Scott Olson/Getty Images News

Investment Thesis

DraftKings Inc. (NASDAQ:DKNG) stock has been hammered over the past year. After attempting to stage a reversal in September, the spread in its growth premium proved too much for investors as they rotated to higher-quality stocks.

Nevertheless, the stock has been consolidating in a tight range since January. Still, famed short-seller Jim Chanos remains bearish on DKNG stock as he highlighted (edited): “Since my CNBC appearance a few months ago, DraftKings’ 2022 adjusted EBITDA loss estimate has gone to $900M from $500M. So, things are getting worse there, not better.”

Not to be outdone, DraftKings CEO Jason Robins also went on the offensive against short-sellers in DKNG stock. He highlighted that he would make these bearish traders/investors regret their decisions of shorting DKNG stock.

We understand the frustration of investors in DKNG stock. Given that the company is still unprofitable, growth investors seemed to have bailed out in favor of “safer” names. Nonetheless, the company’s business model has not changed. Management also telegraphed a sharper focus on customer acquisitions costs (CAC), leading to more robust CAC efficiencies moving forward.

With an eye on CQ4 ’23 adjusted EBITDA profitability, we are confident that the current valuation has reflected extreme pessimism in DKNG to execute. Accordingly, we discuss why DKNG stock is a Buy at its current valuation.

DKNG Stock Key Metrics

DKNG stock NTM Revenue trend (TIKR)

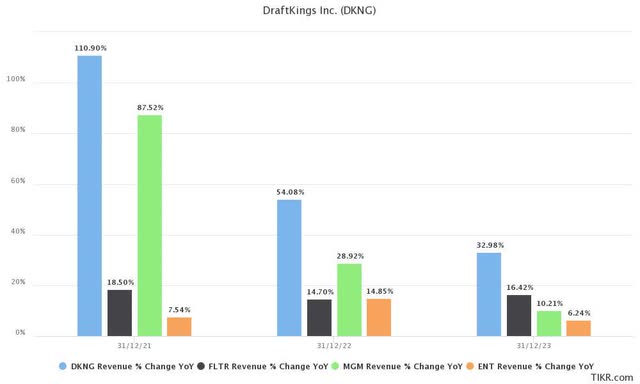

DraftKings revenue YoY change consensus estimates % (TIKR)

DraftKings stock’s valuation has undergone significant compression, as seen above. Its current NTM revenue of 3.3x is much lower than when it was listed (9.8x). Nevertheless, its profitable peers seen above have also been trading at much lower valuations over the last three years.

As a result, investors digested DKNG stock’s valuation in their return to profitable stocks. It demonstrated how pessimistic the market has decided to accord DraftKings’ higher revenue growth estimates. Investors have decided that DKNG didn’t deserve its premium valuation any longer as unprofitable growth stocks went out of favor.

Where is DraftKings Heading?

Therefore, it’s critical for investors to consider whether DKNG stock still deserves to be stacked with a growth premium. Management guided for adjusted EBITDA for the first time in its FQ4 earnings call. However, the Street was disappointed, as their estimates modeled for a faster ramp towards adjusted EBITDA profitability. As a result, the stock sold off post-earnings.

Despite that, DKNG stock has generally stayed within its trading range. Furthermore, we believe the recent “risk-on” sentiments following a potential March bottom in the market could spur investors to re-rate DKNG stock moving forward.

DraftKings held a keenly-awaited investor/analyst conference in early March. Management detailed its financial models, explaining their path towards adjusted EBITDA profitability by CQ4’23. Therefore, investors have a line of sight in DKNG attaining profitability and a benchmark to gauge its performance. Furthermore, DraftKings also emphasized seeing improved unit economics in its newer states. Management accentuated that the speed of customer acquisitions has improved tremendously compared to New Jersey. In addition, it also expanded its estimated TAM from $67B to $80B, given its new cadence.

Furthermore, its customer retention metrics continue to look robust. As a result, DraftKings emphasized that it’s increasingly confident in meeting its profitability guidance. CFO Jason Park articulated (edited):

What could accelerate our path towards profitability? Remember Arizona, we’re acquiring 3.5% of the population in the first 2 quarters versus New Jersey’s 1.3%. So could that create a snap into profitability at state level faster? It very well potentially could unless the TAM is just meaningfully bigger than we thought. And even then, it probably still does.

So, we are acquiring more customers faster when a state launches these days than a state that launched in the ’18, ’19, and even 2020 period. (BofA Sports Betting & Online Gaming Field Trip Conference)

Is DKNG Stock A Buy, Sell, Or Hold?

DKNG stock consensus price targets Vs. stock performance (TIKR)

It’s essential for investors to consider that DraftKings is still unprofitable. Furthermore, it’s still highly dependent on the state legalization cadence, which would impact market sentiments and its revenue estimates. Therefore, investors are encouraged to pay attention to how the legalization momentum pan out in 2022. We believe it would be critical for Draftkings’ bid in reaching adjusted EBITDA profitably in FY24.

Nevertheless, we explained earlier that DKNG stock’s growth premium has already been digested. Furthermore, DKNG stock is also trading in line with its most conservative price targets (PTs).

Hence, we believe that the risk/reward profile seems attractive if you have a horizon of at least five years. As such, we reiterate our Buy rating on DKNG stock.

Be the first to comment