Khosrork

Investment Thesis

V.F. Corporation’s (NYSE:VFC) slashing of FY2023 guidance proved to be the catalyst for massive volatility, with a -6.87% plunge on 28 September 2022. Combined with the pessimistic stock market, we may see more moderate retracements in the short term, assuming that the September CPI rate remains elevated, triggering further weaknesses in consumer discretionary spending. Nonetheless, this has also provided the perfect time for those who have been waiting to load up on this stock for 6.12% in dividend yields.

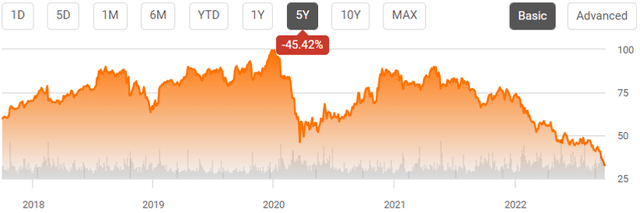

VFC 5Y Stock Price

However, investors should also note that VFC has had an underperforming track record thus far, with a 3Y revenue CAGR of 4.89% and net income CAGR of 3.35%, despite the e-commerce boom during the heights of the pandemic. Furthermore, with a 5Y Total Price Return of -37.5% and a 10Y Return of 11.1%, the stock is only suitable for those who are not concerned about its stock performance ahead and, naturally, with a resilient stomach for more volatility in the near term.

VFC May Prove To Be An Excellent Dividend Stock Through FY2027

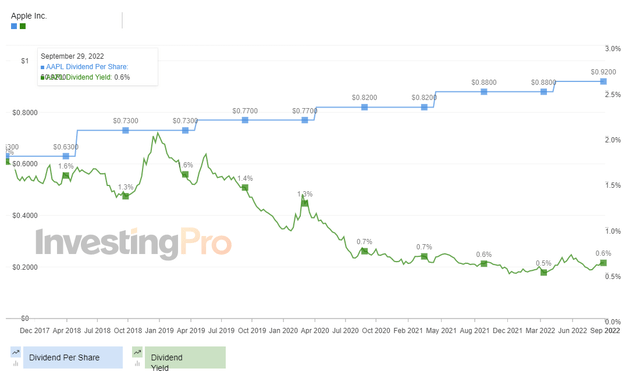

VFC 5Y Dividend Payout & Yield

With approximately $7B pledged for shareholder returns in dividends and share buyback programs through FY2027, we expect VFC’s dividends to remain safe despite the worsening macroeconomics. Based on its last twelve months’ trend, we are looking at an approximate ratio of 1:2 in its shareholder return strategy, with respect to shares repurchase and dividends paid out, respectively. Assuming so, VFC may potentially be hiking its quarterly payouts at a consistent CAGR of 7.26% over the next five years.

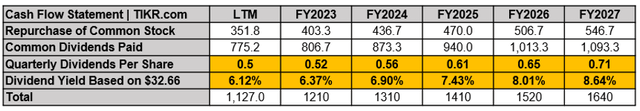

VFC Projected Shareholder Returns Through FY2027

VFC is also likely to announce a quarterly dividend hike to $0.52 by FQ2’23, indicating a notable 4% increase from the previous payout and an improving dividend yield of up to 6.37% then, based on current stock prices of $32.66. In addition, there might be a $403M provision for share repurchases for FY2023, representing an increase of 14.63% sequentially. Assuming so, we may see a total share moderation of up to 375.22M shares by the end of the fiscal year, indicating a meaningful reduction of -3.18% then.

By FY2027, VFC may have hiked its quarterly dividend payouts consistently up to $0.71 with impressive yields of up to 8.64%. That is, if investors had loaded up at current levels. With a total of $1.05B spent on its projected share repurchase programs by then, we would also see a significant reduction in its share count, returning tremendous value to its long-term shareholders. Thereby, providing a decent hedge against the projected cumulative inflation rate of 6.2% then. We shall see.

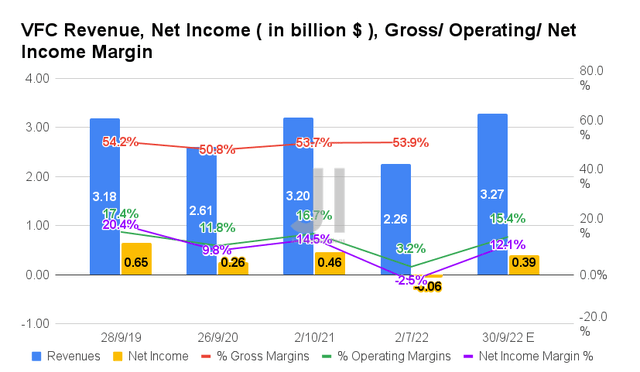

VFC’s Performance For FY2023 Remains A Little Shaky

For its upcoming FQ2’23 call, VFC is expected to report revenues of $3.27B and operating margins of 15.4%, representing a remarkable QoQ growth of 44.69% and 12.2 percentage points, respectively. Otherwise, a modest increase of 2.18% though a decline of -1.3 percentage points YoY, respectively.

