Mario Tama

Investment thesis

Netflix (NASDAQ:NFLX) is the most dominant company among streaming service providers, yet to date it has not demonstrated solid free cash flow. The reason for this weakness can be attributed to the huge expenses incurred to enrich its platform with new products, whose revenues are expected in the following years. So far the company has sustained this business model to get more and more subscribers, but now it is time to improve revenue per user. About 100 million users use Netflix without paying directly, and the company is trying to solve this problem through the introduction of new subscription plans. Currently the future of Netflix is very uncertain as is its free cash flow, so for a risk-averse person this may not be a good investment. Until the free cash flow improves I prefer to avoid this company.

Netflix’s current situation

Since the beginning of 2022, Netflix’s price per share has reached a low nearly 80% far from its 2021 peak. Investor Bill Ackman himself preferred to close his investment in Netflix with a loss of $400 million rather than believe in a recovery. These are definitely not positive signs for this company, but it must be said that it remains the undisputed leader in its industry. In this section we will analyze the most important current and future aspects related to this company, and whether it is a business in decline or not.

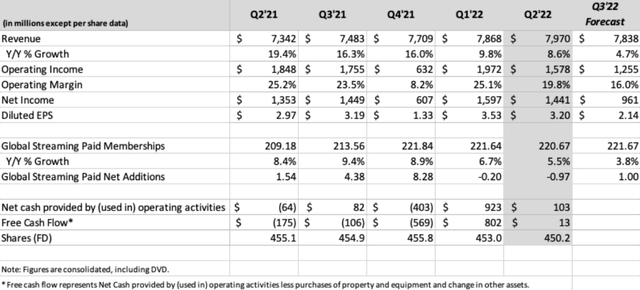

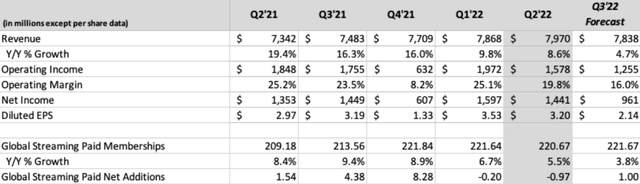

Income growth in the last few quarters

According to the latest shareholder letter issued by Netflix we can see that revenues have always been growing quarter after quarter. Furthermore, comparing Q2 2022 with Q1 2021 we can see that net income increased by $88 million while EPS increased by 23 cents. Unlike previous quarters we can also see that free cash flow has been positive for 2 quarters in a row, which is quite important considering that positive free cash flow has been Netflix’s biggest problem. Overall, the growth has not been as rapid as in the past, but it has been there. Finally, on the topic of revenues, it is also worth noting the geographic diversification.

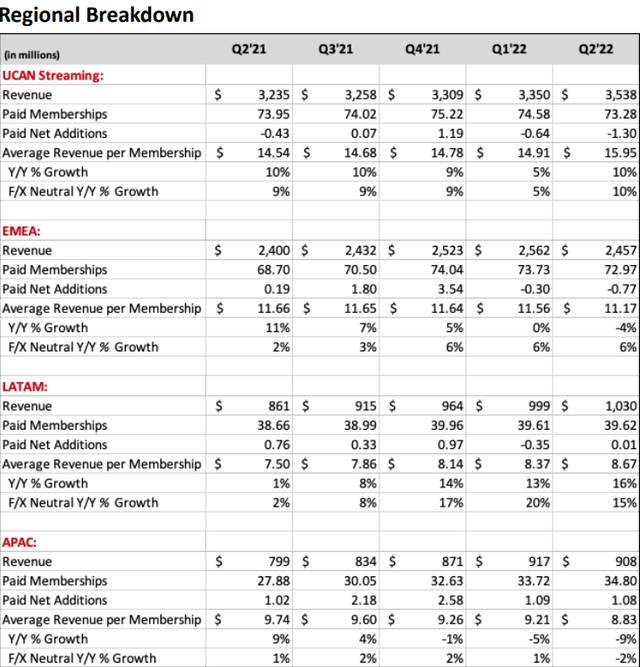

From U.S and Canada comes 44.5% of total revenues; therefore, Netflix has a good diversification of revenues. In the last two quarters, there has been a lull concerning paid membership in all geographic regions except for Asia-Pacific; I believe that this growing segment can limit the losses obtained by the others in the future as well.

