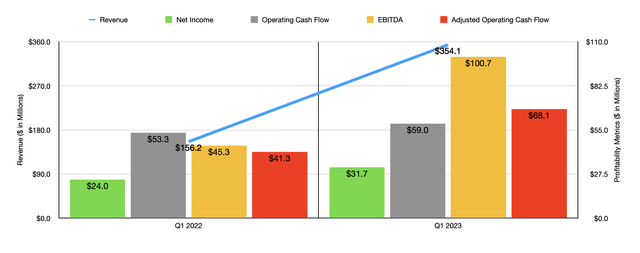

So far, the 2023 fiscal year has been positive. In the first quarter of the year, sales came in at $354.1 million. That’s up from the $156.2 million reported the same time last year. Again, a key driver behind this increase was the aforementioned acquisition of Dodge. Interestingly, however, the impact on the company’s bottom line has been somewhat mixed. Net income rose from $24 million in the first quarter of 2022 to $31.7 million the same time this year. Operating cash flow barely budged, rising from $53.3 million to $59 million. Though if we adjust for changes in working capital, it would have risen more significantly from $41.3 million to $68.1 million. And lastly, we have EBITDA, which rose from $45.3 million to $100.7 million.

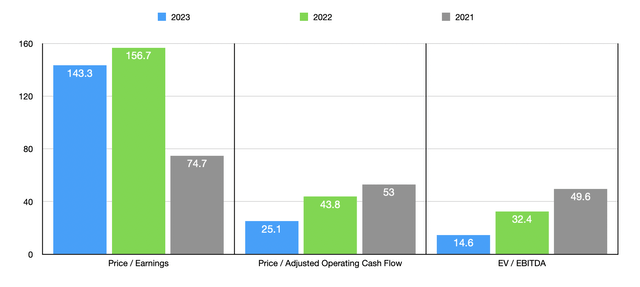

Truth be told, it’s really difficult to know what to expect for the rest of the 2023 fiscal year. Management has not really provided any sufficient guidance for the year. The simple approach is to annualize results from the first quarter. Doing so would give us net income of $46.7 million, adjusted operating cash flow of $290 million, and EBITDA of $592.4 million. Using this data, I was then able to create the chart above, which shows the pricing of the company using data from 2021, 2022, and 2023. Because of the aforementioned acquisition, I do not believe that the 2021 and 2022 fiscal years are reliable for the purpose of valuing the enterprise. Instead, we should trust in the 2023 estimates. Doing this would give us a price-to-earnings multiple for the company of 143.3. This on its own is astronomical. But if we use the price to adjusted operating cash flow multiple, that number improves to 25.3. And that is after taking out $23.3 million in preferred distribution payments from operating cash flow. And finally, we have the EV to EBITDA approach. In this case, we end up with a multiple of 14.6.

As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 12.2 to a high of 156.9. Using the price to operating cash flow approach, the range was from 16 to 402.5. And using the EV to EBITDA approach, the range was from 10.4 to 48.9. In all three scenarios, three of the companies that had positive trading multiples were cheaper than RBC Bearings. To some, my ‘sell’ rating on the company may seem outrageous, especially considering the EV to EBITDA multiple of the firm and considering how shares are priced compared to similar businesses. But at the end of the day, it’s only one of the three metrics and it doesn’t even make the company look all that cheap on an absolute basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| RBC Bearings | 143.3 | 25.3 | 14.6 |

| Pentair (PNR) | 12.2 | 16.0 | 10.4 |

| Donaldson Co (DCI) | 19.2 | 25.2 | 12.4 |

| Chart Industries (GTLS) | 156.9 | 402.5 | 48.9 |

| Symbotic (SYM) | N/A | 64.3 | N/A |

| ITT (ITT) | 17.2 | 21.0 | 13.3 |

Takeaway

Based on the data provided, I will say that while I appreciate the business model that RBC Bearings uses, primarily regarding its emphasis on precision-engineered parts, I do also think that shares are likely somewhat overvalued at this moment. It is entirely possible that management could surprise and post strong performance moving forward. But between house chairs look to be priced and considering current economic conditions that might weaken demand for these particular goods, I do think a soft ‘sell’ rating, reflecting my belief that shares are likely to underperform the broader market for the foreseeable future, is warranted.

Be the first to comment