Justin Sullivan/Getty Images News

On March 18th, VanEck disclosed the latest changes to the MOAT ETF (BATS:MOAT), which tracks the Morningstar® Wide Moat Focus Index. These quarterly updates provide an insight into sectors and companies that Morningstar’s fundamental analysis considers as undervalued. Following the recent bout of volatility, the discounts to fair value were much higher than what we’ve been used to in previous quarters. This is good news not only for investors interested in the MOAT ETF itself, but also for stock pickers who can sift through the ETF’s holdings looking for blue chips trading at a reasonable valuation (see full list at the end of this article).

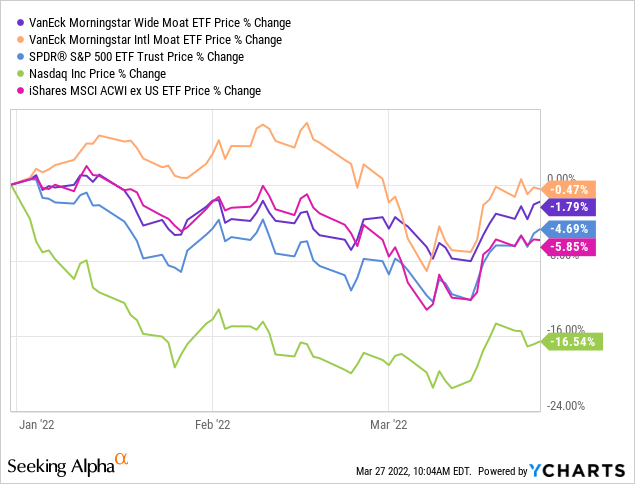

Let’s start with an overview of the ETF’s performance year-to-date, which compares favorably to major indexes. It’s worth noting, too, that MOAT’s international counterpart MOTI (MOTI) also outperformed international markets (ex-US) over the period:

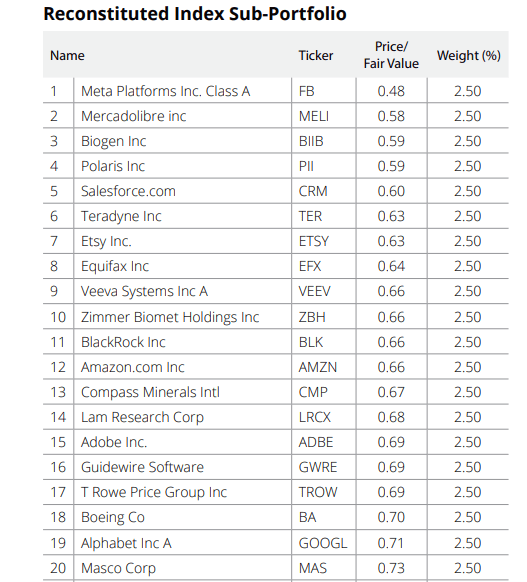

Another interesting aspect of the March reconstitution of MOAT is the renewed confidence of Morningstar in some of the main Big Tech names. In particular, Morningstar saw a Price To Fair Value ratio of 0.48 when it comes to Meta Platforms (FB), suggesting a 52% discount and, therefore, a potential doubling of the stock. These metrics were calculated in early March, and Meta has since rebounded somewhat, but there is still plenty of headroom between the current price and Morningstar’s fair value estimate of $400 per share. VanEck summarized Morningstar’s thesis as follows:

Meta Platforms (the company formerly known as Facebook) reported quarterly results after the close of markets on February 2, sending shares into a free fall the following day. According to Morningstar, revenue was slightly ahead of expectations, but the firm missed on the bottom line due to higher investments in not only the Reality Labs metaverse segment but also in Reels and in overall improvement of its advertising back-end. Its first quarter 2022 revenue guidance was also below consensus estimates.

Source: VanEck

To be honest, I do not have an opinion on Meta’s valuation specifically. For me, the clear takeaway is that Morningstar sees Big Tech as undervalued at the moment, judging from their assessment of other leading companies in the sector (all members of MOAT):

- Amazon’s (AMZN) Price/Fair Value of 0.66 (34% discount) as of early March

- Alphabet’s (GOOGL) P/FV of 0.71 (29% discount)

- MercadoLibre’s (MELI) P/FV of 0.58 (42% discount)

- Salesforce’s (CRM) P/FV of 0.60 (40% discount)

With this in mind, let’s dig deeper into the way the MOAT ETF works and the recent rebalance.

The MOAT ETF: An Overview

Note: Investors already familiar with the MOAT ETF and Morningstar’s methodology may want to skip this part and move directly to the March rebalance section.

The way the MOAT ETF works was well summarized by fellow contributor George Fisher in an earlier article:

[MOAT] owns 40 to 50 stocks with wide moats and that are trading at a discount to fair value, usually in the 15% to 25% discount range. When moat ratings change or the discount to fair value becomes comparatively noncompetitive with others, the position is replaced. Not only do the components change based on moat rating and discount to fair value, but the portfolio is re-balanced to an equal weighting as well. This creates a relatively high annual portfolio turnover of around 25%.