Subscribers

There has been a lot of talk recently about Netflix’s declining subscribers, considered by the market as a clear sign of the end of its growth. Personally, I think this is not entirely correct, especially if we consider a long-term horizon.

Subscribers have grown sensationally year after year, particularly after the outbreak of the pandemic. In the 2 years following the pandemic, subscribers increased by 68.2 million, a growth that was certainly abnormal and mainly due to the pandemic forcing people to stay home. After such an event, it was unlikely to expect further rapid growth; therefore, I do not find it surprising that subscribers are now stalled.

In 2 quarters subscribers have only dropped by 1.17 million, and by the way, the company expects to recover 1 million already in the next quarter. The long-term trend is up, so I don’t find the stall of the last 2 quarters so significant. Finally, we must consider that 700,000 Russian paying accounts were lost in the last quarter due to sanctions towards Russia, so not by their own will.

Market share

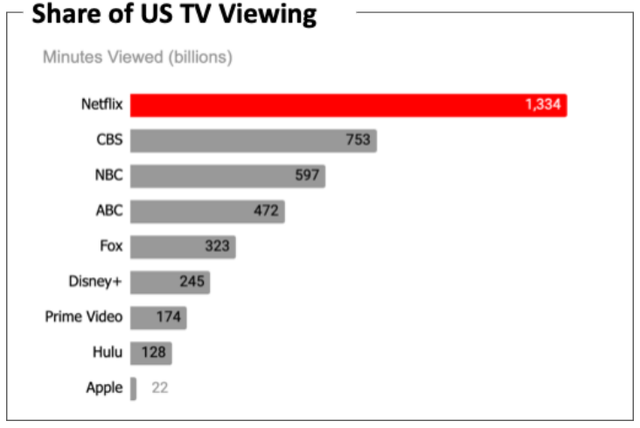

Although Netflix is experiencing stalled growth, its market share is still dominant. In the U.S. market, which is the most competitive market, during the 2021-2022 TV season Netflix ranked first in viewing time among broadcast networks.

In addition, it is also interesting to note how the second place (CBS) and third place (NBC) combined only just manage to surpass Netflix. As of June 2022, Netflix’s share of U.S. TV viewing was 7.7%, higher than June 2021’s 6.6%.

In light of these results it is even more obvious why Netflix has stalled on subscribers, simply because it already has a very high market share and it is very complex to grow it further.

The impact of a strong dollar

Due to a dollar that appreciated greatly against international currencies Netflix suffered $339 million in foreign exchange losses in Q2 2022, otherwise year-on-year revenues would have grown 13% instead of 9%. The wide geographic diversification of Netflix’s revenues had a large impact on this negative result, but it should be considered that this is more unique than rare: it has been 20 years since the dollar reached parity with the euro. As announced by the company this negative exchange rate effect could also affect future revenue growth:

Our Q3 revenue growth forecast of 5% translates into 12% year over year revenue growth on a constant currency basis. Similarly, excluding the impact of currency, operating profit growth would be -3% year over year (vs our forecast decline of -29%) and operating margin would be 20% (vs our forecast of 16%). As we have written in the past, over the medium term, we intend to continue to adjust our business as appropriate given the relative strength of the USD to protect our operating margin and try to avoid immediate actions that we believe could be detrimental to the business.

Summarizing the entire current position, Netflix has reached a stage where its growth is lower than in the past and its subscribers are struggling to increase. In addition, due to a strong dollar and nearly 60% revenue diversification, growth is negatively affected by foreign exchange losses, but this may be a temporary situation. However, many companies are suffering from a strong dollar, not just Netflix. On the market share side, nevertheless, Netflix dominates U.S. TV viewing share and even increased by 1% in 2022 compared to 2021. The latter is the aspect that I consider the most important.