In contrast, VFC may report net incomes of $0.39B and net income margins of 12.1%, indicating impressive QoQ growth of 750% and 14.6 percentage points, respectively. Otherwise, a YoY decline of -15.21% and -2.4 percentage points, respectively, partly attributed to FX headwinds. In the meantime, the company has pre-released an adj. FQ2’23 EPS in the range of $0.70 to $0.75, compared to estimates of $1.01. It is no wonder then, that the stock had plunged drastically afterward.

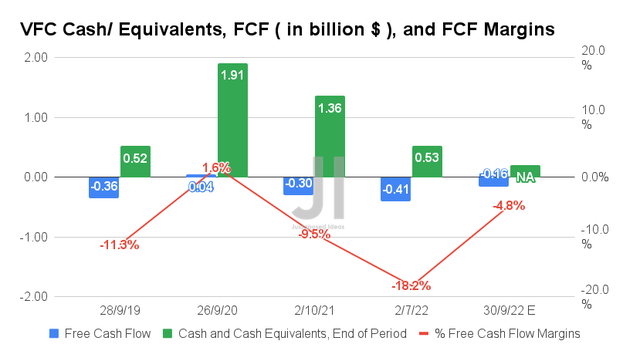

In FQ2’23, consensus estimates are expecting VFC to report a Free Cash Flow (FCF) generation of -$0.16B and an FCF margin of -4.8%, representing massive improvements of 256.25% and 13.4 percentage points QoQ, respectively. Otherwise, 187.5% and 4.7 percentage points YoY, respectively. In the meantime, the management has guided a cumulative adj. FCF generation of approximately $5.5B through FY2027 and $1B for FY2023, down from its previous guidance of $1.2B.

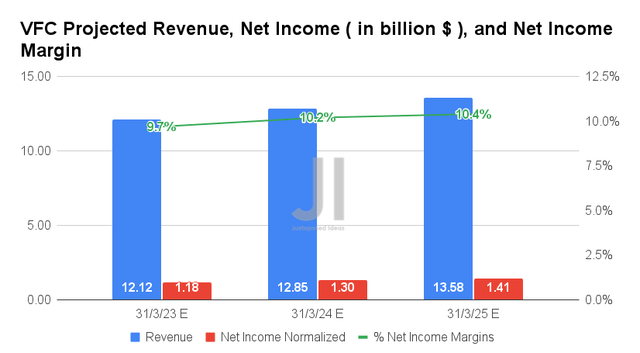

Over the next three years, VFC is expected to report revenue and net income growth at a CAGR of 4.68% and 0.72%, respectively. It is evident that despite the slowing growth ahead, consensus estimates that the company will report improved profitability, from net income margins of 6.5% in FY2020, to 11.7% in FY2022, and finally settling at a stellar 10.4% by FY2025.

Meanwhile, (previous) consensus estimates expect VFC to report revenues of $12.12B, net incomes of $1.18B, and net income margins of 9.7% for FY2023, representing YoY growth of 2.36%, though a decline of -14.49% and -2 percentage points, respectively. However, it is evident that these will be revised downwards by now, given the management’s guidance of FY2023 adj. operating margins of 12% instead of the previous guidance of 13.2%. Thereby, impacting its FY2023 adj. EPS from $3.05-$3.15 and to $2.60-$2.70 instead, against the consensus of $3.05.

So, Is VFC Stock A Buy, Sell, or Hold?

VFC 5Y EV/Revenue and P/E Valuations

VFC is currently trading at an EV/NTM Revenue of 1.51x and NTM P/E of 10.62x, lower than its 5Y mean of 2.76x and 25.09x, respectively. The stock is also trading at $32.66, down -58.61% from its 52 weeks high of $78.91, nearing its 52 weeks low of $32.63.

The slashed FY2023 guidance proved that the macroeconomics and the Fed’s aggressive hikes have successfully reduced consumer discretionary spending. Especially since, VFS previously enjoyed a nice boost in sales during the back-to-school season at 22.6% QoQ in FQ2’22, combined with the reopening cadence then. Nonetheless, given the onslaught of negative news, we reckon that most of the pessimism is already baked in, with minimal to moderate retracements ahead (if any).

Considering the Fed’s projected terminal rate of 4.6% by 2023, the September CPI released in early October may be the key catalyst for the stock market’s recovery then. It suggests that the Federal Reserve might increase interest rates by 75 basis points in November, followed by a more moderate increase of 50 basis points in January 2023. The winds of positive change seem imminent.

As a result, we rate VFC stock as a speculative Buy at current levels, though bottom fishing investors may potentially wait for the high $20s. Who knows, you might be lucky.

Be the first to comment