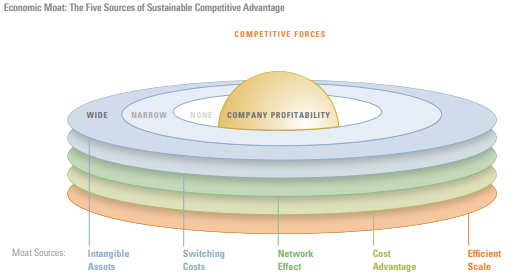

The ETF, managed by VanEck, is based on the Morningstar® Wide Moat Focus Index, which includes only U.S. stocks and, as the name suggests, only companies that possess wide economic moats. But what exactly does Morningstar mean by “economic moat”? As per VanEck:

Economic Moat ratings represent the sustainability of a company’s competitive advantage. Wide and narrow moat ratings represent Morningstar’s belief that a company may maintain its advantage for at least 20 years and at least 10 years, respectively. An economic moat rating of none indicates that a company has either no advantage or an unsustainable one. Quantitative factors used to identify competitive advantages include returns on invested capital relative to cost of capital, while qualitative factors used to identify competitive advantages include customer switching cost, cost advantages, intangible assets, network effects, and efficient scale.

Morningstar

Chart source: Morningstar

This strategy has enabled MOAT to outperform the S&P 500 since its inception in 2012, as analyzed by contributor The Sunday Investor in his article How MOAT Beats The S&P: A Performance Attribution Analysis. With this in mind, let us now discuss the latest moves as part of the recent March reconstitution.

March Rebalance: The Removed Constituents

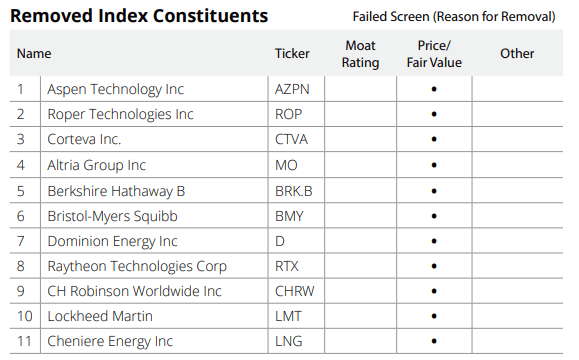

The recent reconstitution – affecting the sub-portfolio whose previous rebalancing was in September – saw the removal of eleven names:

VanEck

(see VanEck’s full document here)

All eleven stocks were removed on valuation grounds, meaning that Morningstar replaced them with more attractive new entrants from a Price/Fair Value perspective. The removal, therefore, has nothing to do with a downgrade of these 11 stocks’ economic moat.

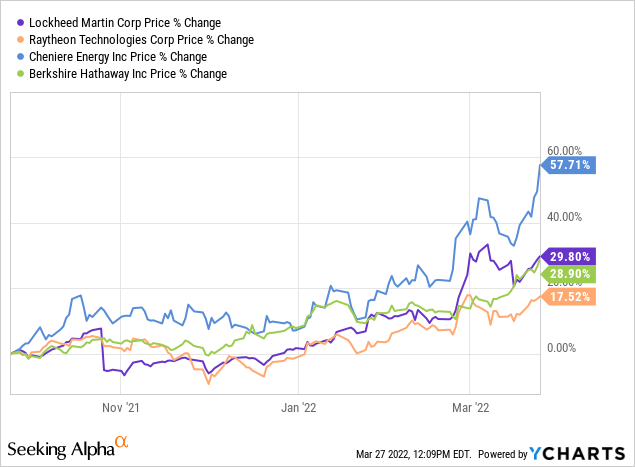

It may come as a surprise to find on this list some names that are very much in favor at the moment, such as the defense stocks Lockheed Martin (LMT) and Raytheon Technologies (RTX), or Cheniere Energy (LNG) which should benefit from increased LNG shipments to Europe. The thing is, these stocks have performed well since the sub-portfolio’s last reconstitution and their valuation appeared less attractive to Morningstar compared with other candidates (in so doing, MOAT did miss out on last week’s spectacular upleg in Cheniere).

It’s worth noting that Berkshire, Lockheed and Cheniere are still part of MOAT’s other sub-portfolio, the one that will rebalance in June, so their removal this month could be viewed as Morningstar/VanEck simply taking partial profit.