Netflix’s core business has burned money so far

What I have explained so far represents the ongoing situation of Netflix, which after all is not as dire as we often read. What I will explain in this paragraph instead is a condition that has always plagued Netflix and is the reason why I would not invest in this company currently. Its business model has burned money even though its revenues have grown a lot, and this reduces the soundness of the company. Let me explain further:

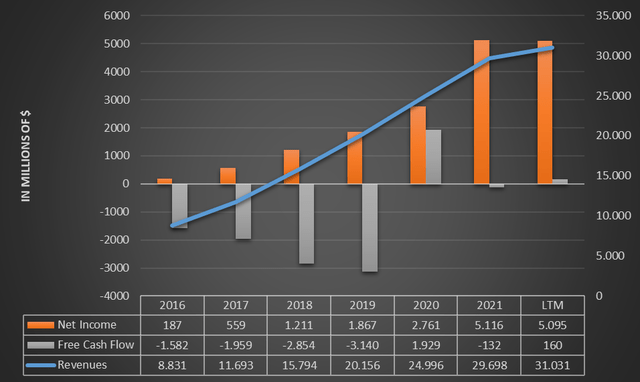

As can be seen from this graph, growth in both revenue and net income has been amazing in recent years, but free cash flow has almost always been negative; thus, even with growing profit the company has been burning cash. The reason for this lies in the nature of Netflix’s business model: costs related to new productions or acquired licenses have to be paid in the immediate term in order to earn revenue in the future, but these costs are not accounted for in the same way in the income statement and cash flow statement. In the income statement they are deferred in cost of sales over 5 years usually, being less burdensome, while in the cash flow statement they are accounted for in full in a single year as a cash outflow. Because of this difference, net income is much higher than free cash flow. In addition, it is interesting to note that the only year Netflix had positive free cash flow was precisely when it stopped production because of Covid-19, this was because costs were lower but products already launched continued to attract more and more subscribers.

To sum it all up, Netflix has great difficulty generating free cash flow because it has significant cash outflows each year to finance new productions. Moreover, this business model to become profitable in the future assumes that Netflix can consistently generate highly rated TV series each year, which is not easy. This is the main reason why I am not inclined to invest in Netflix at least until its free cash flow improves.

However, this situation may not necessarily continue forever; on the contrary, there were some signs of reversal in the last quarterly report.

- The first signal refers to a positive free cash flow for the 2nd quarter in a row: this is not a great result but there is certainly a glimpse of improvement.

- The second signal, on the other hand, is a reduction in cash spent on content so as to ease monetary costs in the cash flow statement. The company’s expectations in this regard are very interesting:

We expect annual positive FCF going forward (with substantial growth in FCF in 2023 vs. 2022) due to our increasing revenue, solid profitability, and the successful multi-year evolution of our content model. We’re now more than a decade into transforming our service from licensed second run content to mostly Netflix originals”. “We’re now through the most cash-intensive part of that transition.

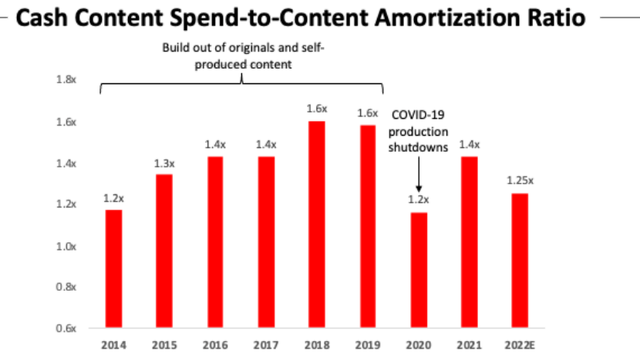

As a result, our cash content spend-to-content amortization expense ratio peaked at 1.6x (along with peak negative FCF of -$3.3B in 2019) and is expected to be about 1.2-1.3x in 2022 and to decline going forward.

After years where the Netflix platform in order to attract customers had to pay a lot to obtain licenses to broadcast certain content, it seems that the company is having more and more consideration for its products developed in its own studios and is trying to focus more on the latter. By now the platform is widely known in the world, so expensive licenses of movies and TV series are no longer needed as in the past. This strategy should give more stability to free cash flow and make the platform less dependent on non-original content. Should all this come to fruition, at that point I would be interested in buying this company at a proper price.

What’s new in subscriptions

One of the reasons that made Netflix so popular was the ability to share an account with multiple people, paying a very low fee for quality content. This has made Netflix the most popular streaming service in the world, but the problem is that for the company, shared accounts are a missed revenue opportunity. As long as the platform is little known and has no competitive advantage all this helps to spread it among consumers, but as of today Netflix is trying to change its business model. To date, about 100 million households are using the Netflix service without paying directly, which is about half of the current subscribers. To try to monetize from these accounts as well Netflix has announced that it is developing a model based on individual households: each household must necessarily pay for the account. So, other households can be connected to the main account as long as an extra fee is paid. Personally, I think this makes a lot of sense, because I don’t think that non-monetized subscribers won’t pay a small commission to continue watching Netflix. Assuming that Netflix may even lose some subscribers after this choice, I consider the overall final effect positive in terms of increased revenue. Obviously for this to happen Netflix must always produce new interesting series or movies, and this is the main unknown. In addition, for those who are against the price increase there will still be the possibility of having a Netflix account at a lower cost but with advertising inside. The first trials of these innovations have been introduced in Netflix accounts in some regions of South America, and the first results will be noticed in the coming months.

About 100 million non-paying accounts is a lot and even if only Netflix could monetize half of them (without losing too many paying accounts) it would still be a very good result. Subscribers were concerned about the inclusion of advertising in their accounts, but in reality it does not directly affect them but potential new users who want to pay less for a subscription. Netflix is now ingrained in the routines of hundreds of millions of people, and I doubt that this change in subscription policy will lead to disastrous consequences. However, the risk of the business model change remains high and especially with economic consequences that are still too hard to predict, which is why I am staying away from this company now but may reconsider in the future. I need more certainty to invest in it.

Netflix’s fair value

Each investment is the present value of future cash flows, so a discounted cash flow will be used to calculate the fair value of Netflix. The model will be constructed as follows:

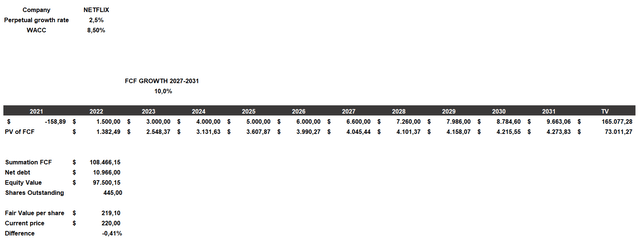

- The cost of equity will be 10% and considers a beta of 1.28, country market risk premium, a risk-free rate of 3.50%, and additional risks of 1% due to the change in business model. The cost of debt will be 5.46%.

- The capital structure considered will be 65% equity and 35% debt, with a resulting WACC of 8.50%.

- Free cash flow was manually entered until 2026 and then increased by 10% each year. I considered a scenario in which the company finally begins to increase its free cash flow through the wider offering of Netflix original productions and in which it manages to monetize some of the 100 million non-paying accounts. Among other things, the company also expects free cash flow to increase greatly from 2022 onward.

Considering this scenario, Netflix’s fair value is almost equal to the current price per share, so it might be proper to wait for a further decline before buying.

Regarding the calculation of this fair value, I would like to make one final point. Netflix has almost always burned cash because of the costs associated with offering products within the platform; therefore, I may well have been too positive in considering such a growing free cash flow. The truth is that it is very complex to calculate the fair value of this company because it does not have stable cash flows, so the ones entered could deviate a lot from future ones. The company is recently making significant changes in its subscription arrangements, and the consequences of this cannot be calculated precisely in advance. What is certain is that Netflix is currently a risky investment given the uncertainty of its future; therefore, for a risk-averse person it might not be a good idea to invest in it. According to my assumptions the fair value could be around $219 per share; therefore, considering a margin of safety I would be interested in buying around $180 per share. For those who believe strongly in this company, the current price is also very convenient when compared to the all-time high.

Be the first to comment