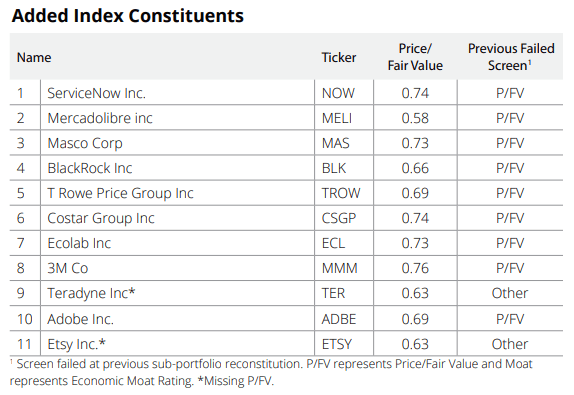

March Rebalance: The New Entrants

The 11 names removed from the sub-portfolio gave way to another 11 wide-moat companies:

VanEck

As discussed earlier, some tech stocks were added, such as ServiceNow (NOW), Adobe (ADBE) and MercadoLibre, the e-commerce platform focused on Latin America. The other takeaway is that the discounts are sizable, ranging from 42% in the case of MercadoLibre to 24% for 3M (MMM). This is much more appealing than during previous reconstitutions, when discounts were typically in the region of 10%. In the same way, BlackRock (BLK) is seen as being 34% undervalued, following the asset management giant’s subdued stock performance since November 2021.

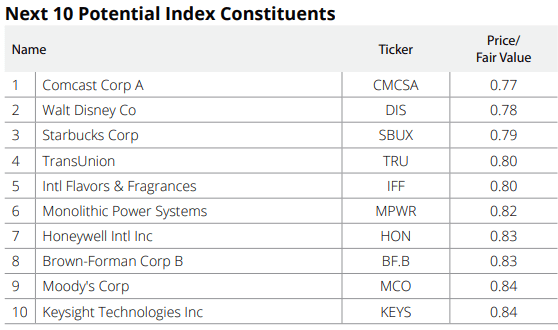

Those Waiting On The Sidelines

As always, VanEck provides a list of stocks that could be included as part of the next rebalance, should their valuations warrant it at the time, such as Comcast (CMCSA), Disney (DIS), and Starbucks (SBUX):

VanEck

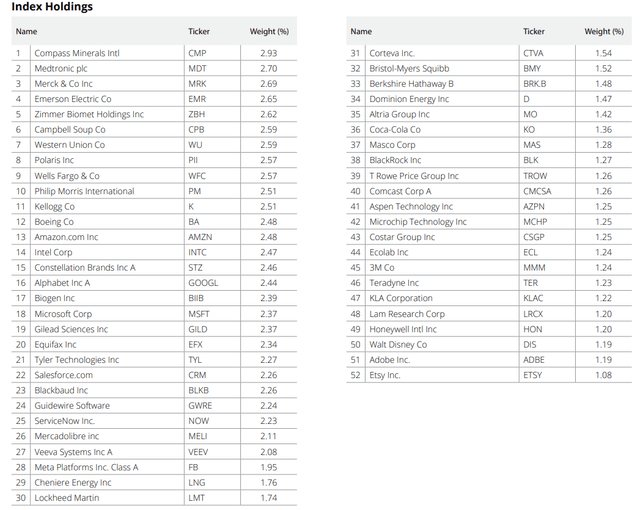

The Full List

Below is the full list of 52 names currently included in the MOAT ETF. At the moment, Compass Minerals (CMP) is the largest position, with a weight of close to 3% of the portfolio. Despite the company’s uninspiring performance in recent years, Morningstar has kept faith in this salt and potash producer. While higher logistics costs have been a drag on the salt segment’s profitability, the potash segment should benefit from supportive fertilizer prices.

VanEck

This list can be used as a source of ideas for investors looking for wide-moat stocks trading at reasonable valuations in the wake of the recent volatility. In this respect, the Price/Fair Value is a helpful metric:

VanEck

(see this document for full detail)

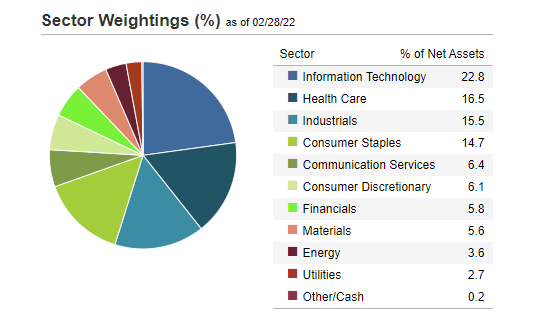

In terms of sector allocation, the breakdown at the end of February was as follows:

VanEck

Takeaway

The MOAT ETF showed some resilience in the volatile environment of 1Q ’22, outperforming the broader market. Morningstar’s early bets on defense stocks in 2021, and on the likes of Cheniere Energy, have been rewarded (leading to the trimming of some of these names on valuation grounds). Morningstar now sees opportunity in Big Tech, with their most conspicuous call being their fair value estimate of $400 for Meta Platforms, and MOAT stands to benefit if their analysis is proven right.

Be the first to comment